Remember, when mobile banking used to be about checking your balance? Those days are gone.

Today’s mobile banking apps are packed with powerful features, and banks are transforming to stay ahead of the competition seeing the growing love for these apps.

People find it hard to manage their finances or save some cash. As a result, they look forward to these apps to serve them better. Consequently, today’s banks are considered successful when they can serve their customers from anywhere and anytime.

This is why having a feature-rich mobile banking app is the need of the hour to serve them better.

So, if you are an investor what features of mobile banking apps can help you stand out in this competitive market by serving, let’s get to know about it in this blog.

What is a Mobile Banking App?

Before we know about the features of banking apps, it is truly necessary to understand the basics.

So, what is a banking app? A banking app is a mobile application that allows you to access your bank account at your convenience, and make any financial transactions efficiently.

It’s like having a mini bank branch in your pocket, offering convenience and 24/7 access to your finances. Currently, there are many innovative banking apps like N26 and Chime that empower users to take control of their finances.

Here are some of the key things that a person can do with their banking app:

- Check your account balance and transaction history.

- You can transfer money between your accounts and send payments to others as well.

- Take a picture of your cheque with your phone and deposit it electronically.

- Schedule and make payments for bills directly from your app.

- Some apps also warn you about potential charges & help you to avoid them.

- Many Apps offer different kinds of budgeting tools and insights into your account to help you manage your savings.

Why Develop a Mobile Banking App?

Are you looking for the reasons for the creation of a banking app?

What’s better than numbers; let’s get to know about them through banking app stats:

- One-third of consumers feel confident covering all their expenses, with baby boomers and millennials expressing the most confidence.

- Men seem more confident than women regarding their financial security.

- 48% of consumers have at least 3 finance apps on their phones.

- 45% of consumers use mobile finance apps daily.

- Banking Apps (37%): Most popular overall.

- Payment Apps (32%): Venmo, PayPal, etc. (Tops list for Gen Z and Millennials)

- Gen X leads the way in using mobile banking apps daily, many utilize multiple finance apps for convenience.

The surge in mobile banking app usage presents a golden opportunity. So, if you are going with the development of a mobile banking app with exceptional features, you can position yourself to thrive in this booming market.

Features of Mobile Banking App: Essentials and Advanced

In today’s world, the features of a banking app are more important than ever. This is why features are considered the way to unlock success in today’s changing landscape.

To help you out, we will dive into the best features for mobile banking apps. These features dive into the basic and latest advancements and how they’ll impact your app.

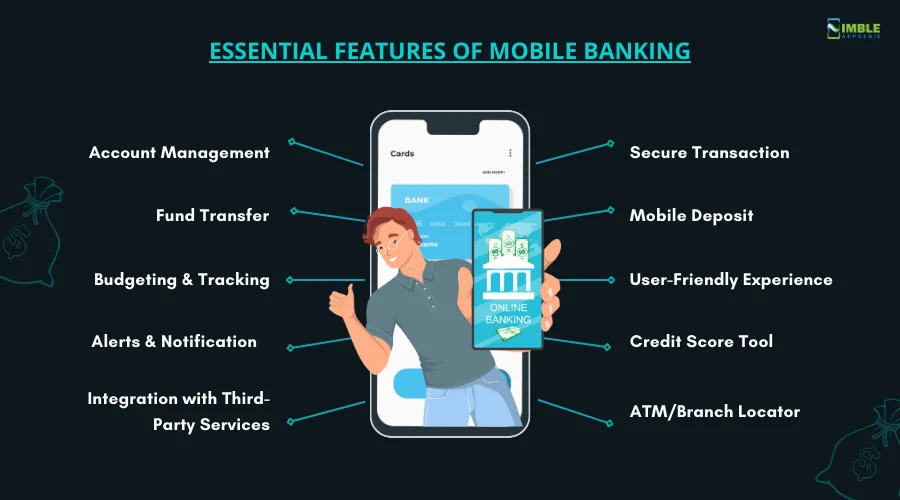

➤ Essential Features of Mobile Banking App

There is several mobile banking apps that have become the go-to tool for managing finances and offering a world of benefits compared to traditional banking Apps.

What are some essential features of a successful mobile banking app? Let’s dive into the must-haves first.

1. Account Management

It is a crucial feature of mobile banking apps.

Through this, you let your user check account balances and see their transaction history. They can view their spending and even download the transaction data to understand their finances better or share it with financial advisors.

This is a very common feature often considered to build a Chime-like app.

2. Secure Transaction

Security in a mobile banking app is paramount.

In today’s time, when app breaches and theft are a huge problem, you should offer a secure transaction facility to your users.

You can do this by offering them multi-factor authentication for login and transaction; offering them different login options such as biometric authentication, end-to-end encryption & more.

This is how you can ensure data and app security.

3. Fund Transfer

Now this is a common yet essential mobile banking app feature. A shared feature of the neo-banking app.

Whether users want to send an amount between their own accounts or send or receive money from others’ accounts, doing so for your user should be effortless work.

Moreover, you can also provide some additional features other than just fund transfer i.e. payment of bills, scheduling monthly payments, and much more. Your users will surely love such a feature in your app.

4. Mobile Deposit

Eliminate your user trips to the bank with this feature.

Mobile deposit feature helps you to check deposits using your phone’s camera and get updates and notifications.

This helps to make a deposit anytime, anywhere as long as you have your phone, so it becomes easy for people to skip the bank lines and save valuable time by depositing money in a matter of minutes.

This is one of the must-have features of mobile banking apps that will get you an extra rating from your user.

5. Budgeting and Tracking

Users love apps that go-to some extra extent to empower them in managing their finances.

Integrating some tools such as budgeting tools, categorization & insights, and others will help them to manage their finances even better. More importantly, this helps users not only see where their money went but also take control of their finances.

6. User-Friendly Experience

In other words, we can also call it personalization.

Users crave experiences that are tailored to their needs.

And, this is why user-friendly experience is one of the top digital banking app features that can transform your app into a powerful financial partner.

So, it’s necessary to design your app in a way that is soft to the user’s eyes.

Besides, one can leverage user data to provide personalized financial insights and recommendations.

This could include alerts for upcoming bills; suggestions for saving opportunities based on spending habits, or targeted financial products relevant to their goals.

7. Alerts and Notification

Alerts and Notifications are essential features in banking apps that provide users with real-time updates about important information.

This is why it is one of the top mobile banking app features.

Through this, user can set alerts for transactional activities of their accounts, such as deposits or withdrawals. As a result, this will help them quickly detect any unusual activity in the app & complain about it.

The app can even send reminders for low balances, and upcoming bill payments, ensuring users stay up to date and don’t suffer any penalty (late fees). This will attract users more to your app and will increase its engagement.

Hence, leveraging push notification services will be a smart move for your banking app.

8. Credit Score Tool

Keeping track of credit scores is a necessity for many.

So, having a credit score tool will further strengthen the foundation of your mobile banking app idea.

Wondering how? You see a good credit score increases your chances of getting loans approved. As you can see growing inflation increases the cost of everyday essentials. As a result, people rely on loans to cover their expenses.

For which a good credit score is really helpful. You can offer them tools through which they can check their credit score, and get tips to improve their credit score.

This keeps users’ financial health right and helps them make informed decisions making it one of the must-have digital banking app features for your app’s success.

9. Integration with Third-Party Services

Beyond basic features, integrating third-party services such as budgeting tools, financial advisors and others helps in creating a wide-ranging mobile banking experience.

Integration with popular tools allows users to seamlessly import their banking transactions into their tools and utilize their services to fulfill their financial goals.

Overall, integration with third-party services expands the functionality of the banking app. This way, user can easily monitor and manage their wealth directly within the banking app.

10. ATM/Branch Locator

Finding the ATM/Branch Locator is no longer a “nice to have’’ feature for a mobile banking app- it’s a fundamental necessity.

In times of urgency, users can easily find Branches & ATMs through the phone without any extra effort. So integrating locators will allow facilities directly within the app, saving time and frustration.

If you offer such a feature in your app, users who love convenience will be engaged with your app and will help you to achieve a stronger market position.

So, don’t forget to integrate this mobile banking app feature if you want to increase customer satisfaction, which you surely want to.

These are some of the essential features that are the foundation, but if you want to level up, advanced functionalities can serve you & user better. Our next section talks about just that.

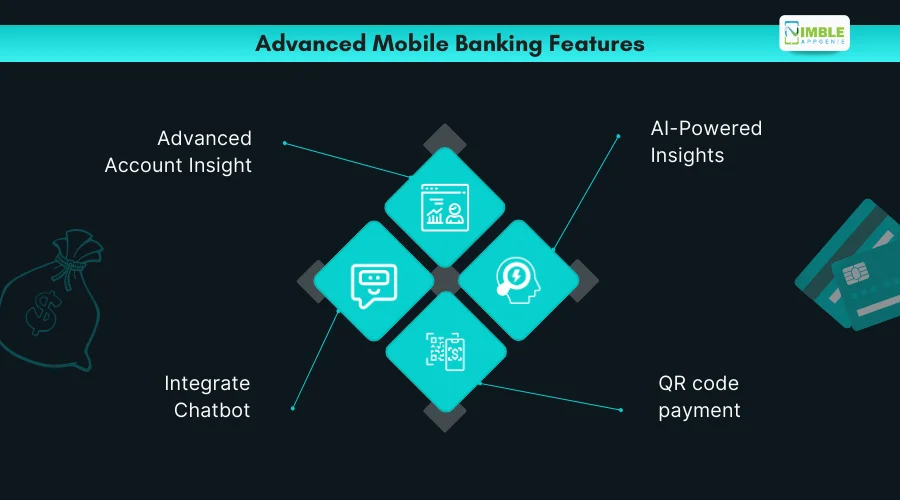

➤ Advanced Mobile Banking App Features

Want to stand out in the crowd? What’s better than integrating advanced mobile banking app features?

Let’s get to know them:

1. Advanced Account Insight

These advanced account insights go beyond the basic features of mobile banking apps.

They provide users with a deeper understanding of their financial activity and spending habits, empowering them to take control of their finances.

It can even analyze the user spending habits as per their history and predict their upcoming bills based on subscription services or any seasonal spending patterns to help plan your future.

Other than that, the app can leverage the power of AI to classify your purchases as subcategories such as groceries, dairy, and more.

This provides a more granular view of spending habits. So, yes this can do wonders for your app. But, we must advise, that for getting advanced features, you need to overcome development challenges, for which to get expert help.

2. AI-Powered Insights

Today’s time is all about leveraging the powerful banking app trend “Artificial Intelligence” to transform your budgeting from a chore into a seamless journey.

AI helps to analyze transactions and identify any fraudulent activity in real time, alerting users about potentially blocking any suspicious transaction.

Leveraging AI development can also help with raising security issues in banking apps & give users peace of mind.

One can also enable users to set up automatic transfers based on pre-defined rules, like saving a percentage of every paycheck.

Also, AI can help you automate regular tasks like bill payments or transferring funds, resulting in reduced human error and avoiding late fees.

3. Integrate Chatbot

Chatbots are so important for the intuitive and engaging experience of users.

One of the major benefits of Chatbot is that it creates a human-like interaction and can mimic conversation as a customer support specialist.

Moreover, unlike human support staff, these Chatbots can operate 24/7, providing instant assistance to users anytime from anywhere.

This eliminates waiting time and helps users get expert help as soon as possible. This might affect your overall cost of building a mobile banking app, but will greatly help in improving user experience with your app.

4. QR Code Payment

Another most-talked advanced Online Banking App Feature is “QR code payment.”

As technology is moving at a fast pace, traditional payment methods like physical cards or mobile payment technology like NFC require proximity to work.

But, this isn’t the case with QR codes as they are simple, and scannable with any smartphone camera, eliminating the need for additional hardware.

Integrating this feature can offer a user-friendly and secure payment feature that attracts users who value contactless payment, especially the new generation.

Other than that, this handiness will encourage your user to use the app even more leading to higher user engagement.

With this, we hope you get an idea about how basic and advanced features can change the scenario of your app severely. Now, if you’re ready to translate these ideas into action, the next section dives deeper into the aspects of getting started.

Nimble AppGenie: Expert Partner in Building Feature-Rich Mobile Banking Apps

Nimble AppGenie: Expert Partner in Building Feature-Rich Mobile Banking Apps

With the increasing number of people getting the help of mobile banking apps, it seems like having a feature-rich banking app is the need of the hour.

From secure account management to AI-powered tools, Nimble AppGenie, a top mobile banking app development company can help you develop a feature-rich app that empowers users.

Our talented developers and professionals are always ready to serve our clients with the best. So, hire mobile app developers and get started today on your idea.

Conclusion

The mobile banking landscape has undergone a dramatic shift, transforming from a simple tool for checking balances to a comprehensive financial management hub.

For banks and financial institutions, offering a feature-rich mobile banking app is no longer optional; it’s a standard to survive in today’s competitive market.

This blog post explored both essential and advanced features that can elevate your mobile banking app, empowering users and driving user engagement. By incorporating features like secure transactions, budgeting tools, and AI-powered insights, you can consider the development of a banking app that positions itself as a trusted financial partner for your users.

Remember, the key to success lies in understanding user needs and leveraging cutting-edge technology to deliver a seamless and secure banking experience.

FAQs

Essential features include secure account management, fund transfer capabilities, mobile deposit options, budgeting and tracking tools, and user-friendly interfaces.

Advanced features include AI-powered insights for personalized budgeting and fraud detection, chatbots for 24/7 customer support, and QR code payment integration for contactless transactions.

Chatbots offer several benefits, including providing a more intuitive and engaging user experience, offering 24/7 customer support, and reducing wait times for users seeking assistance.

Security is paramount. Utilize multi-factor authentication, offer biometric login options, and employ robust encryption measures to safeguard user data and transactions.

Look for reputable mobile app development companies with experience in the financial technology sector. Nimble AppGenie is a leading app development company that can help you create a secure, feature-rich app that meets your specific needs.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.