There is a far greater difference between owning a mobile banking app and sustaining it in a competitive environment.

Thus, this is where mobile banking app maintenance comes into the picture. When you are into developing a dream app, you concentrate on the process that will end up launching it to the market, right?

Well, maintenance starts from the point the app launches in the market.

Scared about how to proceed with mobile banking app maintenance?

This guide is here to provide all related info.

Let’s look at each aspect.

What is Maintenance in Mobile Banking Apps?

Instead of looking into the complete term of mobile banking app maintenance, we have simplified it for you by breaking the term.

In this section, we will discuss the basics.

Mobile banking app maintenance combines two terms, including mobile banking app and maintenance. The first term acts as a service provided by the bank or any other kind of financial institution assisting customers to pursue financial transactions, remotely.

These apps work over the internet and avail users the services such as mobile deposits, ATM locator, card management, customized notifications, cardless withdrawals, internet payments, and much more.

On the other hand, maintenance includes continuous monitoring, infrastructure monitoring along automated system regression level testing. It is one of the phases that cannot be ignored. This is an essential process that comprises fixing bugs, updating the new operating system, security enhancements, along with the addition of new features.

Now, let’s understand the term mobile banking app maintenance.

It is all about maintaining the mobile banking app by drawing its features and updating them to the latest update. Here, you need to test its current functionalities, examine the updates, and improve the overall performance of the app.

A maintained app is much better than a developed app. In development, the cost spent is much higher than the maintenance.

So why not focus on maintenance?

Let’s evaluate this question in the following section.

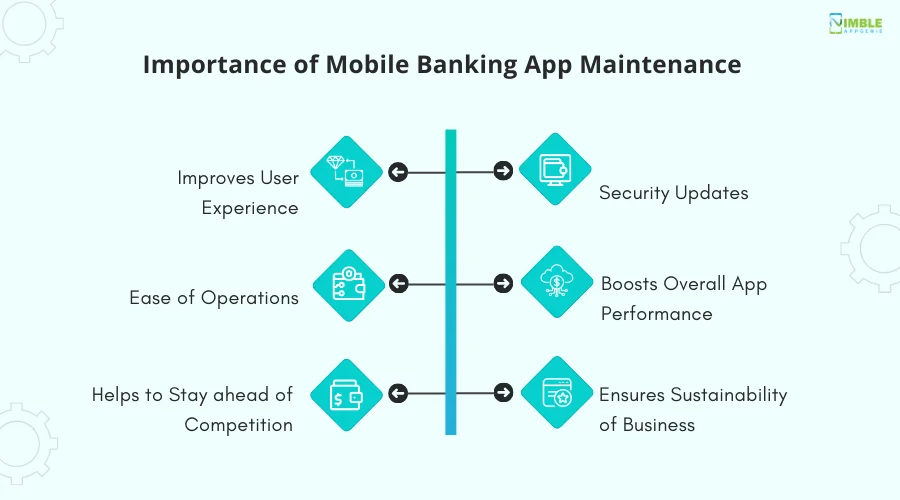

Importance of Mobile Banking App Maintenance

Mobile banking app maintenance is crucial for keeping the app running seamlessly through increased user interaction rates.

Let’s examine more reasons and importance of maintenance in mobile apps in the given section.

♦ Improves User Experience

Timely updates within mobile banking apps are key to user satisfaction. Regular updates, fixing bugs, and adding new features in banking apps, can help the developers to address the issues that users might face, resulting in smoother functionality as well as reducing frustration.

♦ Security Updates

Mobile app security is an essential determinant and developers should prioritize it. The timely updates within the apps are crucial for fixing any type of security issues within an app. The rising cybersecurity threats and hackers are seeking out opportunities to take over our businesses. Thus, updating the security system with the implementation of robust technologies.

♦ Ease of Operations

Implementing current technologies can be useful in addressing bugs and errors and simplifying operations. The phone operating system requires changes and the same goes for the app. It is important to fix the issues before it crashes the program. In such a way, the users will find simplified operations for completing their tasks in a few clicks.

♦ Boosts Overall App Performance

The performance of the app has a direct impact on the user satisfaction rate. Additionally, the app that hasn’t been updated has a huge possibility of slowing down, crashing, or having problems while working with new devices. However, if the developers keep improving the code and fixing any issues, then this can slow down app performance.

♦ Helps to Stay Ahead of Competition

Updating the app based on current technological parameters can be useful in fixing any bugs or errors, by complying with the new operating system requirements as well as by integrating the latest technologies. Maintaining the mobile banking apps will help monitor the competitors and assist them in staying on top of the markets.

♦ Ensures Sustainability of Business

If you want your business to sustain for longer intervals, it is essential to maintain the apps often. Here, you can practice clean coding, with efficient data storage systems, along with cross-platform app development. Regular app updates can be useful in optimal energy consumption and carbon emissions.

These are all the importance you can consider for maintaining mobile banking apps.

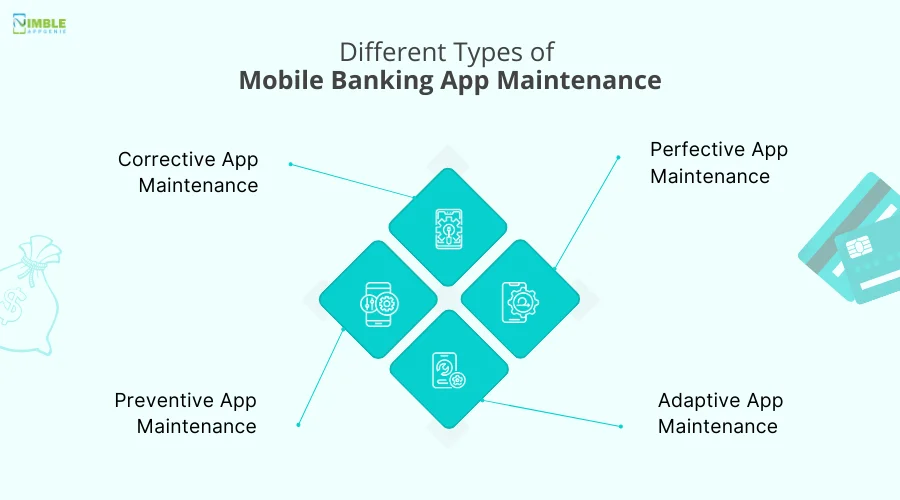

Different Types of Mobile Banking App Maintenance

How to Maintain Banking Apps?

Before you proceed with the steps to maintain banking apps, it’s important to learn about the different types of mobile banking app maintenance categories present in the market.

Within this banking app maintenance guide, we have defined the types to help you select the best.

1. Corrective App Maintenance

This is a type of mobile banking app maintenance focusing on fixing the bugs, errors, and other types of glitches that might arise even after the app’s release.

The main goal of the corrective banking app maintenance is to find errors and then restore the software to be capable of handling the growing user’s dynamic needs.

2. Perfective App Maintenance

Perfective app maintenance not only addresses errors or faults but focuses on reducing the rising issues of the users.

You can opt for perfect mobile banking app maintenance, enhancing the complete software’s performance, refactoring the code to enhance readability, and then improving the functions based on current market issues.

3. Preventive App Maintenance

Preventive app maintenance is a type for increasing the performance of mobile apps by enhancing the complete quality of software applications and by reducing maintenance costs.

This type of maintenance is essential to address the issues even before they occur in the dynamic market. Within this type of maintenance, the user’s issues should be identified in the first place and then reduced in the second.

4. Adaptive App Maintenance

Adaptive app maintenance can be defined as an implementation of the current technologies in a certain part of the software for updating it.

This too helps in ensuring that the mobile banking app works successfully with other devices without negatively impacting the user experience.

These are some of the mobile app maintenance types you can select from for banking software.

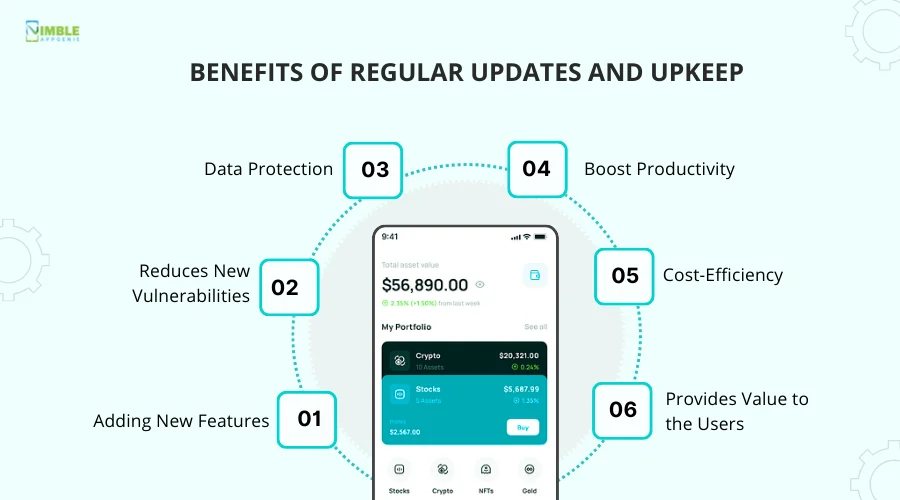

Benefits of Regular Updates and Upkeep

What is the benefit of performing routine app maintenance and up keeping the mobile banking industry?

Consider the list below.

-

Adding New Features

Through regular updates and upkeep, you might add new features and functionalities.

You can add new features based on changing users’ demands. Adding new features keeps the users excited about the brand.

Also Read: Mobile Banking App Features

-

Reduces New Vulnerabilities

Regular updates can be useful in mitigating any new vulnerabilities related to security and any other parameters.

Here, software updates often comprise patches to address new weaknesses related to the brand.

-

Data Protection

App maintenance is a crucial parameter to be considered for mobile banking app updates, useful for protecting the user data, preventing breaches, as well as avoiding any data leaks as well as legal consequences.

Through app maintenance, you should ensure continuous app enhancements, further leading to code refinement and fixing errors.

-

Boost Productivity

Regular updates can be useful in boosting productivity. You should implement mobile banking app maintenance to ensure that your app remains secure against any potential vulnerabilities and potential breaches.

It further helps in maintaining a safe environment, further contributing to overall team productivity.

-

Cost-Efficiency

App maintenance is an essential attribute effective in scaling up the cost. With regular updates, you can reduce any sudden vulnerabilities that can impact the complete performance of your app.

Robust app maintenance needs to be long-term for fixing the bugs, enhancing security along delivering a better user experience.

-

Provides Value to the Users

With regular mobile banking app maintenance, you might provide value to the user by implementing their feedback.

Regular updates and upkeep are useful in reducing the real classroom challenges by considering diversified users’ feedback.

Till now, we have discussed the concept of mobile banking app maintenance, its importance, types, and benefits of regular updates, and upkeep.

Now, let’s check out the step-by-step mobile banking app maintenance process in the next section.

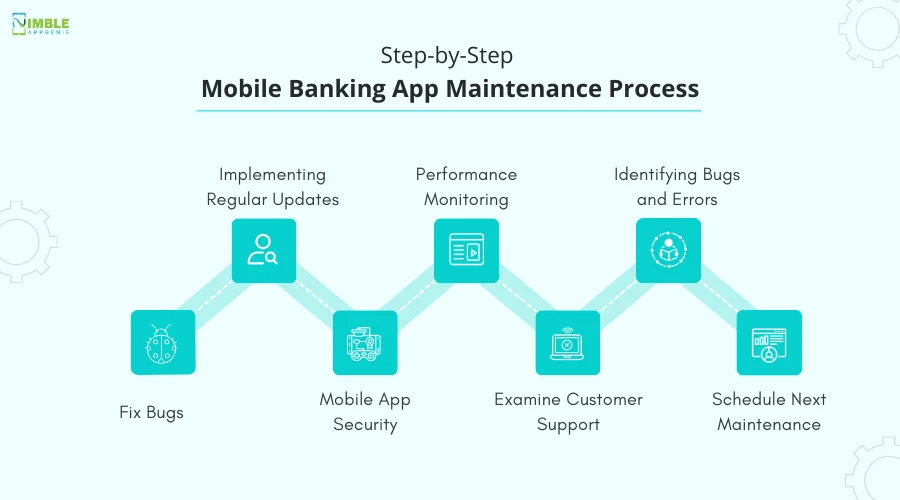

Step-by-Step Mobile Banking App Maintenance Process

How to maintain a mobile banking app?

Well, the right procedure for mobile app maintenance is essential to implement. Check it out below.

Step 1: Implementing Regular Updates

The foremost step in maintaining mobile banking apps is the adoption of regular updates. With the assistance of the right tools, you can thoroughly implement regular updates.

Fostering regular updates will bolster the app in identifying any bugs or errors, through protecting the devices and data from any kind of potential threats as well as vulnerabilities.

Step 2: Performance Monitoring

Another crucial step here is performance monitoring, where the developers will regularly observe the mobile banking app’s performance. It is a systematic and periodic observation for developing and verifying the performance records.

It further assists in uncovering ineffective practices, identifying the need to update the software and detecting underperformance timely for avoid any further bugs and issues.

Step 3: Identifying Bugs and Errors

Now, the next part of the steps for the development of a mobile banking app is identifying any bugs or errors that might cause performance errors. With the assistance of mobile analytical tools, the developers can identify areas where users may encounter issues.

It comprises an approach that combines debugging, testing, along with collaboration. Here, with the assistance of the latest tools, the developers will be able to set goals for the software quality.

Step 4: Fix Bugs

With the help of the latest tools and technologies, the developers will be able to reduce bugs and errors successfully.

The developers can identify the technical gaps found in the app. It is to be noted that not all bugs and errors are equal, so they should be treated depending on the impact they might have on the complete app performance.

Step 5: Mobile App Security

Another step is to examine the security of the mobile banking app. As the app belongs to the fintech industry, thus, app security is a crucial phenomenon to adopt for protecting user data and for preventing the data from hacks and security challenges.

Data stored without proper safeguards can pose significant risks. This can lead to technical complexities and even losing the trust of the users.

Step 6: Examine Customer Support

Another essential step is identifying customer support. It is important to evaluate customer support and it is working for the particular banks.

Effective customer support will result in addressing the end users’ issues in the first place. This is an important part of the maintenance of mobile banking apps where you identify and check for the protocols impacting the platform that connects users to the company.

Step 7: Schedule Next Maintenance

After evaluating all the functionalities of the app, along with identifying the issues, the next process is to consider when the next updates or maintenance activity can be undertaken.

Here, you need to connect with the service provider of banking app maintenance, to know what kind of maintenance will be required next and when.

These were certain steps to be considered for future app maintenance. Now, it’s time to identify factors impacting mobile banking app maintenance.

Let’s check out the following section for the same.

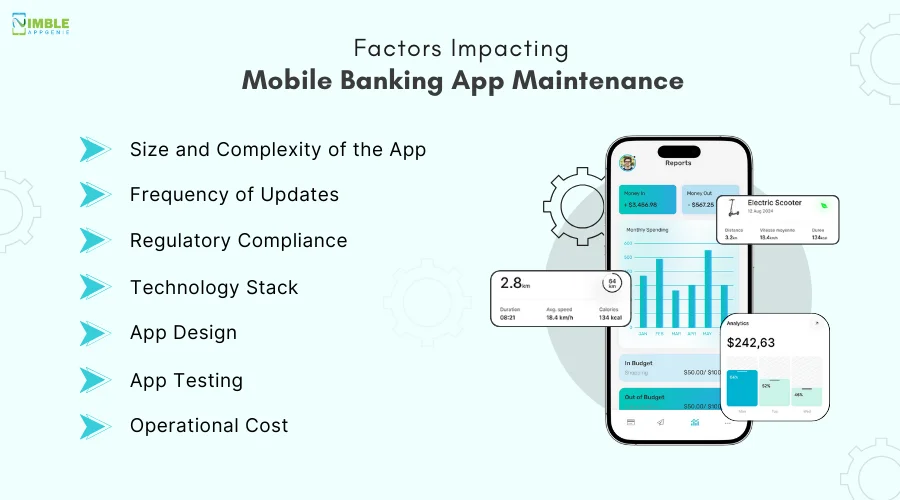

Factors Impacting Mobile Banking App Maintenance

For regular maintenance of mobile banking apps, it is essential to identify several factors.

Let’s discover them all below.

➤ Size and Complexity of the App

It is important to evaluate the size of the app and identify whether it’s large or small because the maintenance will rely on the type of features involved in the same. Complex features of the app will consume more time and vice-versa.

➤ Frequency of Updates

How many times are you required to update the banking app? Well, it is a major component to consider for maintaining the system. The number of updates over the banking app represents that timely updates over the platform can enhance user trust and engagement.

➤ Regulatory Compliance

The banks are required to develop policies every now and then to meet the local and changing compliance regulations. These continuously changing compliance impacts the decision over banking app businesses.

➤ Technology Stack

The technology stack assists in optimizing the data processing, minimizing the load times, and delivering a great user experience. It is the foundation of every app and comprises programming languages, tools, and libraries that can impact the mobile banking app functionalities.

➤ App Design

The type of mobile banking app design can affect the maintenance. A highly complicated design will impact the functions and vice-versa. It enhances the user experience and creates trust of the users. Thus, it’s important to observe the type of design involved in maintaining the app accordingly.

➤ App Testing

The mobile app testing tools used for mobile app testing do impact the maintenance. Well, during maintenance, it’s important to adopt the type of tools and techniques for testing the app based on the type used prior to malfunctioning the key areas and enhancing user experience.

➤ Operational Cost

The cost invested in building the app and for operational activities can impact the complete mobile app maintenance parameter. The banks need to balance this kind of cost for effectively maintaining the banking app.

These were all the aspects to consider for successfully maintaining the mobile banking app. Now, the major importance to excel in mobile banking app maintenance is proceeding with the routine maintenance checklist.

What is the right routine maintenance checklist for a mobile banking app? Let’s check out the next section for the same.

Routine Mobile Banking App Maintenance Checklist

Well, while maintaining the mobile banking app, it’s important to have a routine app maintenance checklist.

Let’s check it out below.

1] Check for App Functionalities

One of the essential scopes to bring to notice is app functionalities. It is important to evaluate the technical nuances and identify the type of error that can impact the functions of mobile banking apps.

2] Security Check

Another significant factor for routine banking app maintenance is continuing with the security check. It is essential to evaluate, understand, and fulfill the reporting obligations. Here the developers have adopted robust security parameters.

3] Fight the Bugs and Errors

Now, it’s important to identify and find the bugs and errors. This is a crucial component in the checklist for performing app maintenance. The developers will successfully evaluate the right procedure for performing regular app maintenance.

4] Monitor the Licenses

Are your app licenses updated? Well, monitoring the licenses helps address the user’s needs successfully. The licenses should be updated regularly whether it’s about the Play Store or Apple Store.

5] Update the Interface

Now, it is important to check if the UI/UX of the app is updated or not. The latest update to the app can help enhance the overall user experience. It can be defined as a change to the app’s UI based on current market parameters.

6] Conduct Regular Performance Tests

Well, this is another effective step within the maintenance regular checklist, for performing a regular test. With a regular maintenance process, the developers can identify the type of updates, along with time for updates.

These were all the essential routine checklists to cover for mobile banking apps.

Well, you can’t continue with regular updates for mobile banking apps without implementing accurate resources, right?

Let’s check it below.

Cost of Maintaining Mobile Banking Apps

How much does it cost to maintain a mobile app?

You cannot ignore the cost of the process which is a regular way to sustain the app in the competitive market.

On average, the cost to maintain a mobile banking app is $15,000 to $50,000. The cost is further impacted by diversified parameters such as complexity, app design, security, and many others.

Here the cost will depend on the type of banking app and the features involved within it.

Till now, we have discussed mobile banking apps, important steps to undertake, importance, factors, cost, and routine checklist.

Now, let’s discuss the top challenges in continuing with maintaining mobile banking apps.

Let’s switch to the next section.

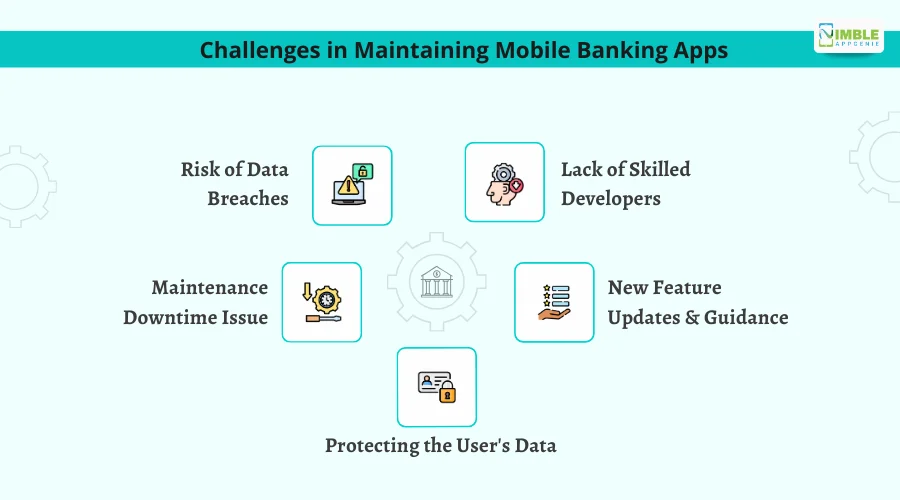

Challenges in Maintaining Mobile Banking Apps

There can be challenges in development of mobile banking apps.

But what challenges can arise during maintenance?

Here is the list to continue with.

► Risk of Data Breaches

Before transferring access to maintain the mobile banking app, you must double-check the data breach protocol.

You should consider the fraud and security issues that can impact mobile app maintenance. A slight ignorance of app security can result in losing loyal users forever.

► Lack of Skilled Developers

Poor skills of developers can impact your complete maintenance process adopted for mobile banking apps. Reduced professional skills of developers may affect the user’s behavior with the app.

This can also lead to unauthorized transactions and difficulties in securing accounts. This is one of the challenges you might face while handling maintenance activity by any third party.

► Maintenance Downtime Issue

Another major landscape to consider here is while maintaining the app, the process can result in slowing down the app for a specific time period.

This might impact the user experience and functionalities of the app. This could further lead to regulatory-based challenges.

Bonus Read: Practices to Reduce Mobile App Maintenance Downtime

► New Feature Updates and Guidance

While updating the app, you might face issues related to updating the features as per user’s requirements and then guiding them to use it in their daily lives.

It can impact the overall process and functionalities of the mobile banking app functionalities. This will impact the customer retention landscape too.

► Protecting the User’s Data

Banking apps store sensitive information that can be impacted while transferring the maintenance process to another party. It can also impact and harm the financial information and user connections with the business.

This could result in a cyber-attack that could also be subject to the need to access protection regulations of the banking app.

These are the mistakes to consider impacting online banking app maintenance. Well, while maintaining the banking app, there are certain future trends to consider for successfully taking it to success.

Let’s evaluate the future banking app trends of maintenance in the following section.

Future Trends in Mobile Banking App Maintenance

When we are already hitting 2025, it’s essential to know what type of trends to cover for not being knocked out of the competitive market, right?

There are multiple series of future trends to consider in practice. Let’s evaluate them all below.

- AI and Machine Learning can be one of the types of trends to adopt and implement that help to enable predictive maintenance, where potential issues can be identified before they hit the ground.

- While maintaining the app, make sure to use and implement the latest tools and technologies successfully to allow the developers to update the app based on recent parameters.

- Continuous integration and coping with technological trends is a trend to consider for improving the functionality of the app during maintenance.

- The era of customization and personalization provokes developers to ensure that the approach for app maintenance needs to be user-centric.

Still wondering how to maintain your online banking app at a significant pace?

Connecting with an experienced company can be helpful.

Choose the Right App Maintenance Partner- Nimble AppGenie

Searching for a partner to maintain your online banking app?

Nimble AppGenie can create customized strategies to maintain your banking app. This will help engage the target audience, update, modify, re-evaluate, as well analyzing present stats based on market tactics.

Our team provides the best app maintenance services and are an effective mobile banking app development company ensuring quality services for your dream application.

We are experts in identifying the current valuable trend in the market and then polishing it according to your dream banking app.

Conclusion

For online mobile banking app maintenance, it’s essential to follow crucial steps beginning from adopting regular updates, to scheduling the next maintenance procedure. Continuing with the online banking app can be worthwhile, but only if you know the reason behind it.

Mobile banking app maintenance can help add new features, fix bugs, improve app security, enhance user experience, app store maintenance, and many other parameters.

There are multiple challenges, such as the risk of data breaches, protecting user data, maintenance downtime issues, and new feature updates that need to be evaluated here.

For your customized app, it is relevant to connect with an experienced company.

FAQs

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.