Banking and finance as an industry have grown significantly in recent years, all thanks to the rise of fintech apps. By taking traditional banking and financial services online, fintech has played a crucial role in the digital transformation.

The modernization of these services has certainly given rise to new and innovative ways to use banking services.

One such initiative is a Neobank. Today, people can make transactions, check their bank balances, open savings and checking accounts, and more from the convenience of their smartphones.

The idea of a Neobank is relatively new, but is catching up with the market as more and more startups, businesses, and traditional banks are inclined towards exploring the opportunities that these bring along.

If you, too, are planning to enter the fintech market with a Neobank app, then this is the post for you. In this one, let us take a look at the entire concept of Neobanks, how they work, what you should invest in a Neobank app, and how you can make money out of it.

Without further ado, let’s start by learning about these digital banks and how they work.

What is a Neobank & How Does it Work?

Unlike traditional banks that take the offline-first approach, Neobanks are digital-only financial institutions whose core focus is on providing necessary banking services online, without having to invest in physical branches and services.

Instead, they designed an experience that is completely online, making the entire process seamless and easily accessible. The idea behind such banks is to optimize banking operations so that more and more people can benefit from the services, without too much of an investment.

You see, for an individual using a traditional bank, there are several benefits of moving to a Neobank, as the fees for transactions are comparatively lower.

This happens because traditional banks have to take care of several liabilities, such as physical bank branches, resources, etc., all of which they have to manage.

On the other hand, they are completely digital, which allows them to lower their fees and interest charges on the service.

The way these digital banks work is quite different from any traditional bank.

Here are some steps to clear the process that Neobanks follow –

- A neobank uses an online platform, usually an application that a user can download and use on their smartphone to access banking services.

- Neobanks are not required to have a license to offer banking services. Instead, they can partner with existing banks so that their regulations are taken care of.

- With a well-designed app, Neobanks primarily focus on making these services convenient for the user. The application integrates real-time data to keep its users updated.

- Customers can directly download these applications and register themselves as users. All the documents required to open a bank account can be submitted electronically, making the entire process hassle-free.

- All the features can be accessed through the application. If support is required, there are integrated tools such as in-app messages, emails, etc.

- Since it is a digital platform, a Neobank leverages data analytics and user interactions to offer a personalized experience and push its services accordingly.

- All the services that these banks offer must adhere to the regulations imposed by the regional and national regulators.

By taking all these steps, a Neobank ensures that it educates its customers about ways they can utilize its services to the fullest.

All of this is still more convenient for users than visiting a traditional bank branch, as completing these steps takes only a few minutes and can be done from anywhere in the world.

Features that Make a Neobank App Successful

Behind every successful neobank is a series of features that power it. It is crucial to identify what features a Neobank must have, and what are some good features to have but are not necessarily found in every Neobank app.

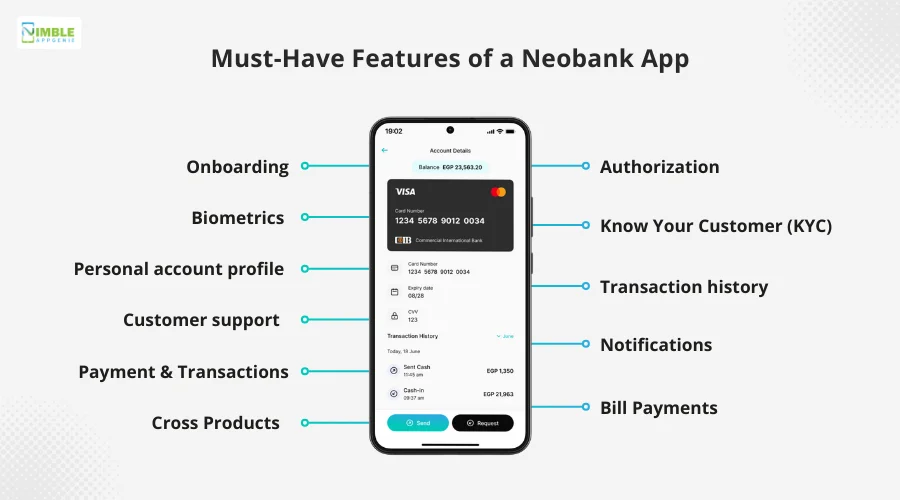

Must-Have Features of a Neobank App

- Onboarding

- Authorization

- Biometrics

- Know Your Customer (KYC)

- Personal account profile

- Transaction history

- Customer Support

- Notifications

- Payment & Transactions

- Bill Payments

- Cross Products

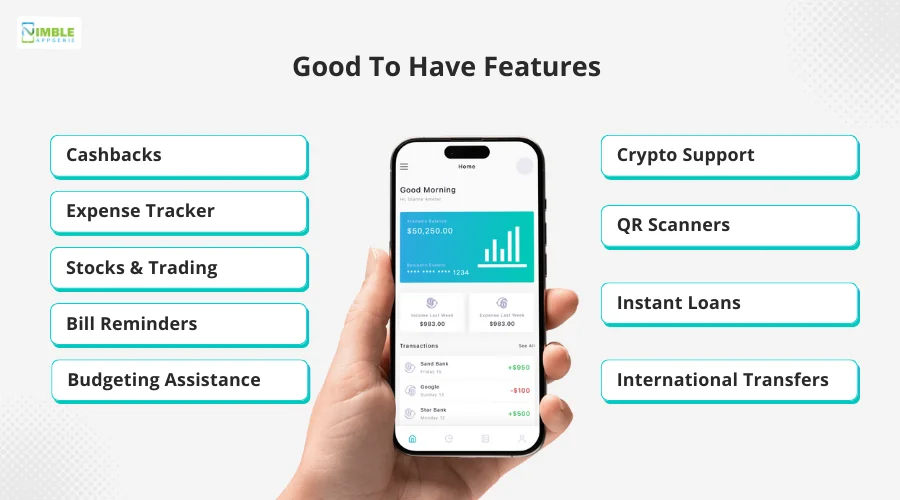

Good To Have Features

- Cashback

- Crypto Support

- Expense Tracker

- QR Scanners

- Stocks & Trading

- Instant Loans

- Bill Reminders

- International Transfers

- Budgeting Assistance

With all these features backing a Neobank, it is difficult for the banking market to ignore Neobanks as they bring along functionalities, convenience, and ease of access.

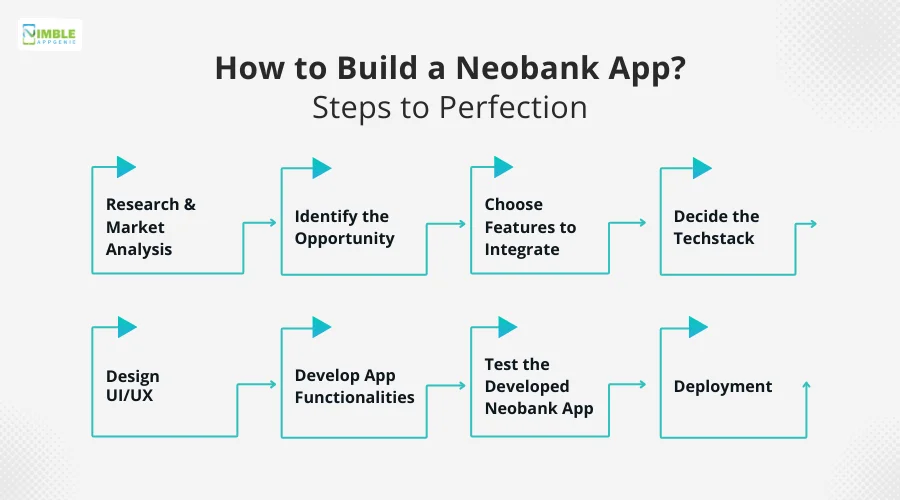

How to Build a Neobank App? Steps to Perfection

Now that you are aware of the features that a Neobank offers, let us move on to understanding how Neobank app development works.

The app development process for a Neobank is somewhat similar to that of any other banking app, as they work similarly. The idea behind the app development is to build a digital infrastructure that allows a user to access banking services safely.

Here are the steps that can help you build a Neobank app –

Step 1 – Research & Market Analysis

The first thing you need to do is research your market appropriately. With the rise of fintech, the market for online banking services is certainly growing and slowly getting cluttered with new and upcoming apps.

Hence, understand the market and find out everything you can before you commence building your solution.

Step 2 – Identify the Opportunity

Based on your research, you need to identify the right opportunity for your service. Design a business plan and craft your value proposition.

It is crucial to place your Neobank in the market correctly, as that decides how people perceive it. You can address the gaps that you find during your research and develop a Neobank app that solves that issue to find your value proposition.

Step 3 – Choose Features to Integrate

Based on your market understanding and how you want to approach the market, you can choose the set of features that you want to integrate into your banking app.

You must identify the features and decide on them firsthand, as it helps the further process. Choosing the features makes the picture clearer for the users.

Step 4 – Decide on the Techstack

The features of Neobank applications are functionalities that require technology to power them. Hence, you need to decide the tech stack according to your banking app features.

There are several components of an app for which you need to choose the technologies. The components are – Fronten. Backend, Database, APIs, Cloud Platforms, and additional advanced technologies like AI & ML.

Step 5 – Design UI/UX

After you have the features and technologies to power them, it is time to design the application layout and user experience.

This is the step where your Neobank app starts taking shape. You can manage the interface and design the placement of features, navigation, and other aspects of your application. The more intuitive and unique your design is, the better it works for the users.

Step 6 – Develop App Functionalities

Once the entire layout is ready, it’s time for the development phase. This is where your application comes to life. The developers start building functionalities one after the other.

Since these functionalities are developed according to the app’s requirements, the process might take some time. This is also the reason why this is the most time-consuming step of the entire process.

Step 7 – Test the Developed Neobank App

While the developers do their job with perfection, the systems they use are high-performance, and hence, the built functionalities might start acting up when the environment changes.

To ensure that there are no bugs and no performance issues, a dedicated team of quality assurance engineers is deployed.

These experts make it their priority to identify problems that may have developed during the development process.

Step 8 – Deployment

Once all the issues are identified and both testing and development teams are satisfied with their work, the application is deployed to designated stores.

This is the final step in the Neobank app development. With this deployment, the app is made available to the public, making it live.

Once the Neobank app development process is complete, it is time to take care of its performance & maintenance. Ensuring that the application is fully functional and has no lags is an ongoing process.

However, these 8 steps of Neobank app development can help you build a robust solution.

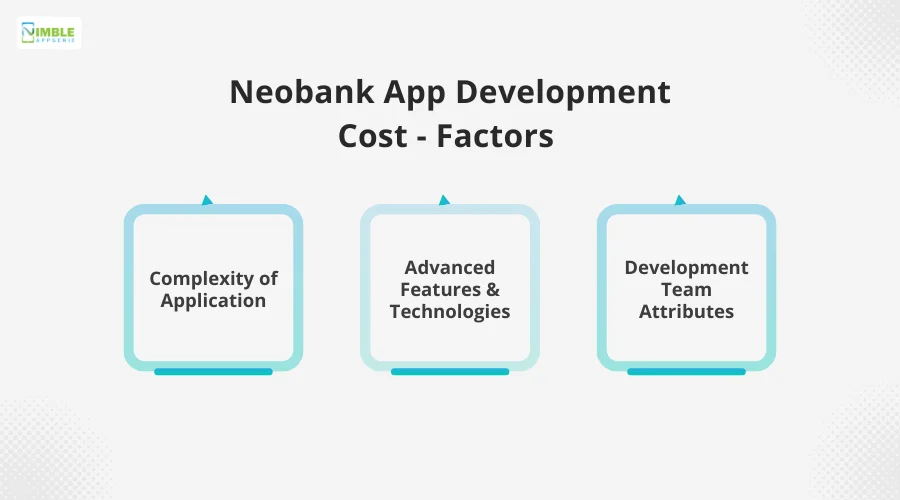

Neobank App Development Cost – Factors

Generally, the cost of developing a banking app lies somewhere between $30,000 to $300,000, depending on various factors.

The process of building a Neobank app is quite straightforward. However, there are several complex intricacies that one has to keep in mind.

This is also the reason why people prefer going for professional neobank app development services, as they offer professional developers and a team of analysts to take care of the process. But all of that comes with a price tag.

Some of the core factors that define the cost of Neobank app development include –

1] Complexity of Application

The cost of your Neobanking app development can significantly vary depending on the complexity and the framework that you choose.

If you plan to go for native app development and build them individually for OSs, it will cost you more, whereas when you go for hybrid development, the process is less time & resource consuming, making it less expensive.

2] Advanced Features & Technologies

Use of advanced technologies can also significantly raise your investment, as these technologies require expensive resources and highly qualified developers who have expertise with those technologies.

All of these amount to an additional cost, which often ends up making Neobanking app development an expensive affair.

3] Development Team Attributes

One of the key factors that usually affects the cost of Neobank app development is the development team you hire.

Attributes like where do the developers work from, the number of resources deployed on the project, the per-hour cost of these developers, etc,. Define the overall cost of your app.

Other than these factors, the framework of application, whether you choose Native or Hybrid App Development, also makes a significant difference.

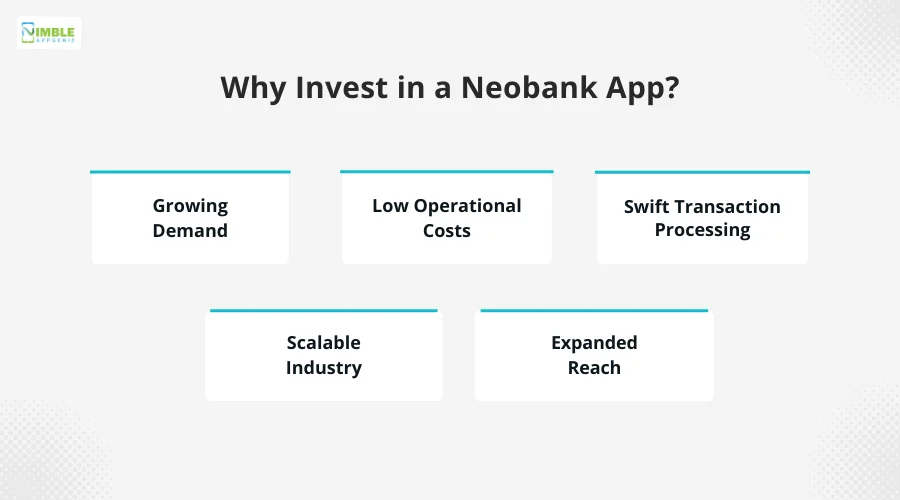

Why Invest in a Neobank App?

Now you may be wondering why one should invest that much into a Neobanking app? Well, the concern is correct, as today everything looks promising, but it is not always the best investment.

However, in this case, the investment seems a vital decision as several factors are currently going in favor of Neobanks.

The market is certainly growing and is set to grow exponentially shortly. Other than these numbers, different factors make this investment a good decision.

♦ Growing Demand

The market for such applications is a growing one. With more and more people getting access to smartphones and seamless internet, the demand for online banking services will increase in the upcoming years.

This offers a great opportunity to start your fintech startup, as people on the internet are always looking for better options, irrespective of what they currently use.

♦ Low Operational Costs

One of the biggest issues why not too many players wanted to enter the banking sector was the resource-hungry nature of the business.

A traditional bank requires physical branches, human resources, ATMs, etc. to cater to a user. In comparison to that, Neobank app development costs a fraction of the offline operations.

Not to mention, maintaining the operations is smoother too, as the majority of them are automated.

♦ Swift Transaction Processing

Since the entire banking process is automated, it can speed up the transactions significantly. This means better settlements and higher success rates.

This transaction processing will help your business thrive as more and more satisfied customers start spreading their positive experiences with others, helping you grow your business.

♦ Scalable Industry

Finance as an industry is deeply rooted in our society. With a Neobank app of your own, you can not only penetrate the market but can even scale your business in no time.

You can start as an online bank affiliated with a traditional bank and slowly make your way to offline banking by offering additional services like physical cards, credit lines, etc. The possibilities are endless.

♦ Expanded Reach

If you are already in the banking and finance business and planning to expand your reach, developing a Neobank app can be a vital step.

You see, in an offline business, your reach is restricted to a limited area as you can only reach people who are in your local area.

However, an online application can help you reach the masses, expanding your reach.

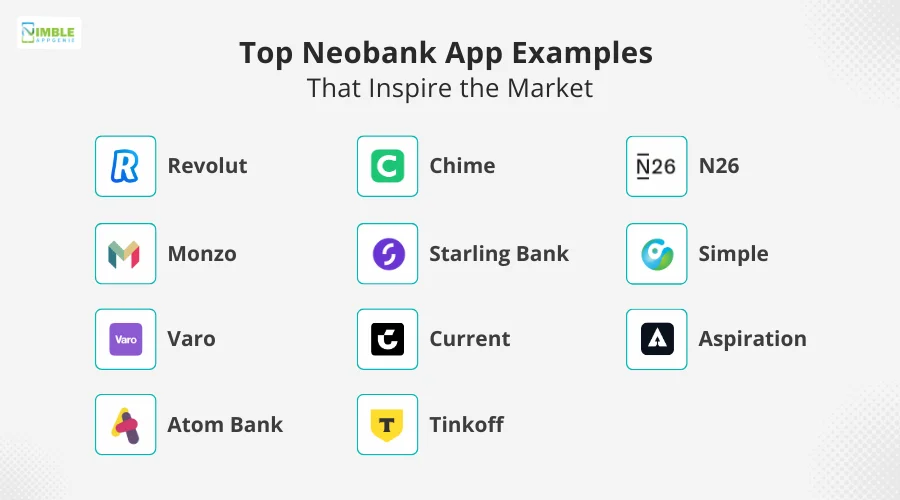

Top Neobank App Examples That Inspire the Market

It’s time to look at some popular neobanks to better understand the concept.

Therefore, these are, as mentioned below:

► Revolut

Revolut is a UK-based neobank known for its multi-currency accounts and low-fee international transfers.

It offers features like budgeting tools, cryptocurrency trading, and stock trading, making it a versatile financial app.

Revolut’s success stems from its user-friendly interface, competitive pricing, and continuous innovation in financial services.

► Chime

Chime is an American Neobank that focuses on providing fee-free banking services.

It offers early direct deposit, automatic savings, and a user-friendly mobile app.

Chime’s success can be attributed to its no-fee structure, simplicity, and a strong emphasis on customer service and financial health tools.

No wonder people want to create a Chime clone.

► N26

N26, based in Germany, offers a sleek mobile banking experience with features like real-time spending notifications, automatic categorization of expenses, and zero-fee foreign transactions.

Its success lies in its seamless user experience and robust security features, making it a favorite among tech-savvy users.

Also Read: Cost to Build an App Like N26

► Monzo

Ever wondered why so many people want to develop an app like Manzo?

Another UK-based neobank is known for its transparent fee structure and innovative features such as bill splitting, instant notifications, and budgeting tools.

Monzo’s community-driven approach and commitment to transparency have contributed to its rapid growth and popularity.

► Starling Bank

Starling Bank is a UK Neobank offering a full range of personal and business banking services.

It’s known for its competitive interest rates on savings accounts and integrated financial management tools.

Starling’s success comes from its comprehensive service offering and strong customer support.

► Simple

Simple, based in the US, focuses on helping users manage their money better with tools for budgeting and saving.

It offers features like Safe-to-Spend, which calculates how much money users can safely spend after accounting for upcoming expenses.

Simple’s clear focus on financial management and user education makes it stand out.

► Varo

Varo is an American Neobank that provides fee-free banking with features like high-yield savings accounts, early direct deposits, and budgeting tools.

Varo’s success is due to its user-centric approach and commitment to offering fee-free banking services.

► Current

Currently based in the US, it targets younger users with features like instant spending notifications, budgeting tools, and fee-free overdrafts.

It also offers a unique feature called “Teen Banking” aimed at helping teenagers manage their money.

The current focus on young users and their financial education contributes to its popularity.

► Aspiration

Aspiration is an American Neobank with a focus on sustainability and ethical banking. It offers cash back for socially conscious spending and high interest rates on savings.

Aspiration’s unique value proposition of combining banking with ethical consumerism has driven its success.

► Atom Bank

Atom Bank, based in the UK, operates entirely through its mobile app, offering competitive mortgage rates, savings accounts, and business loans.

Its success is driven by its innovative approach to banking, offering better rates and a more streamlined user experience compared to traditional banks.

► Tinkoff

Tinkoff, a Russian Neobank, offers a wide range of financial products, including credit cards, loans, insurance, and investment services.

Its extensive product range and focus on digital innovation have made it one of the most successful neobanks in its region.

These neobanks have leveraged technology, customer-centric services, and innovative features to disrupt traditional banking, providing users with more efficient and accessible financial solutions.

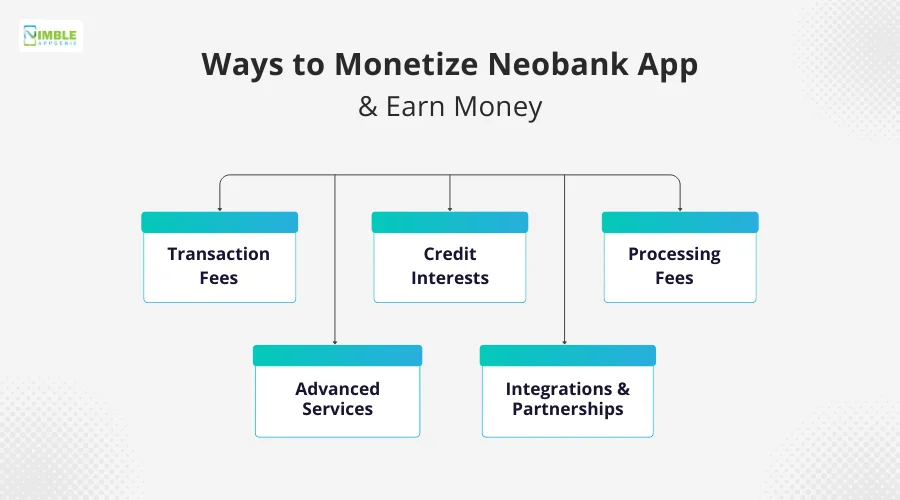

Ways to Monetize Neobank App & Earn Money

Neobank app development is surely one of the most in-demand services in fintech app development. Not only do these applications offer convenience to the users, but they also offer a great opportunity to generate revenue.

Here are some monetization strategies that can help you out –

-

Transaction Fees

A neobank can charge a minimal amount as a transaction fee for every transaction that it facilitates. While it seems a small amount that matters to the customer, it can be highly beneficial for your business when high-volume transactions start coming in.

-

Credit Interest

If your neobank offers a credit line to users, it can surely fetch solid revenue for your business in the form of credit interest. These are a great way to monetize your application, however, you need proper credit risk assessment tools to stay on top of these transactions.

-

Processing Fees

For any request that you process for a user through your platform, be it a bill payment or a third-party platform payment, you can charge a processing fee. This processing fee allows you to maintain the infrastructure that you have built and can contribute to some serious revenue.

-

Advanced Services

You can also offer advanced services at a fee inside your app. Services like checking credit scores, additional insurance plans, and more can be bought through a Neobank in exchange for additional charges. This is another great way to monetize your app.

-

Integrations & Partnerships

In-app purchases, brand integrations, and affiliate partnerships also bring along a great deal of revenue for the users. You can decide the price for those integrations, along with the terms and conditions to make the most of this revenue stream.

Other than these, a Neobank can include subscriptions and other services that can help generate revenue for the users. Needless to say, the opportunities that Neobank apps bring along are endless.

What Makes Nimble AppGenie Your Ideal Partner for Neobank App Development?

As mentioned earlier, you need proper development experts to guide you through the entire Neobank app development process. However, finding the right partner is another headache that causes hindrance in the execution of your idea.

If you, too, are facing a similar problem, then it certainly ends here as Nimble AppGenie has got you covered! Our decades of app development experience, along with highly qualified developers, can come in handy for you.

Not only do we understand the industry, but we are also aware of all the intricacies related to financial regulations and compliance, which a lot of people face issues with while making a Neobank app.

Reach out to our developers today and start your journey towards a successful Neobank app that will help you grow!

Conclusion

Neobanks have certainly changed the way people interact with online banking. Not only do these banks offer convenience, but the complexity of using a Neobank app is much simpler than that of engaging with a traditional banking app. This convenience and functionality make investing in a neobank more viable and worthwhile.

The market is ripe for Neobank applications, and hence developing it can be a vital decision from a growth and revenue point of view.

To build a Neobank app, you need to understand all the parameters of development and follow a series of steps.

The first and most important step is to choose the best banking app development company that can lead you to success.

Hopefully, this blog will help you answer all your queries related to Neobank app development. In case you have any further queries, feel free to connect with our experts.

FAQs

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.