Eager to bring a revolution in the fintech industry, but can’t decide on the features to include?

Features are significant elements without which, one cannot imagine the app development.

However, Choosing the right features for loan lending apps can be a difficult phenomenon but it’s not rocket science.

You can learn the features of a loan lending app by going through them. Besides learning about the top features, you will learn why and how to select them. Let’s begin.

Why Selecting the Right Features Are Important?

What happens when you select the wrong features? Why it’s important to select the right features for your loan lending app?

If you are required to identify the features that can make your app excel, it’s important to know the reasons to select the right features, successfully.

➤ Enhances App Accuracy

Once you get clear with the data that needs to be added to the app. It helps you to look forward to other core strategies by identifying key features of the loan lending app.

Identifying the app’s accuracy can be helpful to avoid irrelevant and redundant features after selecting the useful and essential functions for your app.

It avails the selection of features that are actually valuable to increase the app’s overall functionality.

➤ Resource Allocation

Selecting the right features is useful in deciding and organizing resources effective for further purposes.

After deciding on the number of features for your app, avoiding unnecessary features becomes simple.

Additionally, focusing on the right features ensures optimum utilization of resources effective for enhancing the app’s overall performance.

➤ Provides Competitive Advantage

Enabling the best features for the loan lending app is effective in providing a competitive advantage.

It is effective for understanding the strengths and weaknesses of the app.

Identifying the right features can help you in the process of reaching the target audience through the competitive app.

➤ Growth in the Market

With the growing competition in the market, the scope of growth of the industry is enhanced.

Features are all about what the product and services do and an app with the right traits enables to ensure growth.

Feature selection is a critical aspect and promotes growth by enhancing user experience.

It also results in increased engagement by encouraging users to spend more time.

➤ Fosters Innovation

You can measure the success of the app by identifying user adoption with value. Finding the value can assist you in innovating a feature suitable for the app’s growth.

It ensures continuous improvement by prioritizing the right features that promote ongoing innovation along with a focused feature easier to respond to user feedback and market changes.

Now, that you are aware of the reasons behind selecting the right features, it is essential to learn about them.

The next section will discuss all the must-have Loan Lending App Features.

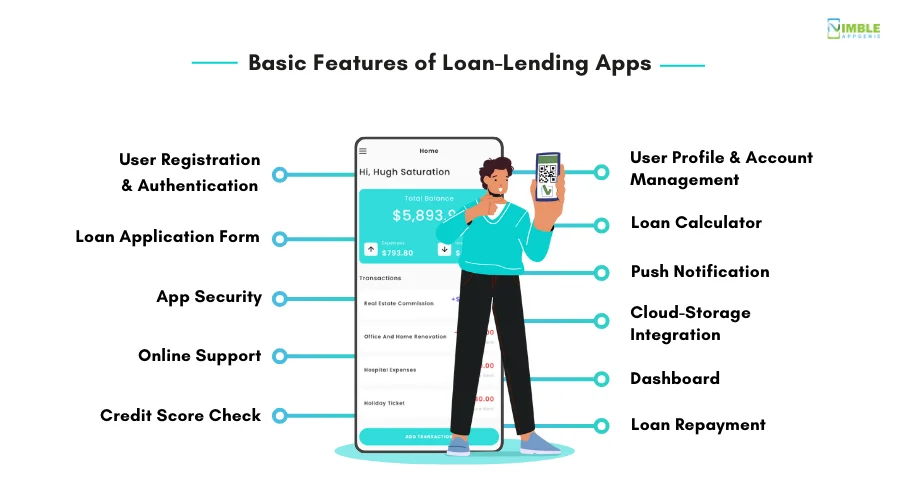

Basic Features of Loan Lending Apps

We have divided the discussion of features into two parts, basic and advanced features. It will help you to prioritize the important and non-core features of the app.

All the best loan lending apps have done it to achieve success in the industry.

Here is the list of core Money Lending App features.

► User Registration and Authentication

This is among the must have features for your Loan Lending App. You can provide multiple options to the users by providing them access to keep the account verified.

User registration permits individuals to create accounts while performing verifications. It is an essential feature that helps users to manage and create profiles.

A secure authentication process such as email/password, social media accounts, and phone number helps to improve security by reducing associated risks.

► User Profile and Account Management

You should provide access to the app users for managing user profiles and accounts. It is a field where users can upload their profiles and manage their privacy settings.

Although, you can provide templates to the people who are using the app for the very first time.

This can help them to view the profile and to make their own after following the steps.

UI/UX design important feature that can enable users to make their profiles without any issues.

► Loan Application Form

It is among the must-have features to build a dream app and will be the core element of your application.

Here users will appreciate it if you break the loan application process.

This digital form app organizes paperwork that includes detailed information on the borrowers.

It is a document that is used by individuals or businesses to request a loan from a lender such as a bank or credit union.

► Loan Calculator

In this feature, the users do not need to take out their personal calculator for calculating rent. Thus, your app should provide a feature of app calculation.

The loan lending application needs to analyze the credit score of the loan borrower before processing their application.

It is an important feature that needs to be considered while deciding on buy now pay later app development.

► App Security

An app that does not provide security to its users, related to privacy and data cannot sustain itself in the competitive market.

Mobile app security is of prime importance in the money lending app features list. And when it comes to financial management, the data including app ID, password, and transaction Id values the most.

Hence, you need to keep the user’s trust by providing them robust security through the latest technology integration.

► Push Notification

Push notification keeps users informed about current loan rates and the due EMIs. Hence, you should implement this feature to ensure the growth of an app.

Push notifications are even more important than email and also other different communication methods.

This is one of the main features of a Loan Lending App due to its remarkable engaging property.

It is effective to grab the user’s attention and to convey useful messages even if users don’t open the app.

► Online Support

These apps contain online support and are readily available to talk to users after extracting information regarding their loans.

This is the most advantageous component for the users, where they can connect with the support team for any queries.

Hence, this feature is considered among the basic features of a loan lending app.

With the assistance of this feature, the users can get all the updates from the app. They can even connect with their admin in real time through this kind of support.

► Cloud Storage Integration

Loan lending apps have a diversified range of data and it is beneficial for the system to collect user data that is secure and private.

It also enables organizations to store, access as well as maintain the data so that they don’t require to own and operate their personal data centers.

Cloud storage is scalable and helps organizations to expand or reduce their data footprint depending on the needs of the users.

► Credit Score Check

Credit scores systematize the loan lending process by saving time and evaluating different financial factors for generating borrowers’ scores.

This is among the must-have features to create a loan lending app. It is useful to identify the current credit score when a lender looks into the financial history along with the credit reporting agencies.

It is effective in determining the creditworthiness of an individual. These credit scores are essential to make lending decisions.

► Dashboard

The dashboard is useful and permits the admin to look at the real-time analytics of the app. A lender dashboard is among the money lending app features effective for organizing loan files.

The loan dashboard displays the summary of total borrowings made by the customer in all accounts.

It allows customers to understand their current position and displays all the useful information related to loans and pending amounts.

► Loan Repayment

Loan repayment is among the most popular features Of a money lending app which is useful for any borrower who takes a loan.

The high-end loan repayment features are extremely important when due dates are near.

The loan lending app should help users with payment queries. These apps have changed the lending industry after availing quick access to credit.

After learning the important features of loan lending apps, now it’s time to learn some additional features. Check out the next section to know more.

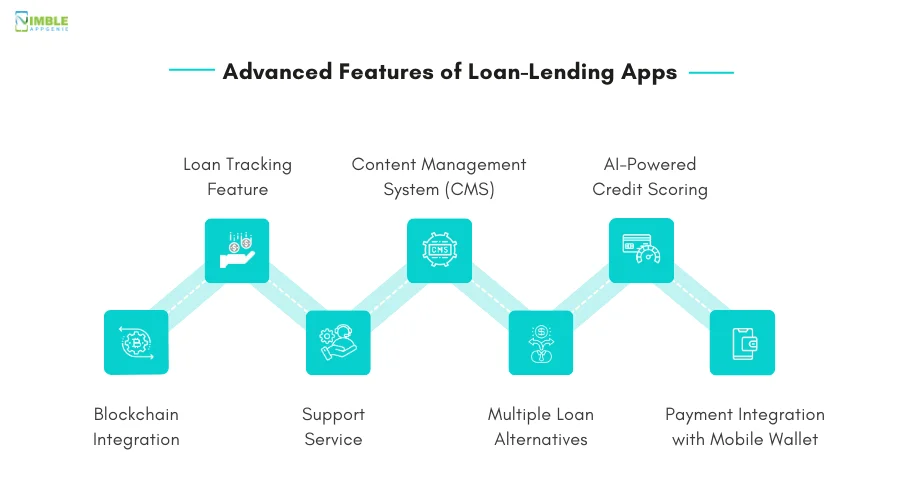

Advanced Features of Loan Lending Apps

When you count the features, it’s important that you include an effective loan lending app tech stack, when you decide to develop a mobile app. Along with this, you should be aware of the fintech app features.

Learning about the basic features is not enough when you decide to develop a mobile app. You should be aware of the fintech app features.

Want to know some of the advanced features of a loan lending app?

Let’s get started.

♦ Loan Tracking Feature

A loan tracking feature within the app assists the users in tracking the real-time status of their loan along with its history of payment.

It is also based on transaction items that are linked to loan types. This is an important feature, where users can effortlessly track repayments, remaining balances, and repayment schedules.

The loan tracking feature ensures prominent financial management with an aim to ensure user transparency to grab trust and enhance the complete experience.

♦ Content Management System (CMS)

With the help of a content management system (CMS), users can manage content from the app.

This feature is useful to streamline the process and useful to know, whether you are liable for a loan or not.

It is among the top features of a money lending app that provides efficient management of digital content. This system allows the administrators to modify, create, and publish content.

Along with this, it ensures that the app remains up-to-date with the relevant information, enhancing user engagement.

♦ AI-Powered Credit Scoring

The core of AI-based credit scoring completely lies in the use of machine learning models.

Using artificial intelligence along with machine learning algorithms is effective in assessing creditworthiness of borrowers.

These tools accurately analyze different data points beyond the traditional credit scores.

The use of AI in loan lending and machine learning focuses on margin maximization instead of risk minimization.

AI credit scoring decisions are completely based on a lot of data including total income, credit history, transaction analysis, and others.

♦ Blockchain Integration

Blockchain technology offers quick payments with 24/7 processing of domestic and cross-border credit repayments with no involvement of any other parties.

It is one of the top features to consider while building your dream app. Here, if you are an entrepreneur, hiring potential developers is important.

The implementation of blockchain in the app ensures transparency, reduces redundancy, and enables app security.

♦ Support Service

Providing suggestions to the users over using the money lending apps and their diversified features is of prime importance.

It represents that the app is user-friendly and provides features including 24*7 customer care through calls, and SMS, where users can easily get assistance.

You should implement this feature to gain the trust of the users and to display transparency along with loyalty among users.

♦ Multiple Loan Alternatives

Users find the app interesting which provides them with different loan alternatives. You can provide them the option from payday loans to personal loans.

All the loan apps will be different related to the types of loans they offer to their borrowers. Here the app can provide a list of loan offers from multiple lenders.

This type of alternative assists the users in selecting the best option from the available list. Thus, it is among the features which might make the app popular.

♦ Payment Integration With Mobile Wallet

In the current era, mobile wallets have won the hearts of people as they provide them the feasibility of performing payments seamlessly.

This is an engaging loan lending app feature as it provides seamless loan disbursement by integration with mobile wallets and through different payment gateways.

It is among the good features for a loan lending app, it provides convenience and accessibility to the users and also enables security as well as fraud protection.

This was all about the features of a money lending app that you can include. You can hire mobile app developers if you want further assistance.

But, how to select them is still a point of concern, right?

The next section is all about the steps you can take to select features of a successful loan lending app.

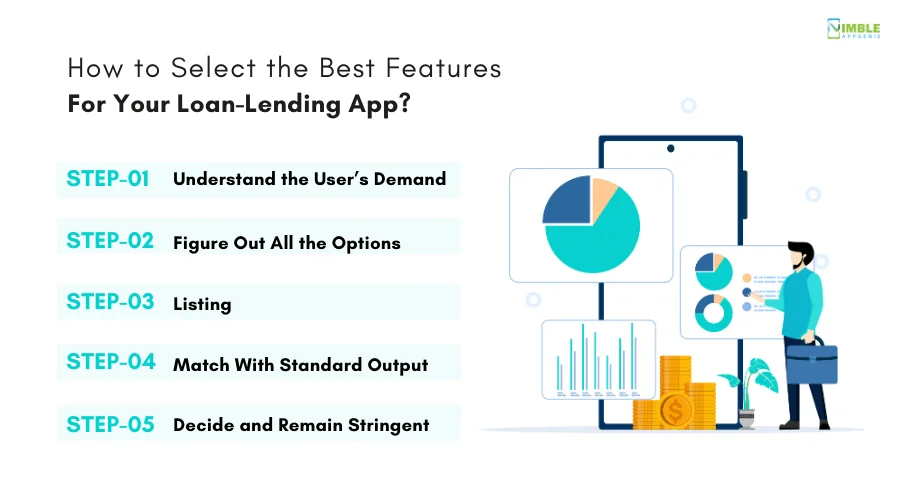

How to Select the Best Features For Your Loan Lending App?

Till now, we discussed why to select the right features for your loan lending apps, along with the top basic and advanced features.

Now, you should know the procedure for selecting the good features for a loan lending app. Here are the steps to check.

Step 1: Understand the User’s Demand

You should conduct market research to recognize the user’s demand. This is one of the important steps as without it, you cannot invest in app development.

Collect the user’s feedback related to pain points of using other loan lending apps. It will be helpful to identify the existing market gap.

Step 2: Figure Out All the Options

You can go through the above list to figure out all the features that you can include in the app development process.

Here you should note available features include core, advanced features, and the ones that match users’ demands.

Step 3: Listing

Now, you should list all the features beginning from demanded to non-important features. Here you should remember that overbuilding of features can confuse your app users. This can even fail the app.

Step 4: Match With Standard Output

Here, you should decide the features by deciding on what is actually demanded. Recheck your app development aim, then evaluate the listed features.

Find the answers to certain questions below.

- Do the selected features match the user’s needs?

- Is this what you want to serve based on your app development aim?

Step 5: Decide and Remain Stringent

Now, at last, you need to decide on the features and functionalities and need to stick to them. This will help to enhance your app’s success and reach the targeted user base.

Well, now you get a clear idea of the app features, the essential steps to implement them along with the ways to select the right features.

It’s time to select the right team who can assist you to build an app.

How Can Nimble AppGenie Help You in Creating Your App?

Deciding on the right company can assist you in creating the complete app. Thus, switch to a more promising and experienced company.

Partner with Nimble AppGenie, we are the best loan lending app development company specializing in making your app stand out from the competition.

We can help you with deciding the top features to include in a money lending app and even can assist you in developing it seamlessly.

Conclusion

Selecting the right features can help enhance the accuracy of the money lending app, it can help provide a competitive advantage and foster innovation in the industry.

There are certain basic features that you can adopt including user registration, deciding on user profiles, app security, online support, etc.

Along with this, you should not forget features such as AI implementation, blockchain integration, multiple loan alternatives, and support services.

The process of initiating the selection of best features begins with identifying user needs and ends with launching the app after testing features.

FAQs

These features include user registration, user profiles, online support, push notifications, credit score checks, and cloud-storage integration. Other features may include a dashboard and loan repayment.

Selecting the right feature can help in attaining the given points

- Foster innovation

- Provides competitive advantage

- Enhances app accuracy

- Provides growth in the market

The advanced features that you can adopt are below.

- Loan-tracking feature

- AI-powered credit scoring

- Blockchain integration

- Support Service

- Multiple Loan Alternatives

Basic features are essential functionalities required for the app to operate effectively, such as user registration, loan application forms, and app security. On the other hand, advanced features, provide enhanced capabilities like AI-powered credit scoring, blockchain integration, and loan tracking, which improve user experience and app efficiency.

Integrating AI and blockchain into a loan lending app can:

- AI-Powered Credit Scoring: Use machine learning to offer more accurate credit assessments, reducing risk and improving decision-making.

- Blockchain Integration: Provide secure, transparent, and fast transactions, enhancing trust and reducing fraud. This also ensures 24/7 processing without intermediaries, making the loan process more efficient.

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.