NFC payment apps are the new normal.

Payment apps in general have become a household name now. Whether you use Apple Pay, Samsung Pay, or a third-party solution like Venmo, every phone has one.

In addition to growth in the user sector, mobile payment is also rapidly growing in retail industries, like eCommerce, on-demand services, and everything app & web related.

If you go to a supermarket, you don’t need to carry your wallet anymore. All of this is thanks to these mobile payment applications. As a result of this growth, we have seen rapid growth in new applications.

But are you using the best and top NFC Payment apps? If you too are wondering about this, or just want to learn more about NFC payment apps and concepts, this blog is for you.

Let us introduce you to the revolutionary NFC technology and the best NFC apps for payment. So with that being said, let’s get right into it:

Why is NFC Payment Gaining Popularity Worldwide?

Have you ever wondered what all the craze is about? Why does everyone love NFC payment apps and why are so many top eWallet companies upgrading their apps to this standard?

Well, we have your answer.

NFC is the natural next step to enable smooth contactless payments in mobile wallet apps. And the world is adapting to it. Let’s look at some market statistics to better understand the landscape.

- Europe is one of the largest markets for NFC payments. Statista shows that from 2020 to 2024 the market size has tripled.

- Smartphone manufacturers are stepping up to the trend as 94% of phones are NFC enabled. This figure will reach 99% by 2027.

- The U.S. is the world’s largest market for NFC mobile payments. The market accounted for 4.4 Billion NFC mobile payments in just 2022. By the year 2027, it will reach 3 billion transactions.

- An Insider Intelligence report says per-user spending will reach $7,827 in 2026. This was just $4,177 in 2022.

How amazing is that? Well, that’s not all. The potential for tap-and-pay apps goes far beyond what we see in these statistics.

Moving on, now that we are done with NFC mobile payment statistics, let’s move to the next section where we shall be going through the best NFC payment apps.

Top NFC Payment Apps

If you are a smartphone user you probably have an NFC-enabled smartphone and an NFC payment app pre-loaded.

But for those of you who are new to the concept or want to look for an alternative NFC payment app, we’ve got you covered. We shall be going through the top 10 NFC payment applications.

| NFC Payment Apps | App Store Link |

|---|---|

| 1. Google Pay | Android |

| 2. Apple Pay | iOS |

| 3. Samsung Pay | Android |

| 4. PayPal | iOS/Android |

| 5. Zelle | iOS/Android |

| 6. Venmo | iOS/Android |

| 7. Square Wallet | iOS/Android |

| 8. Xoom | iOS/Android |

| 9. Cash App | iOS/Android |

| 10. Circle Pay | iOS/Android |

Let’s start with the big three of the industry: Google Pay, Apple Pay, and Samsung Pay.

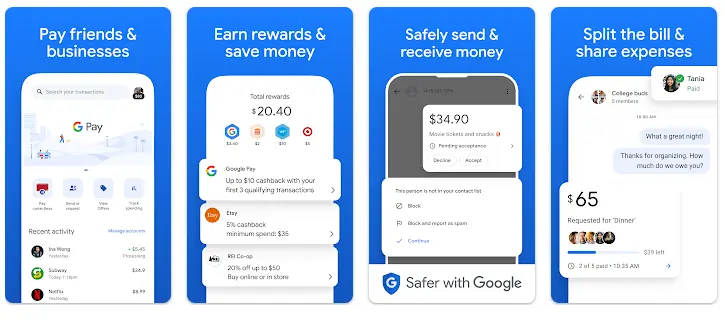

1. Google Pay – Google’s Solution To Mobile Payment

Google is known to lead innovation in various fields of technology whether it is quantum technology or mobile OS. This is their masterstroke in the market for top NFC payment apps.

Google Pay is one of the most popular NFC payment apps in the world.

Because the majority of the smartphone market is dominated by Android and Google Play is a preloaded app, the app has a huge user base.

If we are to go with the statistical data, Google Pay now accounts for 14.9% of the US mobile wallet market share.

Moreover, this app comes with an easy-to-use user interface and takes users to payment without confusing them with 10 extra things.

This is what makes it stand out from the rest. Another winning factor is that it is acceptable. Despite coming from the company that runs the Android system, the app is available on iOS.

Features:

- QR code-enabled payments

- Peer-to-peer payment

- Cashback, rewards, & exciting offers

- Bank account linking

- Manage your bank account directly

- Activity Dashboard

- Detailed transaction history

- Book tickets and manage boarding passes

2. Apple Pay

How can you start a list of top NFC payment apps without mentioning Apple Pay?

How can you start a list of top NFC payment apps without mentioning Apple Pay?

Apple devices used to be a luxury and they still are. But over recent years, iPhones have captured more market than before.

To accommodate the payment needs of their users, Apple introduced Apple Pay. This is just one of the many ewallet app ideas above Apple’s sleeve.

Speaking of market size, more than 15% of Americans use this mobile app for their day-to-day payments. Consequently, in 2022 alone, 45.4 million Americans were enrolled in Apple Pay.

The state will capture one in every five Americans by 2026, talk about growth.

The driving force behind Apple Pay is the unified user experience across the Apple Ecosystem as well as smooth working. As a leading “tap to pay app,” it is very simple to use.

In typical Apple fashion, you will find the app to be very visually appealing. And coming to the technicality part, it’s super easy to use.

The only downside is that it is only available for Apple users. But you figured that out already, didn’t you?

Features:

- Apple Ecosystem synchronization

- Apple Pay later – BNPL integration

- Second-factor authentication

- Fully encrypted secure enclave to keep info safe

- Information tokenization

3. Samsung Pay – Answer To Apple & Google

In third spot for the best payment apps, we have Samsung Pay.

In third spot for the best payment apps, we have Samsung Pay.

Though the app is only used by 13.2% of the US mobile wallet market, it is a big name in the NFC payment scenario.

Again, this is an NFC payment Android app that is strictly exclusive to Samsung users, available in different capacities across different devices.

All in all, this is one of the best and smoothest eWallet applications. In fact, it can connect with other p2p apps on the phone and provide users with an all-in-one payment app experience.

As opposed to Google Pay and Apple Pay, the platform is filled with features and functionality. One might say it’s too much, but give it some time, it will grow on you.

Features:

- Detailed transaction history

- Peer-to-peer payment

- Integration with other eWallet apps

- Manage bank accounts

- Deals, gift cards, promotions, and offers.

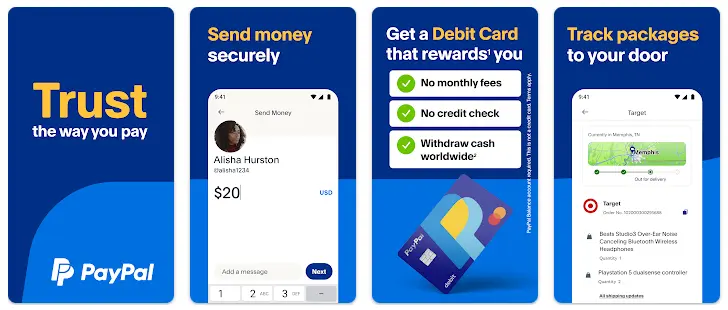

4. PayPal – The OG eWallet App

Did you know Elon Musk was one of the founders of PayPal?

Did you know Elon Musk was one of the founders of PayPal?

Coming to the app itself, PayPal is the eWallet solution that did it before it was cool. Though it was originally introduced as an online payment solution, it soon grew to other fintech niches.

The one we shall be focusing on is the PayPal eWallet app, one among the long list of top NFC payment apps.

To start with, the platform comes with NFC integration, making it one of the most useful mobile payment apps out there.

In addition to this, it is used throughout the world. Therefore, there are hardly any places where you won’t find PayPal acceptance. Not to mention, the app is super secure in its online transactions as well as NFC-enabled payments.

Apart from simple payments, you can also handle bills, ticketing, cross-border international payments, and so on.

In fact, it has inspired a lot of other investors to create an eWallet app like PayPal, being the inspiration for a lot of apps on this list.

Features:

- Safe international payment for cash pickup

- Peer-to-peer payment

- Requesting money from friends and family

- Bill splitting feature

- Rewards and offers

- Add a bank account to app

- Package tracking feature

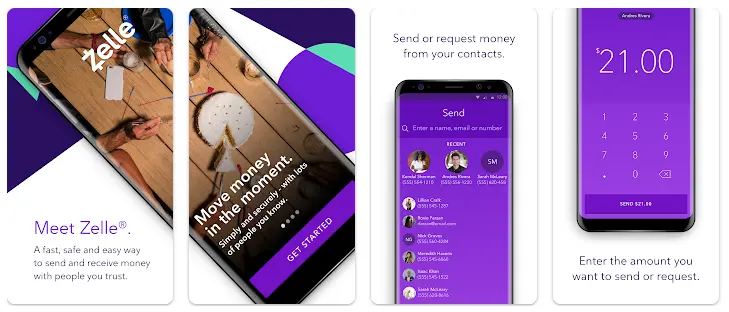

5. Zelle – Lightning Fast Mobile Payments

Zelle’s business model is one of the fastest and most secure NFC payment apps on the list.

Zelle’s business model is one of the fastest and most secure NFC payment apps on the list.

This mobile wallet app has all that you expect from a market-leading eWallet solution and more.

The app is easy to use, lets users send money with the tap of a finger, and has one of the best NFC payment interfaces.

Moreover, the platform works with more than 2,100 financial institutions to make payments easier for the user and integrates seamlessly with mobile banking apps.

If you are situated in the US, the app provides bank-to-bank transfers. The best part is, it’s free to use.

Features:

- Enables free and fast payment

- There is no receiving limit

- Seamless integration with mobile banking apps

- Secure transactions

- Payment history

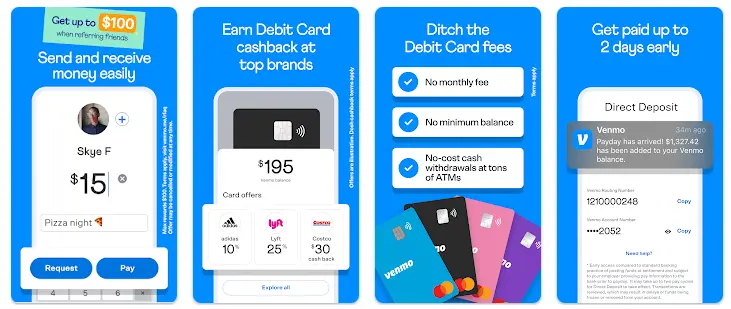

6. Venmo – One Of The Best Payment Apps

Here we have Venmo.

Here we have Venmo.

You have probably already heard of it, after all, it is one of the most used eWallet apps in the country (USA).

But what’s the reason behind such immense popularity? Well, for starters, the app lets you pay at stores, integrate with shopping apps, and so much more.

The platform is super easy to use and feature-filled. For instance, you can send a gift (surprise money) to your friend, split the bills, split rent, earn cash back, and even invest in crypto.

But that’s not all, in addition to being one of the top NFC payment apps, it is also one of the best Cash advance apps.

Features:

- Cash advance feature

- Invest in cryptocurrency

- Peer-to-peer payment

- Bill payment

- Split payment

7. Square Wallet – NFC Payment for Businesses

Square is one of the largest fintech companies in the US today.

All of the solutions that we have discussed so far on the list are focused on the user or for a better choice of word, the consumer side.

If you are a business owner looking to enable NFC functionality in your POS system, Square Wallet is perfect for you.

The company offers a range of amazing solutions, including one of the top NFC payment apps.

Features:

- POS System Integration

- Highly Secure Payment

- Detailed Transaction Record

- Custom solutions for businesses

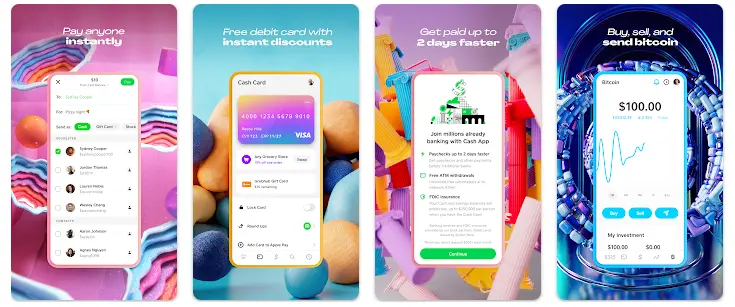

8. Cash App

Coming to the brand we just discussed, Cash App is a market-leading mobile payment app.

Coming to the brand we just discussed, Cash App is a market-leading mobile payment app.

So what makes this rank among the top NFC payment apps, among the likes of Apple Pay and Google Pay? For starters, it is backed by a fintech giant, giving it access to one of the best networks in the market.

Meaning users can pay via their bank account or debit card, make purchases online, make Bitcoin transactions (yes, you heard that right), and much more.

The app comes with a built-in, in-app wallet that keeps your bank account safe. To do this, it also integrates with other apps with a pen name or what we call Alias to keep your identity safe.

Features:

- Take an alias

- Secure payment transactions

- Add bank account

- Debit card integration

- Bitcoin Trading and Transactions

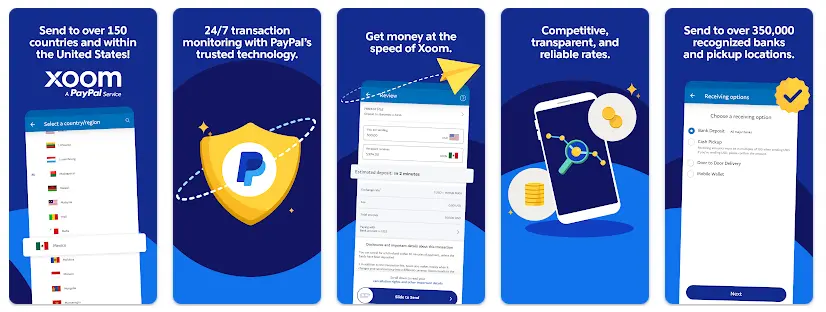

9. Xoom, A PayPal Service

Xoom is the Tap & Pay app you use, for those international payments.

Xoom is the Tap & Pay app you use, for those international payments.

Cross-border payments have long been an issue in the world of e-wallets. But recently, top fintech companies have been solving them.

One such NFC-enabled solution is Xoom. The platform itself is owned by PayPal but specializes in international e-wallet payments.

It comes with some amazing offerings that are unique to this platform like the cash pick service. And there’s more, let’s look at the features:

Features:

- Seamless international payments

- Top-notch security standards

- Deposit directly to the bank

- Cash Pickup Service

- Add debit card

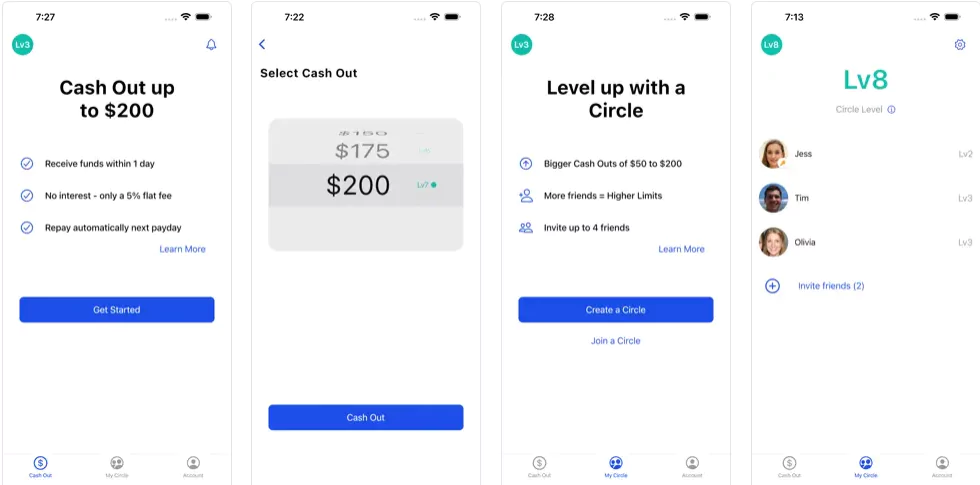

10. Circle Pay

Lastly, we have one of the leading NFC payment apps in today’s market.

Circle Pay.

This is a mobile wallet app that has become quite popular in recent times. Reason? Well, the app lets users manage their cards, passes, tickets, and Key cards in one place.

You can rest worry-free while the app takes care of all headache finance-related. Moreover, it lets your pockets stay light as all debit and credit cards can be directly used from your phone via NFC functionality.

This is what makes it one of the safest, fastest, and one of the NFC payment apps.

Features:

- Verified transactions

- eWallet capacities

- Offers, Discounts, and Rewards

- End-to-end encryption

- Two-factor authentication

NFC Payment vs eWallet QR Code

QR Code payments are a tried and tested technology used in top eWallet applications.

These are physical symbols that, when scanned via an eWallet app scanner, initiate a transaction or create a saved transaction channel.

Due to the ease of payment these codes offer, they broke the market when they were introduced. Just last year in (2022) more than 89 million U.S. smartphone users scanned a QR code.

Now, let’s compare it against our “NFC mobile payments”:

| Aspect | NFC Payment | eWallet QR Code Payment |

| Technology | NFC Wireless Communications | QR code with payment information |

| Convenience | Quick and requires minimal user interaction | Requires generating and scanning QR codes |

| Security | Generally secure with encryption and tokenization | Secure with encryption, but some risk if the QR code is tampered with |

| Speed | Faster for in-person transactions | Slightly slower due to scanning QR codes |

| Compatibility | Requires NFC-enabled devices for both payer and payee | Compatible with any device with a camera and QR code reader |

There are no winners or losers here. Rather, when it comes to eWallet app development, both technologies are used in parallel.

This gives an added edge to the contactless functionality of the app and a promise of versatility to the user.

Speaking of users, let’s look at why people love mobile payment apps through the lens of market statistics in the section below.

Conclusion

These are the top NFC payment apps for 2024. Each app uses advanced mobile payment technology to ensure safe, fast, and correct NFC transactions. Whether we talk about Apple Pay or Cash App, they have their own advantages and disadvantages.

As we discussed in this blog, there are some NFC payment apps that enable direct tap-to-pay functionality while there are others that have come up with greater innovation and added layers of security.

All in all, as time progresses we are to see further improvements in NFC payment applications and their integration into our day-to-day lives.

FAQs

NFC payment apps refer to mobile applications that rely on near-field communication technology to enable financial transactions between two devices. This can be two mobile phones, a mobile phone, and a payment machine.

NFC is one of the most secure payment technologies that the majority of any top eWallet app development company uses in their solution. All information is encrypted and protected by other security measures from third parties.

Some of the best NFC payment apps include:

- Samsung Pay

- PayPal

- Zelle

- Venmo

- Square Wallet

- Xoom

- Cash App

Yes, the majority of the credit companies and banks offer credit cards and debit cards that are NFC-enabled. If you don’t already have one, you can ask for an updated one from your service provider.

All modern banks support NFC-based payments, therefore, regardless of the bank you have an account in, you can make payments using top NFC payment apps.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.