From Open Banking to Fintech, the world of finance has changed forever. With the astronomical growth rate of the industry and solutions like eWallet, loan lending, and mobile banking apps growing more & more popular. Let’s discuss one technology that helps this industry keep afloat, “digital onboarding in fintech ”.

This is an essential component that sits at the core of most fintech app solutions as well as the open banking concept itself. known as KYC API, this technology is what makes possible our day-to-day mobile finances.

Here, we shall be discussing all you need to know about the top fintech digital onboarding and everything related to the same. So, without further ado, let’s get right into it.

What is the Digital Onboarding in Fintech?

The term “Digital Onboarding” refers to the process of integrating a new customer into a digital platform or service. Also known as KYC, it also involves collecting and verifying personal information. And setting up an account for the user to access the platform’s features and services.

The fintech realm is huge. Based on the solution, digital onboarding can take different forms.

For instance, some fintech platforms require a detailed form to be filled out for KYC. While others just require your basic information such as name, email, number, etc.

“API” refers to the set of protocols that allows two programs to communicate. In that sense, a digital onboarding is an interface that allows developers to streamline digital onboarding functionality into their own platforms or services. via KYC API Onboarding

It makes it easier for fintech developers to integrate pre-built workflows and identity verification without developing them from scratch. Something that can be very expensive and time-consuming, not to mention the fact that it’s very difficult to get right.

Therefore, it speeds up the fintech development process while also improving the user experience by a lot. Some of the top digital onboarding are Onfido, Jumio, and Verif.

We shall be discussing the top digital onboarding later down the line. Meanwhile, let’s look at how digital onboarding works.

How does Digital Onboarding Work in Fintech?

So, how does this KYC API work exactly? We all know that identity verification software and its KYC integration is an integral part of digital wallet app development.

There are of things that go behind automating the process of onboarding new customers in a secure and efficient way.

To make it easier for you to understand, we have divided it into different steps.

These steps are, as mentioned below:

1. Customer Information Collection

So, the first step of KYC Verification API is, customer information collection. If you think about it, it makes sense.

Here, the platform i.e. a web form, mobile app, or any other digital channel will get basic information. This includes your name, address, and contact information.

2. Document & Identity Verification

Once the information is collected, the next natural step is to verify it. And that’s what happens in this step.

Document and identity verification is done via KYC Check API. Here, the agency can ask users to present documents like passport, driver’s license, or national ID cards.

Moreover, API makes use of AI Solutions & Algorithms for identity verification. In any case, once this is done,

3. Risk Assessment

After verifying the customer’s identity, the next step is to assess the risk associated with onboarding them.

Digital Onboarding uses various risk assessment techniques to determine if the customer is high-risk or low-risk.

So, why is this important? Well, this step of the process helps organizations to follow Know Your Customer (KYC) regulations and prevent fraud.

4. Account Creation

After KYC verification API has done its work, it’s time for account creation.

It is here that digital onboarding creates a new account for the customer and assigns them a unique identifier.

Moving on, let’s see what happens in the next step.

5. Product Choice

After the account is created, the customer can select the product or service they are interested in.

Reason being that there is a range of fintech services from mobile banking services like online loans and credit cards to BNPL apps.

6. Final Verification

Whether it is a loan lending app or fintech app like PayPal, identity verification is very important.

So before everything is set up, there’s one final verification. What happens here is, Digital Onboarding verifies the customer’s information again and ensures that all the necessary steps have been completed.

With this done, work of KYC API is complete. Let’s move on to the next section, where we shall see the role of Digital Onboarding in fintech development.

Role of KYC API in Fintech

The goal of digital onboarding is to create a seamless and efficient experience for new users, while also ensuring that the platform or service remains secure and trustworthy.

By automating the onboarding process and using digital tools to verify user identities and track user activity, platforms can reduce the risk of fraud and other security threats.

Customer Protection

KYC verification API helps to protect customers from identity theft and fraud. By verifying the identity of each customer, fintech companies can ensure that their services are not used for illegal activities. This helps to build trust between customers and fintech companies.

Compliance

Video KYC API and other types of API is seen as a regulatory need in many countries. Fintech companies that do not follow KYC regulations can face severe penalties. By implementing KYC, fintech companies can ensure that they are compliant with all relevant regulations.

Improved Customer Experience

Fintech companies can streamline their customer onboarding process with the help of identity verification API. This makes it easier for customers to sign up for services and access the products they need. KYC can also help to reduce the time it takes to complete transactions, improving the customer experience.

Reduced Risk

Well, well, what if we told you KYC Check helps reduce the risk of fraud and money laundering?

By verifying the identity of each customer, fintech companies can ensure that their services are not used for illegal activities. This helps to protect the company from reputational damage and financial losses.

Top Digital Onboarding for Fintech

With the advancement of technology, APIs in fintech has become a popular and efficient way of registering new customers.

Many companies have developed APIs to help businesses with digital onboarding and you can make use of them.

Here are some of the top digital onboarding APIs now available:

1. Jumio – Top Digital Onboarding API

With its easy-to-integrate APIs, Jumio is a leader in the online identity verification space. Its real-time results and range of services make it a popular choice for businesses of all sizes.

2. Onfido – Best KYC API

Another top player in the digital onboarding API space, Onfido offers a range of services to simplify the process, including document verification, facial recognition, and biometric authentication. Its APIs are designed to be user-friendly and can be easily integrated into existing workflows.

3. Mitek – ID Verification API

Known for its flexibility and customization options, Mitek offers APIs that can be tailored to fit the unique needs of businesses. Its document verification, facial recognition, and ID verification services are trusted by companies worldwide.

4. Verify – KYC Verification API

With a focus on real-time results and user-friendliness, Veriff is a popular choice for businesses looking for easy-to-use digital onboarding APIs. Its document verification, facial recognition, and ID verification services are reliable and effective.

5. Trulioo

As a global identity verification company, Trulioo offers a range of APIs to help businesses streamline the onboarding process. Its document verification, ID verification, and biometric authentication services are designed to be easy to integrate and can be customized to fit the unique needs of businesses.

Here are some of the top digital onboarding APIs now available. Each API provider offers unique features and benefits, so it’s important to evaluate them carefully before choosing one for your business.

Moving on, you must be wondering how the heck can you integrate these APIs in your mobile app, well, let’s discuss that below.

KYC Integration Process

The KYC integration process is critical for fintech companies to follow regulatory requirements, mitigate risks, and ensure secure customer onboarding.

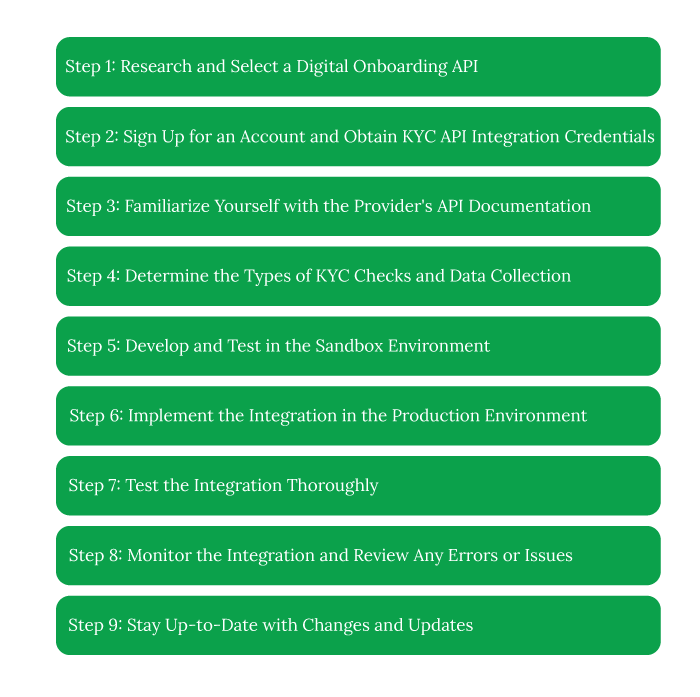

Here’s a step-by-step breakdown of the Know Your Customer (KYC) integration process:

Step 1: Research and Select a Digital Onboarding API

Research and select best KYC API provider that meets your specific needs and requirements. Consider the provider’s reputation, availability, pricing, and customer support.

Step 2: Sign Up for an Account and Get KYC API Integration Credentials

Sign up for an account with a digital onboarding API provider and get an API key and other necessary credentials. You may need to provide documentation to verify your identity and business.

Step 3: Familiarize Yourself with the Provider’s API Documentation

Familiarize yourself with the provider’s ID verification API documentation and available endpoints. Understand the limitations and requirements of each endpoint, such as rate limits and data formats.

Step 4: Determine the Types of KYC Checks and Data Collection

Determine the type of KYC checks you want to do and the data you need to collect from your users. Consider the regulations that apply to your business and the risks associated with your users.

Step 5: Develop and Test in the Sandbox Environment

Develop and test the integration with the KYC API provider’s sandbox environment. Use sample data and scenarios to test the different endpoints and responses.

Step 6: Carry out the Integration in the Production Environment

Carry out the integration into your platform using the provider’s production environment. Use secure and scalable methods to transfer data and credentials.

Step 7: Test the Integration Thoroughly

Test the integration to ensure that it is working as expected. Use a variety of scenarios and data inputs to confirm the accuracy and completeness of the responses.

Step 8: Monitor the Integration and Review Any Errors or Issues

Monitor the KYC API Integration and review any errors or issues that arise. Use logging and alerts to detect and respond to any technical or business issues.

Step 9: Stay Up-to-Date with Changes and Updates

Stay up-to-date with any changes or updates to the KYC API provider’s API and adjust your integration so. Follow the provider’s release notes and announcements to ensure that your integration remains compatible and compliant.

Conclusion

This is all you need to know about the digital onboarding API. Now, if you want to create your own financial app and use KYC API in it, it’s recommended that you consult a fintech app development company.

They will be able to help you with seamless integration. In any case, with this, we end our blog.

FAQ

A Digital Onboarding API typically consists of a series of endpoints that allow developers to integrate the API into their applications. These endpoints enable developers to collect user data, verify identities, and create accounts for new users. The API can also integrate with other systems, such as payment gateways and customer relationship management (CRM) platforms.

Using a Digital Onboarding API can provide several benefits, including:

- •Improved efficiency: By automating the onboarding process, organizations can save time and reduce the risk of errors.

- •Enhanced customer experience: Digital onboarding provides a seamless and convenient user experience, making it easier for customers to sign up and start using a product or service.

- •Increased security: Digital onboarding APIs can help organizations to verify user identities more accurately, reducing the risk of fraud and ensuring compliance with regulatory requirements.

Any industry that requires user registration can benefit from a Digital Onboarding API. Some of the industries that can benefit the most from digital onboarding include banking and finance, healthcare, e-commerce, and online education.

Most Digital Onboarding APIs are designed to be easy to integrate into existing systems. Developers can typically access documentation, sample code, and support resources to help them get started quickly. Some APIs also give software development kits (SDKs) that can simplify the integration process.

When selecting a Digital Onboarding API, consider factors such as functionality, ease of integration, security, scalability, and cost. It’s also essential to choose an API provider with a good reputation for reliability and customer support.

To get the most out of a Digital Onboarding API, consider the following best practices:

- Simplify the user experience

- Verify user data thoroughly

- Ensure compliance with regulations

- Monitor for fraud

- Continuously improve the process

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.