Fintech is an abbreviation for financial technology used to avail of financial services. The traditional economic system is disrupted through fintech as it offers innovative solutions. Fintech offers advanced technologies including big data analytics, machine learning, and cloud computing to develop creative financial solutions for businesses.

With the change in the financial ecosystem; Fintech has significant implications for financial inclusion. In the presented blog, the considerable impact of fintech on businesses is detailed. Along with this, fintech opportunities and use cases for enterprises are discussed.

Challenges Businesses Face Today

To identify the impact of fintech on businesses, it is important to know about the challenges and issues faced by businesses today. Identifying key challenges defines a complete picture of using fintech in businesses.

With the shift in customer demand, the challenges of companies are increasing and impacting the scale of revenue.

Let’s learn about some of the current challenges businesses face in the present era.

| Business Challenges | Brief Description |

| 1. Changes in the Economy | Economic uncertainty and downturn are some of the significant parameters that initiate the risk that impacts the business operations and its financial stability. |

| 2. Supply Chain Management Issues | With the increasing business expansion, one of the protocols is the supply chain management issue. Addressing the impact of supply chain disruptions, geopolitical tensions, and natural disasters is a business concern. |

| 3. Digital Transformation | Coping with the changing digital technologies and remaining competitive to meet the changing customer expectations has become a challenge. |

| 4. Recruiting Skilled Personnel | Attracting and retaining a competitive workforce is a difficult task because as per the customer’s changing demands, hiring skilled people is important. |

| 5. Providing Data Security | Customers trust brands that provide them with information security. However, investing in data privacy tools takes much more investment. |

Other than the challenges stated in the table, other challenges include enhancing the customer experience, retaining potential employees, and marketing the product and services.

Amidst major financial changes and fintech trends, understanding the optimal amount of gold you need to own could serve as a hedge against market fluctuations.

As businesses navigate digital transformations in economic ecosystems, it’s crucial to consider multifaceted investment strategies, including traditional assets like gold, which can be pivotal in ensuring stability.

Now that we have learned about the challenges, let’s look at what fintech is for businesses.

Understanding Fintech For Businesses

Fintech refers to using technology for financial assistance which includes completing financial transactions and improving the financial management of the firm. Fintech is crucial for businesses to gain data-driven insights, have better access to capital, adopt digital transformation, and reduce risk.

Understanding the impact of fintech is important for businesses to design business strategies and excel in the competitive landscape. Leveraging technology, companies are assisting customers with payments, lending, borrowing, blockchain, and digital banking services.

Using Fintech also refers to the integration of technologies offered by financial services companies to improve the usage of advanced technologies for user benefits.

The Fintech Boom

Along with this, the fintech market is expected to reach USD 882.30 billion by the end of 2030. With the growth in the fintech industry, there has been an opportunity for various shareholders to invest in fintech.

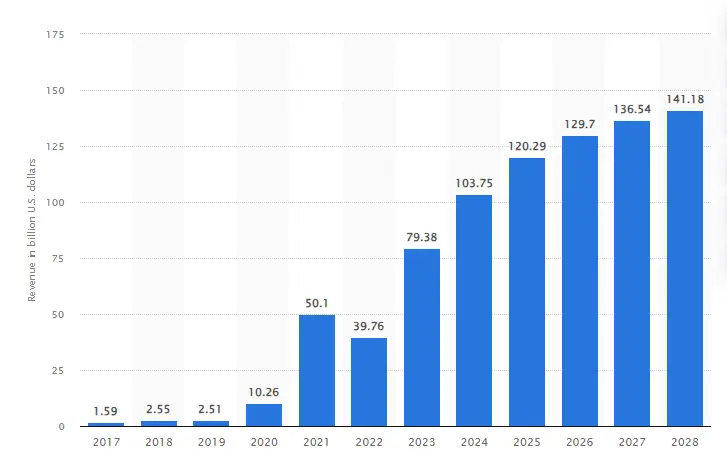

- Revenue in the global fintech industry has sharply increased between 2017 and 2023.

- It has been stated in the graph that the total revenue of the industry was 79.38 billion USD and has been estimated to grow further to 141.18 billion USD by 2028.

- The digital payments market is also expected to grow to amount to 4,805 million users by 2028.

- By the end of 2025, the revenue of the digital payment market is expected to grow by 17.38%.

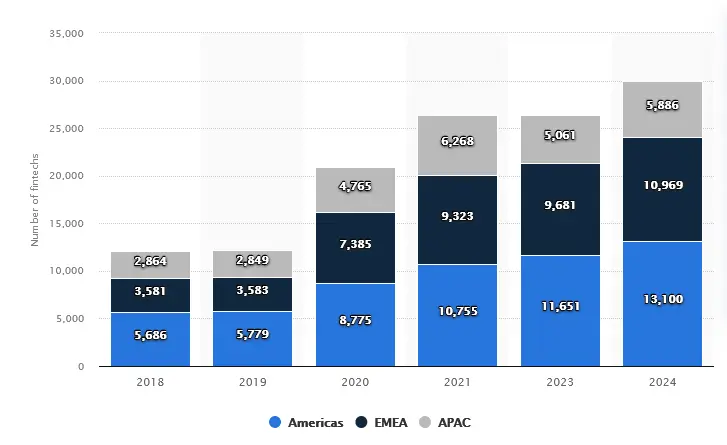

- As of January 2024, America is one of the largest regions with the largest number of fintech firms globally.

- Similarly, there were 13, 100 fintechs in America, which is almost 1500 more than the previous year.

- There are almost 10,969 fintech businesses within the regions of Europe, the Middle East, and Africa.

- Along with this, it has been found that the United States has the greatest number of start-ups in the fintech unicorn globally.

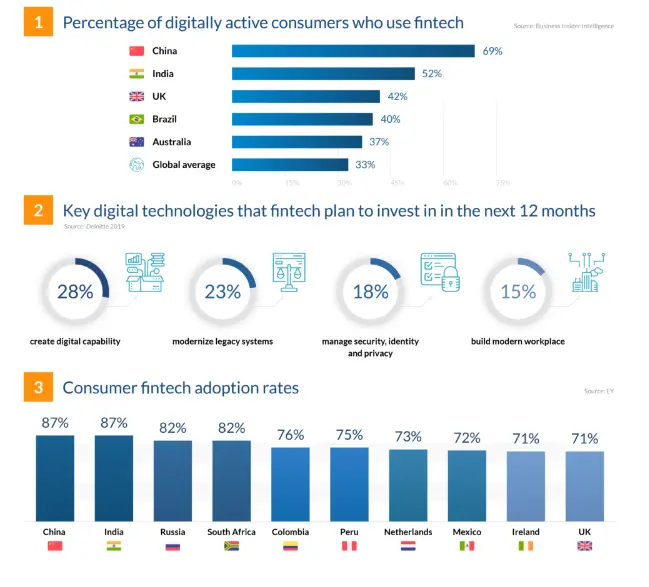

- With the above data, China is among the top countries using fintech apps.

- 87% of customers in China and India have high fintech adoption rates. Meanwhile, the UK has a 71% adoption rate.

- Thus, it can be stated that the trend for fintech users has increased in the current decade.

How Does Fintech Impact Businesses?

Get the stats and data on the fintech company’s growth! Now it’s time to see how fintech impacts businesses.

Businesses with fintech solutions are serving audiences with an advanced number of technologies. With the growing demand for financial management technologies, you can serve the customer better.

Learn about the fintech impact on businesses to further invest in app development.

1. Easier Payments, More Revenue

The fintech industry has helped businesses access finance, especially for small and medium firms. These companies also streamline the payment procedure by offering faster and more convenient payment options, including mobile payments as well as digital wallets.

It helps businesses to improve the customer experience and also improves the sales of the brands. The impact of fintech on linking payment gateway integration is assisting businesses to head on to easier payments.

2. Adapting to the Future

Investing within fintech is permitting businesses to stay ahead of the curve by remaining competitive and by positioning themselves as one of the greatest industry leaders in the digital business.

The impact of fintech on economic growth can be seen through the increasing revenue rate of businesses and the way they are contributing to economic development. The implementation of fintech innovations including IoT and AI permits businesses to remain competitive.

3. For Happier & More Satisfied Customers

The impact of fintech on businesses can also be observed through the happier and satisfied customers of the brand who are opting for fintech solutions.

Along with this, it can be stated that through fintech, businesses offer personalized, efficient, and convenient services to their customers that result in the growth of the firms.

Fintech also offers an AI-powered chatbot to increase customer satisfaction rates. You can check these tips for effective fintech app design. Fintech apps avail businesses and also ensure customer accessibility as well as convenience by offering customers intuitive software interfaces.

4. Better Security (& Compliance)

Through better security measures, fintech impacts businesses to improve the trust of the customers towards the firms. By using artificial intelligence and blockchain technological parameters, businesses can reduce the risk of cyber fraud by following the fintech regulations.

Businesses are using fintech solutions to better know and understand their compliance and financial regulations that add value to their firms. You can avail these benefits with a fintech solution expert, as ensuring customer data security is their prime motive while developing the app.

5. Streamlined Operations

Beginning with digital invoicing for payment processing, automated accounting, and payroll systems, FinTech offers a diversified range of services to businesses.

These services are helping firms to ensure effective business growth by connecting with a diversified range of customers. For smooth financial operations and diversified report generation, having the best invoice template can greatly aid in billing effectively and aligning with the latest industry practices.

By streamlining the operations, the businesses can focus on their core activities and can improve business productivity by driving overall performance initiatives.

Creating an investment platform can be a difficult task without specific fintech app guidance. Thus, fintech guidance can assist you in improving the functioning of your app.

6. Unparalleled Business Insights

Fintech also provides businesses with valuable insights that can help them make informed decisions and strategic planning.

By focusing on fintech development outsourcing, businesses can relax and focus on core business activities. This is a prominent way to gain business insights and minimize the stress of managing the financial system of the firm.

With the usage of fintech analytical tools, businesses can also recognize the opportunities, resulting in mitigating the risks to optimize the business strategies.

Fintech businesses also offer core business insights by evaluating the customer’s feedback; businesses can update their marketing to take advantage of the favorable conditions in the market.

Opportunities & Use Cases of Fintech Solutions

The fintech solutions also offer a different and well-defined range of opportunities through case studies across various industries and sectors.

Fintech has a diversified impact on the world economy and the businesses that are working in these economic parameters.

You can hire mobile app developers to avail of the aforementioned fintech solutions in your app. Some examples of fintech solutions can be detailed below.

♦ Digital Payment

Across different sectors, including retail, fashion, banking, and others, digital payment apps have become an essential tool.

With the digitalization era, using fintech creates an opportunity to enhance customer satisfaction as traditional banking services have diminished. Fintech’s impact on retail can be observed through retaining customers and availing them of measures to connect with retail stores through online modes.

One of the popular cases of digital payment and the implementation of fintech solutions is an app like PayPal.

With PayPal, users can receive and send money, make in-store purchases via mobile devices, and manage their finances with the help of the PayPal app. PayPal has become one of the leading companies with a vast name in the bank fintech industry providing seamless transactions.

♦ Lending and Financing

Businesses using Fintech have increased the funding choices that are currently available to small businesses as compared to the financial choices available to them in the past.

The companies have also provided access to credit and financing options for businesses and individuals who are under-served by traditional banks. Fintech’s impact on lending can be observed through the services provided by banks related to borrowing and lending. Thus, inspiring businesses to invest in loan lending app development.

Based on lending and financing, an example of fintech opportunities is NEOGROWTH. The company is based on fintech parameters and understands that small businesses are the backbone of the nation. By providing lending and financing facilities to small business firms, NEOGROWTH provides effective services to their customers.

♦ Accounting and Bookkeeping

Businesses in accounting and bookkeeping around the world are transforming the financial services industry by enhancing the accounting profession. These companies are using accounting technology to increase the efficiency of tasks by providing new insights to the businesses. Automating financial management procedures assists the brands in dealing with the accounting issues that occur in the businesses.

Intuit is a company that uses fintech solutions to focus on providing financial software services along with functions that help customers manage their money successfully.

The company works with QuickBooks, TurboTax, and Mint, which are specialized software that are used by customers to track finances. Another example of accounting and bookkeeping can be the use of QuickBooks, which is revolutionized small business accounting software that offers cloud-based services to customers.

♦ Investment and Wealth Management

Digital health management is creating an opportunity for fintech by developing a faster way for a more seamless financial planning process.

Businesses using fintech provide personalized investment solutions, including portfolio management and financial planning services to investors. Other than this, the fintech impact on wealth management can be identified through companies that are assisting individuals to take control of their finances.

Investment apps are also beneficial in learning the users’ habits regarding investments and then recommending to them the best practices along with the saving decisions that are aligned with their personal goals.

An example of a company providing wealth management services is UBS Wealth Management, where the experts provide individual solutions to their customers.

♦ Security and Risk Management

Artificial Intelligence (AI) is an important technology, which is assisting businesses in analyzing massive amounts of data and patterns to evaluate user behavior.

Businesses with fintech solutions are using AI for customer verification and to enhance the automation of services. By using robust security protocols, businesses ensure that their customers and employees are aware of the best security practices.

To build a good app, it is vital to consider fintech security and risk management. It is an important practice that helps businesses to increase the trust of the customers in the brand.

Regular security audits and penetration testing can assist in identifying vulnerabilities and strengthening security measures. An example of a fintech app is Stripe, which has revolutionized online payments with a comprehensive range of APIs.

♦ Data Analytics

Businesses with fintech solutions specialize in utilizing AI and machine learning parameters for processing data. Such powerful tools and analytical patterns are imperative in determining future trends.

Here, companies can use technology to evaluate the risk and to detect fraud. Fintech impacts the financial market by developing customer profiles to adopt better insights and diversified customer behavior.

Databricks is one of the businesses with fintech solutions that assist the user to manage their data based on the current and emerging trends in the technology.

The organization combines the best of data warehouses along with data lakes to offer a unified and open platform for data and AI. Thus, by analyzing the customer data, the organizations are providing personalized solutions to their customers.

♦ Personalized Financial Services

Fintech’s impact on the financial market can also be analyzed via significant opportunities that the companies offer for improving personalized financial services.

Companies can harness a vast amount of data from diversified sources comprising demographic information, transaction history, and the spending patterns of the customers.

Also, Fintech’s impact on insurance can be analyzed via the financial insurance services provided by banks and other financial institutions.

Fintech business models vary with the diversified vision of the fintech firms. Stripe is a fintech app that offers users personalized financial services.

Here, the user can keep track of all the information related to customer billing data and can use it to power the marketing campaigns. While providing personalized financial services, companies need to ensure the steps for cybersecurity to enhance user trust.

Industries that can Help by Leveraging Fintech

Would you like to know how different industries can benefit from leveraging fintech? If yes, then the next section deals with all the industries that are being impacted by the advanced technology used by fintech functions.

1. On-Demand Industry

Fintech solutions for businesses can be effective in delivering and enhancing financial management services for on-demand app development including food delivery, taxi booking, and salon booking.

Fintechs can leverage the on-demand industry by providing instant payment processing mediums to their customers. Fintech is helping organizations provide diversified and new ways to invest, share, and manage funds.

The impact of FinTech on e-commerce can be determined through the services it provides to e-commerce firms. With speed and convenience being the payment system, fintech has provided leverage to the on-demand industry.

2. eCommerce

Businesses with fintech solutions have made accepting payments easier for e-commerce businesses while managing the payments and assisting the firm in arranging finances successfully.

Businesses can track spending, and manage and create budgets to make better investment decisions. Fintech impacts on e-commerce can be identified through performing the personalized shopping experience, providing cross-border payments, and also providing fraud prevention services.

It can track spending, create budgets, and also assist e-commerce firms to make better investment decisions. With the assistance of fintech, e-commerce firms can expand into new markets to reach more customers. This is one of the top reasons why firms who are investing in e-commerce app development should consider fintech integration.

3. Healthcare

You can analyze the use of fintech for healthcare app development by reviewing the role of fintech in this specified area. This is how fintech makes money; it provides enhanced access and affordability to its customers. Fintech businesses can also foster healthier populations, via timely payments and improving healthcare providers’ cash flow.

The financial challenges in the healthcare sector are huge. It not only impacts the care received by the patient but also impacts the individual finances, and later society. With short intervals of transaction periods, it provides effectiveness to the patient and also to the family through effortless transactions.

4. Logistics

Fintech does play an important role in logistics, through leveraging new technologies and digital payment systems.

This streamlines the supply chain operations and also realizes significant cost savings, resulting in increased efficiency for the brands. Through expense tracking app development, logistics firms can effectively make use of fintech solutions.

The impact of fintech on supply chain operations can be examined through improved cash flow management. Fintech leverages different financial options for businesses such as logistics businesses that can pay suppliers but do not need to have cash on hand.

Through cross-border payments, fintech contributes to the expansion of global trade, where the fintech impact on the economy can be analyzed.

5. Education

The impact of fintech can also be analyzed through the platforms that provide financial assistance to assist students in understanding budgeting, savings, and responsible borrowing. With integration in education app development, fintech provides secure and transparent verification systems. Fintech businesses also provide efficient payment systems and solutions for students to receive tuition payments, student aid, and scholarship disbursements.

With mobile payment, students can access the payment to their school, university, or any course fees. Fintech firms provide a simple and accessible way for students so that they can enable cashless transactions from remote locations.

6. FitTech

Businesses are leveraging fitness by utilizing financial technology to motivate and incentivize individuals to lead healthier lives.

The use of fintech in fitness apps has a wide impact on society. With the emergence of many fitness companies including Paceline, Ness, and Krowdfit, the usage of fintech cannot be overlooked in the fitness industry.

The new fitness apps and businesses observed in the current era. This represents the impact on society along with the fitness enthusiast people. With the usage of digital financial services, fitness applications are being impacted positively.

7. Music Streaming

Several music streaming apps provide tiered subscription models to their users to remove the commercial ads for a monthly recharge. Through the use of blockchain technology, music streaming apps are providing control to the artist over their music. The relationship between fintech and the music industry is growing significantly.

Music streaming apps with fintech solutions are leveraging the artist to become independent. As with fintech, music streaming apps can analyze the data to build customer profiles. Along with this, businesses with fintech also provide insights into the user’s demographics, preferences, and mood.

8. Banking

Fintech’s impact on commercial banking can be identified by comparing the traditional banking facilities provided by the banks to the current resources available to the customers to avail the banking services. Fintech firms utilize the core banking software list and use it to provide banking services to the end user.

Banks with fintech solutions also offer a secure payment experience to the user for accessing faster money transfers. Fintech’s impact on investment banking also includes trading bonds, mutual funds, stocks, hedges, etc. Users at the bank can take advantage of the automation and speed of transactions, which represents fintech’s impact on banking.

Fintech Trends to Look Out For

Till now, you have identified how fintech leverages different types of industries.

Now it’s time to look at the trends in fintech.

Financial trends can be listed below.

► Blockchain

It is a distributed ledger technology underpinning the development of new financial products and services. The implementation of blockchain in fintech provides potential implications for cost savings due to the distributed nature of finance.

► Embedded Finance

With the help of this service, the customers can make the purchases first and can split the finances later. Along with this, embedded finance provides a broad category of financial services with products that may be used within a certain framework and platform.

► SaaS

Using Software as a Service, companies can access and pay for software applications without even installing them on their computers. It also enhances the financial security of the customers by enabling data protection software.

► Open Banking

Open banking is permitting third-party developers to access the data and to create innovative services as well as products. This technology in fintech leverages the users to have more control over their finances.

► Digital Wallets and Payments

Fintech provides services to customers to avail digital wallets and payment solutions that are becoming increasingly popular. This also includes mobile payment apps, payment platforms, and contactless payment technologies.

► Robo-advisers, AI, and IoT

IoT enables physical devices to easily connect to the internet. Robo-advisers and AI are also offering automated investment management to customers. Customers can also get financial advice and risk assessments based on algorithms and machine learning.

Other than the above-mentioned digital technologies, sustainable finance, cyber security, Regtech, and cryptocurrency are also among the current digital fintech trends that are in high demand. You can build a fintech app with all the technologies mentioned with the help of an expert.

Nimble AppGenie – Your Partner in Fintech Innovation

With the current increasing trend in fintech and the growing number of users, there is a high possibility of entering the fintech industry.

Nimble AppGenie has gained expertise in fintech app solutions.

Explore how our fintech apps work with already-built apps including Pay By Check, CUT, and many others.

Fintech App Development Company can help you design your fintech app with all the advanced features.

We are here to help you by providing you with the actual guidance in discovering the current trends and needs of the market. Additionally, we will help you cover the impact fintech has on businesses and how your app can fit into different industries.

Contact us for more information.

Conclusion

Concluding the above information, it can be stated that the users of fintech in China and India are 87%. The market size of fintech has recorded a growth of USD 257.26 billion.

Hence, it is a great opportunity for the fintech firms to have an up hand in the fintech industry. Fintech has a diversified impact on businesses as it provides an easy payment gateway to customers and offers security to firms with unparalleled business insights.

Fintech has opportunities in digital payments, investment and wealth management, data analytics, and also in offering personalized services to the business.

Industries that are leveraging fintech include healthcare, logistics, banking, education, and music streaming. Other fintech trends include IoT, AI, blockchain, SaaS, and many others.

FAQ

Fintech stands for financial technology, used to provide innovative financial services disrupting traditional financial systems.

Fintech impacts businesses by providing easier payment methods, adopting future technologies, ensuring customer satisfaction, enhancing security and compliance, streamlining operations, and offering unparalleled business insights.

Fintech solutions offer opportunities in digital payments, lending and financing, accounting and bookkeeping, investment and wealth management, security and risk management, data analytics, and personalized financial services. Examples include digital payment apps like PayPal, lending platforms like NEOGROWTH, and accounting software like QuickBooks.

Various industries such as on-demand services, e-commerce, healthcare, logistics, education, fitness, music streaming, and banking benefit from leveraging fintech by improving financial management, streamlining operations, enhancing customer experiences, and enabling innovative solutions.

Current trends in fintech include blockchain, embedded finance, Software as a Service (SaaS), open banking, digital wallets and payments, robo-advisors, AI, IoT, sustainable finance, cybersecurity, Regtech, and cryptocurrency.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.