Worried about building an app like Zelle?

P2P payment apps are among the top variety of fintech that has helped many of the users to make payments seamless.

“Fintech is the key to unlocking financial freedom for all”- Harinder Takhar

There are a variety of fintech and P2P apps available in the market such as Cash App, Google Pay, and many others.

As an entrepreneur, you might be wondering why we stopped at Zelle.

It is because of its unique category of features such as helping users to use diversified banks without interrupting or losing any personal information, which makes it popular.

Now, the question is “How to build an app like Zelle?”

Well, we have covered it for you. Let’s proceed with this amazing journey.

What is Zelle?

Zelle is an app that provides a convenient way to send and receive money with friends, family, and others. Here the users can send money via email address, and mobile number, then the money will be available to use in minutes if the people are enrolled with the app.

The app uses payment API for directly transferring money from one bank to another, as requested. Additionally, it doesn’t charge any fee for any kind of transaction made to the sender or receiver.

Along with this, the app makes use of ACH to settle payments overnight, which is similar to direct deposits. It is the most convenient way to send and receive money for the residents of the United States.

Well, this app has changed the lives of US citizens making them capable of performing seamless transactions and helping them to move forward.

Let’s learn more about the app and its related insights in the following sections.

Why is Zelle so Popular?

The answer to this question lies within the app’s structure, features, and its objective to serve the people effectively.

Here are some of the key points on its popularity.

♦ Fast and Secure Payment Network

Zelle app offers a fast and secure network where users can trust their bank accounts and all their finances.

It is a gateway where the users can send and receive money from people as well as businesses who hold a US bank account.

♦ Took P2P Services to New Heights

The network operator of Zelle took the platform to a new era of P2P services in 2023 as the platform provides financial empowerment for millions of Americans, who have grown its network reach and have led the industry into scam reimbursement efforts.

♦ Features

As mentioned earlier, one of the significant criteria of apps is their features that make them popular among users.

Similarly, Zelle has its feature of splitting costs, where money can go directly to the bank’s account.

♦ Bank-Baked Security

Zelle stands out as a bank-backed app that will directly transfer money between bank accounts without even involving any third-party intermediaries.

Such a design will enhance security and ensure the members that their data and cash are safe.

♦ Seamless Integration

The app seamlessly integrates with your credit union’s online banking platform as well as a mobile app.

This event assists the app in making money by integrating with several apps and providing e-commerce or retail platforms with a secure way to connect with their target users.

♦ Professional Interface without Social Elements

Zelle differentiates itself from other payment apps by providing users with a professional interface without any social elements.

Additionally, the app focuses on direct, secure transactions that do not charge additional fees to any members.

Well, let’s discuss more on market stats related to fintech apps and Zelle in the following section.

Market Stats for P2P Payment Apps

Without evaluating current banking app statistics, or the industry’s information, you cannot assume to enter the sector.

Hence, let’s examine some of the significant points in this area.

- The P2P market is expected to reach USD 13,488.90 billion by the year 2032 from USD 3,087.84 billion in the year 2023. This exceptional growth trajectory displays a compelling compound annual growth rate (CAGR) of 17.8% from the year 2024 to the year 2032.

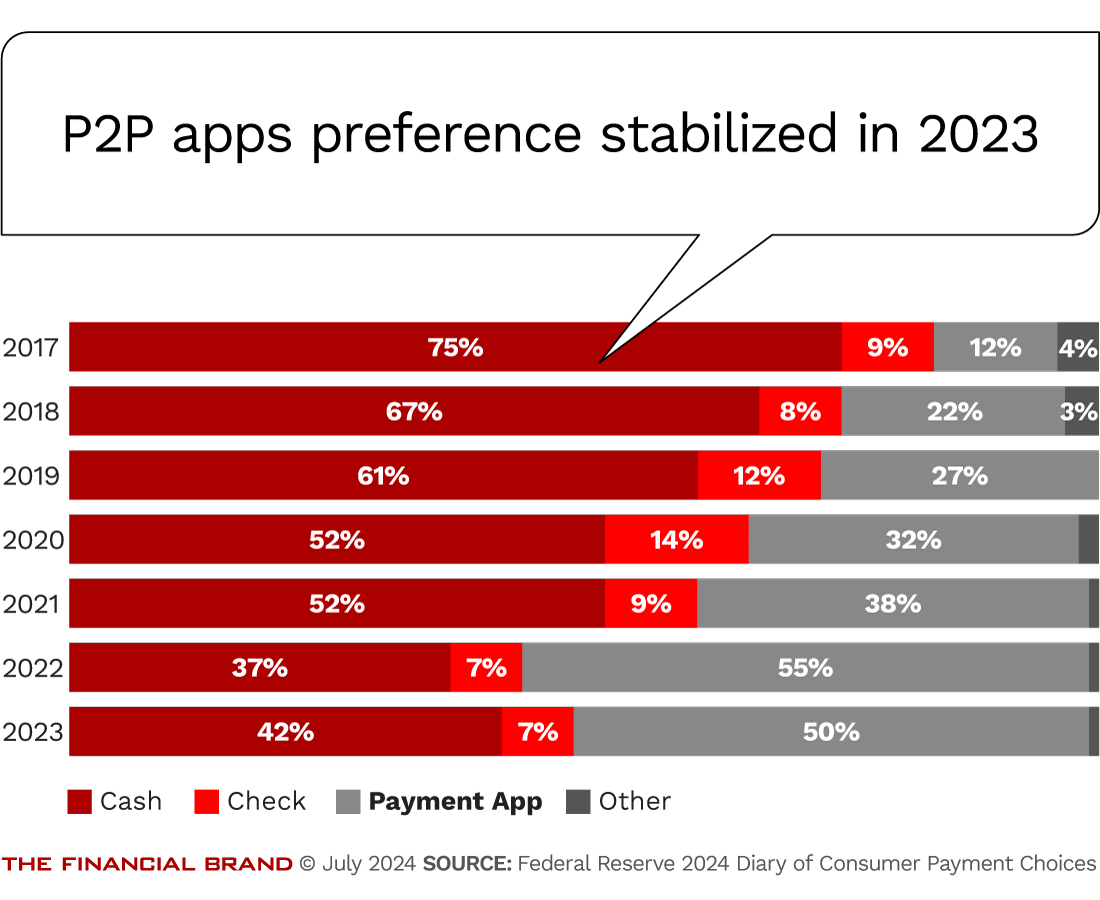

- Similarly, the portion of payments made in cash has decreased from 75% at the outset to 42% in the latest study. Additionally, the app usage of P2P apps has increased from 12% in the year 2017 to 55% in 2022 and then to 50% in 2023.

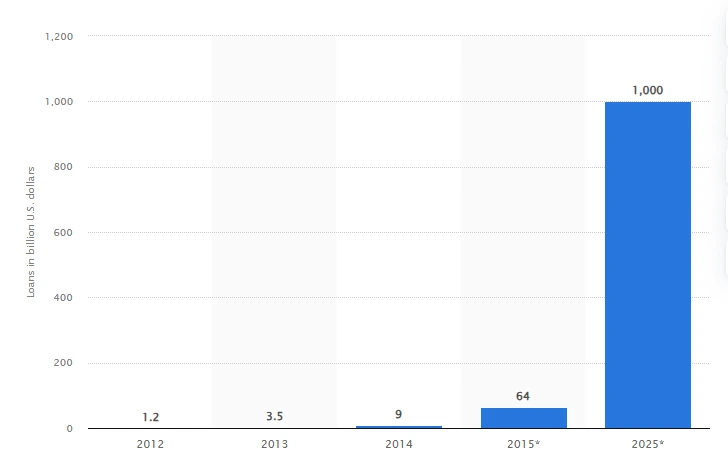

- The below statistics present the value of peer-to-peer lending worldwide from the year 2012 to 2014, with forecasts thereof for 2015 and 2025. It is expected to reach 1000 billion U.S. dollars in the year 2025.

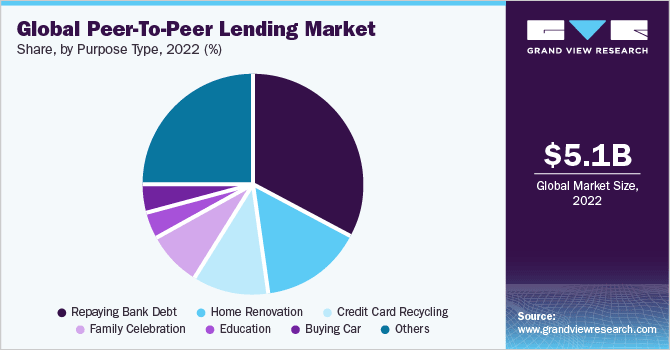

- Additionally, the global peer-to-peer lending market size is estimated at USD 5.07 billion in the year 2022, which is further expected to increase at a compound annual growth rate of 20.2% from the year 2023 to 2030.

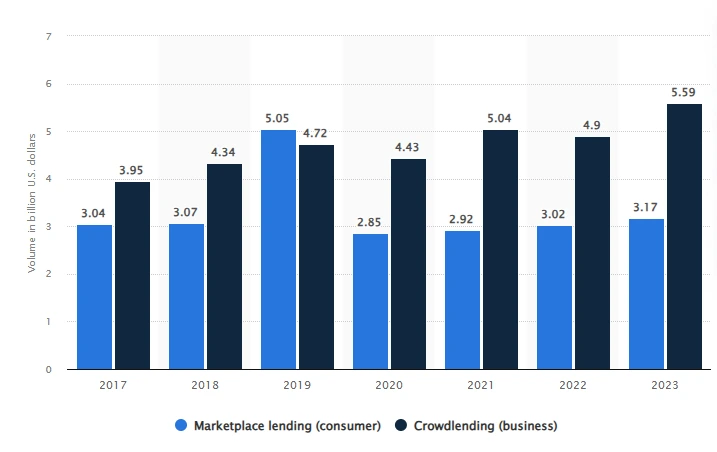

- The transaction value of peer-to-peer consumer and business lending platforms within the European alternative finance market grew between the years 2017 and 2023. Along with this, in the year 2023, the total transaction value of consumer lending was 3.17 billion U.S. dollars.

- In June 2024, there were about 143 million consumers along with small businesses enrolled to use Zelle, which was up by 17 million from the first half of the year 2023.

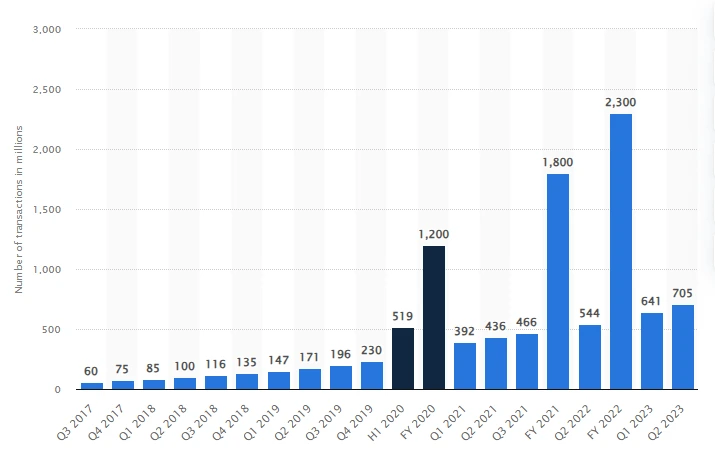

- Zelle’s network has processed roughly 10 percent more transactions between Q1 2023 and Q2 2023 relying on the transaction count. Additionally, it has processed more than 700 million transactions in Q2 2023.

These are some of the stats to discover and cover before you start to build an app like Zelle.

Now, as we learn about the market and its crucial stats, let’s begin with the types of features to include in an app like Zelle.

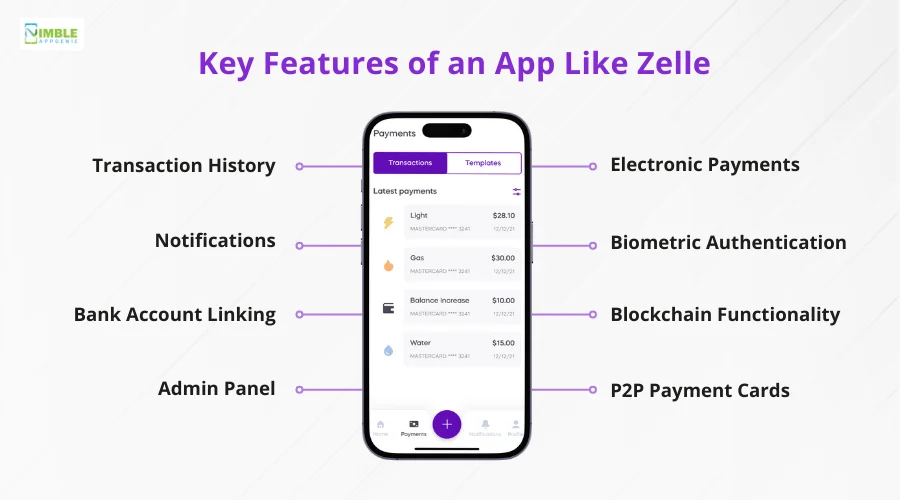

Key Features of an App Like Zelle

Features act as a blood for an app, it creates an identity for the business that reflects in their reputation and working processes.

Here is the list of important banking app features to include while creating an app like Zelle.

1. Transaction History

Including transaction history in an app like Zelle is a crucial part where the users can check through the app for the past orders they have made.

This will enable them to gain a receipt and learn more about the type of expenses they have made. They can even repeat the order from the transaction history.

2. Electronic Payments

Zelle has an amazing feature, where users can start making transactions online through a phone number or an email address.

This feature provides convenience to the users for effectively continuing with the payment processes. It helps the customers to pay for the goods as well as services online.

3. Notifications

Through notifications, the users can get an update about their payments and inform them about any recent changes in the policies. It too enables the users to take specific actions.

Apps like Zelle make use of push notifications to convey significant information to users. This will be effective in informing the users related to any real-time updates.

4. Biometric Authentication

Biometric authentication is a two-way factor authentication that enhances the security of an app. It assists the users with an additional layer of security that protects their sensitive data.

This feature needed to be utilized to protect the apps from various types of cyber threats and crimes.

5. Bank Account Linking

Within bank account linking, the users can include the details of their banks securely. It will enable them to pursue essential transactions through their banks systematically.

It is one of the important features where the users are required to mention all their details related to banks to proceed with the linking processes and perform transactions smoothly.

6. Blockchain Functionality

The blockchain technologies within the P2P payment systems act as a decentralized and distributed ledger that often records all the important transactions simply.

The adoption and implementation of a blockchain system enhance transparency and provide a clear record of transactions to the users.

7. Admin Panel

The admin panel is a tool within an app like Zelle, where the admins can manage and oversee different aspects related to the app’s operations.

This feature in an app is designed for managing the app that too includes the ability to add or remove functions and tracking the transactions.

8. P2P Payment Cards

Payment cards are a significant part of payment systems that are issued by financial institutions such as banks, to a customer that might enable its owner to access funds in the customer’s bank accounts.

This feature allows the funds to be transferred from one person’s bank account to another person’s app or bank account.

These were all the significant features to include while developing an app like Zelle.

Now, that you are aware of the features, why not look into the types of P2P payment apps available in the industry?

Let’s have a check in the following section.

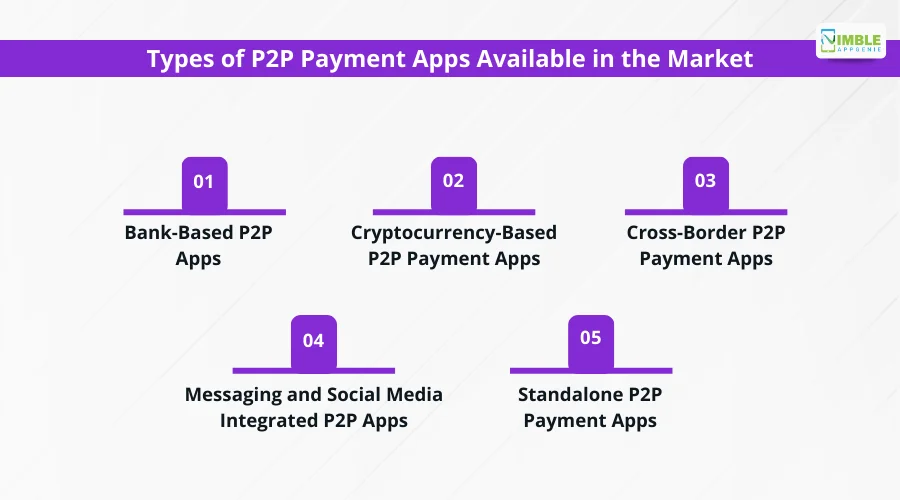

Types of P2P Payment Apps Available in the Market

Before you evaluate the steps to build an app like Zelle, let’s identify the types available in the market.

We understand that you seek to build an app like Zelle, but why not identify the other types available in the market? You can check through the given types.

Type 1: Bank-Based P2P Apps

Zelle is one of the famous examples of bank-based P2P apps. This is an important category that is considered for taking advantage of the P2P systems.

Here the banks are included as a party who is involved while making transactions. Within these apps, the funds are deposited directly into the bank accounts.

Type 2: Cryptocurrency-Based P2P Payment Apps

Cryptocurrency P2P payment apps are an important decentralized system, where the users can trade digital currency directly with one another, without including any intermediaries or central oversight.

These apps comprise of KuCoin, Bybit, Binance, Coinbase, and many others. These apps don’t require any bank or financial institutions to verify the transactions.

Type 3: Cross-Border P2P Payment Apps

These payments are not limited to any personal transactions anymore. Such a category of apps is utilized for business purposes.

Various companies provide such services including Wise, Banking Circle, FIS, Payoneer, and many others. Such apps assist users to send and receive funds internationally.

Type 4: Messaging and Social Media Integrated P2P Apps

Many social media and messaging apps like Facebook and WhatsApp have integrated P2P payment features within their platforms, that help users to send money to their friends and family via messaging apps.

Here the users can transfer money using their debit and credit cards without even exiting the platform.

Type 5: Standalone P2P Payment Apps

These apps function independently without relying on any banking systems. Such apps have their own systems for handling funds. With the feature of a wallet, the users can store their money safely.

It does provide the user’s flexibility for transferring funds into their traditional bank accounts. Examples of such apps are Airfox, PayPal Zettle, Alipay, etc.

Considering these types of P2P payment apps, you can select the most suitable based on your project objective. Now, let’s critically examine the working procedure of P2P payment apps like Zelle in the following section.

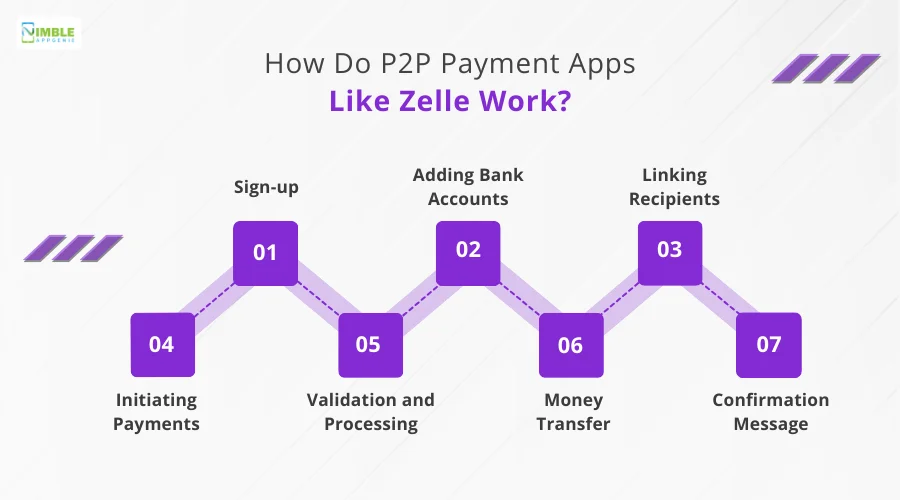

How Do P2P Payment Apps Like Zelle Work?

Prior you evaluating the steps to build an app like Zelle, it’s vital to examine the working procedure of such apps.

Here is a series of steps to consider.

Step 1: Sign-up

After installing the app, it’s vital that the users opt for the signing-up feature. Where they need to add all the details with respect to them.

They can verify the profile through adopting for two-factor authentication process.

Step 2: Adding Bank Accounts

Now the users can add bank details by selecting the banks and including credentials. This will be helpful to the users for proceeding with their banks and to make significant transactions.

Adding bank accounts will make the transactions simpler.

Step 3: Linking Recipients

Now, the app asks for permission from the users to access their contact information. In such a manner, the users are not required to add the bank details of the recipients.

With this context, the users will be required to utilize the same platform for including email addresses.

Step 4: Initiating Payments

Here the users can input all the desired information with an additional remark or description for going along with the type of transactions.

Then with the help of the platform, they can make use of the payment method for initiating the transactions.

Step 5: Validation and Processing

Under this step, the users are asked for their validation to process the transaction. Here, the users can be asked to enter any PIN, password, or biometric.

Later the transaction will be under processing which hardly takes a few seconds with an effective internet connection.

Step 6: Money Transfer

Well, now the money transfer request is processed. The timing of the money transfer will depend on the recipient’s bank server.

This will be a simplified process to proceed with the transactions via an app like Zelle.

Step 7: Confirmation Message

Now, the users can receive a confirmation message of money transfer via bank. This process will be significant for providing the users with information that contains the details of whole transactions.

This message too has a feature of share which can be further shared to the recipient.

After considering and evaluating the working process of an app like Zelle, let’s proceed with answering “How to develop an app like Zelle?”

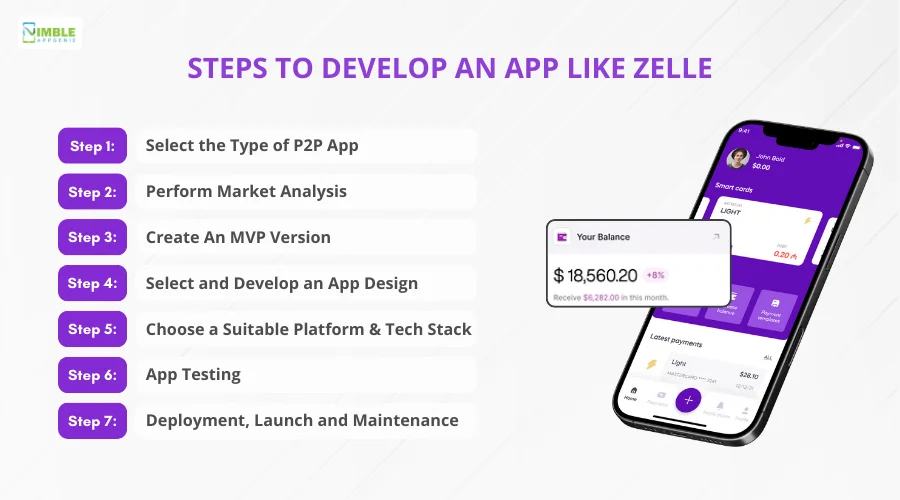

Steps to Develop an App Like Zelle

What is the process to create an app like Zelle?

To build a banking app, as a P2P payment, it’s essential that you have a complete guide to create it.

Here is a series of steps to follow.

Step 1: Select the Type of P2P App

The foremost step here is to select the type of P2P app, where all you need is to focus on the objective of the project before you process with an app like Zelle.

There are different types of P2P apps that you can use such as cross-border P2P payment, standalone P2P payment, messaging and social media integrated app payment, and many others.

Apart from such things, you can select the type of your P2P application from any type of preferred service that can support real-time payments.

Step 2: Perform Market Analysis

Now, it’s essential to perform a market valuation of your mobile app idea. This will be effective in identifying how your app can be useful in addressing related market issues and helpful for the targeted people to enhance their payment operations.

Under this step, it’s important to perform market research, where you can conduct surveys, interviews, and other research techniques for identifying the needs and preferences of the users for using a P2P app.

This will be helpful in examining, how your app can be beneficial and what types of alterations you need to make for addressing their present issues related to payments.

Step 3: Create An MVP Version

You should know a detail about your app here before developing an MVP version of it. Under this step, you need to select the type of features that will effectively address the users’ issues and attract early adopters.

Here, all you need is to connect with an experienced team of developers who will help you to proceed with MVP app development.

Minimum Valuable Product (MVP) is all about adding the essential features within the app that will be sufficient to attract early adopters. These features should be engaging and attractive to grasp the attention of the users.

This step will help you evaluate your app’s value and any further alterations that you require to make to improve its overall operations.

Step 4: Select and Develop an App Design

Now, it’s time to select and create a UI/UX app design. This design needs to be attractive and simple so that the users don’t require any guidelines for operating the platform.

Under this step, you will select the color, theme, and typography to make an app like Zelle. Here you can create the wireframe and prototype of your P2P app.

Within a wireframe, you can develop a fintech app design by creating a visual guide that will represent the structure of your application.

However, in a prototype, you will develop a fundamental design and function of your app.

Step 5: Choose a Suitable Platform and Tech Stack

You need to select a simplified and suitable platform to launch the app. The selection of technologies will totally depend on your selection of payment platforms.

There are different types of platforms that you can consider such as Android, iOS, and Hybrid. Considering the platforms will be helpful in evaluating the type of tech stack you want to include while building an app like Zelle.

A tech stack is all about the collection of software services as well as programming languages that make up an app. A banking app tech stack can be comprised of languages such as Java, C#, Python, react, and many others.

Here the frontend frameworks comprise Angular, Vue.js, and Node.js, however, the backend frameworks include Django, .NET Core, and Node.js.

Step 6: App Testing

Through mobile app testing, you can identify the types of errors and issues that might crash the app or can further lead to a higher challenge.

When it comes to building an app like Zelle, it’s essential to test it successfully because finance is such as critical aspect that shouldn’t be ignored.

You can conduct different types of testing protocols such as security testing, functionality testing, compatibility testing, performance testing, localization testing, and Interruption testing.

Step 7: Deployment, Launch and Maintenance

You need to deploy the app over diversified platforms based on the project aim. Additionally, it’s essential to continue with the launch of your app.

Well, your work isn’t over till the launch of an app like Zelle. Now, you should examine the mobile app maintenance process.

Here, it’s essential to identify the importance of mobile app maintenance. This will be helpful in improving the overall functionality of the app and optimizing the resources effectively.

These were all the important steps to build an app like Zelle. If you want to evaluate the tech stack in detail, we have done it for you in the next section.

Choosing the Best Tech Stack for P2P Payment Apps

For identifying an effective tech stack, you should be aware of all the alternatives available in the current market.

Selecting a suitable tech stack for an app like Zelle can be a headache, hence here is a table covering it all for you.

| Tech Stack | Description |

| Programming Languages | Scala, Python, JavaScript, Ruby, and C++ |

| Frontend Frameworks | CSS, HTML, and JavaScript |

| Databases | PostgreSQL, MongoDB, and MySQL |

| Cloud Platforms | Saas, AWS, PaaS, IaaS |

| Backend Platforms | Python, Java, and JavaScript |

Considering this tech stack table, you can successfully get through building an app like Zelle.

Now, let’s talk about the resources that are significant to make an app like Zelle.

How Long Does it Take to Develop a Zelle-Like App?

How much time does it take to build a mobile app?

Here’s a table to continue with.

| Process | Time Required |

| Conceptualization and Market Research | 2-3 Months |

| Create App Design | 1-2 Months |

| Selection of Tech Stack | 1-2 Months |

| App Testing | 1-2 Months |

| Deployment and Launch | 1-2 Months |

| Total Time Required | 6- 11 Months |

The time here can vary depending on diversified factors such as the skills of developers, types of apps, and the objective of creating an app.

After evaluating the time required to create an app like Zelle, let’s examine what’s the cost to develop an app like Zelle.

Cost to Develop an App Like Zelle

How much does it cost to make a banking app?

Well, on average the cost to build an app like Zelle typically ranges from $20,000 to $200,000 depending on different elements such as the complexity of the app, design, technology stack, maintenance cost, and security cost.

Let’s discover all the factors impacting the mobile app development cost in the given section.

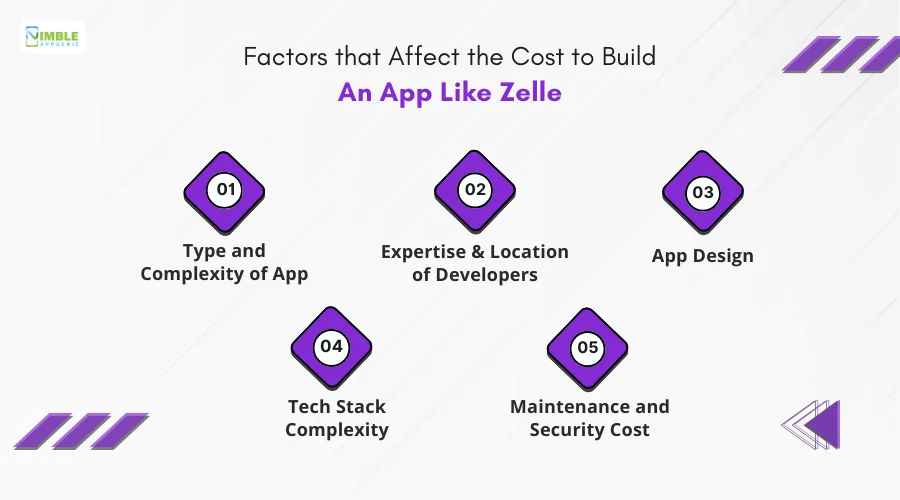

Factors that Affect the Cost to Build an App Like Zelle

Only evaluating the range of cost to create an app like Zelle is not sufficient, you should identify why that is so.

Here is the detail of factors impacting the cost to make an app like Zelle.

-

Type and Complexity of App

The type of app has an impact on the cost to develop an app like Zelle. How? Well, selecting the cryptocurrency P2P app will require a high cost compared to a cross-payment app.

Likewise, highly complex features of the app will impact the overall cost to build an app like Zelle. Here the complex features can be blockchain integration, budget optimization, secure authentication, and biometrics security.

The cost under this factor can vary from $2000 to $10,000. A highly complex feature will require more cost and vice-versa.

-

Expertise and Location of Developers

The expertise and location of the developers have a large impact on the cost to make an app like Zelle. Here if the developer belongs to Asia, the cost will be much lower, however, if the developer is in the United States, the cost to hire them will be just double.

The cost to hire a developer can vary from $20,000 to $200,000 when it comes to Asia, while in the United States, it can be $30,000 to $300,000 that too for the competent level of developers.

On the other hand, this cost can be from $25,000 to $400,000 when you hire experts from the United Kingdom. Thus, location and expertise among the developers play a severe role here.

-

App Design

The type of design for building an app will impact the cost to build an app like Zelle. A complex design will impact you more, however, a simple design can charge you less.

Well, all you need to bring a complex design in a simplified manner to attract and gain the attention of the target users.

Here the cost can vary from $5000 to $30,000 depending on the types of apps and complexity of designs.

-

Tech Stack Complexity

A complicated app requires a complicated and updated technology that is particularly designed for your project, right?

Well, the selection process of your tech stack here will depend on different factors such as the features of an app, size, deliverable timelines, future perspective, along the skills of developers.

Here the cost can vary from $10,000 to $40,000 depending on diversified technologies and updates. You should select the tech stack that complies with the needs of users. You should evaluate the development time and costs.

-

Maintenance and Security Cost

The maintenance and security cost will be 15% to 20% of the overall cost. Here an ongoing procedure of maintenance does add to the total of development costs.

The banking app maintenance can cost you from $5000 to $50,000 depending on the type of app and updates it needs. When it comes to the security of an app, you require tools that can enhance the overall operations of the app and may keep the data of the users safe.

The security cost will also range from 15% to 20% of the overall cost to build an app like Zelle. Thus, this cost too can range from $5000 to $50,000.

After evaluating the factors impacting the cost to build an app like Zelle, let’s discuss the money-making strategies that will help cover the total cost invested to build an app like Zelle.

Monetization Strategies for an App Like Zelle

What are the top app monetization strategies for an app like Zelle? Or how does an app like Zelle make money?

Well, this question can be bothering you right, as after going through an in-depth app development process, it’s essential to evaluate the diversified banking app monetization strategies.

Here is the list describing the same.

➤ Transaction Fees

Apps like Zelle make money through transaction fees. Offering a platform where the users, retailers, or any e-commerce organization can meet such as buying products online or transferring money, will provide them convenience.

Thus, here you can charge a convenience fee from these parties for simplifying the transaction process.

➤ Referrals and Commissions

You can earn money from referrals and commissions by partnering with banks. Here commission, referral fees, rewards, or any other financial gain can be received by a firm.

You can provide significant advice to the users by connecting the businesses to their potential clients.

➤ In-App Advertising

Within in-app advertising, you can provide a space for diversified brands to promote their products and services via the platform.

Under this platform, the developers can earn money from ad clicks or any kind of impressions. It does allow the developers to continue developing their apps as well as enhancing their user experience.

➤ In-App Purchases

By including in-app purchases, you provide a platform to the users to enable them to buy directly via the app. Here the users can go for the features and other elements that can enhance their experience with the app.

Here you can enhance more features along with the content quickly and easily.

➤ Freemium Model

Under this model, you can allow the app users to use the services for free for up to a limited time period, then can ask them to subscribe to the app for using it continuously.

This will provide them the ability to get free access to the basic features as well as limited functionality. It will enable you to earn a regular sum of money for a longer period.

These are all effective monetization parameters that you should consider while creating an app like Zelle. Well, let’s evaluate diversified challenges that might bring issues to your app in the following section.

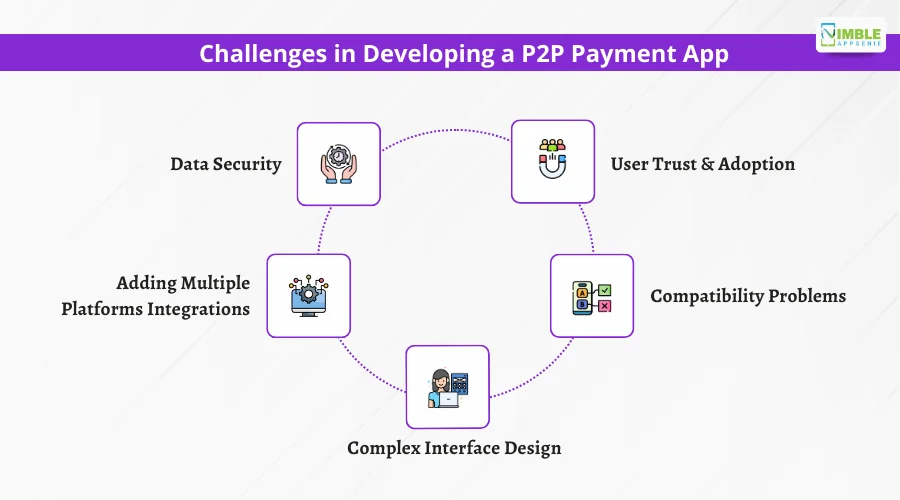

Challenges in Developing a P2P Payment App

What are the top issues that you can face while building an app like Zelle?

Here is the list of challenges to overcome while creating a banking app.

► Data Security

While building an app like Zelle, you can face an issue of data security, where managing a pile of data can be a challenge for your project, or securing it may bring a high demand for resources.

You may overcome such a challenge by including effective security tools.

► User Trust and Adoption

As an entrepreneur or new within the fintech industry, it’s essential to build trust among the users. Well, here you might lose various potential users along with your brand image.

This can impact your brand’s connection with the users.

► Adding Multiple Platforms Integrations

Adding multiple ways to process the payment via an app can help the users get diversified options to make payments.

However, it can bring an issue to app clash as adding more such features can bring performance-related issues. Hence here you require an effective technology stack.

► Compatibility Problems

Is your platform ready to run over multiple devices, Well, if not, then the users can switch over to different apps or to competitors who provide such a service.

Thus, lack of compatibility is one of the severe challenges that you might face.

► Complex Interface Design

A complicated design can be a challenging element within your app. This will prevent the users from utilizing all its features and functionality.

With the complex interface, the users might get shifted to another competitive app which can be a challenge for your app.

Considering these challenges, you can build an app like Zelle.

Well, when it comes to an app like Zelle, there can be certain regulations and compliances that you are required to follow, let’s take a quick look at them in the following section.

Legal Compliances to Follow while Creating a P2P Payments App Like Zelle

When you begin to create an app like Zelle, it’s important to evaluate the rules and regulations that govern it.

Well, based on the diversified regions, the regulations might differ. However, the Financial Conduct Authority (FCA) introduces new rules that are designed to prevent harm to investors, without stifling innovation within the peer-to-peer sector.

It is important to follow the legal regulations of the regions and states, where your target audience belongs. There are various authorities to follow, let’s check in given points.

- Consumer Financial Protection Bureau (CFPB) has proposed rules for enhancing transparency within the P2P payment market.

- Financial Crimes Enforcement Network (FinCEN) has updated recent guidelines for complying with the Bank Secrecy ct.

- Federal Trade Commission (FTC) has identified misleading and deceptive practices within the P2P payment industry.

- California Consumer Privacy Act (CCPA) has set new and prominent standards for protecting the data of the users.

Well, if you are still confused about how to build an app like Zelle, connecting with an experienced company might help.

How Nimble AppGenie Can Help in Creating a Zelle-Like App?

Nimble AppGenie is an experienced company whose app developers are ready to help you in all aspects beginning from market analysis, finding value for your idea in the competitive landscape, building your dream app and even conducting maintenance for it.

We are the leading banking app development company, that is scaling in the field to provide quality experience through following principles such as integrity, honesty, and ethicality.

Our experts can provide you with all the information that can assist to lead the market. Here’s a glimpse of our work.

-

SatBorsa- Currency Exchange Fintech Platform

It is a cutting-edge currency exchange platform that is designed to assist users in performing seamless transactions. The app has provided a solution to currency exchange by assisting users in real-time.

-

Cut- eWallet App

Cut is an e-wallet app that assists users in managing their finances by blending functionality through convenience. The app was crafted with intelligence, to offer personalized payments services to the users.

-

Pay By Check- eWallet App

Through a seamless onboarding process, the app assists the users in managing transactions smoothly. Along with this, the app supports different methods such as ACH and EFT, by assisting users with multiple payment options.

Well, are you ready to drive your journey with us?

Conclusion

When you enter a fintech field, it’s vital to proceed with the right steps. You can begin with a market evaluation, selecting important features, creating the design, as well as, adopting a technology stack that will end on launch.

Here it’s essential to include diverse features such as transaction history, electronic payments, initiating payments, and money transfers. Other than this, you can evaluate the cost to build an app like Zelle by considering different factors such as the complexity of the app, design, tech stack, and many others.

To earn money, you can consider different monetization strategies such as in-app purchases, advertising, referrals, and commissions, and the freemium model. You can connect to an experienced company for more information.

FAQs

You can proceed with an app like Zelle through diversified steps:

Step 1: Market Analysis: Conduct a market analysis to understand the competitive landscape and determine your app’s value.

Step 2: Adding Features: Include key features such as payment initiation, transaction history, and money transfers.

Step 3: Creating Design: Design a simple, user-friendly interface to attract and retain users.

Step 4: Adding Tech Stack: Choose and integrate the right technologies to ensure a seamless app experience.

Step 5: Testing: Implement testing tools to identify and fix errors or issues that could affect app performance.

Step 6: Deployment, Launch, and Maintenance: Deploy your app on the chosen platforms, launch it, and ensure ongoing maintenance and updates.

You can choose from different types of P2P payment apps, including:

- Cross-border payment apps

- Standalone P2P payment apps

- Messaging and social media-integrated payment apps

The choice depends on your project’s objectives and target audience.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.