The rise of fintech has enabled businesses and individuals to enjoy instant payments and faster settlements.

These benefits can be easily accessed with the help of an integrated payment gateway that takes care of all the incoming transactions for your business.

Payment gateways have become an integral part of every application that deals with any type of online transaction.

The convenience of contactless payments that these gateways offer is tremendous, as people can freely make payments online without worrying about their sensitive information being compromised.

However, since payment gateways have become huge over the years, there are several options available in the market.

While these options give the user enough flexibility to choose, it also brings confusion. The confusion of choosing the right gateway.

In this post, let us take a look at all the aspects related to online payment gateway integration and answer some important questions such as how to integrate a payment gateway.

How to choose the right payment gateway for your business, and more!

Without further ado, let’s get started.

Understanding Payment Gateways: How Do They Work?

Payment gateways serve as the middleman between two entities, a business and a customer, allowing them to complete a transaction as they find it convenient.

The payment gateway can be embedded into your existing platform, be it an e-commerce website or an app.

Through this embedded solution, your user gets access to different payment methods that allow a user to use an e-wallet, a credit/debit card, etc.

Here are the steps involved in working on a payment gateway –

- Step 1 – The user selects a product/service they want to purchase.

- Step 2 – The transaction is initiated when a user pays for it online.

- Step 3 – The user enters their payment information, such as credit card details, which the payment gateway accepts.

- Step 4 – The accepted information is sent to the corresponding bank via the merchant service provider to authenticate the transaction.

- Step 5 – The bank then checks the details, matches them with the database, and checks if the user’s account has enough funds to complete the transaction.

- Step 6 – Once the transaction is approved by the bank, the information is sent back to the payment gateway.

- Step 7 – After the payment gateway receives confirmation, the transaction goes through, and the funds are transferred to the merchant’s account.

All of this is done in real-time and takes 5 minutes. The best digital payment apps ensure that the transaction is processed properly.

Merchants verify every transaction when they receive large volumes. Hence, a payment gateway plays a pivotal role in enabling online transactions for businesses.

What Makes Up a Payment Gateway? Essential Components

The payment gateway seems to be a basic API that can be integrated into a solution to use. However, that is not the case. Several components and features come together to make a single payment gateway.

Here is a comprehensive table explaining the essential components of a payment gateway:

| Component | Description |

| Merchant Account | A special type of bank account that allows businesses to accept payments |

| Payment Gateway | A service that processes credit and debit card transactions securely. |

| API Integration | APIs are provided by the payment gateway for integrating with your website/app. |

| SSL Certificate | A secure socket layer (SSL) certificate ensures encryption and secure data. |

| Payment Processor | A financial institution that handles the transaction between the customer and the merchant. | |

| Front End Interface | The customer-facing checkout interface is where payment information is entered. |

| Backend Interface | The server-side code is responsible for handling the transaction logic and communication with the payment gateway. |

| Tokenization | A security method that replaces sensitive payment data with a unique token. |

| 3D Secure Authentication | An added security layer (e.g., Verified by Visa, MasterCard SecureCode) for card transactions. |

| Payment Methods | The types of payments accepted (e.g., credit cards, debit cards, PayPal, wallets, etc. |

| Error handling | Mechanisms to handle errors, payment failures, or issues during the transaction process. |

| Transaction History & Logs | Recording and tracking of all transactions, including success and failure logs. |

| Fraud Detection & Prevention | Tools to detect and prevent fraudulent activities, such as AI-based screening. |

| Currency & Localization | Support for different currencies, languages, and local payment preferences. |

| Compliance & Security (PCI-DSS) | Adhering to the Payment Card Industry Data Security Standard (PCI-DSS) to ensure data protection. |

Knowing what goes into a payment gateway, it surely seems a fair decision to integrate an existing one rather than plan to build your own. Each part has its importance.

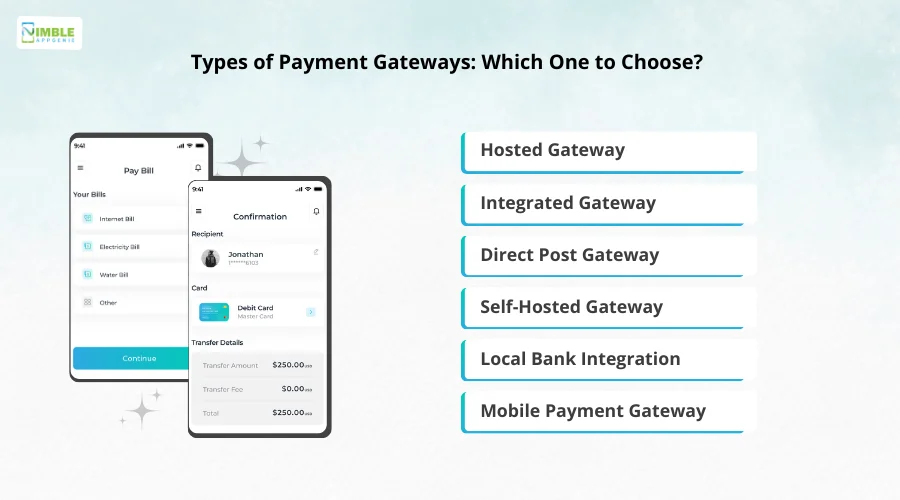

Types of Payment Gateways – Which One to Choose?

Payment gateways for every business have a dedicated role to play. And understanding all those requirements, there are different types of payment gateways available.

This classification is based on how these gateways function and what type of payment experience you choose.

Here are the types of payment gateways you can choose from –

1. Hosted Gateway

These are independently hosted gateways, integrated with the platform but featuring a dedicated payment page.

When using these gateways, the system redirects the user to a hosted page, where they enter their payment information and complete the transaction.

Once the transaction is complete, the system redirects the user back to the platform to continue browsing.

2. Integrated Gateway

These are the exact opposite of hosted gateways. They integrate into the platform and require no redirection whatsoever.

A user can start the payment, enter the payment information and process all of it from the app directly. These gateways offer a sense of consistency to the user, but require added effort to meet compliance and regulatory requirements.

3. Direct Post Gateway

This one is a combination of integrated and hosted gateways, as both the business and the payment gateway divide the entire process.

The platform shares the payment information directly, but the payment gateway servers process the transaction, making it more optimized.

The system completes the payment process in the background, ensuring a seamless user experience.

4. Self-Hosted Gateway

These types of gateways offer an integrated experience where everything is done on the business platform.

The platform itself forwards the payment information to the gateway’s URL. The entire gateway functionality is offered to the user on the business platform, making it appear seamless.

While such payment gateways allow a business to control user interactions and manage user data, they also require the platform to meet a certain set of guidelines.

5. Local Bank Integration

Onboarding a bank partner to collect online payments seems a more convincing and safe method.

Through this type of payment gateway, you can allow a user to be redirected to the bank’s platform and finish their payment.

Many users prefer the same as they are more familiar with the bank platform and find it more trustworthy.

However, the redirection might cause issues for users who do not prefer being redirected again and again.

6. Mobile Payment Gateway

These are payment gateways that support mobile payment options. With fast checkout options and the convenience of using a mobile device to complete the transaction.

Mobile payment gateways have found their way into every e-commerce platform as the majority of users these days prefer paying for things via their smartphones.

All these types offer different benefits for the merchants. Hence you need to identify the direct use case that sits well with your platform. However, to choose any one of them, you need to identify several factors related to the same.

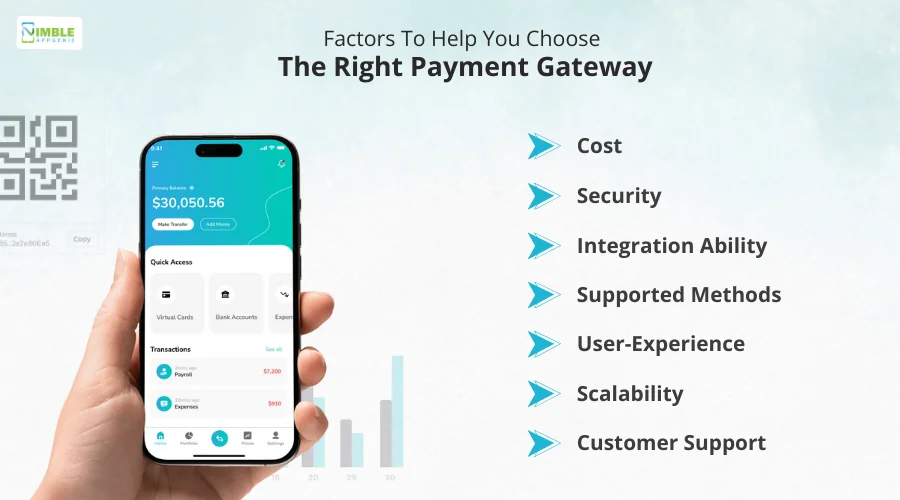

Factors that will Help you Choose the Right Payment Gateway

Choosing the right payment gateway is crucial for seamless transactions and business growth.

Key factors to consider include fintech security, transaction fees, supported currencies, integration ease, payment methods, and customer support.

♦ Cost

Before deciding on the gateway that you want, check the tariffs and charges per transaction.

Account for every hidden charge that a payment gateway might cost you. Also, make sure that you get the best commission rates.

♦ Security

While choosing an online payment gateway for your business, you need to ensure that there are no loopholes in the security of the process.

Ensure that the gateway that you have chosen is compliant with the PCI-DSS regulations.

♦ Integration Ability

This refers to how well the gateway can be integrated with your platform. Look for all the plug-ins and APIs to ensure that the payment gateway integration is seamless.

Choosing an integration-friendly payment gateway can help you save time and effort.

♦ Supported Methods

With the rise in fintech solutions, several payment methods such as e-wallets, pay later accounts, credit cards, debit cards, net banking, etc. have emerged.

Make sure you choose a payment gateway that supports maximum payment methods as it gives your users the convenience and flexibility.

♦ User-Experience

Another thing to consider while choosing an online payment gateway for your business is the user experience that it offers.

If making payments is a troublesome or tedious process, you might lose potential customers. Hence the user experience is a crucial detail to pay attention to.

♦ Scalability

While starting your business, you might not pay attention to this factor as you have limited visitors and customers on your platform. However, the payment gateway you choose should be scalable in the long run.

So much so that even if the number of users or the volume of transactions rises out of nowhere the platform can easily handle the same.

♦ Customer Support

Being a client of a payment gateway, you should check and ensure that the one you choose offers decent customer support.

Since payments and transactions are involved, you need a gateway that is prompt in answering the questions and resolving errors if any.

Based on all these factors, you can identify which payment gateway suits you the best and make the choice.

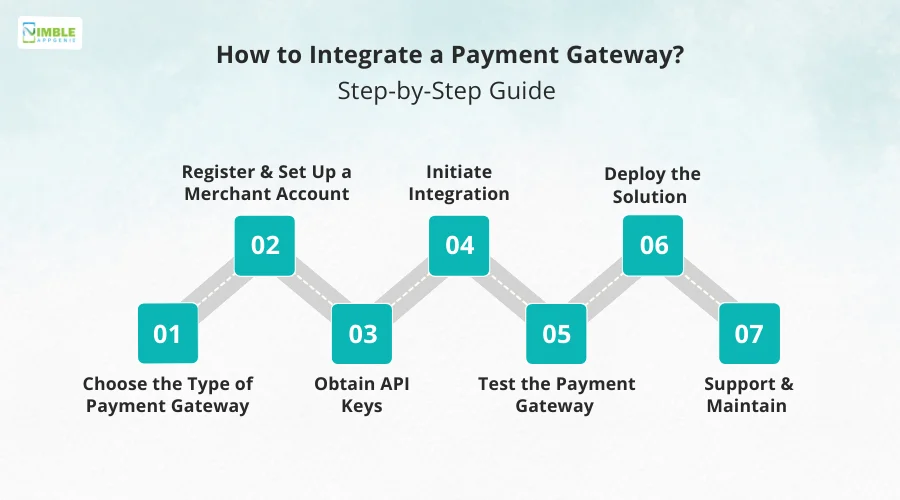

How to Integrate a Payment Gateway? Step-by-Step Guide (App/Website)

Now that you are aware of the types of gateways and how to choose the best one according to your requirements.

Let us take a look at all the steps that enable online payment gateway integration.

Here are the steps involved –

Step 1 – Choose the Type of Payment Gateway

Based on your requirements and affordability, you should choose the type of gateway you want to integrate with your platform.

Choosing a gateway helps you identify the core use-cases of your platform, making the purpose more and more clear.

Step 2 – Register & Set Up a Merchant Account

After you have decided on the payment gateway, the first step is to create your merchant account on the payment gateway provider.

This way you can register your company on the platform to be able to integrate it with your existing app/website.

Step 3 – Obtain API Keys

This is a crucial step, as this is where you will get the respective API keys to integrate with your platform. Look for API keys, credentials, tokens, etc. to add a gateway.

These API keys help you fetch all the necessary functionalities and data from the payment gateway directly into your platform.

Step 4 – Initiate Integration

After you have access to the API credentials, it is time to start the integration process. If you are integrating an online payment gateway into an app, you will need to use dedicated SDKs.

This helps streamline the process of payment gateway integration for different operating systems, including Android & iOS.

On the other hand, if you are planning to integrate the API into your website.

All you need to do is simply integrate the API into the website using the API credentials that you had explored in the previous step.

Step 5 – Test the Payment Gateway

Once the integration process is complete, start testing the gateway. You need proper quality assurance to ensure that the payment gateway is ready to be deployed.

Create test-cases and run them all to check if there are issues in any functionality of the integration.

Step 6 – Deploy the Solution

Resolve the changes that appear and once all of them are sorted, it is time to deploy the solution.

Making the payment gateway live is an easy task however requires prior experience if this step is not done properly, you may find several issues in the final output.

Step 7 – Support & Maintain

The job does not end after deploying the payment gateway. You have to be diligent and follow every transaction to ensure that the integration is working properly.

These integrations require regular maintenance and support for seamless transactions.

When all these steps are completed, you will have a functional payment gateway integrated into your application.

Keep in mind that while these steps appear easy to follow and do, they require guidance and hands-on experience. Hence, it is advised that you ask for professional support from payment gateway integration experts.

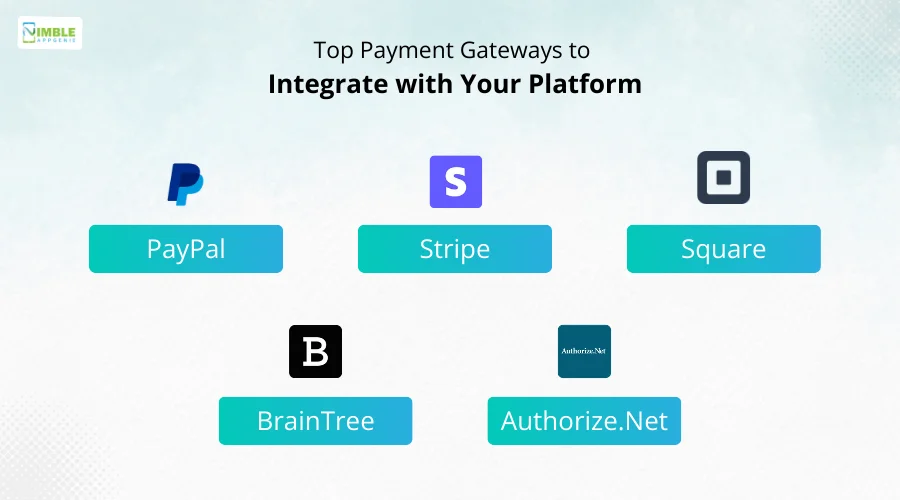

Top Payment Gateways to Integrate with Your Platform (App/Website)

As mentioned earlier, several types of payment gateways are available in the market.

The availability of these options is often confusing to the user looking for the best fit in the fintech market.

If you are also facing a similar problem, then here are some options that you can consider –

► PayPal

PayPal is one of the oldest and most preferred payment gateways, also nominated as the best in the payment gateway world.

It is a widely recognized brand that offers a variety of payment methods, including credit cards, debit cards, and local payment options in specific regions.

It is surely inspiring investors to develop an app like PayPal and launch it.

► Stripe

The application supports various payment methods, including debit cards, credit cards, ACH payments, and other options.

Due to its easy-to-use interface and a variety of features, the gateway is popular among startups and businesses as it offers affordable payment management solutions.

► Square

Apart from its popular payments app, it also provides a Payment Gateway for brick-and-mortar businesses and others.

With Square, businesses can accept online and offline payments, providing suitable payment methods to users. It also provides point-of-sale hardware and online checkout solutions.

Making it a one-stop payment solution for businesses. The charges are also affordable, making it a go-to choice for young entrepreneurs.

► Braintree

A popular name in mobile payment gateways, Braintree is a platform owned by PayPal. It emphasizes more on mobile payments.

Thus, making it a popular option for eWallet app development. It offers payment methods including credit cards, debit cards, and alternative payment options.

Furthermore, it provides robust APIs and SDKs for seamless payment gateway integration with mobile apps and websites.

► Authorize.Net

Authorize.Net is a well-established payment gateway option. It provides all the payment methods that you want from a payment gateway service provider, including credit cards, debit cards, and recurring billing options.

This payment gateway option has a strong focus on security and fraud prevention areas.

All these are reputed players in the payments gateway market and can help you achieve the best results.

For more information on what can be the best payment gateway for your platform, consult a professional.

How Nimble AppGenie Can Help With Online Payment Integration

After identifying all the aspects of a payment gateway, from its types to the steps of integration, you might have understood the crucial nature of these integrations.

However, these integrations are not everyone’s cup of tea, as one mistake and you might lose business.

At Nimble AppGenie, we have expertise in fintech app development services and can integrate the desired online payment gateway for you.

Our professional developers and analysts can understand your requirements and suggest the right payment gateway.

Not only that, you can even rely on our experts to guide you through better integration practices in no time.

With 7+ years of experience and 350+ projects, we can help you get the best online payment gateway integrated into your platform, be it an app or a website.

Conclusion

Knowing the crucial role that a payment gateway plays in your application, you might have an idea of how important it is to integrate one.

There are different types of online payment gateways and each of them has its advantages and disadvantages. Identifying which one you need can help you make an informed decision.

However, the key thing to pay attention to here is the entire process of integrating a payment gateway.

If you own a business or an e-commerce platform, integrating online payment gateways is the most crucial step for you.

Reach out to the experts today to discuss the type of gateway you want to integrate.

With that said, we have reached the end of this post, thanks for reading, and good luck!

FAQs

Payment gateways are of different types and can be used depending on the requirements, vision, and budget of the project. These types include:

- Hosted Gateway

- Integrated Gateway

- Direct Post Gateway

- Self-Hosted Gateway

- Local Bank Integration

- Mobile Payment Gateway

To choose a payment gateway for your business, you need to ensure that the gateway you are choosing meets the following requirements:

- Security Features

- Easy to Use/Integrate

- Supports Multiple Payment Methods

- Availability of Support

- Cost of Implementation

- Scalability

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.