Direct lending applications have redefined the way people borrow money. Today, technology has made it possible for people to access funds at the convenience of their fingertips, all thanks to P2P lending apps.

The market for such applications has flourished over the past few years, making it a profitable business for financial institutions and individuals.

Today, hundreds of applications are available in the market, creating room for more such apps as the market grows.

In case you are wondering what these apps are and how you can develop one for your business, this is the post for you! In this one, we will take you through all the steps that you may need to take to create a successful P2P lending app in 2025.

Without further ado, let’s start by understanding P2P lending apps closely, what they are, and what benefits they offer.

What is a P2P Lending App and Why Invest in It?

A P2P or Peer-To-Peer lending application connects borrowers to lenders. What makes a P2P lending application different from traditional lending is that it does not depend on banks and lending institutions to enable digital borrowing.

This means since there are no mandatory middlemen, banking institutions, brokers, etc. the interest rates on borrowing are comparatively lower, making the entire setup more enticing for the user.

Investing in one such application can prove to be a vital decision as the market for such applications is growing exponentially.

The ease of access that it provides to both, individuals looking to lend and individuals looking to borrow is what makes these apps so popular.

The benefits of investing in a P2P lending application are-

► Rapid Growth Potential

The market for P2P lending was valued at USD 246.61 Billion in 2024 and is expected to reach USD 1950.58 Billion by 2032, growing at a CAGR of 29.5% during the forecast period (2025-2032).

Since the market is growing significantly faster, it offers opportunities for rapid growth. Investing in a growing field can be really beneficial in years to come.

► Multiple Revenue Streams

A P2P lending application offers multiple revenue streams. While you have the primary income in the form of interest and commissions that both lenders and borrowers pay, you can utilize your application for more monetization options like advertisements, additional services, etc.

Helping you earn more from your P2P application.

► Wider Business Reach

One of the issues that traditional lending and banking businesses have faced in the past is limited reach. Thanks to a digital application, you can now reach a wider audience, maximizing your area of functioning.

The application offers exponential reach as it is available on a store and can be downloaded in any region the publisher wants.

► Opens New Business Paths

When you step into peer-to-peer lending businesses, you are not only operating with lending but also opening doors to a whole new realm of financial services.

Gradually with time, you can easily associate with other players in the fintech sector to introduce newer services on your application. Many businesses have done it already and it clearly helps!

► Fewer Investments & More Profits

To start a P2P lending business, all you need is a digital platform. There’s no need for physical branches, ATM networks, or anything else.

All you need to do is take care of things that really matter, which is an optimized application and all the compliance and regulations. Once your app is ready, deploy it and your services will be live instantly!

With improved technology right by your side, you can leave a mark by establishing your own P2P lending application.

The best part is that, unlike traditional banking and lending institutions, you need not worry about hiring a loan officer or providing a physical branch, it’s all digital! It is a step in the right direction to invest in a P2P lending application.

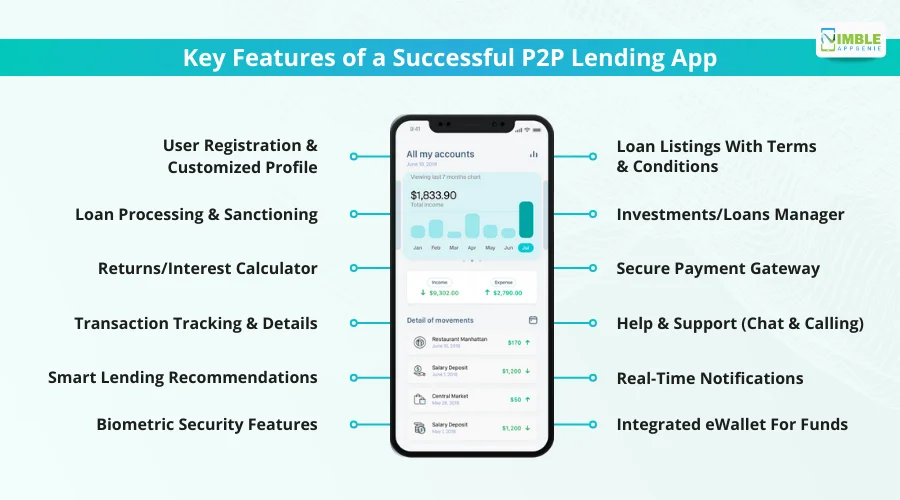

Key Features of a Successful P2P Lending App

Any application becomes popular due to the features that it offers. The same applies to a P2P lending application. You need to understand that the more convenience you offer through your application, the more people use it.

However, since it is not a traditional banking app, many people are confused about loan lending app features.

For your reference, here are a few must-have features of a P2P lending app to make it successful –

♦ User Registration & Customized Profile

Every peer-to-peer application should allow user registration and offer users the ability to customize their profile. There should be different profiles for both borrowers and lenders as they will have different data to access and different tools to manage their profiles.

♦ Loan Listings With Terms & Conditions

This is a vital feature that allows a borrower to search for loans available. Loan listings help in garnering attention of the users. These listings should have an overview that appears in search lost and then must have a dedicated page that offers insights on terms and conditions of the loan.

♦ Loan Processing & Sanctioning

Loan processing and sanctioning are mandatory features for any lending application. These features bring gamification in loan lending apps and help them appear more interactive to the user.

If you are a lender, you should be able to initiate and manage loan processing easily, and being a borrower, you should get crucial information such as an ETA of bank transfer, status of sanction, etc.

♦ Investments/Loans Manager

There should be a proper section in the app that offers management tools for investments and loans for each type of user.

A lender should be able to see a consolidated view of all the funds that they have invested yet, when will they recoup all of it, and how much is going to their profit throughout the time.

Similarly, for borrowers it should show information on how many loans are currently open, what are the repayment dates, when these loans close, etc.

♦ Returns/Interest Calculator

A dedicated calculator that allows borrowers to identify how much interest they have to pay on a particular amount can be a good integration in the app.

On the other hand, a returns calculator, allows the lender to learn what type of profits they will make on lending a certain amount for a certain time at a particular interest rate. This makes the app more interactive and insightful.

♦ Secure Payment Gateway

Any application that involves lending, investments, and transactions must have an integrated payment gateway. This allows users, especially borrowers to pay their outstanding debt directly from the application.

Sure, they can create a recurring payment directly from their account however, in case they want to do it manually at any hour of the day, any day of the week, the payment gateway can be really helpful.

♦ Transaction Tracking & Details

Tracking transactions refers to monitoring the status of any transaction that you have made. In a P2P lending application, this feature is a basic necessity as both borrowers and lenders need to track where their money is.

Not to mention, it also maintains transparency and clarity about the transaction details between two parties to ensure there is no confusion.

♦ Help & Support (Chat & Calling)

People often get restless when they do not get proper support and help in times of distress. In fintech it is one of the biggest reasons why people tend to migrate from one app to another.

Proper help and support, be it via chatbots, or human associates, you must have a dedicated help and support section that is available 24/7.

While these are the key features that every P2P lending application should offer, there are some advanced features that you can opt for when planning to develop a successful lending application. These include –

♦ Smart Lending Recommendations

Lending recommendations to investors can be a game changer. Whenever an individual applies for a loan, there should be a complete background check that runs automatically with AI & ML to let the lender know whether they should clear the loan or not.

These smart recommendations will definitely help in optimizing the lending process.

♦ Real-Time Notifications

Notifications and alerts are definitely a crucial feature for any app, however, by making all these notifications realtime you can enhance the experience of the user to a great extent.

Real-time notifications such as where exactly has your application reached, what is the lender currently doing, has he seen your request, is he actively processing the borrow request, if the lender offline, etc.

♦ Biometric Security Features

Financial transactions and information of any individual are extremely sensitive information.

Hence offering biometric security services such as fingerprint to unlock or facial recognition to access a certain section of the application can take the security of your application to the next level.

♦ Integrated eWallet For Funds

Many people have their trust issue with connecting their bank accounts with a random application.

You can reduce this problem completely with e-wallet development by offering an integrated e-wallet through which people can make their loan repayments easily.

This way their banking details also stay intact and they are able to use the application easily.

With all these features powering your application, you can easily make it to the top of the business and attain the utmost profits.

However, the implementation of features matters a lot, which is also the reason why you should choose the best developers available in the market!

Top P2P Lending Platforms to Know

Success in Peer-to-peer lending is not something that people have not seen before. Several active platforms offering P2P lending services have been thriving in the industry, making new records and reaching new heights every day.

If you are planning to create a successful P2P lending app, there’s no harm in learning about your competition closely.

Here is a quick overview of the top P2P lending platforms-

1. Funding Circle

Based in the UK, Funding Circle is one of the best loan lending apps that offer loan opportunities to small businesses.

It serves as a connecting platform between investors and businesses. This way small businesses can reach out to genuine investors for business loans at flexible rates and terms.

This way, they reduce default risks as they have proper information on the businesses.

2. Prosper Funding

Founded in 2005, Prosper funding has made a great name for itself in the peer-to-peer lending industry.

It offers great flexibility to both lenders and borrowers, allowing investors to offer multiple small loans to different borrowers from the same profile.

What works for Prosper Funding is its community driven approach that helps it create a personal connection with the users.

3. Dave

With its convenient features such as Extra Cash, Checking Account, and Side Hustle, Dave is a short-term lending application that allows borrowers to reach out to the investors in their area.

It is more of a local business that can help small and budding businesses to get funds when in need.

With all these apps making waves in the market, the overall P2P lending has become more accessible for users.

While you might not have the first mover advantage in the field due to existing competitors, these apps open doors for new apps like yours.

Think about it, one of the core issues that first movers face is spreading awareness about the services and how they work. But thanks to these apps, that will not be a problem for you.

As far as the competition is concerned, you need not worry as the market has a lot of users who are looking for something else.

That is where your app can help. All of these apps have their pros and cons. What you need to do is identify their gaps and fulfill them!

How to Develop a Successful P2P Lending App

To develop a successful P2P lending app, you need to go through a series of steps that will help you create the appropriate solution. You will also need a Loan Lending App Development Company to back you up for the development process.

Step:1 Research and Market Analysis

The first thing you need to do is identify the gaps in the market. For that you need proper research and market analysis.

Checkout the existing apps, go through them and try finding things that they do the best and things they lack in. Understand the issues that people are facing and create a plan.

Before entering any field, you should be familiar with how things work in that field. It is the first step but definitely lays the foundation for further steps.

Step:2 Identify the Features

The features are the backbone of any application. Through your research, you will come across several features that are common in all the apps. You can innovate in choosing the features as it will also help you create a unique value proposition for your application.

Offering features that no one in the market offers gives you an edge. However, you have to be smart and evaluate whether the feature you plan to add is financially feasible, follows all the compliance requirements, and most importantly helpful for the user.

Step:3 Choosing the Tech Stack

In this step, you need to decide what type of technologies will power your application. Technologies that are combined to create an application are called its tech stack.

Choosing a loan lending app tech stack becomes easier when you have experienced developers to help you out.

Listing features in the previous step also comes in handy as you now have a vision of what features you want to implement and can select technologies accordingly.

There are 4 components that you have to choose technologies for. These are-

- Front-End: This component requires designing technologies as it refers to the entire user interface and experience of the user.

- Back-End: This is where all your processing is done. Functionalities are defined in the backend so that everything can be connected.

- Database: You need a database system to store everything from user data to the information generated during the app usage.

- APIs: These are added features that you can simply integrate in your application without having to build them up from scratch.

Step:4 Designing the App

After you have decided on the tech stack, all your groundwork is done. Now what you have to do is give shape to your vision by deciding on the design of your application.

The development company you have hired will help you identify the perfect balance between functionality and aesthetics of your app, making it a good experience for the user, without having to suffer in finding crucial features.

A well-designed application is something that can help you garner a lot of attention hence ensure you pay attention to this step.

Step:5 Developing Functionalities

After the design is chosen, let the developers work on developing the functionalities that you have chosen. Implementing all the features that you have thought of will take time as it is definitely not easy. Task.

If you have professional developers with experience in P2P app development, you can expect the process to be over soon, however, keep in mind that this is going to be the most time-consuming step of the development process, and hence you should not rush it as it may hamper the usability of your application.

Step:6 Testing & Compliances

Compliances and regulations are important to be taken care of while developing a peer-to-peer lending application. When the development process is over, you need to check that the application is compliant and follows all the guidelines and regulations.

After making all the checks, it’s time to run all the functionalities of the application and test it in all environments.

You need a team of quality assurance professionals who can check your app for several use cases, identify the mistakes to avoid while developing a loan lending app, and ensure that the final application is free of bugs.

Step:7 Deployment, Support & Maintenance

Once your application is developed and free of all the bugs, you can prepare for deployment. The deployment process requires you to meet the guidelines of stores on which you have to publish the application for people to access.

After deploying, you have to stay active in managing the application when more and more people are using it is important to ensure that the quality of user experience does not deteriorate.

Maintenance and support are crucial to maintain a bug-free environment for your application.

Once you are through all the steps, you will have a well-designed P2P lending application with you, ready to market.

Keep in mind that since this is a lending application, you should try and close a few lenders to fund the application in the beginning. Once you have closed the investments, the app is ready to cater the services.

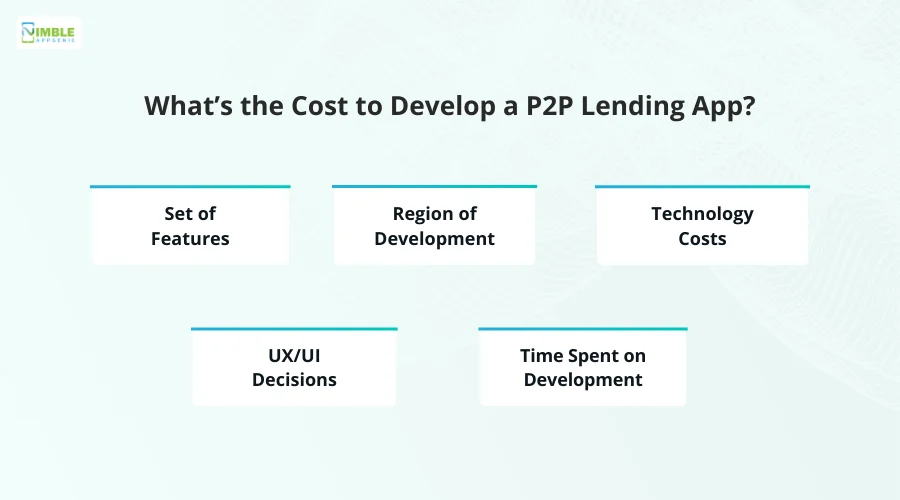

What’s the Cost to Develop a P2P Lending App?

To develop a P2P lending application, you need to have a proper budget allocation. Since it is a lending application you will need funds to start the loan lending process on your application, however, we will not be counting that cost into the development process.

Depending on your pro, the application development process can cost you anywhere from $25,000 to $250,000. This range is decided based on several factors. These factors include –

• Set of Features

The features you select can affect the cost of development as not every feature can be executed on a specific budget. Some can prove to be costlier to implement.

• Region of Development

The region where the development team that you hire exists also has an impact on the cost of development as the per hour rates vary from region to region. The cost may be less in the Asian region whereas if you go towards Europe, you will have to pay more!

• Technology Costs

Technologies are not cheap to implement. You need professional help to implement a functionality and when it comes to tech, there has to be a field expert.

Also, the resources required to implement technologies like machines, computing power, etc. are expensive!

• UX/UI Decisions

What type of user interface/ user experience you choose is also a factor that must be considered while deciding on the loan lending app development cost. The more complicated a design is to execute, the higher the cost!

• Time Spent on Development

When you are paying experts based on the number of hours they have worked, the time spent on development is definitely going to be a key player.

Sure, there has to be a set timeline that you decide on, however, this too should be decided beforehand.

These factors determine the ultimate cost of your development process. You can try several development services to get an idea.

The complexity of the application is another crucial factor as you need to decide whether you are going to opt for a basic application or a high-complexity advanced app that will automatically take more time, costing you more.

How P2P Lending Apps Make Money?

Peer-to-peer lending applications are a great way to make money as they offer so many options for monetization. Some of the ways P2P lending apps make money include-

1. In-App Purchases

By offering additional features like credit score checkers, expedited help, etc.

2. Advertisements

By allowing other similar apps to advertise on your application.

3. Subscriptions

You can create a premium subscription offering an ad-free experience with additional advanced features.

4. Origination Fees

When offering lending services, you can charge the origination fee that helps you convert the entire process. It is also called processing fees.

5. Services Fees & Penalties

These are regular fees your platform can charge when offering a sort of transactional service. Also, a platform can add penalties when a transaction is delayed by the user, making it an added income.

With all of these streams of revenue, P2P applications are one of the best ways to make money in 2025.

Even proper financial institutions have gone the digital route by creating applications that offer loans.

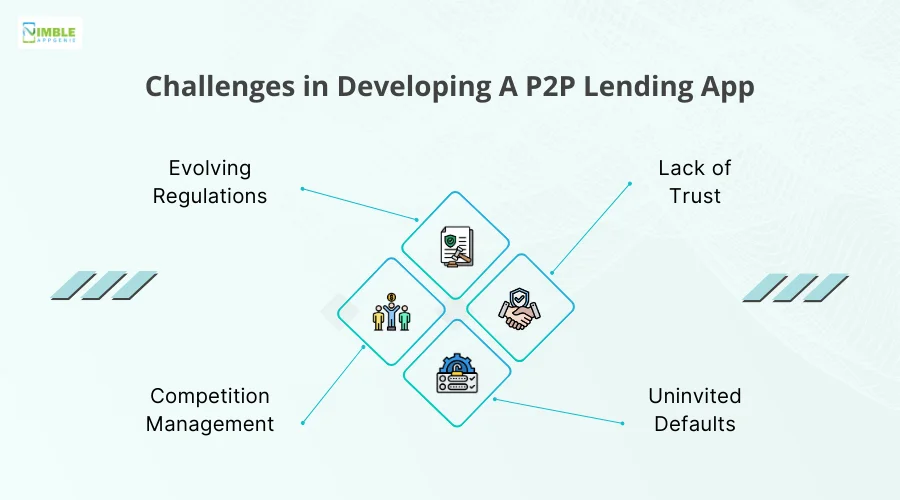

Challenges in Developing a P2P Lending App

When you plan to develop a loan lending app, several risks come along with it.

These risks often have to do with the business aspects however, challenges in developing a P2P lending app are also something that you should consider.

These challenges include-

➤ Evolving Regulations

When you are planning a platform that offers financial services of any sort, there are so many strict requirements that you have to fulfill else your application is always at risk of being removed from the store or being blacklisted by the government.

And the real issue here is that these regulations can change at any time which means you have to stay diligent.

➤ Lack of Trust

When you do not have a physical presence, it can become extremely difficult for a user to trust you with money matters. In order to convert an individual into a user, you have to generate trust among them which can be a huge challenge.

While already existing apps have defined how things work, several users still find it difficult to trust an online platform for lending and borrowing money.

➤ Competition Management

With so many people eyeing the growing market of peer-to-peer lending, the competition has grown fiercely in the past few years. Hence, you may find it challenging to manage the competition and emerge in the crowded market.

You have to pay attention to your app features and spend more on marketing as the challenge of visibility is something that haunts a lot of businesses.

➤ Uninvited Defaults

On every lending application, the most common issue is payment defaults by the borrower. That happens because P2P lending platforms do not require any sort of collateral.

Now this challenge can only be managed with proper risk analysis and thorough credit worthiness checking. However, minimizing defaults is something every app, new or old, has struggled with.

To be ahead of all these challenges, you need to ensure that you are using the latest technologies and work on creating a community so that if something goes south, you have a community that trusts you and aligns with you!

Trends in P2P Lending Apps For 2025

While P2P is a new concept altogether, it has seen a great evolution in terms of execution and user interests. Several trends are ready to change the way current P2P applications work. These include –

- Use of IoT Devices for Ease of Access

- AI & ML Implementation for Insights

- Blockchain & Additional Security Technologies

- DeFi Integration for Expanded Opportunities

- Enhanced Risk Evaluation & Background Check

AI in lending apps can be a game changer and the same goes for other technologies. Any cutting-edge P2P lending app will have these implemented in 2025.

You should always keep looking for the latest loan lending app trends as these can help you stay ahead of the competition. You can always make the most of these trends when you have a team of expert developers always by your side to guide you with the best practices.

Why Choose Nimble AppGenie For Your P2P Lending App?

After knowing everything about how these applications work and the opportunities that p2p lending apps offer, you might have made up your mind on whether you want to create your application.

And if you plan to go for P2P lending app development, then Nimble AppGenie is hands down the best option you have!

Our fintech app development experts offer extensive services that not only help in the development of the app but also make it their priority to guide you through various details about the industry.

Since the education about how P2P lending works is relatively less, it really is crucial that you delegate the development to someone who has already worked on a similar project.

Nimble AppGenie is one of the most experienced names when it comes to fintech development and hence is your best option!

Reach out today to get more insights on how you can turn your idea into a full-fledged profitable mobile application!

Conclusion

Hope that this post has provided you with ample insights on how to create a successful P2P lending application.

The idea of enabling individuals to borrow and lend from each other while regulating the entire process through a digital platform is truly remarkable and offers a great opportunity for generating profits.

Sure there are several things that you have to take care of when developing the app however, with proper guidance and expert developers everything can be done successfully.

As far as the future of these apps is concerned, it seems that they are going to change the way lending works completely.

With new technologies like AI, ML, IoT, and Blockchain, all the transactions on the applications are set to become more efficient, convenient, and secure.

FAQs

Technologies that usually power a P2P lending app include –

1. For iOS: Swift 5, UIKit, MVVM+C,

2. For Android: Kotlin, Android Studio/Eclipse,

3. For Admin Panel: Node.js, React,

4. Payment Gateway: Stripe, PayPal

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.