If you want to lead the loan lending app industry, you need to evaluate the current competition in the sector.

And when it comes to assessing the top apps, Empower Cash Advance leads the list.

Do you want to create an app like Empower Cash Advance?

Well, we got it covered for you.

Let’s examine it all together.

What is Empower Cash Advance? Key Statistics and Insights

Here you can begin by learning about the app.

Empower cash advance app provides surplus cash-related assistance to individuals, who are tired of asking their friends to cover them.

The app will float you anywhere from $10 to $300 when the user requires it the most.

Here the user enjoys zero interest, no late fees, and no credit checks. Here the users can pay the amount back to the business when they find the cash abundant.

Currently, the app has 1 million+ users who are actively using the software.

The app offers advances of up to $300 and doesn’t need any credit check for approval. This app is widely different from the cash advance apps that allow gig economy workers to apply here.

Additionally, the app offers budgeting tools, notifies the users of updates, and helps in credit score monitoring.

Why is the Empower Cash Advance App Popular Among Users?

When you begin to build an app like Empower Cash Advance, it’s significant to proceed with why you are creating it. Let’s evaluate the following reasons closely.

► More than Cash Assistance

The app offers more than cash assistance to the users. It assists the users in tracking their spending, by providing financial advice and offering tips.

It helps the users to assist with all the cash requirements and manage the cash flows.

► Zero Late Fees and No Interests

The Cash Advance app offers zero late fees and does not charge any interest when it comes to repaying the cash within a certain time interval.

This assists the users in taking control of money and paying required bills.

► Offers Tools to Save Money

With the help of the Empower app, users can save more money, budget, track their expenditures, and even monitor their credit scores.

This is a valuable assistance that tends the people to select the Cash Advance app.

► More than $300 Access

The users who pay off money taken up to $300 are further eligible to access the amount of $350 and more.

Additionally, these users are given various other opportunities and additional feature access. This is the major reason that people select the Empower Cash Advance app.

► Financial Management

An app like Wego allows financial management that helps users to enhance their management. It assists the users to automate expense reporting and helps to ensure policy compliance.

These are some of the reasons that you can continue with. Now, let’s proceed with the working process of the app.

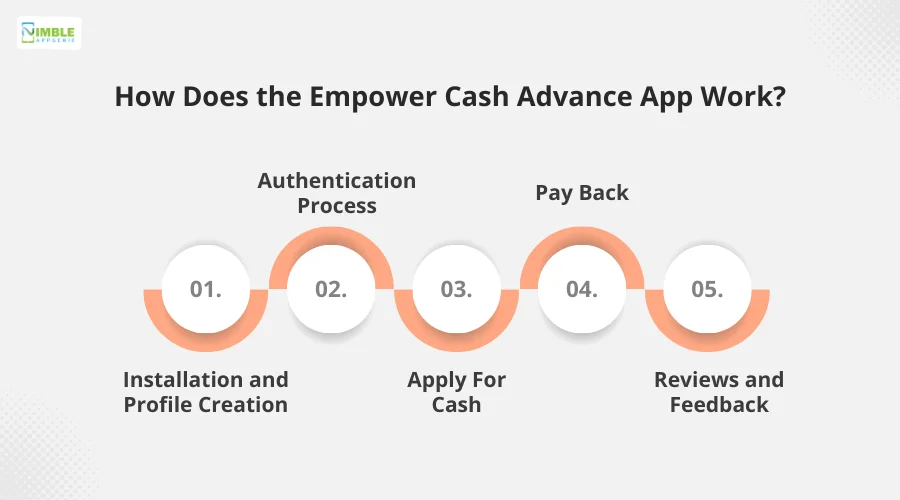

How Does the Empower Cash Advance App Work?

If you want to create an app like Empower Cash Advance, it’s crucial to identify, how the users will follow the instructions and can follow the app.

Let’s figure them all out here.

Step 1: Installation and Profile Creation

Once the app gets installed by the users, they can create a customized profile adding useful details.

This step is all about creating a profile where the users can mention all the required details related to their cash and financial management.

Step 2: Authentication Process

The authentication process is important for both the business person and users. It helps the users to ensure that the app isn’t a fraud and can be trustable.

This further assists the users to trust the business.

Step 3: Apply For Cash

Now, the users can apply for the cash that they want and for which they have installed the app.

This assists them to take cash when they need it the most. Along with this, the app offers zero interests and no credits which makes the app relevant to use.

Step 4: Pay Back

The users can pay back the cash to enjoy further benefits of the app that also contains taking more cash from the app.

Within a defined period, the users need to pay back the cash, which not only maintains the credit benefits for the users but also helps them to enhance the app’s value.

Step 5: Reviews and Feedback

Now, the users can proceed with the reviews and feedback option. Where they can provide reviews based on the usability of the app.

This feedback and reviews can be used to improve the functionality of the app.

These were all the steps to follow when it comes to make an app like Empower Cash Advance.

Now, let’s proceed further with the types of features to include in an app like Empower in the following section.

Key Features of the Empower Cash Advance App

If you want to compete among the best loan lending apps, it’s significant to process with the types of features they include within the same.

What are the top loan lending app features that you can include in an app like Empower?

Let’s discover all these features below.

♦ Loan Management

It is a feature that helps users to manage their loans successfully. The loan tracking feature ensures prominent financial management.

♦ Chatbot

The feature can assist the users in enhancing the overall user experience. With the implementation and use of chatbots, the users can interact even without the presence of human expert support.

♦ Cloud Storage Integration

You may integrate the cloud storage within the app that will further assist you in engaging the target users and saving their data securely over the cloud.

♦ Push Notifications

Push notifications are all about providing updates to the users for loan lending and any crucial information related to payment.

This is one of the significant ways to inform the users. It is a short message that appears as a pop-up on the desktop, and mobile home screen of the device.

♦ Transaction Record

If users want the receipt, it’s important to have past transactions, right? Well, you can check it over the app and even repeat the transactions.

This is a common pattern that you can observe in the maximum loan lending app.

♦ Loan Calculator

Well, here the users need not take out their personal calculator, they can do it within the app. In such a manner, you can successfully figure out your monthly payments over different types of loans.

♦ Convenient Payment Plans

Through convenient payment plans, users can select the option for restricting their monthly payments only to a sum. This helps the users to conveniently pay for the loans.

♦ Online Support

The app has an online help desk which is important to speak to the users and provide them details related to the loans that they have taken.

With the assistance of online support, the users will instantly notify the users about any latest transactions.

♦ Analytics and Reports

The administrators can access the comprehensive reports with detailed analysis which will improve the efficiency of the decisions taken by the users.

♦ Credit Score

The credit score can systematize the loan lending procedure by saving time along by evaluating diversified financial factors.

These are all the important features you can implement while developing an app like Empower Cash Advance.

If are you still confused about the features, then let’s examine the steps to build it, in the given section.

Steps to Develop an App Like Empower Cash Advance

How to create an app like Empower Cash Advance?

To develop a loan lending app, you should consider important steps. Let’s learn them all below.

1. Market Analysis

You can evaluate the current market share and then successfully build an app like Empower Cash Advance.

It’s significant for you to conduct market research, that too for identifying the existing gaps in the market, which your app should address.

Under this, step, you can develop a user persona, which will further assist you in better understanding the users.

It will better assist you in understanding the users by defining the target audience, evaluating the market competition, as well as identifying the practical solutions for the same.

2. Select Prominent Features

Under this step, you should evaluate effective features to include within your app. Here you can select features such as cloud storage integration, credit score, online support, loan calculator, and transaction records.

This is a useful step, where the users can go for features that will be important to consider. Selecting the features can be useful in connecting with the potential audience, and addressing their growing needs.

It’s vital to select the types of features to address the growing needs of the users. This will be helpful to the users.

3. Create App Design

You can create the UI/UX app design by successfully examining the current scenario. It is evident to proceed with the app design that too can comprise consistency, accessibility, navigation, along usability.

Here the UI design is very different from UX Wireframe, and prototyping. Under this parameter, you can deal with the visual representation of the concepts, shapes, buttons, fonts, and images.

Under this step, you test multiple designs to see what works best for the users. Additionally, to get the best results, the users can bear these principles in mind and should place the user at the center.

4. Build the Tech Stack

Under this step, you can build the technology stack according to the features’ design and target audience.

Here a seamless integration is important for minimizing the disruptions, and to gain acceptance from the team.

You should look for technology-related solutions that might complement the existing process and further offer a smooth transition.

Mobile app tech stack can be defined as a combination of programming languages, as well as software products that further can be utilized for creating a web application.

5. Create the Complete App and Platform Selection

You can build the complete app, by combining all the steps and processes. Under this process, you can try to combine the programming languages, tools, and frameworks. To develop the apps.

To build the app, all you can do is combine the processes. It is all about combining the multiple steps that will lead to build the overall app.

Now, you can select the type of platform and can further select the technologies accordingly. This will be effective in delivering the appropriate performance.

6. App Testing

Mobile App testing is all about evaluating the usability, visual appeal, functionality as well as consistency across diversified mobile devices.

This step is about an optimal user experience, irrespective of the device used to access the app. You can test the app by including important tools and techniques for the app.

For app testing, you can ensure an optimal user experience, irrespective of any device used for accessing the app.

7. Deployment, Launch, and Maintenance

It’s important to deploy the app over the selected platforms. Then, you can launch the app over decided platforms.

Now, you should monitor the performance of the app and then needs to examine whether the app can sustain the market or not.

In the current situation, you should go for mobile app maintenance services, to complete the app.

These were all the essential steps required to build an app like Empower Cash Advance. Well, if you want to continue with the app, then learning about the technology stack is important.

Tech Stack Used in the Empower Cash Advance App

Let’s evaluate the technology stack that you can use within your app.

Here’s a table to consider with the Loan lending app tech stack.

| Technology Stack | Brief |

| Frontend | React, Angular, Vue.js |

| Backend | Ruby on Rails, Django, Node.js |

| Database | MySQL, MongoDB, PostgreSQL |

| Authentication | JWT, Firebase, Authentication |

| API Integration | APIs, RESTful, GraphQL |

| Security | Two-Factor Authentication, SSL/TLS |

These were the top technologies to include while building an app like Empower Cash Advance.

To compete in the current scenario, you can include AI in loan lending apps for enhancing the functionality of the apps. Now, as we proceed further, there are two attributes to be included here: cost and time frame.

Let’s consider it all within the following sections.

Cost to Develop an App Like Empower Cash Advance

What’s the cost to develop a loan lending app?

The average cost to develop an app like Empower Cash Advance can be from $20,000 to $150,000. You can go through different factors that might have an impact on the costs.

There are many factors to consider such as complexity, size, app design, technology stack, platform compatibility, along team developers.

Now, let’s evaluate the time factor in the given section.

How Much Time Will it Take to Create an App Like Empower Cash Advance?

How much time will it take to build an app like Empower?

Let’s find that all in the given table.

| App Development Process | Time Frame |

| Planning and Conceptualization | 1-2 Months |

| Selection of Features | 1-2 Months |

| App Design | 1-2 Months |

| Tech Stack | 1-2 Months |

| App Testing | 1-2 Months |

| Deployment and Launch | 1-2 Months |

| Total Time Frame | 6-12 Months |

Now, as we have analyzed the top resources, it’s essential to evaluate the sources of earning income from the heading below.

How Does Empower Cash Advance Make Money?

Under this scenario, you will learn the types of resources to earn money.

Here are the top loan lending app monetization strategies, to follow.

➤ In-App Advertising

In-app advertising can be defined as the practice of displaying paid advertisements, within a mobile app, that helps owners to capitalize the application.

Here you can connect with the third-party companies and can provide them space to display their ads over the platform. This can become a regular source of revenue for your app.

➤ In-App Purchases

In-app purchases can be defined as purchases where the users can make purchases inside an app to unlock additional features as well as functions.

It is the most effective monetization strategy for apps where you can earn a decent amount of income.

➤ Data Monetization

Data monetization is one of the important procedures for using the current data to procure economic benefits.

It is a direct or external data monetization that comprises selling the data to the parties.

This further comprises creating a measurable economic benefit. All you need here is to take consent of the users for utilizing their data.

➤ Subscription Plans

Another significant monetization strategy is subscription plans, where the user can pay a recurring fee to access the content and features.

It is a monthly recurring revenue model to pay a set amount each month in exchange for accessing the product and service.

It assists you build long-term relationships with the customers by offering consistent value to the users.

➤ Late Fee Charge

Although, the loan lending apps don’t charge any interest or fees. Still, there are several reasons to consider this as an income source, one of them is for the users who don’t repay the loan on time.

Thus, this can become a regular income source for the users. It can be one of the important monetization frameworks here.

These are all the important money-making strategies that you can implement while creating an app like Empower Cash Advance.

Along with this, you can connect with an experienced company to discuss all these things.

How Nimble AppGenie Can Help You Develop an App Like Empower Cash Advance

Are you searching for a budget-friendly and experienced company?

Well, Nimble AppGenie is ready to serve you at the most. Our team can cover the market analysis for you and help you with the insights that will be effective for you to make suitable and necessary decisions.

We are the leading Loan Lending App Development Company, focused on delivering authenticity, integrity, and honesty. You can connect with our team to learn more about the same, successfully.

Conclusion

You can develop an app like Empower Cash Advance, by including the steps to build them. Here, you can begin with market analysis, selecting features, creating app design, and building a technology stack that ends on the app’s launch.

Here, you can include multiple features in the app such as loan management, chatbot, push notifications, online support, convenient payment plans, and credit score.Considering these features can be useful in addressing the issues within the app.

Along with this, you can evaluate the technology stack, costs, and prominent monetization strategies.

You can include the monetization strategies within the app such as in-app purchases, in-app advertising, data monetization, late-fee charges, and subscription plans.

FAQs

You can follow the given steps to develop an app like Empower Cash Advance.

- Market Evaluation: You can consider the market evaluation for successfully competing in the market and to know the needs of the users.

- Select Features: It’s important to select the number of features that can improve the overall performance of an app.

- Create App Design: You should develop an app design that will be useful to visualize the app.

- Build Tech Stack: Now, it’s time to build the complete technology stack and select the type of platforms to launch the app.

- App Testing: You should test the app on the fundamental grounds. This is all about adding crucial tools and techniques for testing the app.

- Deployment, Launch and Maintenance: Well, it’s time to deploy over the targeted platforms and then launch the app. You can consider app maintenance as a significant perspective here.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.