Gamification in eWallet apps has revolutionized the way users engage with digital wallets.

E-wallet apps have been around for years now. The ideal use of these apps is to enable people to use fund transfer and payments instantly through their smartphones. Nothing fancy, nothing engaging. But that also means that the use of the app is limited.

So how does one improve app engagement?

Well, incorporating game-design elements such as points, badges, challenges, and leaderboards, eWallets can help in enhancing the user experience.

How? Well, that is what we are going to discuss in this post!

In this blog, let’s explore the benefits, examples, and implementation of eWallet gamification. We will also find the potential challenges and considerations to keep in mind.

So without further ado, let’s get started!

Understanding Gamification

Gamification in mobile apps refers to the incorporation of game design elements and features into non-game applications.

In the era where the digital banking space is full of emerging apps and solutions like Neobanks, BNPL wallets, and other fintech solutions fighting for user attention, standing out with your app can be difficult. Gamification offers a more effective way to capture user attention through interactive features.

When we talk about eWallet gamification, it is one of the evergreen eWallet app trends that has stayed relevant over the past few years.

Implementation of fintech gamification can easily enhance user experience by making daily transactions and other features more interactive and rewarding.

Features like reward points, badges, milestones, and challenges are some prime examples of gamification in ewallet apps. Let’s take a look at the next section, where we have discussed these examples and how the top players have leveraged e-wallet gamification.

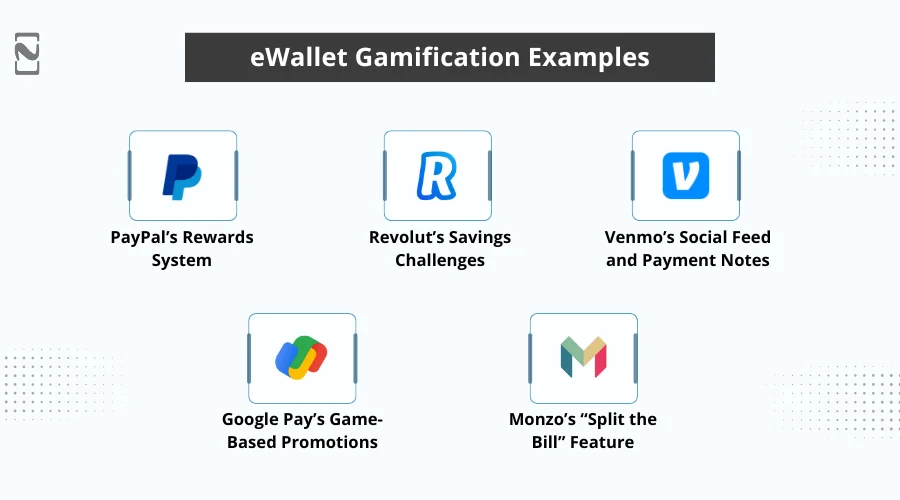

eWallet Gamification Examples

Gamification in itself is a great strategy when it comes to improving user retention. And it is certainly visible in existing solutions, as many key players in the e-wallet market have already used it for better engagement.

Some of the prime examples of existing solutions that use e-wallet gamification are as follows:

► PayPal’s Rewards System

PayPal is a leading name in the e-wallet and online payment industry.

It was also one of the first payment apps to use rewards, a gamification feature that encourages users to engage more with their services. Apps like PayPal are leveraging this trend.

It has an internal rewards system that allows users to earn points for making transactions, which can then be redeemed for various benefits such as discounts or cashback.

This eWallet gamification strategy boosts user activity and loyalty by offering usable rewards that you can leverage for better savings and prices on products and services.

► Revolut’s Savings Challenges

Revolut is one of the fastest neobank apps that offers an e-wallet with a physical card for users to enjoy hassle-free online payments.

Revolut has integrated a “savings challenge” feature using gamification.

Through the feature, users can participate in challenges like “Save $100 a month” and track their progress through the app.

The gamification in the Revolut app makes the process of saving money more engaging and enjoyable. This further helps a user develop better financial habits while keeping the user engaged with the application.

Other banking apps like Revolut have also followed the trend.

► Venmo Social Feed and Payment Notes

Venmo is another popular e-wallet and payments app that uses gamification to create an enhanced experience.

It uses gamification as a social element to its digital wallet by allowing users to share payment notes and view a feed of their friends’ transactions.

The feature creates a sense of community and fun, as users can like and comment on each other’s transactions, turning routine payments into social interactions.

Venmo’s business model certainly states that it works on engaging Gen-Z users, which makes ewallet gamification absolutely worth it for both users as well as the app, as more and more people are happy to engage and spend time on the app every day.

► Google Pay’s Game-Based Promotions

Google Pay has a wide user base with users from all over the world and all age groups using the same for regular transactions. The application uses a no-bloatware policy and directly offers the option to make payments. However, it does include a few features that use gamification.

The best example of Google Pay’s gamification features is the scratch cards that it offers after completion of every transaction.

To make it more interesting during festive seasons, users are asked to collect certain items through transactions to win prizes.

This approach to eWallet app gamification not only drives transactions but also adds an element of excitement and competition for Google Pay users.

► Monzo’s “Split the Bill” Feature

Monzo’s “Split the Bill” feature allows users to divide expenses with friends directly through the app, and is a perfect example of gamification in a fintech app.

The feature simplifies group transactions and adds a gamified element by making it easy and fun to manage shared expenses.

These examples showcase how gamification in eWallet platforms can make financial tasks more interactive, engaging, and enjoyable. Incorporating elements of fun and reward, digital wallets can significantly enhance user experience and loyalty.

However, that is not the only benefit that an e-wallet app observes when using gamification. In case you are wondering what other advantages e-wallet gamification brings, do not worry, as we have discussed them in the next section!

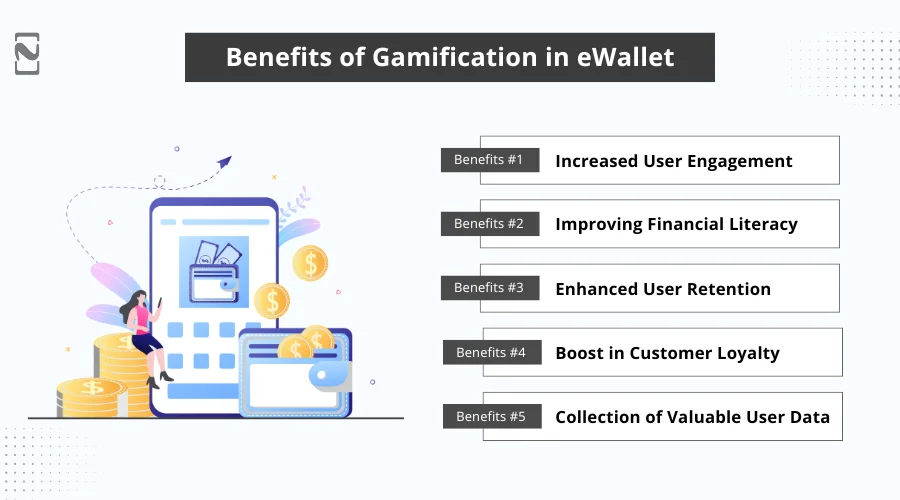

Benefits of Gamification in eWallet

E-Wallet gamification offers several benefits. From making your app more appealing to the user to generating better user engagement, it is one of the most fruitful integrations in today’s era.

Here are some of the key advantages:

1] Increased User Engagement

Gamification in eWallet apps allows a user to be more active and engaged when using a financial service through your application.

This increased engagement leads to higher transaction volumes and more consistent use of the platform, which, in hindsight, results in better user retention.

- Examples: Rewarding users for frequent transactions, saving goals, or completing educational modules about financial literacy.

2] Improving Financial Literacy

By incorporating educational challenges and quizzes, users can learn about budgeting, saving, and investing in a fun and engaging way.

Gamification in digital wallet platforms not only improves user knowledge but also promotes better financial habits.

- Examples: Interactive tutorials on financial topics, quizzes with rewards for correct answers, and simulation games for investment.

3] Enhanced User Retention

User retention in a digital payment app is critical.

The number of e-wallet apps is continuously growing, which means an average user has more options to explore when they want to use an e-wallet service.

Gamification allows users to be more connected and engaged with a single e-wallet app so that they keep returning to the same one. This gives your application a better retention rate, which is a key metric in today’s market.

- Examples: Daily login bonuses, streak rewards for continuous use, and loyalty points that accumulate over time.

4] Boost in Customer Loyalty

Integrating gamification into your eWallet app can significantly boost customer loyalty.

This loyalty translates into increased lifetime value and advocacy, as satisfied users are likely to recommend the app to others.

- Examples: Referral programs with gamified rewards, exclusive badges for long-term users, and personalized rewards based on user activity.

5] Collection of Valuable User Data

Gamified elements can encourage users to share more information about their habits and preferences.

This data can be invaluable for understanding user behavior and improving the app.

Analyzing eWallet app trends and user interactions helps in tailoring personalized experiences and offers.

- Examples: Surveys and feedback forms with gamified incentives, tracking of user progress and preferences, and data-driven personalization.

These benefits illustrate the significant impact that eWallet gamification can have on both user experience and business outcomes. By making financial tasks more engaging and rewarding, gamification not only enhances user satisfaction but also drives the overall success of the eWallet platform.

Implementing Gamification in eWallet

Now that you are aware of the benefits that e-wallet gamification can offer, you may be wondering how it is implemented in the app.

In order to add gamification to your e-wallet app, or for any app for that matter, you first need clarity of execution and how you want the features to work.

Gamification often becomes a dicey move when combined with financial services, as these features can overpower the seriousness of financial decisions. Hence, you need a solid strategy to implement gamification.

Here’s how you can implement gamification in e-wallets.

♦ Understand User Behavior and Preferences

Before implementing gamification, it’s crucial to understand your users’ behavior and preferences.

Analyze eWallet app statistics to identify how users interact with your app, what features they use the most, and what motivates them.

♦ Define Clear Objectives

Identify why exactly you want to implement gamification into your e-wallet app? Several times, businesses only want to integrate a feature because it is trending or just because the competition has it.

You must identify the objective of implementing these features before starting your journey.

Whether it’s increasing user engagement, improving retention, or educating users about financial literacy, having clear objectives will guide the design and implementation process.

♦ Design Engaging Game Elements

Incorporate various game elements that can motivate users and make the financial tasks more enjoyable. Today’s generation is all about stimulation.

The more you can stimulate their attention, the more interested they are in your services. Hence, designing a game-like experience where you have captivating animations and interactive features can give you leverage over your competitors.

♦ Integrate Gamified Features into the App

Once the gamified elements are designed, integrate them seamlessly into the eWallet app.

Ensure that these features are easily accessible and do not disrupt the core functionalities of the app.

♦ Test and Optimize

Before rolling out gamification features to all users, conduct thorough e-wallet app testing to ensure they work as intended and are well-received by users.

Use A/B testing to compare different versions and identify the most effective elements.

♦ Monitor and Iterate

After implementing gamification, continuously monitor its performance and impact on user behavior.

Use analytics to track engagement, retention, and user satisfaction.

Through these steps, you can implement gamification in an e-wallet quite easily. However, there are several things that you need to consider when performing these steps.

You see, just like any other process, integration of gamified features also has its own functionality challenges. Let’s learn more about them below!

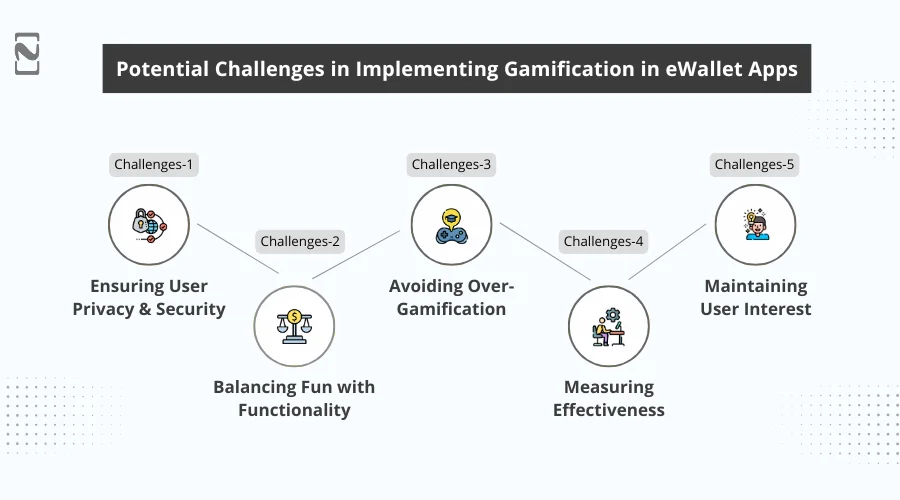

Potential Challenges in Implementing Gamification in eWallet Apps

The whole purpose of adding gamification features to e-wallets is to add interactivity without compromising the convenience of the app functionalities. However, when planning to integrate such features, it can certainly become a little inconvenient.

There are several challenges that one has to keep in mind when implementing e-wallet gamification.

What are these challenges and considerations? Let’s find out!

Challenge 1: Ensuring User Privacy and Security

One of the main challenges in implementing gamification is maintaining user privacy and security.

Gamified features often require collecting and analyzing user data, which can raise privacy concerns.

Challenge 2: Balancing Fun with Functionality

While gamification aims to make the app more engaging, it should not compromise the core functionalities of the eWallet.

Striking the right balance between fun and functionality is crucial.

Challenge 3: Avoiding Over-Gamification

Over-gamification can lead to user fatigue, where users may feel overwhelmed by too many game-like elements.

This can reduce the app’s effectiveness and user satisfaction.

Challenge 4: Measuring Effectiveness

Measuring the success of gamification can be challenging.

It’s essential to have clear metrics to evaluate the impact of gamified elements on user behavior and business outcomes.

Challenge 5: Maintaining User Interest

Keeping users continuously interested in gamified features requires regular updates and innovation. Stagnant gamification elements can lead to decreased user engagement over time.

The challenges mentioned above clearly indicate that the core issue lies in identifying what feature to choose and how it should function.

Gamification seems like an easy job to achieve, as the features feel engaging and easy to implement. However, without the right support, it can become difficult to

A solid e-wallet development company can easily help you navigate through the challenges and considerations. The only catch here is to identify the right partner.

To understand who can help you implement gamification in eWallet, make sure you read the next section!

Nimble AppGenie: Your Partner in eWallet Innovation

The idea of integrating gamification features into your e-wallet app is certainly worth investing in, as it gives your app new and interactive features.

To ensure that it is implemented properly and doesn’t hamper the user experience of existing features, you need professionals who are experts in fintech app development and understand gamification in e-wallets.

Nimble AppGenie is one of the leading names in gamification implementation and can become your perfect partner.

With 8+ years of experience and a team of professionals, they understand the user requirements and can accordingly guide you with the best implementation of gamification in e-wallet. Reach out today to get started!

Conclusion

Integrating gamification into eWallet apps offers numerous benefits, such as increased user engagement, retention to improved financial literacy and customer loyalty.

By understanding the challenges and continuously refining the gamified experience, eWallet providers can create a more engaging and rewarding platform for their users.

All in all, you should easily go for the best partner who can offer easy integration of gamification in e-wallet apps. With that said, we have reached the end of this post.

Thanks for reading. Good luck!

FAQs

Gamification in eWallet apps involves incorporating game-design elements such as points, badges, challenges, and leaderboards to enhance user engagement and make financial tasks more enjoyable.

Gamification benefits eWallet users by making financial activities more engaging, encouraging better financial habits, increasing user retention, and providing a more personalized and rewarding experience.

Examples include PayPal’s rewards system, Revolut’s savings challenges, Venmo’s social feed, Google Pay’s game-based promotions, and Monzo’s “Split the Bill” feature.

Challenges include ensuring user privacy and security, balancing fun with functionality, avoiding over-gamification, measuring effectiveness, and maintaining user interest.

Gamification can improve financial literacy by incorporating educational challenges and quizzes that teach users about budgeting, saving, and investing in a fun and interactive way.

Key elements include points and rewards, challenges and competitions, leaderboards, and badges. These elements motivate users to engage with the app and achieve their financial goals.

Gamification increases user retention by creating a sense of achievement and progress, encouraging users to return to the app regularly for rewards and new challenges.

While gamification can benefit most eWallet apps, it should be carefully tailored to the specific user base and financial activities to ensure it enhances rather than disrupts the user experience.

Success can be measured by tracking metrics such as user engagement rates, retention rates, user satisfaction, and the effectiveness of different gamified elements through A/B testing.

Best practices include understanding user behavior, defining clear objectives, designing engaging game elements, integrating gamified features seamlessly, testing and optimizing, and continuously innovating to maintain user interest.

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.