The Internet of Things, commonly referred to as IoT, is considered the technology of tomorrow. This is because, with the help of IoT, almost every sector is heading towards automation and enhanced user experience. It is truly remarkable how IoT has changed the way things work in just a few years.

From cashless transactions to automated orders at your favorite restaurants, IoT is the foundation of every technical convenience you experience today. One of the key fields where the impact of IoT is massive is financial technology or fintech. Banks from across the globe have implemented IoT in one way or another and it seems like this is just the beginning.

In this blog, let’s explore the possibilities that IoT opens and learn what is the exact role of IoT in fintech today. Without further ado, let’s get started!

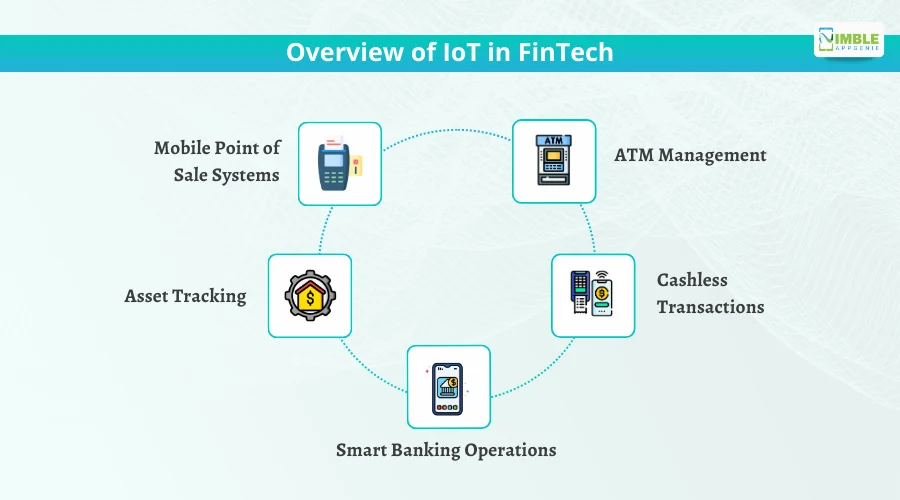

Overview of IoT in FinTech

IoT in fintech refers to the use of sensors and technology to integrate manual processes with automation techniques. In fintech, the use of IoT helps to improve customer experience, security, and operational efficiency.

The Internet of Things when combined with fintech can help save a lot of time, money, and resources for financial service providers. It helps automate key financial solutions processes such as easy payment collection, efficient information processing, and effective data transfers and management.

With the help of IoT, all sectors in fintech like banking, financial services, and insurance (BFSI) can implement process automation and smart devices to simplify how their services are used.

Some of the IoT applications in finance include-:

- Mobile Point of Sale Systems: POS terminals have become super smart with the implementation of IoT. Mobile point-of-sale systems offer great flexibility and offer multiple modes of accepting payments.

- ATM Management: For any bank, managing ATMs is a headache. With a combination of IoT in fintech, banks can easily manage things like how much cash is currently present in a machine, which one requires maintenance, etc.

- Asset Tracking: Tracking where your assets like machinery, cars, etc. have been becoming super easy with IoT. With IoT asset tracking, financial institutions can easily optimize their security and operational efficiency.

- Cashless Transactions: NFC readers, QR code payment, and card payment terminals are all part of IoT and can easily help you enable cashless transactions. Customers can easily use their smart devices (smartphones, smart wearables, etc.) and pay for things.

- Smart Banking Operations: Smart branches are the best example of smart banking operations. IoT can help financial institutions enable tracking of occupancy in a branch through a network of connected devices, help in predicting wait time, and improve customer service.

With all these applications, IoT has become an integral part of the entire fintech sector. The implementation of IoT has also enhanced the revenue generation in financial services. If you are wondering how fast industries are opting for IoT devices, then you should know that the number of Internet of Things (IoT) devices worldwide is forecast to almost double from 15.9 billion in 2023 to more than 32.1 billion IoT devices in 2030.

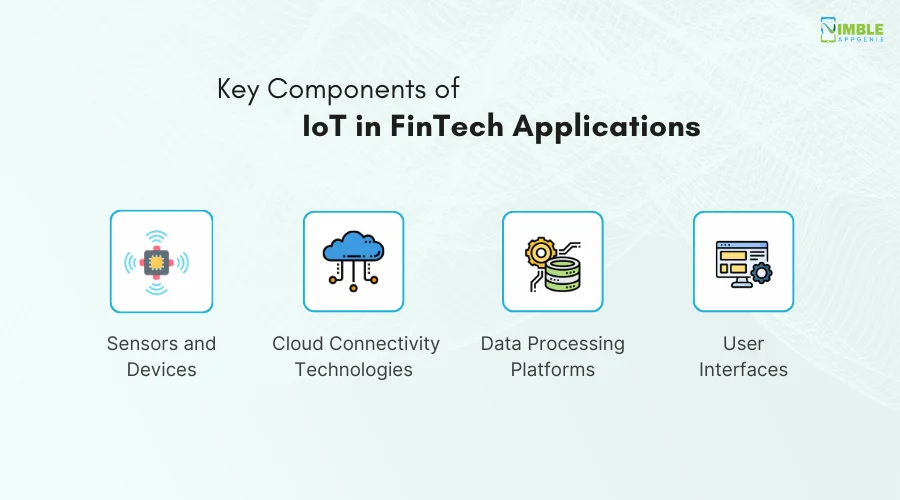

Key Components of IoT in FinTech Applications

When we talk about IoT applications in finance, it refers to the components of IoT that are used in fintech. Every technology has different roles to play in different sectors and not every sector needs to implement the technology as a whole. Several components can be chosen for use.

For instance, the following are the key components of IoT in fintech-:

-

Sensors and Devices

These are interconnected devices that work together to get a process done. For instance, a customer allocation system that helps a customer to raise a complaint using a smartphone, and when he reaches the branch, the support executive is notified and allocated instantly.

-

Cloud Connectivity Technologies

Cloud connectivity helps create an infrastructure with ample storage and computing power that IoT devices need to function. Since these are wireless connections, the entire processing is done over the internet via cloud platforms built for IoT.

-

Data Processing Platforms

These are real-time cloud platforms that help collect data from all the devices connected to IoT. This helps a business process the collected data to make further decisions. It also plays a crucial role in streamlining dedicated operations.

-

User Interfaces

User interface, as the name suggests is a way users interact with the IoT devices. These are simple outlets that help the IoT admin access data captured as well as the features that the executed system offers. The better the UI, the higher the adaptability of an IoT system.

All these components help in optimizing fintech operations to a great extent. With the help of IoT, the fintech applications have become more user-friendly and convenient. The impact is real as not only does IoT offer ease of access, but it can also help streamline the entire process.

Check out the next section where we have discussed the impact of IoT on the fintech industry and how it helps it grow better!

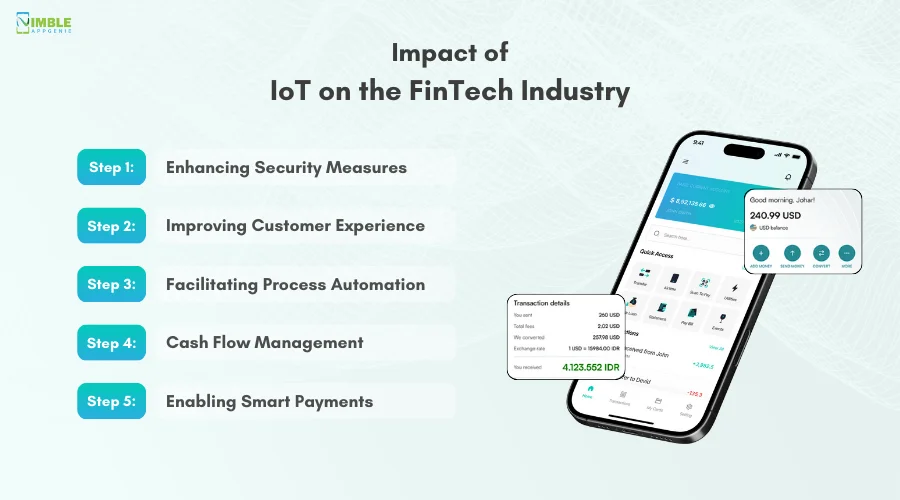

Impact of IoT on the FinTech Industry

The Internet of Things is one of the most impactful technologies that has found its application in fintech. By simply using a network of interconnected sensors and devices, fintech services have significantly improved.

Here are some areas of fintech services that IoT has transformed and made better-:

1. Enhancing Security Measures

With the implementation of modern-day technologies like IoT, you have to upgrade security measures in place too.

This means your fintech solution gets a security update, helping you enable biometric authentication that changes the way people interact with financial institutions.

With the increasing use of wearable technology, it enhances the security of fintech.

2. Improving the Customer Experience

Introducing IoT applications in finance helps in creating convenient ways for customers to interact with the services.

With the help of IoT, service providers can identify the preferences of the user, creating better experiences for them.

Not to forget, the convenience of banking and sending money through your smartphone via IoT-enabled applications elevates the customer experience by leaps and bounds.

3. Facilitating Process Automation

IoT devices tend to create an ecosystem that helps in automating a process.

This can be experienced in several fintech implementations, where the devices transfer data automatically by communicating with one another, helping reduce the chances of errors.

Automating entries and exits in a banking facility is another example, where a user has an IoT device (usually a smartphone).

They can tap on another IoT interface (NFC Enabled) to gain access.

4. Cash Flow Management

For financial institutions, managing cash flow is one of the biggest challenges that IoT can help resolve. Be it a bank, a business, or an office, with the help of IoT one can easily automate the management of all the incoming and outgoing transactions.

IoT makes all the management real-time, which helps in the proper functioning of ATMs and other similar devices that keep sending data based on the availability of funds.

It is IoT that allows a bank to keep track of the exact amount available in an ATM at a time.

5. Enabling Smart Payments

Smart payments refers to the ability to pay through your smartphone, contactless cards, and wearable devices. The network of devices helps in collecting the payment and transferring it to the receiver’s account in no time.

The process is super-quick and optimized and all of it happens in near real time. Smart payments with IoT help save of time. Contactless payment methods are the best examples of smart payments enabled by IoT.

With the help of the Internet of Things, the entire fintech ecosystem can be streamlined in such a way that the operations become more efficient and optimized while maintaining proper security standards.

Emerging Trends in IoT for FinTech

While the Internet of Things offers support for cutting-edge innovation in fintech, several emerging financial technology trends will help solidify IoT’s place in the BFSI sector.

The future for IoT seems super promising as resources like 5G connectivity, Artificial Intelligence, Machine Learning, Blockchain, etc. Are all being explored to their full potential.

♦ Adoption of 5G Technology

One of the key factors in the functioning of the Internet of Things is their connectivity and data transfer speeds. With the latest and updated 5G technology, the functioning of IoT devices will become more seamless.

5G networks have already taken over in many areas of the world and with the availability of high-speed internet, implementing IoT for fintech applications will be much easier.

♦ Integration with Blockchain

Security is always a point of concern when things are planned for automation. With the ability of decentralized storage, Blockchain can help IoT minimize breaches on connected devices as the data is more secure with Blockchain.

Fintech has already started implementing Blockchain to keep their database digitally distributed. With the combination of Blockchain & IoT, fintech is more secure.

♦ Implementation of Digital Twin Technology

Digital Twin technology is exactly what it seems, it creates a digital twin in the form of a virtual replica, that helps in testing different scenarios without putting the real interface at risk.

This can be of great help in predicting issues and monitoring performance for better optimization.

The Internet of Things often experiences issues that can only be detected by hampering the current system. Well with digital twin technology, that should not be a problem anymore.

♦ Utilization of AI and Machine Learning

AI and machine learning have already made their way into fintech and IoT. However, they are still to be explored properly considering their capabilities in data analysis and hardware.

Another sector where the utilization of AI and ML can make a difference in the implementation of IoT is personalization and fraud detection.

There are so many applications of artificial intelligence and machine learning in fintech that are still unexplored and will hopefully be explored further.

♦ Advancements in Edge Computing

As you are already aware, IoT is a network of devices connected to process a series of tasks. In fintech, currently, the data is passed through these devices to the data processing platform, then the processing happens, and later the task is carried out.

However, with advancements in edge computing, every device will be able to process a request that it receives from the closest sources. This will speed up the decision-making and action triggering.

The innovation in IoT with all these emerging financial technology trends is something to look forward to. However, this does not mean that there are no challenges in implementing IoT in fintech.

Challenges in Implementing IoT in FinTech

If you plan to integrate any technology into a system, there are a few things that may pose issues. The same is the case in implementing IoT in finances.

1] Data Security and Privacy Concerns

The Internet of Things generates large volumes of data for any business. While this is a plus for businesses as they can get more insights, it can go the other way in the finance sector.

That is because, when large volumes of data are generated concerning financial transactions, sensitive information is often left on digital platforms and IoT devices.

This creates a vulnerability of getting hacked or losing all the data due to network/device failure. Hence, data security and privacy prove to be a major challenge when it comes to implementing IoT in fintech.

2] Integration with Legacy Systems

The digital transformation of fintech has been an ongoing challenge for a while now. Introducing the latest technologies like the Internet of Things can be difficult as the legacy systems that are in place may not be compatible with them.

Another challenge that IoT poses while integrating it with legacy systems is its evolving nature. Today the technology is stable but not at its peak.

New advancements are happening now and then. Amid the continuous evolution of technology, if you plan to implement it chances are that you will either have to replace it again, or you will have issues in integration with the legacy systems.

3] Regulatory Compliance Issues

Fintech is one of the most monitored fields as it involves public interest and cash transactions. There are several financial regulatory compliances that one has to meet to implement anything new in fintech.

These regulations often enforce the involvement of humans in some of the operations that IoT can easily take over. This leads to a conflict of interest between regulatory bodies and the financial institution itself.

This poses a significant challenge in the implementation of IoT in fintech. Not to mention, meeting all the guidelines with the help of devices seems a bit difficult if you do not have an experienced team of developers with you.

4] High Implementation Costs

The cost of implementing a network of devices can be significantly high in the beginning. While it seems a better solution for reducing operational costs in the long run, implementation costs that you might have to pay in the beginning.

This cost often becomes a deal breaker for many small fintech businesses as they do not want to spend a lot of money right away.

Implementing IoT is expensive as it requires a lot of devices, networking equipment, centralized systems, etc. Don’t forget, you need to have IoT-trained professionals to make the most of the mechanism that you’ve implemented.

The core reason behind these challenges is that finances and banking services go way back in time and have a set way of functioning. Introducing newer technologies means changing the traditional ways of operation and not every upgrade is widely accepted in the beginning.

Case Studies of IoT in FinTech

However, these challenges often come across as an issue of perspective as many examples have implemented IoT and have seen massive success in their overall operations and functioning.

► Stripe’s IoT Innovations

Stripe is one of the leading online payment processing platforms that offer businesses multiple ways to accept payments.

It enables online payments for any organization by offering custom means such as a POS or an online payment gateway. Being a payment management platform, Stripe has made a lot of progress in the fintech market by implementing IoT in their system.

Majorly, they enable smart payments with IOT. However, there are multiple use cases for which Stripe has implemented IoT in their fintech business.

These are-:

Use Case #1 – POS Terminals

Stripe offers dedicated point-of-sale terminals that enable direct payments through Stripe. This allows businesses to collect payments instantly through a mobile payment collection terminal.

Use Case #2 – Payment Initiation

Stripe uses IoT technology to help its customers initiate payments from the convenience of their smartphones. This is done by using IoT-compatible devices and apps.

Use Case #3 – Transaction Reporting

Every transaction made through Stripe is reported instantly with the help of IoT data transfers. It also helps in faster transaction processing.

Thanks to IoT, Stripe is bringing innovations to the way people make payments and adding convenience to regular transactions for both businesses and consumers.

► Mastercard’s Connected Devices

Mastercard is always at the forefront of technical innovation when it comes to payment solutions. Other than being the leading name in electronic fund transfers, it is always focussing on innovations in payments.

So much so that they have addressed IoT as the next big thing in fintech. In one of their publications, they shared some extraordinary use cases of IoT that they plan on implementing with the help of data collected by connected devices.

These include-:

Use Case #1 – Enabling Pay-Per-Use

Mastercard is all set to use integrated IoT devices that will be able to record when a user has used a certain service and for how long to enable a pay-per-use model.

Use Case #2 – Connected Devices

Mastercard’s connected devices are a range of products and services that allow a user to make payments via their preferred credit or debit cards. It allows Mastercard to utilize IoT to create a synchronized experience for users.

Use Case #3 – Automated Payments & Service Delivery

With the implementation of IoT, Mastercard actually creates an interconnected experience that allows its customers to use automated payments and service delivery.

Mastercard has already implemented remote point-of-sale functionality to enable cashless transactions that require no direct contact.

It is one of the biggest names in open-loop payment systems and with IoT, it is just going to climb the ladder of success much faster!

► Cash App’s Use of IoT Features

Cash App is the most commonly used application for instant payments in the United States. It allows easy money transfers, and cash cards that you can use for cashless payments and also offers banking services such as direct deposits.

Since there are so many users onboard, this is the perfect application to understand how IoT helps in creating convenient solutions for fintech and financial transactions.

Cash App uses IoT to keep track of the payment methods used along with the transaction details from device to device.

Use cases where IoT is helpful for Cash App-:

Use Case #1 – NFC Technology

NFC or Near Field Communication technology helps Cash App implement faster transactions with IoT-powered devices, enabling payments.

Use Case #2 – Online Banking

Since Cash App offers significant banking services, it uses IoT sensors and smart devices to monitor all transactions along with bank branches, ATMs, and data centers.

Use Case #3 – Security Measures

By using applications of IoT, Cash App enables Multi-factor Authentication to add an extra layer of security. Since the Internet of Things allows interconnection of the smartphone app, with its card, a wrong pin can easily trigger MFA, making it more secure.

With the Internet of Things, Cash App can generate a lot of data that helps them improve their services. Since they already have integrated banking services, the IoT helps them stay connected with their customers’ banks making it a direct transaction.

With these case studies, you might have an idea of how implementing IoT in fintech can help a business skyrocket its revenue.

Final Thoughts on the Future of IoT in Financial Services

With all the insights that we have gone through so far, if there’s one thing that can be said with certainty, it is that IoT is going to redefine the way financial transactions and operations work. The implementation of the Internet of Things in fintech presents so many opportunities for automating transactions and decision-making.

It can be safe to say that in the upcoming years, there will hardly be any fintech applications that will not be IoT-friendly. If you are planning your fintech product, you should consider making it IoT-enabled.

The growing use of smartphones and smart wearable devices will allow IoT to help in better financial tracking, which will in turn help in developing expense tracking and budgeting platforms. IoT can offer significantly more sophisticated solutions for better and personalized financial advice.

How Nimble AppGenie Can Help You Integrate IoT in Fintech Apps?

In the coming years, even the most basic financial services will be able to leverage the Internet of Technology to simplify their everyday operations, from transactions to collections.

If you also plan to integrate these smooth fintech app development services, then Nimble AppGenie is the ultimate choice!

With proven experience in IoT implementation and fintech development, we offer well-curated insights on what type of solutions will be beneficial for you and then help in proper execution.

IoT in fintech is going to play a significant role in the upcoming few years. The best way you can make the most of this revolution is by becoming a part of it. Reach out today for top-notch fintech IoT solutions.

Conclusion

By now you might have got a clear understanding of the crucial role that IoT plays in fintech. With all the components combined, IoT can be impactful making the entire fintech process faster and automated. While the technology is super cutting-edge, there are a few advancements that can help in better implementation.

Hope this blog helps you understand the role that IoT plays in fintech and what the future holds for it. That’s all for this post.

FAQs

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.