So, you’re thinking about diving into the POS business? Smart move!

In today’s digital-first world, every business—whether it’s a cozy coffee shop or a bustling retail store—needs a seamless way to handle transactions.

And guess what? That’s where you come in.

Starting a POS (Point of Sale) business isn’t just about selling some fancy tech; it’s about becoming the backbone of small businesses everywhere.

With the global shift toward digital payments and the boom in e-commerce, the POS market is on fire right now. The global POS market is expected to hit $125 billion by 2027!

Yep, you heard that right- $125 billion.

But before you jump in, there’s a lot to consider, from choosing the right tech to figuring out how to stand out in a competitive market.

Don’t worry, though; we’ve got your back.

This guide will walk you through everything you need to know about starting a POS business and making it thrive.

Let’s get started, shall we?

Statistics: POS Market Growth

Alright, let’s talk numbers—because numbers don’t lie, right?

If you’re serious about starting a POS business, you need to know the lay of the land. The POS market is not just growing; it’s exploding. And fintech statistics show us just that.

Here’s a quick snapshot to get you pumped:

- Global POS Market Size: The global POS market was valued at around $75 billion in 2021. Fast forward a few years, and it’s projected to hit $125 billion by 2027. That’s nearly double the growth in just a few years. The demand for POS systems is skyrocketing.

- Regional Insights: North America, being tech-savvy, holds the largest market share. But don’t sleep on Asia-Pacific—it’s the fastest-growing region, thanks to a massive shift towards digital payments in countries like India and China. Europe’s no slouch either, with steady growth driven by an e-commerce boom.

- Mobile POS (mPOS): The mPOS segment is the real MVP here. With businesses and consumers embracing mobility, the mobile POS market alone is expected to reach $55 billion by 2026. Everyone’s ditching the bulky setup for sleek, mobile-friendly solutions.

- Trends Fueling Growth: Digital payments are the future, and POS systems are at the heart of it. With the rise of contactless payments, integrated systems, and AI-driven analytics, the POS industry is evolving faster than ever.

So why are these stats important? Because they show you the insane potential this market has.

Whether you’re targeting brick-and-mortar stores or e-commerce giants, there’s a massive opportunity waiting for you. And if you play your cards right, you could be a major player in this booming industry.

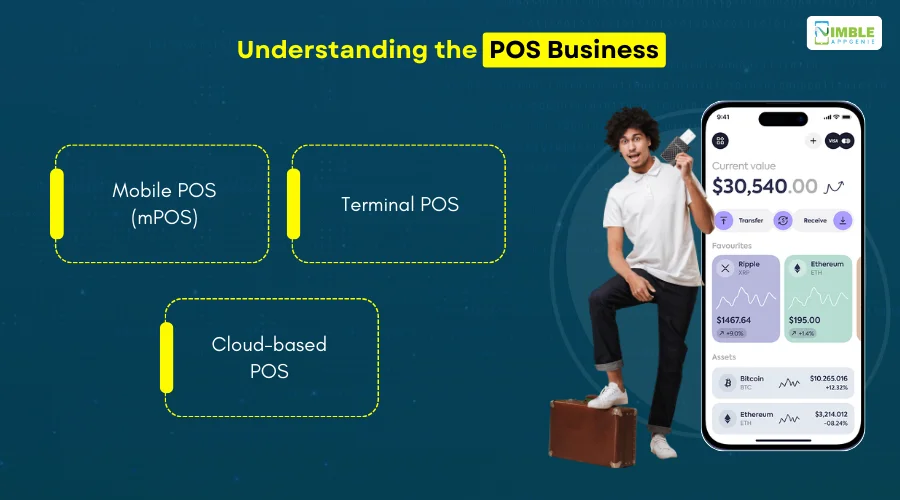

Understanding the POS Business

So, what is a POS (Point of Sale) system?

In simple terms, it’s where the magic happens—where customers hand over their hard-earned cash (or tap their card) and walk away with their purchases.

But a POS system is more than a cash register.

It’s the hub of business operations, handling everything from sales transactions to inventory management and customer data.

Now, let’s break it down further.

There isn’t one type of POS system out there—different businesses need different setups. Let’s explore the main types of POS systems you could offer.

► Mobile POS (mPOS)

Imagine running your business from a smartphone or tablet.

It’s mPOS.

It’s portable, flexible, and perfect for small businesses or anyone on the move—like food trucks or pop-up shops.

With mPOS, you can accept payments anywhere, anytime.

► Terminal POS

This is your classic in-store POS setup.

It’s a touchscreen device connected to a cash drawer, receipt printer, and card reader.

Terminal POS systems are reliable and often packed with features like inventory tracking and customer management, making them ideal for retail stores and restaurants.

► Cloud-based POS

Welcome to the future.

Cloud-based POS systems store all your data online, meaning you can access your business info from anywhere.

Plus, they’re super easy to update and integrate with other software. It’s a scalable solution, perfect for growing businesses.

Understanding these types will help you decide which POS solution fits your target market best. Up next, we’ll dive into why starting a POS business is a solid move.

Why Start a POS Business?

Starting a fintech business can be a daunting task.

One of the biggest questions that comes to mind is, But why should you dive into the POS business?

Here’s why starting a POS business could be one of the smartest moves you make.

♦ Massive Market Potential

The demand for POS systems is off the charts.

With businesses of all sizes looking to upgrade their payment systems, you’ve got a huge market waiting to be tapped.

Whether it’s small mom-and-pop shops or large retail chains, everyone needs a reliable POS system to keep their operations running smoothly.

♦ Recurring Revenue Model

Think about it—once a business integrates your POS system, they’re in it for the long haul.

With a subscription-based model, you’ll be earning steady, recurring revenue.

Plus, businesses often need ongoing support and updates, giving you even more opportunities to build long-term client relationships.

♦ Tech-Driven Innovation

The POS industry isn’t just about processing payments anymore.

It’s at the intersection of cutting-edge technologies like AI, IoT, and big data. By getting into the POS business, you’re positioning yourself in a tech-savvy market with endless possibilities for innovation and growth.

These are just a few of the reasons why getting into the POS business is a no-brainer. The combination of market demand, revenue potential, and tech innovation makes it an exciting and lucrative field to explore.

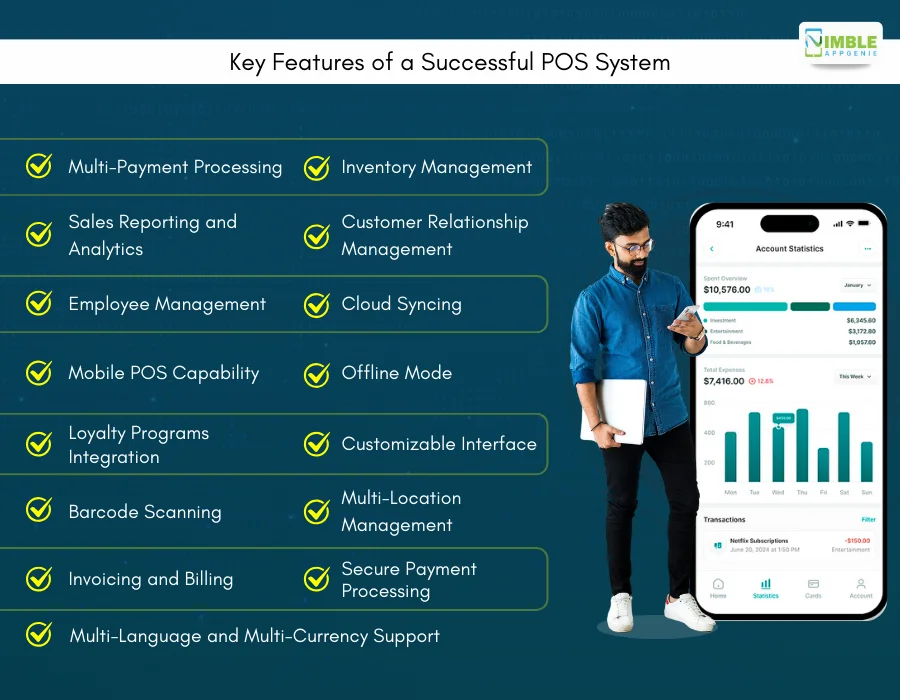

Key Features of a Successful POS System

Alright, now let’s get into the nitty-gritty—the features.

When it comes to building a successful POS system, the features you include will make or break your product.

Your goal is to create a system that’s not just functional but a game-changer for businesses.

Here are 15 must-have features that will set your POS system apart from the competition.

1. Multi-Payment Processing

The ability to accept multiple forms of payment—credit/debit cards, mobile payments, digital wallets, and even cash—is crucial.

Your POS system should handle everything from swipes to taps to QR code scans seamlessly.

2. Inventory Management

Businesses need to keep track of their stock in real-time.

Your POS system should update inventory levels with each sale and alert the business when stock is running low.

Bonus points if they include reordering functionality.

3. Sales Reporting and Analytics

Data is king.

Your POS system should offer detailed sales reports and analytics, helping businesses track their performance, identify trends, and make data-driven decisions.

Customizable reports are a big plus here.

4. Customer Relationship Management (CRM)

Understanding and managing customer relationships is key to business success.

Integrating a CRM feature allows businesses to track customer preferences, purchase history, and loyalty, enabling personalized marketing and improved customer service.

5. Employee Management

Whether it’s scheduling shifts, tracking hours, or managing permissions, your POS system should make employee management a breeze.

This feature is valuable for businesses with multiple employees and locations.

6. Cloud Syncing

With cloud-based POS systems, data syncing is instant and seamless.

This means businesses can access their data from anywhere, on any device, and ensure everything is backed up securely.

7. Mobile POS Capability

Flexibility is the name of the game.

Your POS system should work on mobile devices, allowing businesses to accept payments and manage operations from a smartphone or tablet, whether they’re at a trade show or running a pop-up shop.

Read More: How To Build A Fintech App?

8. Offline Mode

The last thing a business needs is to lose sales because of an internet outage.

An offline mode allows the POS system to keep running smoothly, storing transactions locally until the connection is restored.

9. Loyalty Programs Integration

Encouraging repeat business is key. Your POS system should integrate with loyalty programs, enabling businesses to reward customers with points, discounts, or special offers.

This keeps customers coming back for more.

10. Customizable Interface

No two businesses are the same, so your POS system should allow for customization.

Whether it’s adjusting the layout or adding custom fields, a customizable interface ensures the system works exactly how the business needs it to.

11. Barcode Scanning

Barcode scanning is essential for speeding up transactions and reducing errors.

Whether it’s integrated into the POS terminal or via an external scanner, this feature is non-negotiable for retail businesses.

12. Multi-Location Management

If your client has multiple stores, they need to manage them all from one central system.

Multi-location management allows businesses to track sales, inventory, and staff across different locations without breaking a sweat.

13. Invoicing and Billing

Generating invoices should be quick and easy.

Your POS system should allow businesses to create, send, and track invoices directly from the system, ensuring they get paid faster and more efficiently. Using an online invoice generator can simplify this process by offering intuitive, customizable, and accessible solutions for all businesses irrespective of their size.

14. Secure Payment Processing

Security is a top priority.

Your POS system should offer encrypted payment processing to protect sensitive customer data. Compliance with PCI DSS standards is a must to ensure transactions are secure and trustworthy.

15. Multi-language and Multi-Currency Support

In a global marketplace, your POS system should cater to businesses operating in different regions.

Multi-language support ensures the system is accessible to a broader audience, while multi-currency support allows businesses to accept payments from around the world with ease.

These features are the building blocks of a robust, competitive POS system. By including these, you’re not just meeting the needs of your customers—you’re exceeding them. Now, let’s move on to the challenges you might face and how to overcome them in the next section.

Steps to Start a POS Business in 2025

You’re pumped and ready to kickstart your POS business—but where do you begin?

Launching a POS business isn’t about having a great idea; it’s about executing that idea with precision.

From understanding your market to developing a top-notch product, there are several steps you need to follow to ensure your business not only takes off but also thrives in a competitive market.

Let’s break it down, step by step.

![Steps_to_Start_a_POS_Business[1]](https://www.nimbleappgenie.com/blogs/wp-content/uploads/2024/09/Steps_to_Start_a_POS_Business1.webp)

Step 1: Market Research

Before you dive into developing your POS system, you need to understand who you’re building it for.

Market research is your first and most crucial step. It sets the foundation for everything that follows.

- Identify Your Target Customers: Are you targeting small businesses, retail chains, or specific industries like hospitality or healthcare? Understanding your customer base will help you tailor your POS solutions to their unique needs.

- Analyze Competitors: Who are the big players in the market, and what are they offering? Look at their strengths and weaknesses. This will help you identify gaps in the market that you can exploit.

- Understanding Market Demand: Is there a growing demand for mobile POS systems, or are businesses leaning more toward cloud-based solutions? Knowing the trends will help you stay ahead of the curve.

Step 2: Business Plan

Once you have a clear understanding of the market, it’s time to put pen to paper and draft your business plan.

This document will be your roadmap, guiding you through the journey of building your POS business.

- Define Your Business Model: Are you planning to sell hardware, software, or a combination of both? Will you operate on a subscription model, a one-time purchase, or perhaps a hybrid approach? Your business model will determine your revenue streams.

- Set Your Pricing Strategy: How much will you charge for your POS system? Consider the cost of development, support, and updates. Your pricing should be competitive yet profitable.

- Outline Your Revenue Model: Will you generate income through subscriptions, transactions, or additional services like support and maintenance? Make sure your revenue model aligns with your long-term business goals.

Step 3: Legal Considerations

Now that you have your plan in place, it’s time to make things official. Legal considerations are a vital part of starting any business, and the POS industry is no exception.

- Register Your Business: To formalize your chosen structure, it’s crucial to draft an LLC operating agreement to ensure legal protection and structure for your operations.

- Obtain Necessary Licenses and Certifications: Depending on your location and the nature of your business, you may need specific licenses to operate legally. Don’t skip this step—it could save you a lot of headaches down the road.

- Set Up Data Security Compliance: Since you’ll be handling sensitive financial data, ensuring compliance with data protection regulations like GDPR or PCI DSS is crucial. This not only protects your customers but builds trust in your brand.

Step 4: Choosing the Right Technology

The technology you choose will be the backbone of your POS business.

Whether you’re developing your own system or partnering with existing vendors, you need to make smart choices here.

Here’s how you can choose the fintech tech stack.

- Decide on the Type of POS System: Will you offer mobile POS, terminal POS, or cloud-based POS solutions? Each has its own advantages and target market.

- Select Hardware and Software Vendors: If you’re not developing everything in-house, choose reliable partners for your hardware and software needs. Ensure they offer integration capabilities that can meet the demands of your target market.

- Plan for Scalability: As your business grows, so will the demands on your POS system. Choose technology that can scale with your business, whether it’s adding more features, integrating new payment methods, or expanding into new markets.

Step 5: Development and Customization

If you’re building your POS system from scratch, this is where the magic happens.

The development phase is all about bringing your vision to life with a product that stands out in the market.

- Outline the Development Process: Map out the stages of development, from initial design to coding, testing, and deployment. Make sure you have a solid timeline in place.

- Include Essential Features: Your POS system should at least cover basics like payment processing, inventory management, and customer management. But don’t stop there—think about adding advanced features like AI-driven analytics, cloud integration, and mobile compatibility.

- Focus on User Experience (UX): A POS system is only as good as its usability. Ensure your system is intuitive, easy to navigate, and doesn’t require extensive training to use.

Step 6: Setting Up Infrastructure

You can’t run a POS business without the right infrastructure in place.

From data storage to cybersecurity, this step is all about building a robust backend that supports your operations.

- Invest in Cloud Storage: With businesses increasingly relying on data-driven decisions, cloud storage is a must. It offers flexibility, scalability, and secure data management.

- Implement Cybersecurity Measures: Protecting your POS system from cyber threats is non-negotiable. Implement firewalls, encryption, and regular security audits to keep your system safe.

- Ensure Reliable Data Handling: From processing transactions to storing customer data, your POS system should handle data efficiently and securely. Consider using AI to optimize data handling and analysis.

Step 7: Building a Team

It’s time to hire developers.

No business can succeed without a strong team behind it. Building a team of skilled professionals is crucial to driving your POS business forward.

- Hire Developers and Engineers: These are the people who will bring your POS system to life. Looking for talent with experience in fintech, POS systems, and software development.

- Assemble a Sales Team: A great product is nothing without a sales team that can sell it. Hire people who understand the POS market and can connect with your target audience.

- Establish Customer Support: Your customers will need help with installation, troubleshooting, and ongoing support. A dedicated customer support team is essential for keeping your clients happy and loyal.

Step 8: Marketing and Sales Strategy

You’ve got the product, the team, and the infrastructure—now it’s time to get your POS business out there.

A strong marketing and sales strategy will help you reach your target customers and close deals.

- Develop an Online Presence: Build a professional website, create engaging content, and leverage social media to connect with your audience. Your online presence is often the first impression potential customers will have of your business. One social media strategy is to share your website link on your Instagram profile. To maximize distribution, purchasing Instagram followers will increase your follower count, allowing you to reach a wider pool of potential customers.

- Partner with Industry Influencers: Collaborate with industry influencers and thought leaders to build credibility and expand your reach. This could be through guest blog posts, webinars, or co-hosted events.

- Offer Demos and Free Trials: Sometimes, seeing is believing. Offering free trials or demos of your POS system can help potential customers experience the value you bring before they commit.

Step 9: Launching Your POS Business

The big day has arrived—time to launch your POS business to the world. But don’t just flip the switch; make sure you’re fully prepared for a successful launch.

- Conduct Beta Testing: Before going live, conduct beta testing with a select group of customers. Gather feedback, identify bugs, and make any necessary tweaks.

- Create a Launch Plan: Plan a launch event or campaign to build buzz around your POS system. Whether it’s an online event, a series of blog posts, or a press release, make sure you’re reaching your target audience.

- Prepare for Customer Onboarding: Make the onboarding process as smooth as possible for your new customers. Provide tutorials, guides, and dedicated support to help them get started with your system.

Step 10: Post-Launch Support

Your job doesn’t end once your POS system is live. This is where the real work begins.

Ongoing support is crucial to maintaining customer satisfaction and ensuring the long-term success of your POS business.

- Offer Continuous Updates: Keep your POS system up-to-date with the latest features and security enhancements. Regular updates will keep your customers happy and your system competitive.

- Provide 24/7 Customer Support: Businesses rely on their POS systems 24/7, so your support should be just as available. Offer round-the-clock support to address any issues quickly and efficiently.

- Collect and Act on Feedback: Customer feedback is invaluable. Regularly collect feedback and use it to improve your system and services. This will not only help you retain customers but also attract new ones.

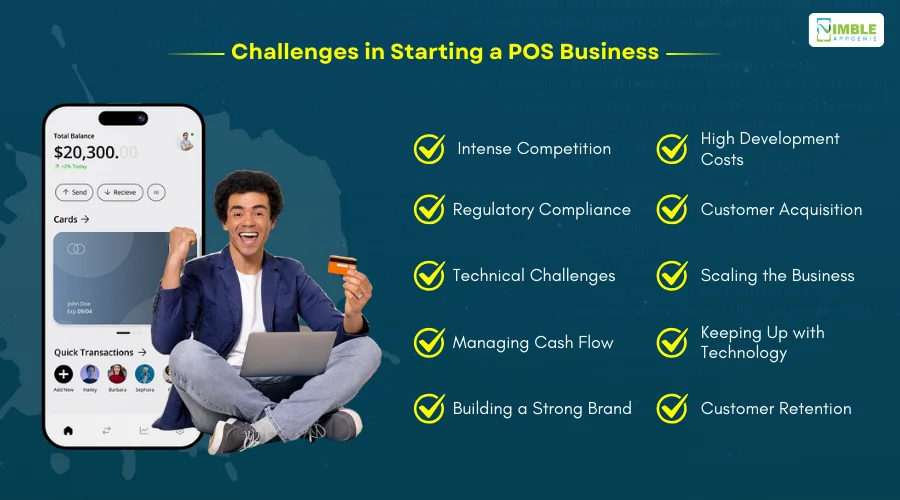

Challenges and Solutions in Starting a POS Business

Starting a POS business is an exciting venture, but let’s be real—it’s not all smooth sailing. Like any business, there are challenges you’ll face along the way.

The good news?

With the right strategies, you can overcome them and turn obstacles into opportunities. Let’s dive into some of the common challenges and how you can tackle them head-on.

1] Intense Competition

The POS market is already crowded with established players offering a wide range of solutions.

Breaking into this market can be tough, especially when customers are loyal to brands they already trust.

The Solution: Differentiate yourself by offering something unique. Maybe it’s a feature that others lack, exceptional customer service, or competitive pricing. Focus on a niche market where the competition is less fierce and tailor your product to meet the specific needs of that segment.

2] High Development Costs

Developing a POS system from scratch requires significant investment.

From software development to hardware procurement, the costs can quickly add up, making it difficult for startups to compete with larger, more established companies.

The Solution: Start small and scale up. Consider launching an MVP (Minimum Viable Product) with just the essential features to get your foot in the door. As you gain customers and revenue, you can reinvest in the development of additional features and improvements. Alternatively, you could partner with existing hardware or software providers to reduce initial costs.

3] Regulatory Compliance

The POS industry is heavily regulated, especially when it comes to data security and payment processing.

Compliance with financial regulations like PCI DSS can be complex and costly, but it’s non-negotiable.

The Solution: Stay informed about the latest regulations and ensure your system is compliant from the start. Invest in robust cybersecurity measures and consider hiring a compliance officer or consultant to help navigate the regulatory landscape. This will not only protect your business but also build trust with your customers.

4] Customer Acquisition

Acquiring your first customer is one of the biggest hurdles. Without a proven track record, convincing businesses to switch to your POS system can be difficult.

The Solution: Offer free trials or demos to showcase the value of your system. Build partnerships with other businesses in your industry to expand your reach. Leverage social proof by gathering testimonials and case studies from your initial customers to build credibility.

5] Technical Challenges

Developing a reliable and bug-free POS system is no easy task. Technical issues can lead to downtime, frustrated customers, and a damaged reputation.

The Solution: Invest in thorough testing and quality assurance before launching your product. Regularly update and patch your software to fix any issues that arise. Additionally, provide excellent technical support to quickly address any problems your customers meet.

6] Scaling the Business

As your customer base grows, so do the demands on your infrastructure. Scaling your business to handle more users, transactions, and data can be challenging.

The Solution: Build your system with scalability in mind from the start. Use cloud-based infrastructure that can expand as your business grows. Carry out automated processes to handle repetitive tasks and invest in scalable technology that can grow with your customer base.

7] Managing Cash Flow

Cash flow is the lifeblood of any business, and managing it can be challenging in the early stages.

Delays in payments or unexpected expenses can put a strain on your finances.

The Solution: Keep a close eye on your finances and create a detailed budget that accounts for both expected and unexpected costs. Consider offering subscription models with recurring revenue to ensure steady cash flow. Additionally, seek out investors or small business loans if you need extra capital to keep things running smoothly.

8] Keeping Up with Technology

Technology in the POS industry evolves rapidly.

Staying up-to-date with the latest trends and ensuring your system is compatible with new payment methods or devices can be overwhelming.

The Solution: Research industry trends and incorporate new technologies into your POS system. Partner with tech innovators to stay ahead of the curve and be willing to adapt your product as the market changes. Continuous learning and innovation are key to staying competitive.

9] Building a Strong Brand

In a crowded market, building a brand that stands out is crucial but difficult. Without a strong brand identity, it’s hard to attract and retain customers.

The Solution: Develop a clear brand identity that resonates with your target audience. Invest in professional branding from your logo to your website and consistently communicate your brand values. Engage with your customers on social media, give exceptional service, and build a community around your brand.

10] Customer Retention

Getting customers is one thing—keeping them is another. In the POS industry, where switching costs are low, retaining customers can be challenging.

The Solution: Focus on providing value beyond the product. Offer excellent customer support, regular updates, and loyalty programs to keep your customers happy. Listen to their feedback and improve your system to meet their evolving needs.

Tackling these challenges head-on will give you a competitive edge in the POS market. Remember, every challenge is an opportunity in disguise. By staying proactive and solution-oriented, you can overcome obstacles and build a thriving POS business.

Cost Breakdown of Starting a POS Business

Starting a POS business isn’t about having a great idea—it’s about having the budget to back it up.

On average, you’re looking at an initial investment of $150,000 to $300,000 to get your POS business off the ground.

This includes everything from development to marketing and ongoing support.

To give you a clearer picture, here’s a quick breakdown of the key costs involved:

| Expense Category | Estimated Cost |

| Software Development | $50,000 – $100,000 |

| Hardware Procurement | $30,000 – $60,000 |

| Licenses and Certifications | $10,000 – $20,000 |

| Infrastructure Setup (Cloud, Servers, etc.) | $20,000 – $40,000 |

| Marketing and Sales | $20,000 – $50,000 |

| Employee Salaries (First Team) | $20,000 – $40,000 |

| Legal and Compliance | $10,000 – $20,000 |

| Miscellaneous Costs | $10,000 – $20,000 |

Of course, these figures can vary depending on the scale of your operation and the specific features you plan to include in your POS system.

But this table should give you a solid starting point to plan your budget and understand the financial commitment involved.

Case Studies of Successful POS Businesses

To understand what it takes to succeed in the POS industry, it’s helpful to look at companies that have already made it big.

These real-life case studies highlight how different POS businesses found their niche, overcame challenges, and scaled their operations.

► Square

Square started in 2009 with a simple yet powerful idea: to make it easy for anyone to accept card payments.

They launched with a small card reader that plugged into a smartphone, which was revolutionary at the time.

Their focus on mobile POS solutions tapped into the needs of small businesses and freelancers who needed a quick, portable way to accept payments.

- What Worked: Square’s success came from its user-friendly design, low barrier to entry (no monthly fees initially), and seamless integration with smartphones and tablets. They also built an entire ecosystem around their POS, including inventory management, payroll, and business analytics.

- Lesson Learned: Focusing on a specific market segment (small businesses) and offering a solution that was simple to use gave Square a competitive edge. Their innovation in mobile payments helped them expand rapidly, and today, they’re a multi-billion dollar company.

► Shopify POS

Shopify, known primarily for its e-commerce platform, entered the POS market to offer a seamless online and offline sales experience.

Shopify POS allows retailers to unify their online and in-store sales, making it easier to manage inventory, sales, and customer data across all channels.

- What Worked: Shopify leveraged its existing customer base of e-commerce businesses to push its POS solution. By offering a POS system that integrates smoothly with its online platform, Shopify provides a comprehensive solution for retailers looking to expand into brick-and-mortar stores without needing separate systems.

- Lesson Learned: Integration is key. Shopify’s ability to merge online and offline sales into a single system made it incredibly appealing to retailers who wanted to manage everything in one place. This seamless experience has helped Shopify POS become a strong player in the market.

► Toast

Toast is a cloud-based POS system designed specifically for the restaurant industry.

Launched in 2013, it quickly gained traction by offering features tailored to the unique needs of restaurants, such as table management, online ordering, and integration with kitchen display systems.

- What Worked: Toast’s industry-specific focus allowed it to develop features that truly resonated with its target market. The ability to offer all-in-one solutions, including hardware, software, and payment processing, gave restaurants everything they needed to run their operations smoothly.

- Lesson Learned: Knocking down can lead to big success. By focusing solely on the restaurant industry, Toast could offer specialized features that other generic POS systems couldn’t match. Their deep understanding of the restaurant business helped them rapidly grow their customer base.

These case studies show that whether you focus on mobile payments, integrated systems, or industry-specific solutions, there’s a path to success in the POS business.

It’s all about understanding your market, delivering value, and continuously innovating to meet the needs of your customers.

How Nimble AppGenie Build a POS System for Your Business?

Looking to dive into the POS businesnimbleappgenie.com/…/fintech-app-developments but not sure where to start?

That’s where Nimble AppGenie comes in.

As a leading Fintech app development company, we specialize in creating cutting-edge POS solutions tailored to your unique business needs.

From designing user-friendly interfaces to ensuring seamless payment processing and robust security, we’ve got you covered.

Partner with us, and we’ll help you build a POS system that stands out in a competitive market, driving growth and success for your business.

Conclusion

Starting a POS business is an exciting journey filled with potential, but it requires careful planning, strategic decisions, and a solid understanding of the market.

From understanding the core types of POS systems to navigating the challenges and costs involved, you’ve now got a roadmap to guide you through the process.

Remember, success in the POS industry comes down to offering a solution that meets the needs of your customers—whether that’s through innovative features, excellent customer support, or a deep understanding of your target market.

FAQs

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.