Fintech applications have taken the market by storm. In the early days, when these applications were emerging and limited.

The sole idea was to simplify financial services and get things done faster.

However, things have changed drastically. Today, there are thousands of applications that millions of people use on a daily basis to finish their banking and other finance related tasks.

And with the rise of these options, people are always looking for the most convenient solution.

Irrespective of added features, people always look for a well-designed, easy-to-use fintech solution.

That is also the reason people have started paying attention to fintech app design. If you too are planning to build a fintech app for your business or already have one but are not satisfied with the way it is performing, this is the post for you!

In this one, let’s take a look at fintech app design practices that will help you resolve all the issues that may be stopping your app from achieving the success that it deserves.

Without further ado, let’s get started!

Why is Fintech App Design Important?

One of the core reasons why people have started paying so much attention to fintech app design is the complicated nature of features and functionalities involved. You see, financial services are already typical to use.

To simplify these services, people tend to use applications. However, things get tricky when even these applications are unable to deliver that convenience due to a complicated design.

Paying attention to fintech app design is really important as it can easily make or break your application. Gone are the days when offering a feature was enough to attract a user.

Today, the competition is cut-throat and hence you need to combine usability and simplicity to have an edge over other applications.

Other than that, some of the main reasons why it is important to pay attention to your fintech app design –

#Reason 1 – For Positive User Impact

When a user starts using your application, the first thing they notice is the design of your app.

When a fintech app design is done properly, the user immediately gets comfortable with using the application, even if they are not familiar with fintech terms and trends.

The application should be responsive to every user, irrespective of their expertise. This leaves a great impact on the user experience and enhances retention.

#Reason 2 – For Garnering User Trust

When an application is simplified and easy to understand, users find it easy to trust and use. User trust is the key, especially when we talk about fintech apps.

With a well-designed application, an app can easily garner a new audience, along with the trust of the user.

When your fintech app design is free of unnecessary features and offers direct access to necessary features, people find it reliable.

As soon as your user relies on the application, your purpose behind focusing on fintech app design is achieved.

#Reason 3 – To Gain Competitive Edge

Fintech is an industry where competition is always on the offensive. You need to be prepared for all the existing and potential competitors.

Since a user has so many options, you need to give them something more than features, and what better than convenience and a well-defined user experience?

Paying attention to fintech app design can surely help you gain a competitive edge over your competitors.

Paying attention to the design of your fintech application can put you ahead of the competition automatically.

However, the issue with many of the app owners is that they are not aware of the elements and principles of fintech app design. Check out the next section to learn more about them.

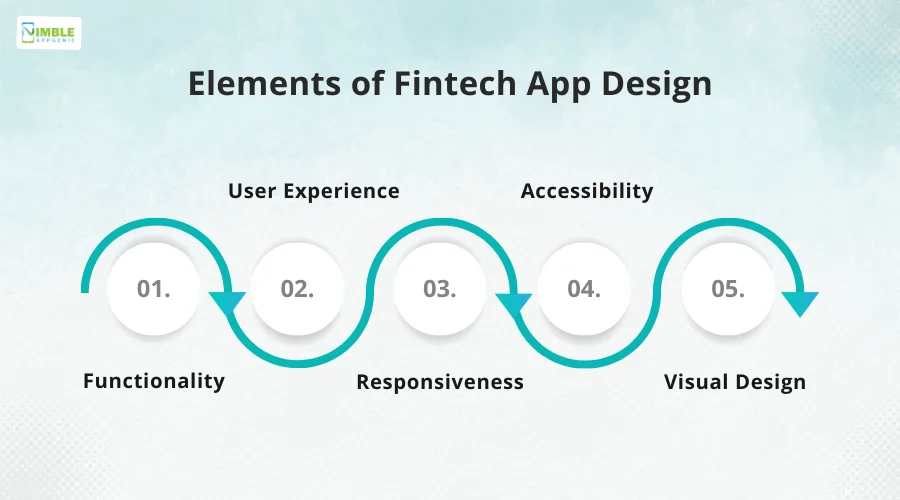

Elements of Fintech App Design

In any fintech application, some fixed elements must be included in the design.

The elements of the application are –

- Functionality: Features and functionality that are designed as the base of your application.

- User Experience: This is the basic way your application functions. Pressing buttons, tapping on icons, etc., all of it falls into the user experience.

- Responsiveness: This is the element that defines the nature of functionalities and how quickly they can be executed.

- Accessibility: The ability of a user to interact with your app features and navigation methods is called the accessibility of a fintech app.

- Visual Design: How your app appears and what the user interface design falls into the visual design element of your fintech app.

All these elements must be designed properly to have a decent fintech app design.

Since all of these elements have their own quirks, you need to handle them accordingly and make sure that all these elements are justified.

As you might have gotten an idea, these elements make up your entire application.

Hence, breaking them down and designing them properly will directly reflect on the final version of your fintech app.

Key Design Principles for Fintech Apps

Whatever you decide to design your fintech app, you must know that while functionalities will attract people to your app. It is the design that will convert them into a permanent user.

When designing your app, you must follow a set of UX Design Principles when talking about fintech applications.

These principles include –

- Simplicity: A fintech application should be built with simplicity as a priority. Try to avoid any type of jargon or complex processes to make it more direct and simple.

- Clarity: The design elements, fonts, and spacing that you use should promote clarity in the app. The more clear the experience, the higher users prefer your application.

- Efficiency: Keep your fintech app design efficient by keeping the features easily accessible and fast enough. This way, users have a snappy experience.

- Personalization: Always leave room for personalization. The user should be able to play around with the buttons you have added and change them if necessary.

- Security: Your fintech app design should not lack in security, in fact it should be able to build a fortress of security at every feature that a user decides to explore.

- Transparency: Make your app design as transparent as possible, allowing users to gain insights on how each feature works and what is the purpose of it.

Your fintech app design must adhere to all these principles to ensure that it is appropriate and reaches the masses.

More importantly, following these principles of fintech app design will help you build an application that is future-ready and preferred by users.

Best Practices to Incorporate in Fintech App Design

Fintech app design principles clearly define things that you should keep in mind while planning your application.

However, you may not be able to implement all of them, unless you are aware of the best practices to incorporate them.

Here are some of the best practices you can opt for while designing your fintech app to make the most of it –

1. Understanding the Target Audience

The first thing you should do while deciding on fintech app design is to understand the target audience. Identify the core target group that your app will cater to.

Knowing who will use your app will help you understand the type of features you can integrate, along with the level of complexity your app can have in terms of usability and design.

2 Keep it Simple

The majority of fintech applications fail because they tend to complicate even the simplest features.

Keep your app as simple as you can and only focus on features that matter. The more straightforward your app is, the better it will appear to the user.

Going over the board just to appear out of the box can backfire, causing the app to lose users.

3. Prioritize Consistency

Your fintech app design should follow a consistent pattern. This consistency is the key to making a user familiar with all the sections of your app.

Sure, you can use different colors to highlight things, however, the overall consistency in terms of theme, icons, features, etc. should be consistent and maintained throughout.

4. Make it Inclusive

A fintech application should be designed in such a way that it doesn’t make any user think that it is not for them.

Take care of all the necessary salutations, genders, and profile sections as inclusivity is definitely a key player in today’s day and age. The more inclusive your app is, the more users it attracts.

5. De-Clutter as Much as Possible

While a swipe gesture to disclose your balance may seem futuristic and amazing in theory, it should be avoided as it is nothing but a complex way to do a simple task.

Remove as much clutter from the app as you can, as minimal applications always get the job done better and faster.

6. Focus on Basic Features

Never underestimate the basic features like checking balance, navigating from one section to another, checking notifications etc. as these are the most commonly used ones.

These features are similar in other apps as well which means if you change their position or way in your app, you will be breaking the user’s muscle memory, leading to disappointment for the user.

7. Keep Your Users Informed

Your fintech app design must include a section where you keep your user informed about every change that you make to your app.

Keep the regular updates rolling and always have a way for your users to raise issues or ask for help.

This way your users have a way to connect and ask questions about your application. This builds a two-way interaction between you and your user.

Implement these practices in your fintech app design, and you will have an attractive, simplified, and effective application.

Needless to say, these practices will always keep you ahead of the competition as a well-designed app is always the first preference of a user.

Case Study: Top Fintech Apps and Design Lessons

The market is filled with the best fintech apps and each of them has amazing designs.

Now, if you want to be the next big thing and create the best fintech app design, it’s a good idea to learn from the best.

Here, we shall be dissecting the design of some popular fintech apps:

► Robinhood: Investing Made Simple and Engaging

Robinhood is a commission-free stock trading app designed to make investing accessible to everyone.

Their user interface is clean and intuitive, removing the intimidation factor often associated with traditional investment platforms.

The stock trading app offers fractional shares, allowing users to invest any amount, breaking down the barrier of high minimum investment requirements.

Here’s what we can learn from one of the top investment platforms:

♦ Target User: Millennials and Gen Z are interested in investing but intimidated by traditional brokerage platforms.

♦ Designed for Trust: Robinhood prioritizes transparency with clear fee structures displayed upfront and easy-to-understand investment information presented in a jargon-free manner.

Their user interface is clean, minimalist, and focuses on visual simplicity. This reduces the feeling of complexity often associated with investing, building trust with a user base that might be new to the world of stocks and options.

♦ Designed for Engagement: Robinhood gamifies investing through fractional shares. Users can invest any amount, removing the barrier of high minimum investment requirements.

They incorporate educational resources and news feeds curated based on user interests and investment goals.

This keeps users informed, engaged, and confident in making informed investment decisions.

► Venmo: Social Payments with a Fun Twist

Want to create an app like Venmo? Well, you aren’t the only one.

Venmo is a mobile payment service that allows users to send and receive money from friends.

It prioritizes social integration, making it ideal for splitting bills, repaying loans, or sending quick gifts within friend groups.

Transactions are displayed in a social feed format, and users can personalize payments with emojis, comments. animated avatars, adding a fun and interactive twist to money transfers.

♦ Target User: Young adults and social circles looking for a convenient way to split bills, send money to friends, and manage shared expenses.

♦ Designed for Trust: Venmo prioritizes secure social integration, allowing users to connect with friends through Facebook or phone contacts, but with clear privacy settings for transaction visibility.

Transactions are displayed in a social feed format with optional anonymity features, fostering transparency and accountability within friend groups while maintaining user comfort.

Security is further bolstered through PINs, two-factor authentication, and real-time transaction monitoring.

♦ Designed for Engagement: Venmo injects a social element into money transfers, going beyond just sending and receiving funds. Users can personalize payments with emojis, comments, and animated avatars.

This adds a fun and interactive layer, encouraging social sharing within the app and making splitting bills or repaying friends a more enjoyable experience.

► Mint: Personalized Financial Management with Clear Visualization

Mint is one of the best budgeting apps that helps users manage their finances, track expenses, and achieve financial goals.

It connects with various financial institutions, allowing users to view all their accounts in one place.

Mint offers robust data visualization tools and personalized financial insights. Empowering users to make informed decisions and stay on track with their financial goals.

♦ Target User: Individuals looking for a comprehensive tool to manage finances, track expenses, and achieve financial goals.

♦ Designed for Trust: Mint prioritizes data security with industry-standard encryption and a transparent data usage policy. Users can connect securely with various financial institutions through a multi-step verification process, ensuring only authorized accounts are linked.

Mint provides clear explanations of how its data is used to personalize the app experience. This builds trust by giving users control over their financial information.

♦ Designed for Engagement: Mint offers a user-friendly interface with robust data visualization tools that go beyond basic charts and graphs.

Users can personalize their dashboard with relevant financial metrics and set custom budgets. Mint utilizes progress bars, goal trackers, and motivational prompts to keep users engaged and on track with their financial management journey.

Additionally, Mint offers personalized financial insights and recommendations based on user data, empowering them to make informed financial decisions.

How Nimble AppGenie Can Help You Design the Next Big Fintech App?

With every aspect of fintech app design unfolding right in front of you. It is obvious that there are so many things to take into consideration.

While it may seem easy to take care of all the elements and principles of fintech app design, you need years of experience to be able to build them properly.

This is where Nimble AppGenie’s app designers come into the picture. With decades of experience, we are your best fintech app development company that excels in both design as well as functionality.

Connect with our experts today and start your journey towards a well-designed fintech app.

Conclusion

Meanwhile, people tend to pay more attention to functionalities of a fintech app. The users always look for a well-designed app that is convenient to use.

With the help of this fintech app design guide, you can easily define the design that will attract your users and help you reach more users, faster.

Hope this post helps you understand the intricacies of fintech app design. Use this guide for your next project, and it will help you get better results. Thanks for reading, good luck!

FAQs

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.