Digital Transformation has been the backbone of the world economy for over a decade now. Every sector, from medicine to sports has seen drastic changes in the way things work. Fintech is no stranger to this wave of digitization.

While it has become the need of the hour to implement digital transformation in your field of work, there are still a few traditional businesses that do not realize the power of digitization.

Several financial institutions still insist on doing things the traditional way, which is not wrong but is surely becoming an outdated approach.

There are several things that they are missing out on and if you too are one of them, then this post is just what you need to read.

In this one, we are going to understand the true meaning of digital transformation in fintech. Along with various factors that will help you understand how digitization of sectors can help revolutionize the future of finance as an industry.

What is Meant by “Digital Transformation” in Fintech?

Many of you may be wondering what digital transformation means for fintech and finance. Well, to understand this, you need to first understand the meaning of digital transformation.

Integrating cutting-edge technology and turning something traditional into digital is called digital transformation.

If we talk about digital transformation in finance, it refers to using technology to simplify traditional financial processes and transactions. The entire concept of fintech or financial technology is based on digital transformation.

By going digital or creating a new-age financial environment for its users, any finance-based business can reach a newer audience while creating a user experience admired by all.

Instant boost in customer satisfaction and engagement can be achieved by using digital transformation for your business.

If you use any of the banking apps, payment apps, or trading apps, it is all because of the digital transformation of the finance industry.

How has Digital Transformation Helped Fintech? Stats & Trends

Fintech as an industry has evolved over the past few years.

The credit goes to digital transformation as banks, insurance companies, trading firms, and other financial institutes have started realizing the power of implementing technology in their daily operations to improve efficiency.

As per the current trends, more and more financial institutions are moving towards digital transformation. Online banking, instant payments, and digital trading have become the flag bearers for this transformation.

This could be a game changer in the coming years as every business will spend money on digital transformation. As per Statista, spending on digital transformation in the US is set to reach $3.9 trillion by 2027.

If we talk specifically about finance, digital payments alone, the transaction value is set to grow with a CAGR of 15.9% during 2025-2029, projecting a total amount of US$36.75tn by 2029, which shows the significance of digital transformation in finances to a great extent.

Technologies like Big Data Analytics, Cloud Computing, and Generative AI play a crucial role in transforming the finance industry as they help execute scalable solutions while allowing organizations to stay on top of their decision-making with predictive AI.

Key Factors that Drive Digital Transformation: Why Now?

A lot of you may be wondering why everyone has started talking about digital transformation out of nowhere.

Well, the market for financial services is long due for an update and with the increasing use of smartphones, every other business has already started its digital journey.

Eventually, every field will have to go through a digital transformation. Why so? Because it has become the need of the hour as every field has taken a digital-first approach since the pandemic outbreak.

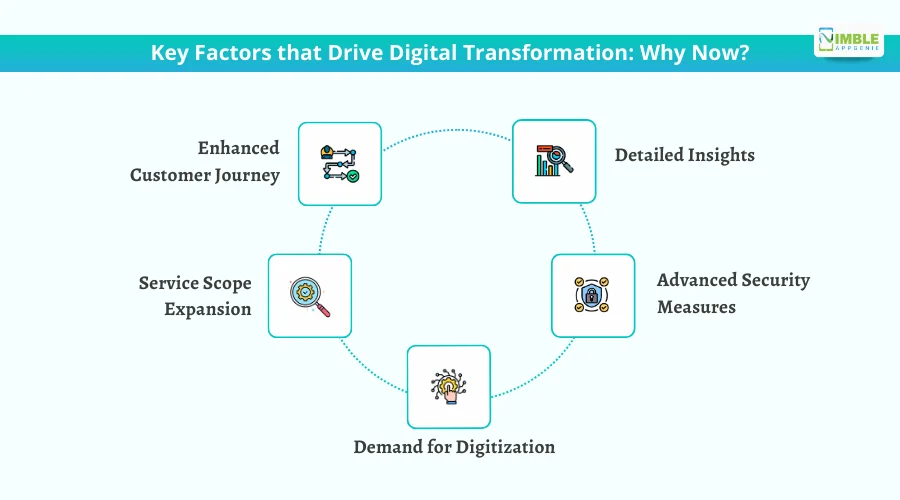

Several factors are leading to the adoption of digital transformation in the finance sector, these include –

♦ Enhanced Customer Journey

By deploying digital solutions, the journey of an individual client can be improved to a greater extent. That is because, in a digital solution, the customer has the flexibility to access from anywhere. The implementation of new technology allows businesses to take a customer-centric approach.

♦ Detailed Insights

With the use of digital technologies, data analytics can be improved. These analytics can be interpreted concerning the business, leading to better decision-making and insightful planning. This also allows for better risk mitigation in fintech businesses.

♦ Service Scope Expansion

Digital transformation helps a business expand its scope of services. A traditional business has its geological limitations however digital platforms know no limits.

♦ Advanced Security Measures

With technologically advanced security, customers’ sensitive data can be kept secure without any hassle. It’s digitization that helps in detecting fraud and reduces the risk of data leaks.

♦ Demand for Digitization

One of the key factors that has driven digital transformation is the rising demand for digitization across the globe. With smartphones taking over, every business and service provider has started going digital, leading to the rise of fintech.

Digital Transformation in Finance: Complete Process

The transition from an offline business into a digital one is not that simple. Especially for small businesses as they have to identify their pain points and accordingly set a budget for this transformation.

On the other hand, the fact that there are so many available options to go digital, that businesses are often confused in choosing the correct path. This is also why it is very important to follow a process to begin your fintech digital transformation.

There’s a series of steps that you must follow. The steps include-:

Step 1: Identify Your Objectives

The first step is to identify the objective of your digital transformation.

Why do you want to go digital? To expand your reach or to simplify your internal operations?

Do you want to create another revenue stream, because as sooner you identify your goals, the better the strategy can be developed.

We recommend you create a list of your primary objectives beforehand as it will help you choose the right solution.

Step 2: Evaluate Gaps in the Current System

After identifying the objectives, you have a set of functions that you want to make digital (to start with). Analyze the current system in place and find out what are the current gaps that you want to fulfill.

Where does the current system fall short? What are the issues that you plan to resolve with digital systems? After evaluating the gaps, you will get an idea of the features to make your digital transformation in finance a success.

Step 3: Understand the Needs of the Customers

Once you are through with analyzing your current system and the gaps in it, it is time to take a closer look at the market to understand what exactly a customer needs.

This way you will be able to create a balance between simplifying your operating model and enticing new customers with digital transformation.

Take note of every digital trend related to finance and banking and try aligning your services with it to get an idea of whether it works for you or not.

Step 4: Get a Digital Transformation Partner

Now with all the research, you may have a solid list of objectives that combine both your internal and external operations.

Now what you need is a digital transformation partner who not only guides you through the process but also helps you implement technologically advanced solutions.

Consulting a fintech app developer can be a great first step if you have decided to go the digital route as it will help you understand the solutions properly.

Step 5: Execute Changes

After aligning your vision with a fintech digital transformation expert, it is time to execute your changes. This will take time considering you will have to implement custom fintech solutions for your services.

After the entire process is over, you will have a digitally transformed solution for your existing services.

Keep in mind that you don’t need to build an entire team in-house as there are several experts, consultants, and development companies available to help you through.

There are a plethora of benefits that you can experience after implementing digital transformation. Check out the next section to learn more about the benefits of digital transformation in fintech.

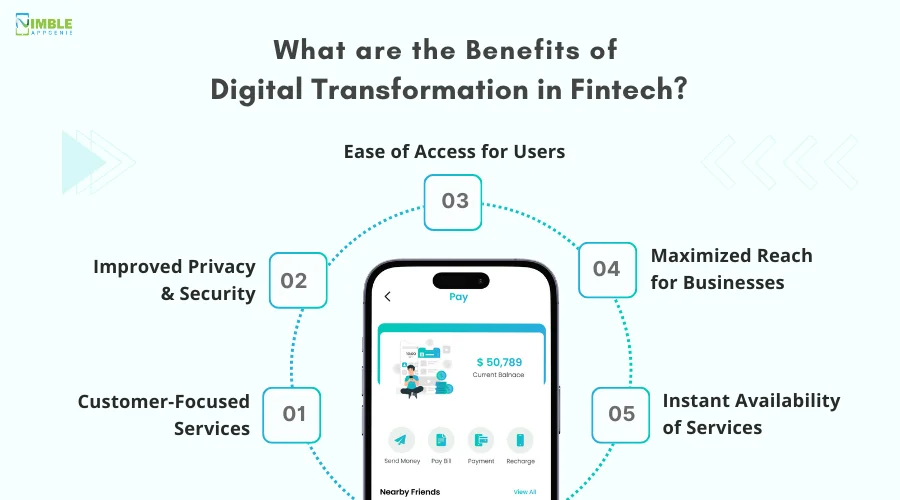

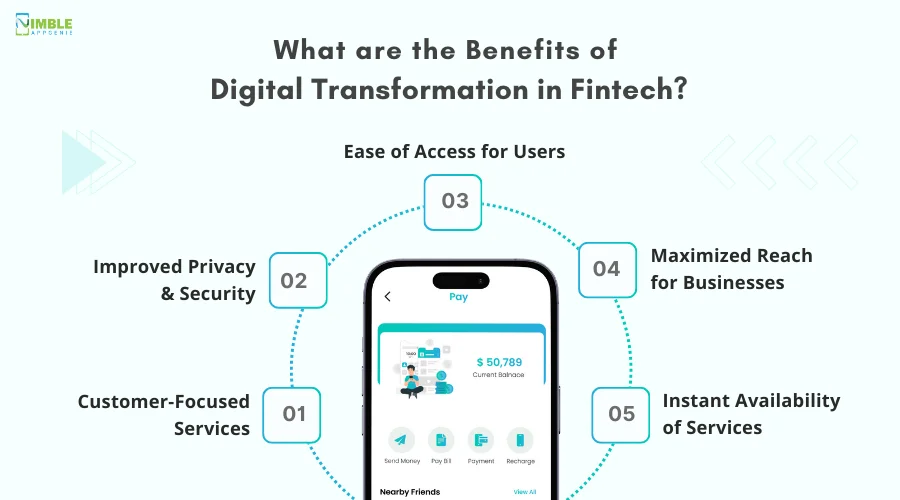

What are the Benefits of Digital Transformation in Fintech?

Going digital has its benefits that help both businesses and consumers. If we talk specifically about fintech, the benefits are extremely helpful considering finance is something that everyone has to engage in.

While traditional practices where you had to visit physical branches for even the most basic tasks were something that drove people off, digital transformation has changed the way people interact with financial services.

Some of the key benefits of digital transformation in finance include –

-

Customer-Focused Services

When you have a digital outlet for your customers, it tends to offer more control to them, making them the center of every service. And since these services generate a lot of user data, you can easily use digital solutions like AI to understand user behavior to provide better customer services.

-

Improved Privacy & Security

With technologies like encryption and blockchain supporting your services, the security of user information can be easily enhanced and made more reliable.

The issue of privacy and security has always been a pressing one for finance-related businesses. Thanks to the digital transformation of finance, issues like data theft can be minimized.

-

Ease of Access for Users

One of the biggest challenges for a finance company is to provide easy access to its services. People have to visit branches, connect with customer care on call, and wait for days for a process to be over in traditional services.

However, with digital transformation users can easily access the services through their smartphones or desktops. The convenience that digital transformation brings to your business can be remarkable.

-

Maximizing Reach for Businesses

Another benefit of digital transformation is it amplifies your presence in the market exponentially. While traditional businesses are limited to a particular region, digital services can reach any corner of the world, opening a completely new market for your fintech business.

-

Instant Availability of Services

Banking and financial services are the lifeblood of the economy. And rightly so, they should not be limited to working hours. With digital transformation, your services became available to your customers 24/7 with instant access.

Further advantages of digital transformation can be explored in specific areas of the fintech industry. All in all, the benefits sweeten the pot for users to migrate to a digital platform. Needless to say, the digital benefits make the investment worthwhile.

Technologies Driving Digital Transformation in Fintech

To introduce digital transformation in financial services, you need technology that is both advanced and futuristic. There are a bunch of technologies that you will have to implement to create a truly digital transformation for your finance business.

The technologies that are at the core of driving digital transformation in fintech are as follows-:

► Cloud Computing

Cloud computing is the modern way of keeping computing resources without having to physically maintain them.

It allows a business to manage data and deploy newer features easily. A business can simplify its operations and minimize its cost of resources by using cloud computing for fintech.

► Machine Learning

Machine learning algorithms help in analyzing the usage patterns of the user to generate insights for businesses and provide smart recommendations to the users.

Machine learning is also helpful in keeping your platform secure as ML algorithms can help in fraud detection too.

► Artificial Intelligence

Artificial Intelligence in fintech conjunction with machine learning to enhance the user’s experience.

It can help in automating a few processes and personalizing the recommendations as well as services for the users.

You can even deploy a digital assistant for your customers with the help of AI.

► Blockchain

For any finance-based business, security and transparency are really important.

Blockchain offers both these advantages as it serves as a decentralized ledger that records transactions and keeps them distributed across multiple computers. So it stays safe from any breach.

► Robotic Process Automation (RPA)

When going digital, you have to be ready for large volumes of users coming to you for services, even at odd times.

Robotic Process Automation in fintech helps you deal with all of these incoming queries. How?

Well by automating the customer interaction with your services with the help of chatbots and bots to automate usually manual processes.

► Internet of Things (IoT)

With IoT in fintech, you can manage physical assets virtually, helping your fintech business to stay afloat through digital transformation.

IoT as a concept enables a business to create an ecosystem of devices that interact with each other to simplify a task for you.

Some of the core applications of IoT in fintech businesses include contactless payments, mobile banking, etc.

► Big Data Analytics

If you are part of fintech services, you have of user-generated data coming your way.

While it may not seem useful to you, of insights can be fetched through the analysis of this data. Big Data Analytics is a technology that helps you do exactly that.

It can help you break down large data into insightful information that can be used to improve your decision-making and operations.

► APIs

Fintech application programming interfaces (APIs) play a crucial role in data sharing between two or more software systems.

This means if there’s already an application available for the functionality you want in your application.

The API for the same can be integrated with your system instead of building the functionality from scratch.

It really speeds up the process of digital transformation for different fields including fintech.

With all these technologies backing your fintech business, you are bound to stay on top of all the operations.

The use of all these technologies can help in getting hands on a solid and robust fintech solution that simplifies the overall business for you.

What are the Challenges in Digital Transformation in Fintech?

Looking at the benefits of the digital transformation in fintech, you might have gotten a bit too excited about jumping on the digital bandwagon.

However, you should be aware that there are still several challenges that you will have to face to carry out digital transformation in fintech.

These challenges include:

#1 Implementation of Technology:

It can be difficult to implement technologies on your own as not every business is compatible with transforming all of its services and operations digitally.

Access to resources that can help in implementing a technology is another crucial factor.

#2 User Adaptation & Acceptance:

As a business when you plan to opt for digital transformation, you have to consider the rate of user adaptation and the acceptance of the services in the market.

If we talk about tier 2 and tier 3 countries, there’s still a bit of resistance in moving towards a digital transformation among customers.

#3 Cost of Development:

For several small businesses the cost of development can be a challenge.

It is not possible for an SME to spend thousands of dollars on developing digital solutions when they have other things to take care of.

#4 Cyber Threats:

While a digital platform offers robust security in fintech, there are still cyber threats that often become a point of concern for many users.

When information is kept on a remote server, the chances of cyberattacks and data breaches are higher, leading to resistance to implementing digital transformation.

#5 Evolving Compliance:

As digital transformation in financial services is on the horizon, the norms and compliance requirements are not stable and keep evolving.

Creating a system after spending time and money to find out that it is not compliant with new regulations and cannot be used can be disheartening and loss-making decisions for the users.

The above-mentioned challenges do pose a problem in implementing digital transformation.

If you get the right guidance and a digital transformation partner, these should not be a problem. However, finding the right fintech app development company in itself can be challenging.

If you too are facing a similar issue then make sure you do not skip the next section at any cost!

How Nimble AppGenie Can Help in Digital Transformation

If you have decided to take your fintech business to the next level, then going the digital route can be a good choice.

But, to implement digital transformation, you will need a partner who can help you achieve the best results.

We at Nimble AppGenie can help you carry out digital transformation in fintech.

With cutting-edge technology and experience in developing high-tech solutions such as a multi-currency wallet, integration of payment gateways, etc.

We can guide you through every step smoothly, making the transformation process sustainable for your business.

Conclusion

Hope the entire post helps you understand the complete process of digital transformation along with its benefits and challenges.

Digital transformation is a crucial aspect of every business trying to thrive in today’s day and age.

There are different aspects of digital transformation that one has to understand before planning to implement the same.

It is sure that sooner or later every business will have to take the digital route as it helps in making the business more scalable and convenient.

FAQs

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.