When people face the challenge of financial strain, they search for apps that can help them with the loan or related banking process.

This creates a market for lending apps and similar banking apps. If you are an entrepreneur and want to evaluate the current market, then it’s the right time to tap such an audience.

Are you ready to begin with the LendingClub app? Why so?

Well, the app has created a unique image in the competitive loan lending world and there are many other factors that you will learn here.

Then, the question arises “How to develop an app like LendingClub?”

We will all learn it here. Are you ready to begin?

What is LendingClub? Key Statistics and Insights

Let’s begin with the concept of LendingClub.

LendingClub bank is an app that is a full-spectrum financial technology (fintech) marketplace bank and the first public US neobank.

It is built on a belief that offers creative solutions, with innovative value and defines a better experience.

The app allows the customers to manage all the transactions that would be handled via traditional banks.

The commitment of the app results in delivering world-class experiences, that are committed to making borrowing, as well as saving simple and easy for everyone.

If you want to evaluate what exactly the LendingClub app does, then it offers consumer and commercial loan products for each credit bracket and offers a full suite of deposit products that are designed to assist users in keeping more of the money they earn, and even assist to earn more on what they keep.

Well, without examining the stats, you cannot imagine entering the industry, right?

Then, here are a certain number of banking app stats to follow.

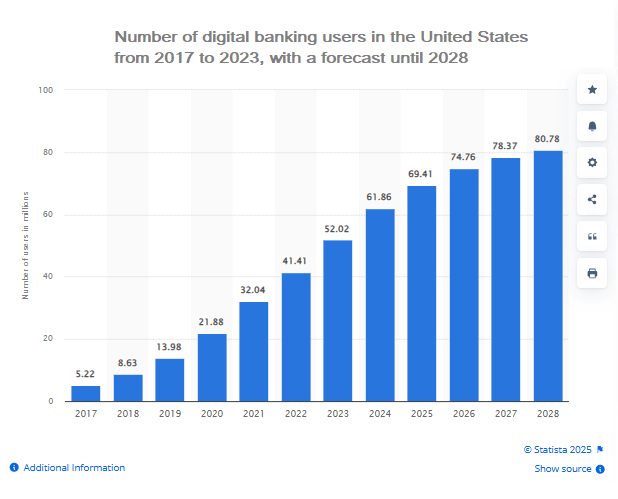

- The estimated number of digital banking users in the U.S. has increased between 2017 and 2023,exceeding 52 million by the year 2023. Additionally, it is further expected to reach 80 million by the year 2028.

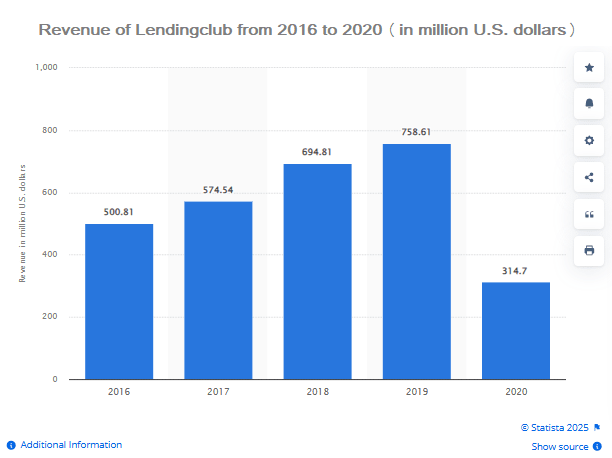

- The revenue of LendingClub with headquarters in the United States amounted to 314.7 million U.S. dollars in the year 2020. Here the reported fiscal year ends on December 31.

- Since 2007, there have been more than 5+ million members who have joined the Club app to reach their financial goals.

Well, do you get a brief on LendingClub app statistics, additionally to make your app trendy, learning about the top loan lending app trends in 2025 can be useful?

Now, let’s examine certain reasons that make the LendingClub app popular.

Why is the LendingClub App Popular Among Users?

When you enter the industry of banking, it’s important to consider the reasons to build an app.

Let’s evaluate it all in this section.

► Connects Lenders and Borrowers

In the banking industry, you can bring a revolution after creating a platform that will connect lenders and borrowers.

Creating a peer-to-peer loan lending app is a great opportunity that assists in connecting borrowers as well as lenders.

Along with this, here businesses can make a lot of money from interest, fees, as well as other services.

► Enhances Customer Value

A well-built mobile application can offer a personalized banking experience for streaming daily banking activities to enhance user’s convenience.

The mobile banking apps provide the users with a view of their financial well-being and provide them with the connected tools for managing their financial well-being and tracking progress towards their goals.

► Offers Easy Access

Here the users can securely sign in with the fingerprint or face recognition. Thus, it assists the users in making instant transactions.

Additionally, LendingClub is a simple as well as transparent online application procedure that strengthens the borrowers to access funds and lenders to evaluate the credit score of the borrowers for availing the funds.

► 24*7 Credit Monitoring

One of the important features of the LendingClub app that makes it popular among users is 24*7 credit monitoring.

Here the users can sign up for timely alerts whenever the credit report changes.

This will assist the users in monitoring their bank accounts and loans all in one place. Here, users can personalize their loans, by changing due dates and making payments.

Additionally, they can grow their money by making deposits from the phone.

► Earning Revenue

Another significant attribute to earn revenue here is making credit more affordable and investing more rewarding.

The app offers various rewards and discounts to users when they use the app to manage their finances.

This further asks the users to be members of the business through unlocking exclusive rewards, discounts, and products.

► Competitive Rates and Flexible Terms

Through offering competitive rates and flexible terms, LendingClub is a platform that empowers customers to achieve their overall financial goals with simple techniques.

Additionally, LendingClub assesses the applicant’s risks in applying for the loans and assists the investors directly to connect with the individuals.

Till now, we have examined the concept and market stats of the LendingClub app, along with its popularity in the sector.

Now, let’s evaluate how this app works because to make a LendingClub app, you should know its complete working procedure.

The following section can help here.

How Does the LendingClub App Work?

You can check out the following steps to identify the working procedure of how a LendingClub app works.

If you want to build the best loan lending app, it’s important that you consider their working processes.

Let’s begin with the stepwise process here.

1. Installation and Registration

Here the user installs the app and registers for the banking process. It’s all about mentioning all the details related to names, linking bank accounts, authentication processes, and all the essential details that make a customized profile of the users in the app.

2. Application For Loan

Users can apply for loans and include all the information related to credit, employment, and income.

This step is all about applying for a loan and gaining a rate check that will further not impact the complete credit score.

3. Select a Loan Offer

Now, users can evaluate the present loan offers and may select the one that suits their interest-paying rates capability and fulfills all preferences of the lenders.

Here the users should specify the types of loans, before applying for one.

4. Complete the Application Process

Well, here the user needs to complete the overall application procedure, after confirming the application process.

This will assist them to get instant loans. Additionally, they can manage the overall financial process smoothly.

5. Waiting For Approval

This is the final step, where the users should wait to complete the process to avail of the loan.

In this manner, the LendingClub app works effectively. Along with this, the user (Borrower) needs to pay for interest as detailed by the lender.

These were the procedures that started the working process of an app like LendingClub. Now, to make an app like LendingClub, let’s focus on the significant features and learn them all.

Are you ready to proceed?

Key Features of the LendingClub App

When you decide to create an app like Lending Club, it’s important to identify the different types of features that the app adopts or implements.

Let’s examine the loan lending app features here.

♦ User’s Registration

After installing the app, the users can register their details within the same.

This can help learn about the users and then can be effective in connecting them and then providing them with related advice or recommendations.

Here, you need to provide the users with a customized and simple interface that can help them to perform user registration.

♦ Security

App security is all about providing the process of developing, adding, and testing the multiple security features within the applications to prevent the security vulnerabilities against any threat such as unauthorized access as well as modification.

Enable the developers to manage the overall security for the application-level tasks. This further assists the users to trust the brand and defend against cyber threats.

♦ Manage Accounts

The users can manage their accounts by checking the balance and viewing the account history and statements.

Additionally, the app offers a secure and convenient medium for managing loans, and making it simple for businesses to track their online payments, review loan details, and access necessary documents easily.

♦ Payments and Transfers

Users can make internal account transfers with this feature. It will be useful for the users to simply access accounts.

While performing the transactions, the users can receive a confirmation email. This will further assist them to promote wire transfers and conduct further transactions.

♦ Push Notifications

Push notifications are a powerful tool within the LendingClub app. Where the users can get instant notifications and real-time messages that are further sent directly to the user’s mobile device via a banking application.

This feature is one of the instant and important aspects where the users can successfully get effective data related to lending or managing money.

♦ Money Management

One of the important features of the LendingClub App is managing all the respective finances.

This further assists the users in evaluating the current money transactions and simplifies the account management process.

The users can take loans, pay debts, pay interest, and much more via managing their accounts within an app like LendingClub.

♦ QR Code Payments

The users can find access to merchant payments via a QR code with the app. This further assists those to consider an improvement in security along with the authentication feature.

This feature enables the users to simply make payments and that too combines the two security methods including biometric authentication and tokenization.

♦ Chatbots

Chatbots are a feature that helps in resolving the issues among the users without even interacting with humans.

Here you can implement the latest technologies in chatbots such as AI to provide assistance to solve banking-related issues of the users.

This helps the users to attain solutions 24*7 even without consulting their issues with the human.

Additionally, the users are willing to evaluate important details via chats that help them to operate banking features. AI in loan lending apps enhances the operations.

♦ Lending and Borrowing Money

LendingClub offers an advanced way to lend and borrow money via the app. It is the first neobank in the United States that further helps users process money lending and borrowing.

This is a basic feature of the LendingClub app that helps users borrow money or lend money without the interruption of any third party.

It provides a platform to connect the borrower and the lender, securely.

♦ Loan Calculator

The feature of the loan calculator is useful to provide them a details of processing loans without putting a manual way to calculate interest and payment period.

This feature is useful for the app to enable users to calculate loans and related interest easily.

After understanding the features to include in creating an app like LendingClub, let’s move ahead to the steps of developing it.

The following section can be useful here.

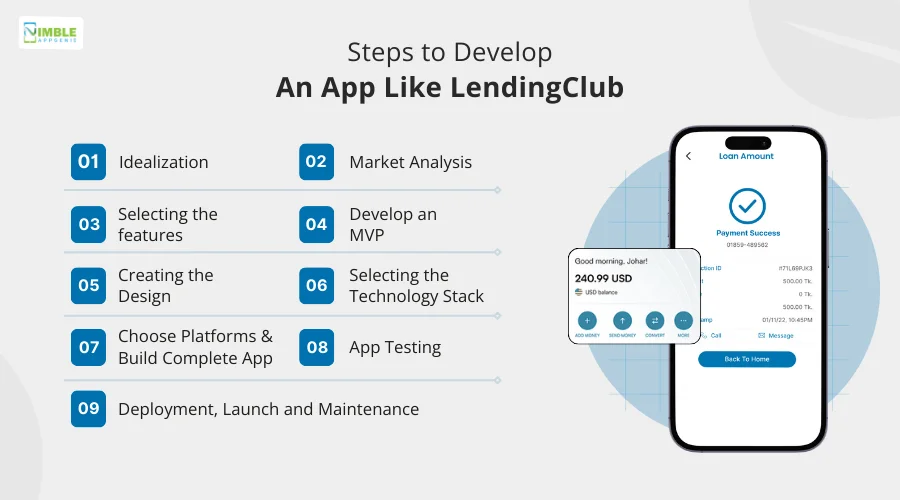

Steps to Develop an App Like LendingClub

How to develop a loan lending app?

Here are different steps to evaluate the development of an app like LendingClub.

Step 1: Idealization

Here the entrepreneurs are required to idealize the complete app and the reason to launch it within the competitive market. This first step is all about mobile app idea development.

It is the mental process under which the person exaggerates the positive qualities to minimize the risks. This will further help you to plan the complete project.

Step 2: Market Analysis

Now, you should analyze the market after conducting the interview process, and other details that will assist you to know the audience successfully.

Within the market research, you can be able to enhance the overall project by understanding the competitors and how they are performing in the market or attracting the respective audiences.

Step 3: Selecting the Features

You need to select the number of features that will enhance the importance of your app in the competitive market.

Here the features can be lending and borrowing money, loan calculator, money management, QR codes, managing accounts, and push notifications.

Step 4: Develop an MVP

Now, you should build an MVP (Minimum Valuable Product) which is all about launching the version of an app with all the essential features.

This step will assist you in evaluating the need for your app idea in the competitive market. It will further help to collect the feedback of the users and then use it to enhance the overall functionalities of your project.

Step 5: Creating the Design

You need to develop the UI/UX app design by adding effective features and enhancing attractiveness to gain the target user’s attention.

The Loan lending app design should be engaging. This further includes the creation of a wireframe and portfolio of an app.

It will assist you to visualize the complete app to attain the goal of the project.

Step 6: Selecting the Technology Stack

You should select the mobile app technology stack for your app that will enable you to develop the back-end infrastructure.

Here the back-end infrastructure is all about adding the technologies and data sets as for the backend, you might need Node.js, Ruby on Rails, and Spring Boot.

Additionally, you need to evaluate the type of database required for the back-end process.

The database comprises PostgreSQL, MySQL, and MongoDB, depending on the type and features of an app.

Step 7: Choose Platforms and Build the Complete App

When you start to create an app like LendingClub, it’s important to select the number of platforms to launch your project.

Here the platforms can be Android, iOS, and Hybrid. Thus, selecting the number of platforms will impact the overall development process.

Now, it’s time to combine all the steps and then build an app of your choice.

Step 8: App Testing

After the development of the app, going for the launch is not a wise decision.

You should ask the developers to state and identify the number of errors or bugs that might lead to app crashes or further impact the operations of the app.

Thus, with the help of updated testing tools, you need to conduct a mobile app testing process.

Here the testing will include security testing, functionality testing, performance testing, usability testing, localization testing, and automated testing.

Step 9: Deployment, Launch and Maintenance

Here, it’s time to deploy the app over the selected platform and then opt for launch. You should launch the app on the pre-defined date to avoid undertaking of market by any other competitor.

When it comes to mobile app maintenance services, you need to adopt this step for bug tracking, and debugging, as well as for ensuring smooth app performance.

Thus, these are some of the important steps to undertake when you start to build an app like LendingClub.

After evaluating the steps, you should analyze crucial technologies. Do you want to study the technologies in detail?

Well, let’s figure it out in the next section.

Technology Stack Used in the LendingClub App

The loan lending app tech stack should include the types of techniques as well as tools that might further help you select the right methods to create an app like LendingClub.

Let’s study the tech stack that can be used here, below.

| Technology Stack | Types of Technologies |

| Front-End | Angular, React, Vue.js |

| Back-End | Ruby on Rails, Node.js, and Django |

| Cloud Infrastructure | Google Cloud, AWS, Azure |

| Payment Gateway | PayPal, RazorPay, Square |

| Data Processing | Apache Kafka, Hadoop, and Apache Spark |

| Security | Encryption, Two-Factor Authentication |

This tech stack will depend on different aspects such as factors, features, and the trend of technologies in apps like LendingClub.

After evaluating the technology stack, you can proceed with the steps to make an app like LendingClub.

However, there can be a series of challenges that your app might face.

Let’s evaluate them all in the following section.

Challenges in Developing an App Like LendingClub and Their Solutions

What are the mistakes to avoid while creating a loan lending app?

When you start building the app of your dreams, there can be chances that you might stuck with the app development process.

Let’s discover the types of challenges or issues you can face while building an app like LendingClub.

➤ Security Challenges

Your app might face the challenge of security. How? Well, a lack of data security results in losing the trust of the individuals over the brand and business.

These challenges further lead to breaches of data and violations of data privacy, which have become common in the digital age.

➤ Poor Market Research

If you are avoiding the market evaluation for your app then it can result in creating an app that will be without any effective market valuation.

Ignoring market research is also an avoidance of the target audience. Thus, a poor market analysis will further impact the app’s performance and its sustainability among the competitors.

➤ Unattractive App Design

If your app doesn’t have an attractive app design, well then it can impact the user’s retention rate. This can further impact the complete performance of the app.

A poor app design will impact the navigation process and users may find it difficult to operate the software successfully.

➤ Regulatory Compliances

Another specific determinant that might be impactful here is regulatory compliance. Which consequences can be financial penalties, legal actions, along reputational damages.

This challenge can further impact the overall application and its functionality.

The regulatory challenges further result in complexities and difficulties that the organizations face while navigating the legal as well as compliance frameworks.

➤ Financial Literacy

The challenge of spreading knowledge and learning to use an app like LendingClub can be one of the important determinants that can impact the process of building your dream app.

Thus, providing and spreading literacy is one of the challenges that can affect knowledge while using an app like LendingClub.

Confused about how to mitigate the challenges?

Well, for more, you can concert with the expert team to avoid such challenges.

Now, as we proceed further, let’s evaluate the costs and their related factors because without evaluating the right resources, you cannot achieve success in creating the app of your dreams and achieving the destined project goal.

Are you ready to evaluate the resources?

Then the following section is for you.

Cost to Develop an App Like LendingClub

What’s the cost to build Loan Lending App?

The average cost to develop an app like LendingClub ranges vary from $20,000 to $150,000. Depending on various determinants or factors such as the complexity of an app, design, technology stack, and others.

You can evaluate all these factors here.

1. Size and Complexity of an App

The large size of an app will include the implementation of many features that will result in increasing the cost to build an app like LendingClub.

The cost can vary from $1000 to $5000, depending on the type of features such as including AI and ML in the app can lead to complexity and might raise the cost to build it.

2. App Design

The app design cost will further impact the overall cost, well selecting the type of design that will comprise color, typography, and theme can affect the complete cost.

Here the app design cost can vary from $3000 to $8000 depending on the type of features, the nature, and various other determinants.

3. Tech Stack

Now, you should identify and evaluate the type of technologies. Updating the technologies or using the updated version of the technologies can affect the overall cost to build an app like LendingClub.

The cost to build a tech stack here can vary from $5000 to $15,000 depending on the type of features and complexity of technologies.

4. Choose Effective Platforms

You need to select the right number of platforms depending on the type of audience you want to reach. Here, the cost to build an app for Android, iOS, or Hybrid will impact the choice of platforms.

Under this factor, the cost can vary from $10,000 to $20,000. You need to select the type of platforms or buy licenses depending on the audience to target.

5. Security and Maintenance Cost

The mobile app security and maintenance cost is 15%-20% depending on the total cost to make an app like LendingClub.

This cost will further comprise the types of tools used for enhancing the complete security of an app and even to maintain it closely. Here the cost can vary from $3000 to $15,000.

6. Team of Developers

Another important and specific factor that shouldn’t be avoided is the team of developers. The cost to hire developers should be evaluated here.

You should hire mobile app developers based on two factors, including skills and location.

If you hire a team of experts from Asia, it can cost you from $15,000 to $200,000. While for the United States, UK, or Middle Europe it can go up to $1000,000 or more.

These are some of the attributes that you need to evaluate before estimating the complete cost to build an app like LendingClub.

Now, as we proceed further, along with identifying the cost, it’s vital to make money. Without including the money-making strategies, you cannot achieve success in the market.

Then, let’s proceed with the money-making strategies in the following section.

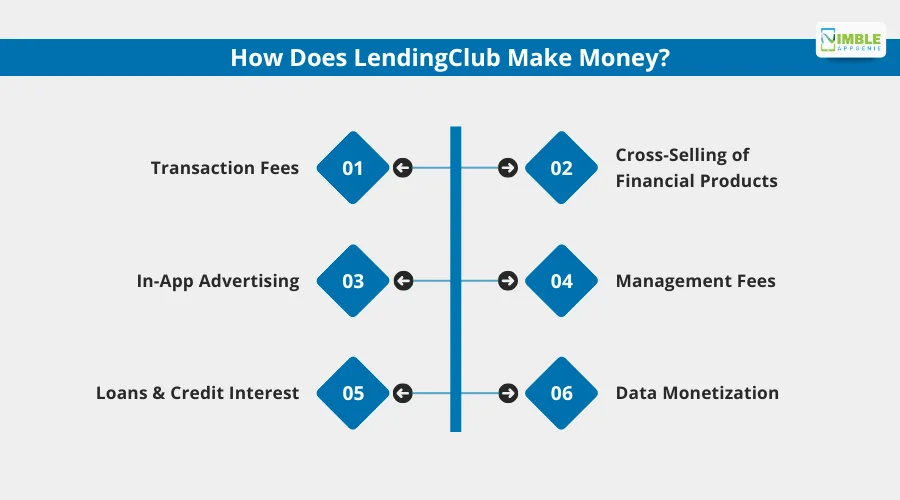

How Does LendingClub Make Money?

You should evaluate the money-making procedure by including effective mobile app monetization strategies.

Here is a list of strategies related to how a loan lending app makes money.

• Transaction Fees

One of the significant attributes here is transaction fees. An app like LendingClub earns money by providing a platform to lenders and borrowers.

Thus, via this pattern, you can earn a commission.

• Cross-Selling of Financial Products

You can cross-sell the financial products to earn a significant amount. This will be useful in engaging the users and then retaining them in the long run.

It can help you to earn an extra income via the app.

• In-App Advertising

With this strategy, you can connect with third-party apps or businesses to promote their products and services via your app.

It will assist you to earn a permanent source of income. These ads serve as a network to connect businesses and users.

• Management Fees

Management fees can be your permanent income here. This fee can be earned for managing the transactions and other financial elements effectively via the app.

Thus, here you can earn money from the banks and the customers by providing them the convenience of managing the accounts, securely.

• Loans and Credit Interest

Within the banking apps or loan lending apps, earning interest from the borrowers can be a regular set of income.

You can have a commission-based model here on the interest rates that might comprise transaction fees.

• Data Monetization

As per the name of the strategy, data monetization is all about monetizing the user’s data. This is all related to earning income from the app through using the data.

All you need is to get consent from the users to utilize their data for making money.

Furthermore, connecting with the experienced team of developers can be useful here.

How Nimble AppGenie Can Help You Develop an App Like LendingClub

Are you searching for a trusted team of developers?

Well, connecting with a company such as Nimble AppGenie can be helpful. We are the leading Money Lending App Development Company that provides all the essential advice, makes strategies, and builds your app to lead the competitive market.

Our developers are ready to serve your purpose by building a complete strategy for your app and then successfully molding it to achieve the desired goal for your business.

Conclusion

To create an app like LendingClub, you should know and evaluate the process to build one. This process starts with market analysis and ends on launch.

Additionally, you can include top features within the app such as user registration, app security, push notifications, QR code payments, chatbots, and a loan calculator.

Furthermore, the cost as a resource can impact the development process to create an app like LendingClub.

Here the factors can comprise of complexity and size of the app, design, technology stack, money management, and QR code payments.

If you want to make money via an app, you can include strategies such as in-app advertising, push notifications, cross-selling of financial products, and management fees.

FAQs

To create an app like LendingClub, follow these steps:

- Idealization: Discovering the purpose of the loan lending app is significant. Thus, it’s all about idea formulation.

- Market Analysis: Identifying the market is a specific step where you can evaluate the needs of your app.

- Selection of Features: You should include the types of features in the app based on the type of app.

- Develop an MVP: Create an MVP version of your app that might include all the essential features to attract the target users.

- Create the Design: The Design of an app should be attractive and engaging.

- Build the Tech Stack: The tech stack should be supportive of the features.

- Develop an App: Here you need to complete the steps to build an app.

- Deploy, Launch, and Maintenance: Now, it’s time to launch the app and then opt for maintenance.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.