Tokenization is one of the latest developments in the world of digital asset management. The technology revolves around keeping digital assets secure.

The rise of financial technology has allowed users to convert their financial assets into digital assets. This means tokenization can be of great value when combined with financial services.

So how does it work? Well, let’s try to learn more about both of these concepts and how they align.

In this post, let us understand what exactly tokenization is, how it works, and how exactly it can be used in financial services.

What is Tokenization in Financial Services?

Tokenization is a process that helps you keep online data and assets secure. It basically replaces sensitive data with a string of less sensitive data, while keeping the original data secure.

Tokenization is majorly used in payment processing, data security, and asset management.

And when we talk about financial services, such as payments, insurance, investing, etc. There are several factors that give rise to the use of tokenization in fintech. Combining tokenization can help you enhance your fintech app security and data processing.

Tokenization in financial services can aid institutions that are already using blockchain technology for their business to keep their transactions secure. Now, these financial services can vary from lending to mutual funds, and from regular banking to insurance tech.

How Does Payment Tokenization Work?

To understand how tokenization works in real life, let us take an example of a payment done on a tokenization-enabled payment system/gateway.

Let the consumer be referred to as A and the merchant be referred to as B.

- Step 1: A initiates the payment using B’s point of sale infrastructure. It can be an online checkout form or a card machine.

- Step 2: B’s POS captures the sensitive information shared by A and sends it to the payment gateway where it replaces that information with a randomly generated token.

- Step 3: The original information is sent to the token vault which is available on B’s payment gateway.

- Step 4: Once the information is completely replaced by tokens, these tokens are again encrypted before being sent to the server for verification.

- Step 5: The verifying entity, usually a bank, accesses the token to find the information and authorizes the entire transaction, making the payment successful.

All of it is done in a matter of seconds. Since the information is not being passed on from one point to another, the chances of compromised transactions become significantly low.

An added layer of encryption makes it impossible for a hacker to identify your sensitive banking details.

Adoption of Tokenization in Fintech: Stats & Trends

Tokenization was initially thought of as a technology that could simply replace encryption.

However, with the introduction of Web 3 and other technologies, people realized how Tokenization can help different sectors in different ways.

When we talk about tokenization in financial services, several factors have contributed to the adoption of this tech. One of those factors is the gradual growth that the market has shown.

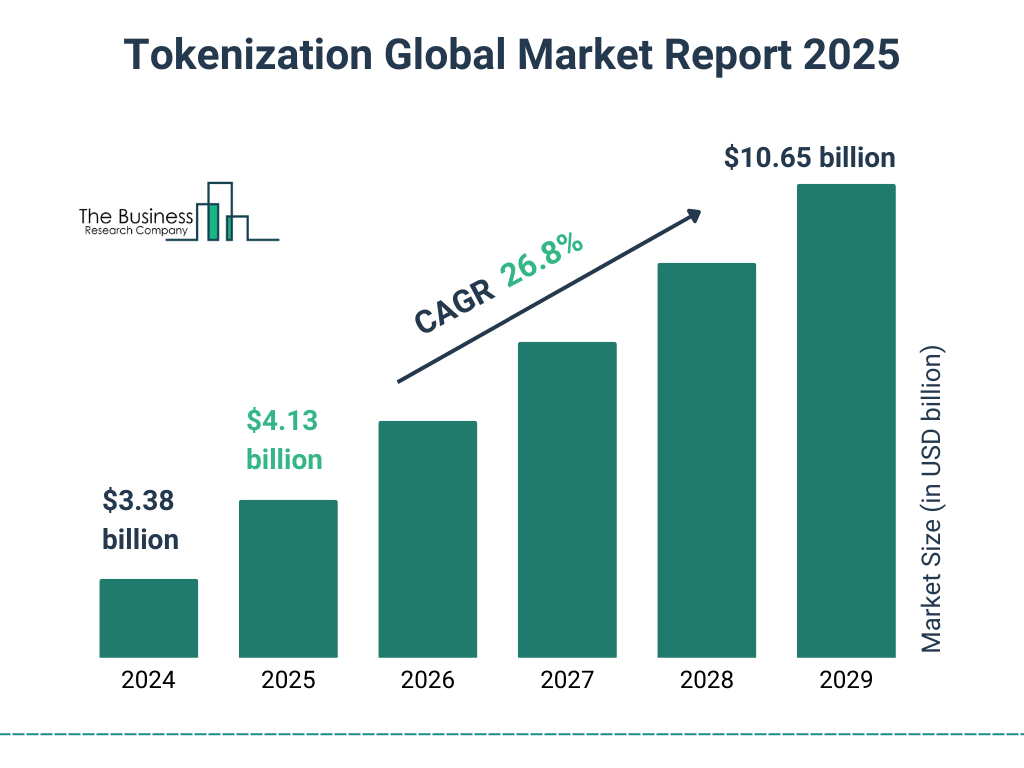

The fintech market size has grown in recent years. The market will grow from $3.38 billion in 2024 to $4.13 billion in 2025 at a compound annual growth rate (CAGR) of 22.1%.

Other than these, some of the latest financial trends in tokenization also prove to be a great motivation for the adoption of tokenization in fintech.

These trends include:

► Tokenization of EMV Transactions

All the chip-based transactions are set to be tokenized to ensure that the data is safe and no sensitive data is leaked.

► Enhanced Security for Card-on-File

One of the key problems in implementing recurring transactions and variable recurring payments (VRPs) is that sensitive data has to be saved online. With the help of tokenization, the implementation of VRPs can be facilitated, benefiting both businesses and consumers.

► Improved Card Not Present Mechanisms

Online CNP fraud is another issue that users face, as credit card transactions are not secure enough to avoid breaches. Saving the card on a platform puts it at a significant disadvantage.

However, with the implementation of tokenization, platforms will be able to save a token instead of the information, keeping it secure from data breaches and unauthorized access.

With all these trends and numbers indicating the rising use of tokenization, it will not be long before the majority of financial institutions adopt tokenization.

Needless to say, the technology is ready to be implemented.

Technologies Used to Implement Tokenization

To implement tokenization in fintech, you need to identify the compatible technologies. Usually, Tokenization is implemented with Web3, the latest technology for cutting-edge applications.

With the availability of compatible solutions and expert developers, any fintech organization can gain access to a robust tokenization infrastructure.

In general, tokenization is implemented with blockchain technology in fintech. The distributed nature of blockchain helps in enhancing the strength of tokenization, enabling faster processing and lower transaction costs.

The entire concept of tokenization is based on the decentralization of information.

Hence, technologies such as blockchain, smart contracts, asset trackers, etc., are the core of these technologies. Implemented with Web3, tokenization already supports the upcoming tech, making fintech startups and technologies, making it a viable choice.

Benefits of Tokenization in Financial Solutions

Tokenization, when implemented in fintech, can offer significant benefits.

These benefits can be related to security, ease of use, or data accuracy.

♦ Enhanced Security

Tokenization of information can help in keeping sensitive data secure. It replaces the information with security, making things more secure and free of data breaches and leaks.

Since tokenization is implemented on Blockchain, the decentralized structure of the technology helps reduce the risk of uninvited fraud and helps in creating safe ownership of records.

The immutable ledger offered by blockchain helps in keeping track of every transaction and ownership transfer.

♦ Faster Transaction Settlements

The asset transfer can be made swifter, thanks to blockchain-enabled technology and the 24/7 availability of the services. Usually, bank services take 2-3 business days to settle a transaction. However, with the help of tokenization, the entire system of allocation and settlement can be made instant, reducing the time for settlement by a huge margin.

♦ Better Data Analytics

Tokenization helps break large data into smaller, swiftly processible chunks that can yield better analytics. This directly reflects in the decision-making of an organization and since there is loads of data coming in regularly in a financial service company, the implementation of tokenization can be of significant benefit.

♦ Programmability

Each token used in tokenization offers programmability when implemented with Web3. This means you can easily embed code into the token to make it work automatically. This is a game changer, considering it can offer serious assistance in automating all processes.

♦ Operational Efficiency

With the help of tokenization, these basic tasks can be automated by embedding them into the smart contract of the token.

It might seem complicated, however, an individual with experience in working on tokenization can surely guide you through the process easily. With this applied automation, operational efficiency can increase significantly.

Other than these benefits, the fact that tokenization is already compatible with upcoming tech makes it more attractive to implement.

However, when we talk about the benefits, we should never undermine the limitations and challenges associated with it.

There are two sides to a coin, and the case with tokenization is no different. Check out the limitations of tokenization in financial services in the next section.

Limitations of Tokenization in Digital Finance

While tokenization seems a great way to protect digital assets/information from unauthorized access, it is not easy to implement.

Several limitations might become a problem while trying to implement tokenization.

These limitations include:

1. Regulations & Compliance

There are no clear financial regulations and compliance around the use of tokenization. This simply means that a company is always under scrutiny, which no fintech institution wants.

2. Cost of Implementation

As mentioned above, tokenization is best implemented with blockchain and Web 3 technologies. The cost of implementation is significantly high for these technologies as they are comparatively new.

3. Lack of Experts

Since the technology is new, there are hardly any experts who can help in the proper implementation of tokenization. This factor also reflects directly on the cost as the fewer experts, the higher the cost!

4. Complexity in Execution

Tokenization can be complicated to execute. It may be as simple as the concept that all it does is simply replace a particular string/asset with a token created at random. However, it can take months to set up the process for it.

5. Compatibility with Legacy Systems

To implement tokenization in finance, existing systems have to be upgraded. If not the entire system, at least the security mechanism has to be revamped completely.

The incompatibility of tokenization with legacy systems is a crucial limitation that you should consider.

Tokenization as a technology hardly shows any limitations. It is the implementation of it in fintech makes it typical to manage.

Not to mention, the technology is too new to be implemented as the experts for the same are not widely available.

Use Cases of Tokenization in Fintech: The Future of Digital Finance

The use of tokenization can help in bringing new concepts like direct investment to the forefront.

The implementation of this technology will surely help in opening new doors for fintech institutions.

Here are some use cases that can be explored via tokenization:

Use Case #1.Global Trade

Tokenization can significantly reduce the requirements of physical documents, helping in fixing traditional barriers such as document verification.

How? Well, tokenization converts these documents into digital assets, allowing these transactions to be more and more smoother.

If your financial service works with international transactions, this can be a great technology to take advantage of.

Use Case #2. Debt Issuance

If you are into lending, you already know how tricky managing debt issuance and different entities related to it can get.

Thanks to tokenization, you can simplify the entire process by automating repayments and interest calculations, reducing the operational hassle.

You can easily tokenize bonds and loans to simplify the issuance process.

Use Case #3. Debt Liquidity

Since the tokens are redeemable instantly and require no waiting time whatsoever, the overall liquidity of funds is always maintained.

The assets that you keep with the bank can be monetized instantly. This is a great way for banks to gain access to liquidity instantly as all their assets, bonds, and issued debts are converted into tokens, making them easily accessible.

Use Case #4. Direct Investments

For financial institutions that implement open banking and are interested in direct investments, tokenization is a great technology.

The market for peer-to-peer lending is certainly a growing one and thanks to tokenization, the gap between the investor and seeker can be bridged as the risk is significantly reduced.

This means they require no banking institution in the middle.

Use Case #5. DeFi Risk Management

The risks of decentralized financial institutions is already known by many. With the implementation of tokenization, you can easily reduce this risk as it can offer access to the latest products and services while reducing the overhead cost associated with the traditional models.

Keep in mind that these use cases can be implemented only by a professional who is good with blockchain and other Web3 technologies. And since it is new to implement, there are not many development companies available for you to choose from.

How Can Nimble AppGenie Help You Implement Tokenization in Fintech?

If you are looking to implement tokenization or want to build a fintech app that has all the latest features and technologies implemented, Nimble AppGenie is the ultimate solution.

With a team of experienced developers who regularly work on the latest technologies, we offer you a 360-degree financial app development services.

Tokenization is going to be a game changer for financial services in the upcoming years.

If you plan to be ready when the time comes, start your journey today! We at Nimble AppGenie offer innovative solutions for fintech, which helps a financial institution stand out! Connect now!

Conclusion

Tokenization offers robust security and data processing solutions that are both fast and safe for financial institutions.

The implementation of tokenization in financial services is the future as it holds significant benefits and use cases in fintech. If you are worried about how to implement this technology in your business, the use cases can help you understand the direction.

Hopefully by now you might have got a good understanding of what tokenization is and how it can be used in financial services. Thanks for reading, good luck!

FAQs

Some common examples of tokenization in fintech include:

- E-wallets that securely store credit card data.

- Shopping apps that protect user payment details and autofill order information when needed.

- Tokenized real-time debt fund management systems.

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.