Are you interested to develop loan management software?

Well, in this competitive fintech technology world, it is important to include the software that will help you enhance your operations, create great audiences, and build great networks with them.

To proceed with the same, you require a complete guide, right?

Well, we have done it for you. Here is a guide that includes concepts, benefits, types, steps, monetization framework, and much more.

Let’s find them all, together.

About Loan Management Software & Their Statistics

Management software is a type of software that is used to manage and automate business procedures.

It provides access to the right information to the right people and that too within the right time frame.

This is a category of diversified tools that are useful for streamlining different management tasks such as team collaboration, and project management.

Now, let’s come to learn loan management software.

The use of loan management software helps banks, captives, credit unions, as well as lenders streamline the management of all the loan-lending procedures.

This further enables the lenders to seamlessly manage the loan lifecycle.

Through loan servicing software, lenders can enhance revenue, and customer satisfaction, simplifying portfolio management, for reducing operating expenses.

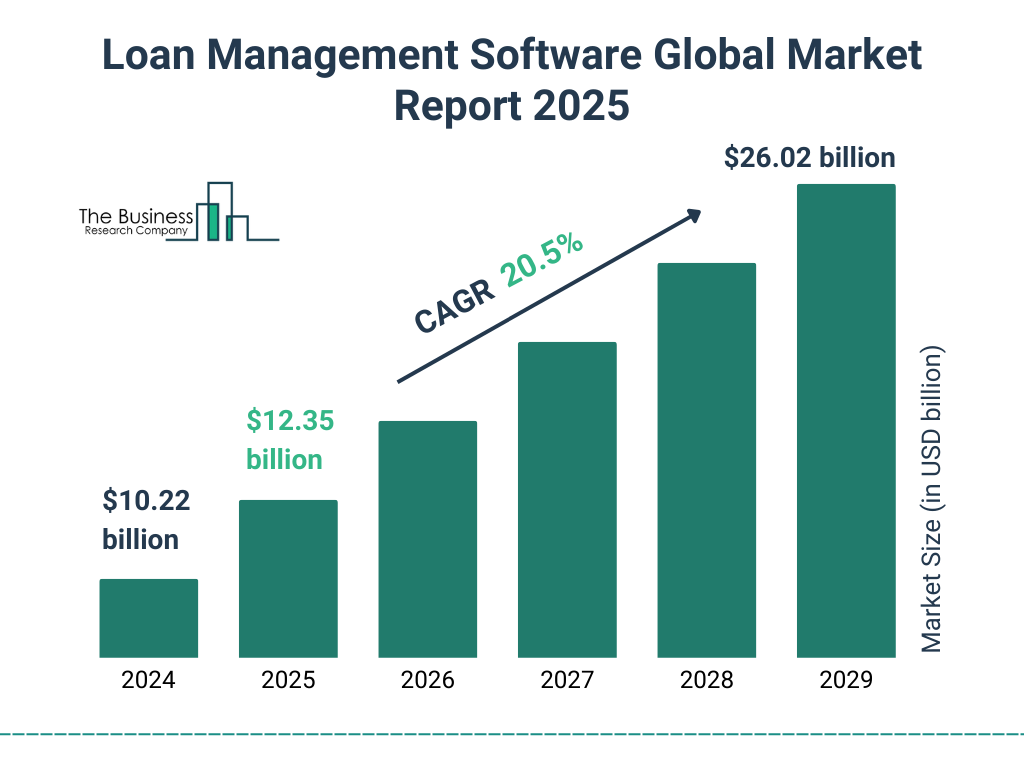

The global loan management software market is valued at $5.9 billion in the year 2021, which is projected to reach $29.9 billion by the year 2031, and is growing at a CAGR of 17.8% from the year 2022 to 2031.

Loan management software market size has grown from $10.22 billion in the year 2024 to $12.35 billion in the year 2025 that too at a compound annual growth rate (CAGR) of 20.8%.

The global commercial loan software market is valued at USD 7.6 billion in the year 2024, which is further projected to grow at a CAGR of 9.7% that too between the years 2025 and 2034.

Are you ready to proceed with loan management software development?

Well, you should ensure the benefits of the loan management software, to learn more about the same, in the following section.

Benefits of Loan Management Software

What are the benefits of loan management software?

Let’s learn them all below.

► Integration Capabilities

The seamless integration is no longer a luxury, instead, it’s a necessity. Additionally, it must connect effortlessly with other systems for optimizing data consistency, and workflows.

Through integrating with underwriting and decision-making systems, lenders can automate credit evaluations to ensure the consistent application of lending criteria.

► Scalability and Customization

The financial needs evolve over time and are the crucial features that allow the loan management software to adapt to the changing demands.

With the scalable systems, the app can handle increasing loan volumes without facing any performance errors.

The customizable software enables the institutions to define any specific workflows, product offerings, and lending criteria.

► Reduces Operating Costs

With the implementation of loan-management software, businesses can reduce overall operating costs while growing the business.

This helps to make substantial savings across both ways including COGS and OPEX.

Through modern loan management systems, businesses can streamline processes, and may accelerate the application through applying automated decision-making.

► Minimizes the Time and Efforts

One of the crucial benefits of using a loan origination system is that it can reduce the time and effort that are required for processing loan applications.

With the help of loan management systems, you can automate many of the manual processes that are involved in the loan origination process.

Here lenders can process the loan applications more efficiently and quickly.

► Ensure Regular Updates and Compliance Maintenance

You should ensure in a business that your loan management software is regularly updated with the latest security features, along with compliance tools that help to keep up with the regulatory changes.

Through regular maintenance and updates, you can prevent system glitches, enhance security, and ensure that it streamlines the overall operations of the apps.

Considering these points, you can step ahead with developing loan management software.

Now, when you proceed to create a loan management software, it’s significant to observe different types of loans along with their management software.

Let’s evaluate them all in the following section.

Types of Loans & Their Management Software

Within the industry of loan management software, it’s important to evaluate various types of loans with which you can successfully reach the potential audience.

Here is the list of different loan management software to be considered.

♦ Lendio

Lendio is an amazing loan management software that is focused on catering to the needs of both borrowers and lenders.

The software offers a user-friendly interface with advanced analytics, as well as reporting tools.

♦ CloudBankin

CloudBankin is a detailed lending platform that exists for streamlining the loan disbursement procedure.

Along with this, the system specializes in offering automated solutions along with versatile workflow management.

♦ AllCloud Loan Management System

AllCloud specializes in building fintech solutions to enhance operational efficiency in institutions.

The platform was originally developed as a Software-as-a-service (SaaS) for vehicle loan services.

♦ Blend

Blend is well known for its seamless integration with diversified financial institutions and its ability to handle complicated lending scenarios.

The platform is an intuitive interface that allows lenders to manage loans with smooth operations procedures.

♦ Turnkey Lender

The Turnkey Lender is an all-in-one lending automation platform that caters to both traditional and alternative lenders.

It is a powerful software that uses machine learning algorithms to assess creditworthiness for streamlining the underwriting process.

♦ Cloud Lending Solutions

The platform offers diversified solutions for end-to-end lending operations. It’s a modular architecture that helps lenders select any specific functionalities that are based on their requirements.

This platform provides automated workflows and real-time data access.

After evaluating the loan management software types, let’s assess the diversified steps to make a loan management software.

Steps to Develop a Loan Management Software

How to build loan management software?

Let’s follow the following steps to build a loan management software.

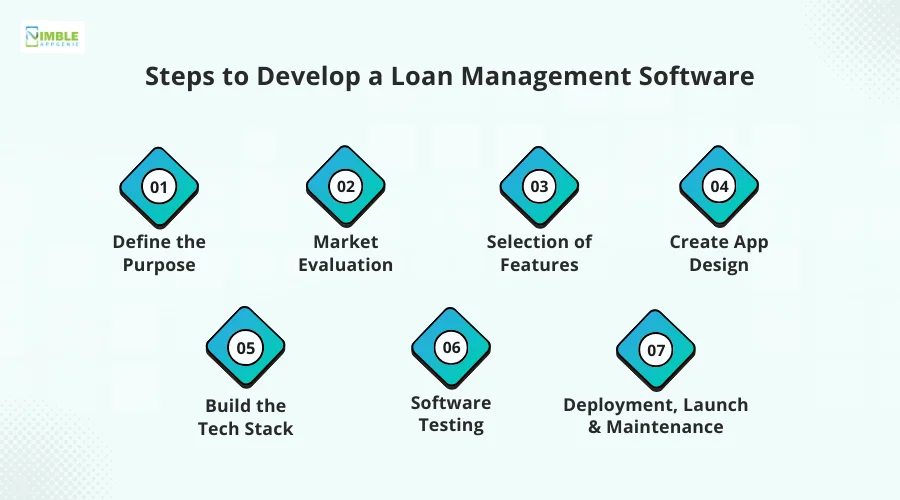

Step 1: Define the Purpose

Is your purpose of building a loan management software clear?

You should define the purpose of developing a loan management software by mapping out the measurable goals that might align with the business vision as well as user requirements.

Here they can clear the objectives from the very start which can help to keep the complete project on track.

These apps provide users with a convenient way to access complete information, entertainment, and services.

Step 2: Market Evaluation

To develop a loan app, or create a loan-management software, learning about the market is a crucial component.

You should consider the market evaluation, through which you can identify the users’ needs and preferences.

Market research is all about identifying and assessing the market’s potential opportunities along with the market dynamics.

The phase includes studying the behaviors of the target audience, and competitors, along with analyzing the diversified market dynamics.

Step 3: Selection of Features

Now you need to select the types of features that will address the project goals and objectives. This will focus on integrating the diversified functionalities that you want to serve the users.

However, you should note that the loan lending app features can blend consumer behavior along with economic trends to achieve the project’s aim.

You should identify that the features should serve the purpose of creating it such as automation, security, compliance, and scalability.

Step 4: Create App Design

The next step is to build an overall UI/UX app design that can cater to the needs of the project. The design should be simple and attractive depending on the type of audience.

An attractive and engaging design should be capable of entertaining the users as well as addressing their concerning issues with the app.

Additionally, you should create a wireframe and prototype while building loan management software. This is all about building the visual representation of the loan-lending management.

Step 5: Build the Tech Stack

The back-end software development is the selection of programming languages, databases, and cloud databases that are suitable for creating the software.

Here the technologies can be machine learning for credit scoring, and robotic process automation for considering the repetitive tasks can be included in the software.

You can discover a mobile app tech stack that is suitable for managing and creating the software.

These technologies that can be included are JavaScript, Python, MongoDB, and Apache (for servers).

Through a loan management system, you can manage the entire loan lifecycle from the origination to servicing and closure.

Step 6: Software Testing

If your loan management software isn’t bug-free, then it’s the right time to consider it. You should opt for top testing tools and techniques for verifying the software product as well as applications.

The testing is all about unit testing, integration testing, system testing, usability testing, stress testing, alpha testing, and regression testing.

You can find, evaluate, and mitigate the bugs and errors within the loan management software through effective tools.

Step 7: Deployment, Launch and Maintenance

Now, you can deploy the software and proceed with the launch.

After launch, the tasks don’t end here. It’s essential to continue with the mobile app maintenance services, effectively.

Here maintenance services are all about bug tracking, as well as, debugging, to ensure smooth app performance.

These were all the crucial steps to follow while creating a loan management software. This is an important criterion to discuss here after the software launch.

Now, after discussing the steps, let’s get ahead with the technology stack in the following section.

Best Tech Stack for Loan Management Software

If you want to build the best loan lending apps, identifying suitable technology is crucial.

You can select the suitable loan lending app tech stack, only after identifying the fundamentals.

Let’s consider the following table for more information.

| Tech Stack | Brief |

| Front-end Technology | HTML, CSS, and JavaScript |

| Back-end | Reactjs, Angular, Vuejs |

| Database | MongoDB, PostgreSQL |

| Security | JWT, SSL/TLS |

| Middleware | Kafka or RabbitMQ, middleware |

Considering this tech stack, you can proceed with creating the loan management software.

Now, let’s proceed with the resources to include in it in the following section.

Cost to Develop Loan Management Software

What’s the cost to build a loan lending app?

Well, there is a difference between the software and app development. However, you can select the cost depending on the various factors.

On average the cost to create a loan management software can vary from $15,000 to $200,000.

Here this cost can vary depending on the complexity of the app, design, technology stack, team of developers, security cost, maintenance cost, and features of the app.

Now, let’s discover the time to build the loan management software below.

How Much Time Does it Take to Create a Loan Management Software?

The cost, and time required to make a loan management software has a large impact.

Let’s learn them all in the given table.

| App Development Process | Time-Required |

| Conceptualization | 1 – 2 Months |

| Features Selection | 1 – 2 Months |

| Design | 1 – 2 Months |

| Technology Stack | 2– 3 Months |

| Testing | 1 – 2 Months |

| Deployment and Maintenance | 1 – 2 Months |

| Total Time Required | 7- 13 Months |

You can undertake this time to build a loan management software. Furthermore, there are certain challenges that your software might face.

Let’s learn them all below.

Challenges in Loan Management Software Development & Their Solutions

When you step ahead to build a loan management software, there will be certain issues that might come forward.

With identifying the mistakes to avoid while developing a loan lending app, you can overcome the issues faced in such a scenario.

Let’s examine them all below.

➤ Data Security Complexity

Is your software capable of protecting sensitive data?

Well, protecting sensitive customer data is paramount, and any breach could result in severe financial and reputation damage.

Avoiding data security can cause issues such as a lack of trust among the users related to the brand.

This further results in allowing access to the third-party of the users’ data. Thus, it is an important concern to be considered.

➤ Third-Party Integration Complexity

Can your loan management software is capable to be integrated with other devices?

If not, then this can be a serious concern to be noted. Avoiding this can impact the overall competitive journey of your management software.

Third-party integration often impacts network access, which can potentially introduce vulnerabilities. This can include unauthorized access, as well as malware infections.

➤ Compliance and Regulation Risks

Loan management software can be prone to compliance and regulations risks due to falling within the financial sector.

If your software is not according to the current regulations of the state or country, it can impact the complete management software.

This automates compliance procedures and might lead to reducing the risk of non-compliance and improving risk management.

Thus, identifying effective compliance and regulations risks is useful and essential.

➤ Insufficient Customization

Each lending business has a unique operational procedure and needs. Is your loan management software efficient in providing customized solutions?

If not, this can provide an opportunity for the competitors to take over the market. The poor level of customization can raise the issues of operations and even result in a lack of security protocols.

Avoiding customization can further affect the overall functionality of the app and even the complete user interaction.

➤ Cyberthreat Challenges

Your loan-management software might face the challenge of cyber threats. There can be malicious code that might designed to harm the computer and steal the data.

This further can be comprised of everything from viruses and worms to spyware and trojan horses.

Other than malicious code, hidden trackers can be defined as pieces of code that are embedded in third-party apps and can track a business’s online activity.

This further can comprise browsing history, social media activity, and location data.

This challenge can impact the operations and even the user’s data. Thus, you require effective security tools and techniques to overcome such an issue.

You can overcome such errors by implementing effective practices.

Till now, we have discussed the concept of loan management software, its statistics, benefits, types, steps, tech stack, cost, and challenges.

Now, it’s time to discuss the process to make money.

Let’s evaluate it in the given section.

How Loan Management Software Companies Make Money?

When it comes to “how money lending apps make money?” It is important to evaluate the particular strategies.

Because investing is all about the costs, then let’s identify the strategies for earning money.

Well, let’s discuss them all here.

• Advertising

One of the prominent strategies that you can proceed with is advertising, where you can connect with third-party companies and provide them space to promote their products and services.

This revenue can be regular and can help you produce a great amount of money. Through advertising, you can build great networks with the brands.

• Late Interests Fee

When you provide loans to individuals, and they can’t pay it on time, you might charge a late fee from them.

This can become a permanent source of income for your loan-management software.

Here you can ask the users for the late fee or interest that is to be charged for the delayed payment or non-payment scenarios.

• Subscription Plan

Another useful framework that you can include within the loan management software is a subscription plan.

Here you can present different pricing sizes in front of the users and can ask them for the one to subscribe as per their convenience.

A subscription plan can be a permanent source of earning revenue as it is a recurring fee that will be generated for the users to pay. It can be weekly, monthly, or even annually.

These were some of the effective monetization strategies to cover when you get confused about earning money through proceeding to build a loan management software.

How Nimble AppGenie Can Help You Develop a Loan Management Software?

Are you searching for a leading development company to create your loan management software?

Nimble AppGenie is here to assist you with the process beginning from market analysis, to launch.

Our team is ready to provide you with all the help in this scenario. We can convert your dream app into reality and can help you to lead the industry.

We are the leading Loan Lending App Development Company, who have expertise in creating efficient and user-friendly software too.

Conclusion

In the competitive environment, it is important to proceed with the loan management software, that can provide maximum height to your business.

You can begin with identifying the purpose of creating it, market evaluation, and then launch it in the market with the assistance of a leading developers team.

There are several loan-management software types that you can adopt such as Lendio, CloudBankin, AllCloud Loan Management System, Blend, and cloud-lending solutions. Other than this, you can determine the cost to make it after analyzing different factors such as complexity, design, technology stack, and team of developers.

Furthermore, to earn money, you can continue with strategies such as advertising, subscription plans, and late interest fees. Connecting with the leading development team can be helpful.

FAQs

You can create loan management system by following a series of steps as briefed below.

- Conduct Market Evaluation: You can conduct research to examine whether your idea is suitable to sustain in the market, or not.

- Selection of Features: You need to select the types of features that support loan types.

- Design the Software: You can visualize the software in this step.

- Build the Tech Stack: Now, you should select the technologies that might include programming languages, databases as well as cloud networks supporting the features.

- Testing: Well, it’s time to conduct testing by identifying bugs and reducing them via effective measures.

- Deployment and Launch: You can deploy the software and may launch it as per your project goals.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.