Banking applications are powerful tools in today’s world. For every banking service, people tend to open their smartphones and get things done.

This dependence on smartphone banking apps has opened up doors for banks and developers to introduce new applications. Or at least that is the thought process of an individual who decides to develop a solution.

You see it is highly motivating to see the numbers when it comes to the growth of digital banking and mobile apps. However, when it comes to building an app that yields results and contributes to those numbers, the majority of users fail.

That is because while their vision is fueled by motivation and ever-rising numbers, the approach they take is full of flaws.

Developing a banking app is not a cakewalk. There are several factors that need to be considered while building an app. You can easily resonate with what we have mentioned above if you have ever failed in building an application.

And if you are wondering what mistakes we are talking about, then you have certainly reached the right post.

In this one, we share mistakes to avoid while developing a banking app that we have made and learned from in the years of our journey. We have also shared ways to avoid these mistakes along with the reasons why people fall for them.

Make sure you read it till the end as this is super important for any individual planning to build and launch a banking application.

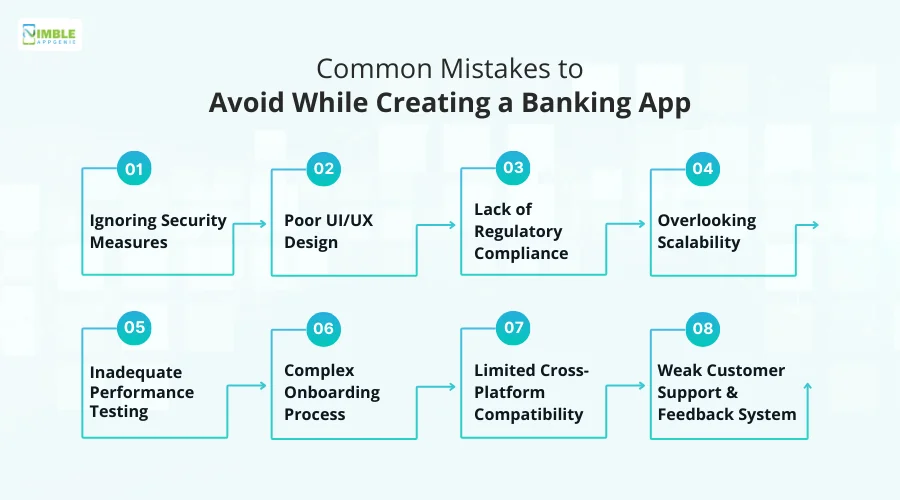

Common Mistakes to Avoid While Creating a Banking App

If you go to an app library be it Play Store or App Store, you can find thousands of mobile banking apps listed there. However, not all of them are as good as the others.

You will be shocked to know that the number of banking apps that could not make it to these stores is significantly higher than the apps that are present.

Why did they fail? Well, as mentioned earlier, there are several reasons behind them. More than the reasons, there are mistakes that developers and business owners make while deciding the course of action for developing a banking app.

Being an experienced banking app development company, we have also faced several issues. However, we did not stop, moreover, we decided to identify these issues and resolve them for you.

Check out the list of mistakes to avoid while developing a banking app along with ways you can avoid them. We have also listed the impact of that issue along with ways to resolve it.

1. Ignoring Security Measures

Issue:

For any application in the fintech realm, security is the most important aspect to take care of. While building a banking app, many users tend to focus on the functionalities more than the security of those functionalities.

You see, it is great to be optimistic and have a vision about changing the way people use banking services. However, there’s no point in offering functionalities that are not secure enough and put the user’s hard-earned money at risk.

Impact:

Ignoring these security measures often leads to failure in compliance with the necessary regulations. Not to mention, such apps might not even make it to the stores considering the privacy policies and security measures are a prime concern.

Solution:

The ideal way to ensure that your application is secure is to identify all the key security measures that must be implemented and only add functionalities that you can secure.

Do not go overboard with features that require additional information that is difficult to secure.

2. Poor UI/UX Design

Issue:

User interface and experience are the face of any application. It does not matter if you have offered the best features if the user is unable to access them instantly. Banking and financial services are already complex services that the majority of users struggle with.

If your app is not simplifying things for a layman, there may be no point in offering the app. Not to mention, the navigation of your application plays a crucial role. If it is not up to the mark with existing apps, then you might have to struggle.

Impact:

When the user interface and design are not up to the mark, people are unable to find the feature they are looking for. Which leads to direct dismissal of your application. And when a user is not inclined to use your app, it eventually dies.

Solution:

Market research and user requirements are two things that can help you design a banking app. User interface and user experience define the way your application simplifies the regular tasks.

The best way to resolve poor user experience is to re-design the app. It is an issue that you can resolve and hit the market again.

3. Lack of Regulatory Compliance

Issue:

When we talk about banking and finance-related applications, one of the core reasons why banking apps are unable to make it is the lack of regulatory compliance.

While building an application, both developers and app owners get so excited about creating the best application that they forget about ensuring that every feature they offer is compliant with both regional as well as national regulatory requirements.

Every banking application is under scrutiny as these apps handle a lot of sensitive data of users. Not meeting the regulatory requirements leads to direct cancellation of the application, which means your app will never be available in stores.

Impact:

When your application is not compliant with regulatory requirements, the application is considered unsafe to be used. More importantly, no bank can directly work with your application as it is no longer considered safe.

Solution:

The best way to handle this issue is to identify all the core banking app security compliance and regulations that apply to your banking application.

Once you have all the regulatory requirements with you, tweak your features in such a way that they follow the compliance guidelines.

4. Overlooking Scalability

Issue:

While designing your application, you need to understand that releasing apps is not a one-time thing. It is a long journey that requires patience and persistence. The app that you create today will get obsolete with time irrespective of what technology you have used today.

If you have not paid attention to the sustainability of the technology that you are using, things may not be scalable in the future, resulting in reducing your application’s age and making it obsolete in no time.

Scalability should be on your priority list as banking applications are not something that people use every day, but they keep it on their phones for years to come.

Impact:

When you have built an application, especially related to banking and financial services you need to understand that thousands of users will come to your platform.

Not only do you need to update your app regularly, but you have to create a mobile banking app that hundreds and thousands of people can use simultaneously, which often becomes difficult when you overlook scalability.

Solution:

Choose your tech stack wisely. If you have an application that you are planning to launch for the masses, make sure you launch it with cloud-enabled tech so that your app is scalable enough to accommodate new users easily.

Not to forget, the technology you choose should be upgradable and scalable with time, it is fine if it is not the best available at the moment as long as it is upgrade-friendly.

5. Inadequate Performance Testing

Issue:

Imagine you are baking a cake. The cake was supposed to stay in the oven for 30 minutes but pull it out of the oven in 25 minutes. If we look at the numbers, it is not that big of a deal considering it’s only five minutes. However, your cake is half-baked and not suitable for eating.

Similarly, testing is like cooking the application to its best form. If it is not done properly your app might remain half-cooked and lacks in various aspects.

Banking apps must be properly tested for bugs and performances as they deal with financial matters and people might not like glitches in the experience.

Impact:

When your application is not tested adequately for performance, it might have issues related to user experience, functionality issues, and overall glitches in the app.

Your application cannot be considered ready if it has not been tested for all the use cases that may be required.

Solution:

Ask your app development service partner to deploy a dedicated quality assurance team that checks the developed application for performance issues.

Once your application is out of the development stage, it should be properly tested. If you already have an application with you, you can opt for dedicated testing services and get your app refined.

6. Complex Onboarding Process

Issue:

For any banking app one of the key processes is the onboarding of a consumer. Understanding this, the need for banking applications arose due to the complex nature of banking services. If your digital solution to the same is also complex, is there a point?

The onboarding process for a banking application has to be simple enough so that even the first-time user can navigate through the application properly and does not struggle with basic functionalities such as signing in.

It is definitely understood that you need to add some sort of security to ensure that not everyone can access or onboard the application, however, making it too complex is definitely an issue to be addressed.

Impact:

When your application is not user-friendly then it becomes highly difficult to attract a user. Users tend to avoid using the solution, which in turn leaves your application with limited to no users.

Solution:

Designing your application user-experience is what you need to pay attention to. The more simplified your application onboarding process becomes, the more users it can attract.

You need to research how apps similar to you are targeting users and what their onboarding features are.

7. Limited Cross-Platform Compatibility

Issue:

Banking is something that every adult needs access to. People today tend to switch smartphones easily and when they switch from one OS to another, they need access to all their applications, especially banking. If your banking application lacks cross-platform compatibility then chances are that you have made a mistake.

Limiting your banking app to a platform is certainly not an option as people of all ages use these services. Some may be comfortable on an Android device, some may have an iOS device. Some may use it on their smartphone while some may use it on their iPads.

Impact:

When your application is unable to satisfy the usability requirements for a user it becomes of no importance to them. Similarly, if your application is limited to a platform or OS, the users on the other end of the spectrum are no longer your clients, limiting the entire reach of your app.

Solution:

If you have budget constraints you should instantly go for a cross-platform development approach as it offers compatibility with different OSs and allows you to target a wider audience. However, it is advised that you build native apps as they offer the best performance.

8. Weak Customer Support and Feedback System

Issue:

Banking applications need to offer instant feedback to user issues as they are delicate. A user might have concerns related to their bank account, their balance, or a transaction. One of the core reasons why banking apps struggle is the fact that they lack the surety that traditional offline banking offers.

Now, of course, as a banking service provider, it will be your responsibility to offer assistance and answers. However, when building an application it is the duty of your developer to ensure that proper customer support and feedback channels are integrated into your application.

Impact:

Users when they do not get the answers they need tend to switch the application. It can lead to an unsatisfactory user experience, which directly affects your application’s presence in the market.

Solution:

Identify the ways people are most compatible to interact with a banking app. If a chatbot is enough to answer their queries or register their feedback, integrate the same. Market research again will play a crucial role in how your app performs.

Fixing Development Mistakes for Banking Apps: Additional Tips

Other than the above-mentioned issues, people often face problems with things like high latency in payment processing, longer waiting times, missing banking services, etc. All these issues are results of lack in research and planning for developing a banking app.

Building a mobile banking app is an intricate process that has to be penned down properly before execution. Some of the core tips to pay attention to so you can avoid making mistakes include:

Tip #1: Research Research Research!

The more you can find out about the type of banking app you plan to build, the better it is for your application. Try using existing apps to find out the plus points and gaps of the apps.

This can surely help you resolve the majority of the issues that you may encounter while building a mobile banking app.

Tip #2: Never Go Overboard

A banking app is more of a necessity than an aspiration for many users. Hence you need not create an over-the-board experience for them. If you can offer what people are looking for with ease of access, you are already a great banking app.

Tip #3: Always Build an MVP

Before you jump into giving your app the final shape, you must create the minimum viable product for the app to understand how things will work.

Building the MVP gives you a peek into how your app will look after proper development. It will also help you identify the cost of development and manage your finances accordingly.

Tip #4: Build Less, Optimize More

When you are developing a banking app, you need to understand that it should be refined. Even if it has a few gimmicky features, missing it is fine as long as the final solution is optimized for a better user experience.

Every functionality to build must be refined to the extent that banking app maintenance becomes super easy.

Tip #5: Monitor User Behavior

You need to identify user behavior when it comes to breaking down their usage pattern and the features that they need. This can be done by going through existing data and applications offering insights on what users prefer and what should be avoided.

Take care of all these issues and you will surely be able to avoid mistakes while developing a banking app.

How Nimble AppGenie Can Help?

One of the key factors to consider while building an app is to choose the right team of developers. Sure, mistakes are a part of the process however, what matters is the end product. Nimble AppGenie’s team of experienced developers and the ability to manage the development challenges of banking apps is something that can come in handy for you.

We firmly believe that when you know what mistakes to avoid while developing a banking app the journey ahead becomes super smooth.

Reach out to our experts today and you will have access to some of the finest resources that will help you avoid mistakes and build a robot banking app.

Conclusion

Understandably, mistakes can take place in the development process. However, the correct approach always addresses these mistakes and resolves them. If you are planning to build a banking app of your own, make sure you pay attention to these issues and be ready to conquer them.

I hope the information shared above simplifies the process for you. That will be all for this post. Thanks for reading, good luck!

FAQs

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.