Want to know more about KYC in Fintech apps?

Join the ride.

The Know Your Customer (KYC) framework is a critical process that financial institutions and fintech companies use to verify the identity and assess the risk profiles of their customers.

There’s a lot more to it than meets the eye.

So, it uncovers it, and we shall be discussing everything you need to know about the same in this blog.

Therefore, with this being said, let’s get right into it:

What is KYC in Fintech Apps?

KYC stands for Know Your Customer.

In simple words, it’s the process where fintech companies build their customer’s profile, cross-check their identity, and with this, assess the risk associated.

This is common practice with modern fintech platforms, with a stronger concentration in eWallet apps and loan lending ones.

The remote KYC process in fintech apps doesn’t only save time and effort required in manual KYC verification, but it also helps reduce the risk many times over.

Digital KYC has effectively helped reduce financial crime and ensure fintech regulatory compliance.

So, that’s what KYC is. And with this clear, let’s see why is KYC important in fintech apps.

Importance of KYC in the Financial Sector

The financial sector is huge.

There are endless fintech companies and even more fintech apps. With billions of people across the world using these solutions.

This makes KYC in financial services an essential integration.

♦ Fraud Prevention

One of the biggest reasons why KYC is important in fintech apps is the increasing frauds across the world.

Each year, fintech world loses billions in cyber fraud, a number that keeps increasing each year.

This is one of the biggest issues in the fintech market. We are stopping it with KYC.

KYC helps ensure authenticity of the user and whether or not the platform should lend the money or be open for money transfer.

This helps create an overall more secure environment for the platform.

♦ Regulatory Compliance

FinTech regulatory compliance is a big deal if you don’t already know.

The majority of these regulations and rules make it pretty much mandatory to include KYC in the fintech platforms.

To be more specific, it has to do with the anti-money laundering (AML) and counter-terrorism financing (CTF) laws. If you ask us, that’s pretty serious.

Global KYC compliance has become super important due to the amazing fintech security it offers.

♦ Trust & Reputation

One of the most important values that a brand has to invest in if you want to become a big platform is trust among users.

And it’s with trust that you in turn generate reputation of the fintech brand.

This is one of the most important reasons why KYC is important today. You see, the importance of KYC lies in the fact that it tells your users that there are measures in place to safeguard everything.

Now how amazing is that? Well, let’s see what are other importance factors.

♦ Anti-Money Laundry

If you don’t already know, money laundering is a pretty big issue across the world.

This is especially an issue for fintech platforms because it can lead them to become a tool of the same.

This can lead them into huge issues. To stop money laundering, the government can ban the platforms or limit their capacities.

To save themselves from this, KYC for fintech apps helps a lot.

This doesn’t only ensure limitations on money laundering activity but also makes fintech platform a trustworthy party.

♦ Secure Digital Transaction

If you are planning to develop an eWallet app, you should know that KYC is essential to ensure secure digital transactions.

KYC ensures that customers’ digital transactions are secure by identifying and verifying legitimate users.

This creates a secure environment where users can confidently perform digital transactions without the fear of financial crimes or identity theft.

In the fast-growing fintech industry, KYC is more than just a regulatory requirement; it is a fundamental process for building a secure, trustworthy, and compliant financial platform.

By investing in strong KYC measures, fintech apps can safeguard their users, prevent illegal activities, and strengthen their market position.

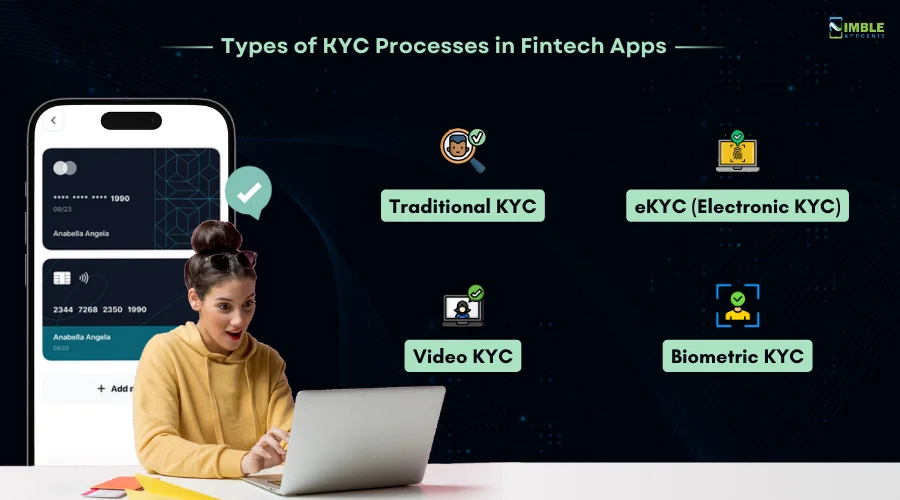

Types of KYC Processes in Fintech Apps

To better understand KYC for fintech apps and how it works, one must understand different types of KYC processes.

In this section of the blog, we shall be discussing the different types that you can choose as per your fintech business model.

Therefore, this being said, let’s get into it:

1. Traditional KYC

Let’s start with traditional KYC or paper based KYC.

This is often also known as a manual KYC process. This happens physically. A person from fintech company’s side would approach you.

Following manual KYC verification, the user will be able to use the full functionality of the fintech platform.

2. eKYC (Electronic KYC)

eKYC for fintech apps is a digital version of one we discussed above.

Digital KYC verification happens online as suggested by the name. What happens here is driven by Digital Onboarding APIs, the user submits the document to the fintech company.

They are cross-verified via internal purposes. The entire process takes minutes at max and it’s lightning fast.

It can be initiated by the user. This is most prevalent in today’s apps.

3. Video KYC

Video KYC is just that, a KYC process for fintech apps driven via video conferencing.

As the name suggests, this remote KYC process happens via video medium, where an authorized personal will do it.

Video KYC for fintech apps is a growing trend, especially when used by credit card companies. This is again a super simple and quick process that takes a few minutes at max.

4. Biometric KYC

Lastly, we have KYC with biometrics.

This is a verification driven by biometric authentication. Since the majority of the government document have biometric database of users, fintech companies can use the same

The biometric KYC verification process is super easy and one of the most secure.

It is the most secure of the entire different types we have discussed so far.

These are the different types of KYC processes that are seen in fintech apps. And with this out of the way, it’s time to look at technologies that are innovating fintech app KYC processes.

Technological Innovations in KYC for Fintech App

As the fintech industry rapidly evolves, Know Your Customer (KYC) processes must keep pace to ensure security, regulatory compliance, and customer satisfaction.

Traditional KYC methods are often time-consuming, requiring extensive documentation and manual verification.

If you want to create a fintech app or already have one, it’s very important to understand the same.

► AI-Powered KYC

AI in fintech has been a long time and we now see it’s impact in KYC.

Artificial Intelligence (AI) is one of the most influential technologies revolutionizing KYC processes in fintech.

AI-based tools can instantly verify documents and analyze customer data for patterns, reducing the chances of human error and fraud.

With machine learning algorithms, AI continuously improves its accuracy, making it an indispensable tool for large-scale KYC operations.

- Automated Identity Verification: AI automates the scanning and verification of government-issued IDs, comparing them with the user’s live photo. This process, which once took days, can now be completed within minutes.

- Behavioral Analysis: AI analyzes users’ financial behaviors to detect anomalies, which can help in identifying suspicious activities or potential fraud.

► Blockchain for KYC

Blockchain technology is all the rage, especially in fintech industry.

Using blockchain for KYC in fintech apps opens the door to a decentralized, tamper-proof solution.

In simpler words, blockchain is used to safely store and share KYC data.

By creating a shared ledger where customer information can be securely stored, fintech companies can streamline the KYC process and avoid repetitive process of identity verification across multiple platforms.

- Immutable Records: Blockchain ensures that once customer data is entered, it cannot be altered, preventing tampering or forgery.

- Cross-Platform Use: With blockchain, customers only need to complete the KYC process once. Verified information can be securely shared across multiple fintech platforms, speeding up onboarding and improving efficiency.

► Digital ID Verification

Digital IDs have become standard in the fintech industry. This has a big part to play in KYC integration in apps.

The rise of digital identities simplifies KYC for both users and fintech providers.

Digital ID verification uses encrypted identification data that can be shared and verified instantly. This reduces the need for repeated manual documentation while providing a highly secure solution.

- Mobile-Based Verification: Users can easily verify their identity using their smartphones, allowing fintech apps to offer remote onboarding.

- Real-Time Verification: Through digital IDs, customer verification can be done instantly, ensuring a seamless and fast onboarding process.

These are the different components of the framework. Therefore, with this being said, let’s move to the next section of the blog.

Key Components of a KYC Framework

KYC in fintech platforms is a complex process rather than one feature, a framework if you will.

That’s why, to better understand the same, let’s look at the same. Therefore, let’s get right into it:

1] Customer Identification Program (CIP)

Let’s start with CIP.

It stands for Customer Identification Program. The name is quite self-explanatory. The purpose of this one is to verify the user’s identity.

Based on this, a record of their information is created.

Here are the steps:

- Information is collected like ID documents. (passport, driver’s License, utility bills, etc)

- Documents are verified by the fintech organization.

- Record customer information in a secure database.

2] Customer Due Diligence (CDD)

CCD compliance is yet another big point.

Customer due diligence is used to assess the risk associated with the specific user in question and determine the level of due diligence required.

Hence the name. Speaking of which, in this one, there are many factors.

Let’s look at what these are:

- Customer’s business activities

- Geographic location

- Source of funds

- Political exposure

In addition to this, there are two types of due diligence here. Namely:

Simplified Due Diligence which is for customers with low risk and enhanced due diligence which we will discuss below.

3] Enhanced Due Diligence (EDD)

Now that you already know what due diligence is, let’s see why an enhanced one is needed.

In very simple and plain words, this is a more thorough investigation of the users who seem riskier investments.

Here’s how it’s done:

- Obtain additional information about the customer’s business.

- Verify the source of funds.

- Assess the customer’s political exposure.

- Consider any adverse media reports.

4] Continuous Monitoring and Risk Assessment

Lastly, we have continuous monitoring and risk assessment.

Much like the earlier part of the framework, this is done to assess the risk involved with a customer, making it an important part of the whole KYC practice.

There are various ways to do it.

They are:

- Customer data periodic review

- Adverse media report monitoring

- Customer behavior change assessment

- Risk assessment updates as needed

So, these are the different parts of KYC framework, that is often seen in Fintech apps. And with this out of the way, it’s time to look at working of the KYC in fintech apps in detail in the next section of the blog.

How KYC Works in Fintech Apps?

If you want to start a fintech business and KYC integration is out of the question. If you are to do this, you must understand how KYC works.

Let’s see how it works below, detailed:

1. Data Collection

- Identity Verification: Users typically upload copies of government-issued IDs (passport, driver’s license, etc.).

- Proof of Address: Utility bills or bank statements are commonly used to verify residential addresses.

- Additional Information: Depending on the risk level, users might be asked for details like occupation, income source, or purpose of the account.

2. Document Verification

- Manual Review: In some cases, human experts manually check the authenticity of documents.

- AI-Powered Verification: Advanced algorithms can analyze documents for inconsistencies, forgeries, and other anomalies.

3. Biometric Authentication

- Facial Recognition: Comparing selfies with ID photos.

- Liveness Detection: Ensuring the user is a real person and not a photo or video.

- Fingerprint or Voice Recognition: Adding extra layers of security.

4. Risk Assessment

- Customer Profiling: Analyzing collected data to assess the risk associated with the user.

- Sanctions Screening: Checking against global sanctions lists.

- Adverse Media Screening: Monitoring for negative news related to the user.

Now that we are done with the work and understanding it, let’s move to the next step and discuss regulatory compliance related to KYC in fintech mobile applications.

Regulatory Compliance and KYC in Fintech

Regulatory compliance is a big part of Fintech as a whole and big design a big part of KYC.

Now, let’s see what the regulations and rules have to do with the same.

These are, as mentioned below:

► Global KYC Regulations

- Financial Action Task Force (FATF): The FATF sets international standards for combating money laundering and terrorist financing. Its recommendations provide a framework for countries to develop their own KYC regulations.

- Basel Committee on Banking Supervision: This committee, composed of central banks from major economies, has issued principles for effective KYC practices in the banking sector. While primarily focused on banks, these principles can be adapted to other financial institutions.

- International Organization of Securities Commissions (IOSCO): IOSCO has published principles on investor protection, which include KYC requirements for securities markets.

► Regional KYC Guidelines

- European Union (EU): The EU’s Fifth Anti-Money Laundering Directive (AMLD5) introduced stricter KYC requirements for financial institutions, including fintech companies. It also mandates the use of beneficial ownership registers.

- United States: The USA Patriot Act and Bank Secrecy Act impose KYC obligations on financial institutions, including those operating in the fintech space.

- Asia: Many Asian countries have their own KYC regulations, often aligning with FATF standards. Examples include Singapore’s Payment Services Act and Hong Kong’s Anti-Money Laundering and Counter-Terrorist Financing Ordinance.

So, these are all major international as well as regional regulatory guidelines based around KYC. Therefore, it’s finally time to discuss the major challenges in the section below.

Benefits of Implementing KYC in Fintech Apps

It’s time to look at some benefits.

We are doing this for the better understanding the entire KYC process and why you should go for it.

So with this being said, let’s get right into it by looking at the best benefits of KYC integration in Fintech apps.

These are, as mentioned below:

-

Enhanced Customer Trust

Who doesn’t want to build sincere trust among their audience base?

Well, that’s what KYC helps you with.

This integration instills confidence in customers by demonstrating a commitment to security and transparency.

When customers know that their personal information is protected and used responsibly, they are more likely to trust and engage with fintech services.

Now that’s one of the big reasons to integrate KYC into fintech mobile applications.

-

Reduced Fraud and Risk

Fintech is a risky business with fraudsters all around.

However, you can reduce that with the help of KYC, as we have discussed multiple times in this blog. KYC helps prevent fraud by verifying the identity of the customer and detecting suspicious activity.

By identifying potential fraudsters, fintech companies can protect their assets and mitigate financial risks.

-

Regulatory Compliance

Yeah, yeah, we know, there’s talk about regulatory compliance in everything, and that’s true.

Adhering to KYC regulations is essential for fintech companies to operate legally and avoid penalties.

KYC compliance demonstrates a commitment to responsible business practices and can enhance a company’s reputation.

-

Improved Risk Management

Another big benefit is that KUC helps fintech platforms improve risk management. This is done by making it easy to assess customer risk and tailor their services accordingly.

By understanding customer risk profiles, companies can implement appropriate risk management strategies to minimize losses.

-

Enhanced Financial Inclusion

Financial inclusion has become a trend.

You can capitalize on it with the help of KYC.

Here’s how it’s done, Know Your Customer can play a crucial role in promoting financial inclusion by providing access to financial services for underserved populations.

By simplifying the onboarding process and making KYC more accessible, fintech companies can help individuals and businesses participate in the digital economy.

So, these are the benefits of KYC in fintech apps. And with this out of the way, it’s time to look at the best practices for implementing KYC in the section below. Let’s get right into it.

Best Practices for Implementing KYC in Fintech Platforms

If you want to take full advantage of KYC on your fintech platform and want the very same for the end user, it’s a good idea to learn about best practices.

Therefore, with this being said, it’s time to look at best KYC practices.

These are, as mentioned below:

-

Robust Identity Verification

One of the most critical aspects of KYC is ensuring accurate and reliable identity verification.

Fintech companies should employ a combination of verification methods, such as document verification, biometric authentication, and other advanced techniques, to strengthen the identity verification process.

Real-time verification, facilitated by advanced technologies, can significantly reduce friction in the onboarding process and enhance the user experience.

-

Data Privacy and Security

Protecting customer data is paramount in the fintech industry.

Fintech companies should employ strong encryption algorithms to prevent unauthorized access to sensitive information.

Implementing granular access controls ensures that only authorized personnel can access customer data.

Regular security audits are crucial to identify and address vulnerabilities, safeguarding customer information, and preventing data breaches.

-

User-Friendly Onboarding Process

A seamless onboarding experience is essential for attracting and retaining customers.

Fintech companies should design the KYC process to be user-friendly on mobile devices, catering to the preferences of today’s customers.

Clear and concise instructions should guide users through the process, avoiding confusion and frustration.

Minimizing data collection requirements is another important consideration, as excessive information can deter customers.

-

Scalability and Efficiency

As fintech companies grow, their KYC processes must be able to scale efficiently.

Automation tools can streamline KYC procedures, reduce manual effort and improve efficiency.

Integrating a reliable KYC solution with other systems through APIs can facilitate data sharing and further enhance operational efficiency.

Investing in a scalable infrastructure ensures that the KYC process can handle increasing volumes of customers and data.

-

Regulatory Compliance

Adhering to KYC regulations is essential for fintech companies to operate legally and avoid penalties.

Staying updated with the latest regulatory changes is crucial, and seeking legal advice can help companies understand specific requirements and best practices.

Maintaining thorough documentation of KYC procedures and compliance efforts is essential for demonstrating adherence to regulations and facilitating audits.

-

Risk-Based Approach

A risk-based approach to KYC involves identifying high-risk customers and implementing additional verification measures.

Conducting a risk assessment helps fintech companies prioritize their efforts and allocate resources effectively.

Continuous monitoring of customer activity is essential to update risk assessments and identify potential risks.

Establishing clear escalation procedures for suspicious activity or potential fraud ensures that issues are addressed promptly and effectively.

-

Customer Education

Open and transparent communication with customers is crucial for building trust and understanding.

Fintech companies should communicate KYC requirements to customers, explaining the reasons for the verification process.

Providing a comprehensive privacy policy outlines how customer data will be collected, used, and protected, enhancing customer trust.

Offering responsive customer support addresses any questions or concerns related to KYC, demonstrating a commitment to customer satisfaction.

So, these are some of the best practices that one should follow if they are looking to integrate KYC into their app process. And with this, we have come to the end of the blog.

Conclusion

A well-structured KYC framework is essential for safeguarding fintech platforms and financial institutions from fraud, money laundering, and other illegal activities.

By implementing a robust system that includes Customer Identification, Due Diligence, Enhanced Due Diligence, and Continuous Monitoring, businesses can ensure compliance with regulatory requirements and build trust with their customers.

In an evolving financial landscape, keeping pace with technological advancements in KYC, such as AI-driven verification and blockchain, will be crucial to maintaining security and operational efficiency.

Ultimately, a sound KYC framework helps protect the financial ecosystem while fostering long-term growth and customer confidence.

In any case, if you are looking for more information, it’s highly recommended that you consult fintech app development company.

FAQs

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.