The fintech revolution is here.

Without a doubt, mobile banking apps are at the forefront of this revolution.

From payments and insurance to countless other areas, technology has fundamentally transformed how we handle our finances. Undoubtedly, apps like Monzo have redefined the concept of whole mobile banking by providing a user-friendly interface and cutting-edge features.

Monzo’s success inspired a wave of entrepreneurs to enter the market with their own neobanking app ideas. But for aspiring fintech entrepreneurs often, a question lingers:

“How much does it cost to build an app like Monzo?”

Well, the average cost to develop a Monzo-like app varies from $30,000 to $150,000. This can increase or decrease as per what your project demands.

Although there is a lot to learn and understand about the cost and process to create an app like Monzo, we will equip you with the best. We have explored a lot in this guide to the Monzo-like app. Let’s get to know:

Monzo: A Leading Neobank App

Launched in 2015, Monzo is a Challenger Bank, meaning it is a mobile-first financial institution that operates outside the traditional banking system.

Unlike any other established bank with physical branches, Monzo offers its all services entirely through a smartphone app.

While Monzo gained its popularity for being a user-friendly banking app, it has wide-ranging tools and services specifically designed to empower users.

Imagine simplifying your financial management with different accounts dedicated to different needs. It will not only give you complete control of your business but will also help you to avoid any confusion.

The best part? Monzo streamlines any and every payment by enabling instant domestic and international transfers. For your safety, they have in-built fraud protection giving you peace of mind while managing your business finances.

Features like this made the app so famous and friendly for users. No wonder why people are interested to create more apps like Monzo.

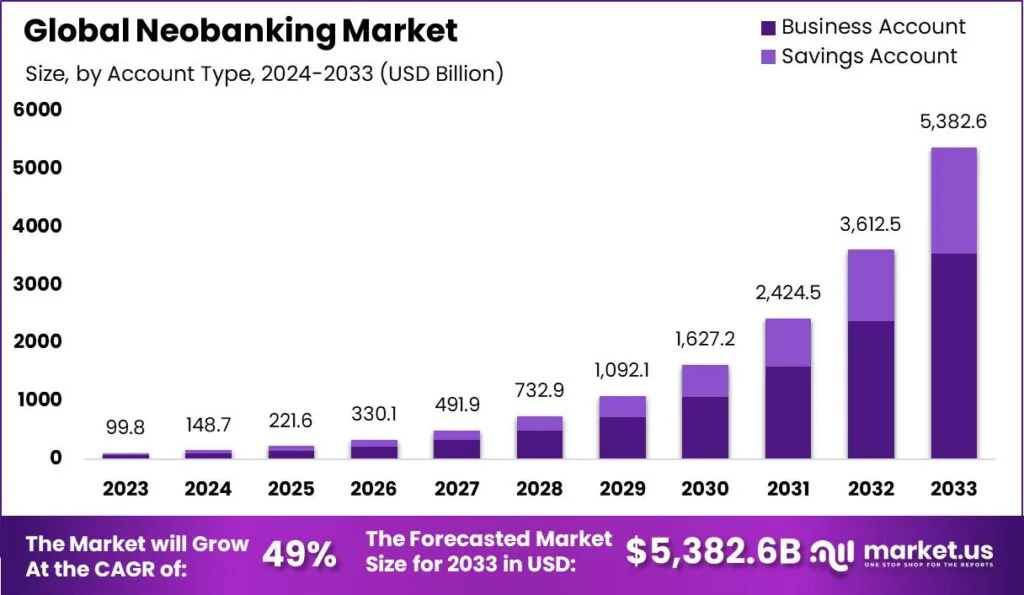

Overview of the Global Neobanking Market

Neobanking is one of the most flourishing segments.

We are not saying this but the numbers. Here are some stats backing up our words.

Looking at the report, the Market size estimated at USD 221.6 billion in 2025 is expected to reach $5,382.6 bn by 2033. This means a surge in CAGR of 49% from 2024 to 2033.

- When it comes to Neobanking services, payments, and money transfers reigned supreme in 2023, capturing a market share of over 41%.

- The application sector of Neobanking saw enterprises take the lead in 2023, securing more than 53% of the market.

- Geographically, Europe emerged as a frontrunner in Neobanking, accounting for over 30% of the global market share in 2023.

- The Neobanking market is a competitive space with top apps like Revolut, Monzo Bank Limited, and N26 AG.

Key Features That Determine the Success of Your App

So, what are the features that determine the success of your app?

If this is your question, then this section will enlighten you with the best features that are necessary for developing an app like Monzo.

Without any further ado, let’s get to know:

1. Easy User Registration

Yes, this should be your priority feature to create an app like Monzo.

One of the major reasons Monzo is so successful is because of easy sign-up that offers a great experience. To stand out, we should make signing up as frictionless as possible. Lengthy signup processes can annoy users.

Instead, help them onboard with different signup options using phone numbers, Gmail Accounts, or social media accounts.

2. Real-Time Transaction Notifications

To develop an app like Monzo, instant awareness of account activity is essential. This is a shared feature of mobile banking apps.

Immediate notifications for every transaction keep users informed about every move. This assists in alerting users about any kind of movement in the app.

Real-time transaction alerts empower users to stay informed about their finances and promptly report any suspicious activity to a responsive customer support team. With the growing cyber-attacks, this will be a great feature to integrate and appreciate by your users, so don’t overlook it.

3. Budgeting & Money Management Tools

Budgeting and money management tools are no longer “nice to have” features, but have become vital.

With this, users can take control of their finances; they can understand their spending, save more, set some goals, and achieve them easily.

4. Secure Login and Authentication

Secure login and authentication are the foundations of any financial application.

They act as digital gatekeepers; ensuring only authorized users can access financial information and functionalities. With the increasing number of data breaches, security issues are one of the major challenges of banking apps.

To fight it, you can allow users to use strong passwords, and offer multi-factor authentication, and biometric authentication for data and app security.

5. Account Management

If you want to create an app like Monzo, then you should give users control to manage their accounts.

Account Management is the basis of any banking app, you have to let your users manage their accounts otherwise they will run to the app that’s providing it.

In a Monzo-like app, account management features should be user-friendly, secure and offer a variety of functionalities to empower users. This way they can learn about low balances, successful payments, pending payments, and much more.

6. QR Scanner and Seamless Transaction

Users expect to make seamless transactions and secure ways too, this is what the basis of your app should be.

If you want to create an app like Monzo, you should prioritize these needs by providing a complete view of the cashless payment experience.

You can integrate mobile payment technology like NFC for the tap-to-pay function. Also, make sure to embrace QR code technology by allowing users to scan QR codes for in-store and peer-to-peer payments.

Additional Features That Can Set You Apart

Here are some additional features to develop an app like Monzo.

7. Saving Goals and Round-Ups

Saving up can feel like a chore.

To create an app like Monzo, you can transform savings from a burden to a rewarding experience with features like round-ups and goal setting, helping users achieve their financial aspirations.

Monzo allows setting saving goals and has a “round-up” that automatically saves the difference when the user pays with a card.

8. Managing Card

A debit card is the key to accessing your funds.

For which, app should empower users to manage their cards effectively, with a variety of features like security, convenience, and control.

Furthermore, features like freezing or unfreezing cards should be an option from your app to provide users with peace of mind. In case of loss or theft, let them report and freeze their card to minimize potential financial losses.

9. In-App Customer Support

When it comes to financial apps, navigating complex features can be frustrating.

Sometimes, users need expert guidance while accessing the app. It is best to help them with in-app chat support; this helps them to offer readily available expert guidance.

Also, users will feel valued as this support via phone calls and emails is handy and provides quicker responses than traditional methods. This way, users can get their questions answered or issues resolved promptly.

How to Develop an App Like Monzo? Step-By-Step Process

“How to create an app like Monzo?” To develop such a groundbreaking app like Monzo, you need to have a plan and execute it properly.

Let’s see the development process to understand what it takes to bring your app idea to life.

Step 1: Market Research

Mobile app market research is the foundation of your app.

By doing in-depth research about your target audience, user preference, and competitor analysis, you can get to know what the market lacks and what you serve. This way, you can develop a unique value proposition and get a competitive edge.

Step 2: Define Core Features

Once you have an idea about the market challenges, you can design your features that are essential and can make your app successful.

These may include some basic features such as money management tools, transaction history, payment, and more. As well as some advanced features including AI development, leveraging AR/VR trends, in-app customer support, and more.

Step 3: Designing Your App

Creating an app like Monzo is a must to strike a balance between functionality and a user-centered design approach.

Meaning, you have to craft a user-friendly and intuitive interface for seamless navigation and accessibility.

We suggest you create a wireframe and prototype to get an idea of the user flow and identify any potential usability issues early on.

Step 4: Development of Your App

Time to create your neobanking app.

This is the heart of the app development process, where your app transforms from a concept into a viable solution.

Here, your developers bring the entire app to life by writing source code and integrating pre-discussed functionalities, and iterations to ensure a smooth experience.

Step 5: Testing & Launching

Once the app is ready, make sure to do thorough mobile app testing.

It helps to identify and eliminate bugs, errors, and technical issues before launch, ensuring a smooth and stable user experience.

Once it’s done, time to publish the app. It will take some time to hear back from them, till then you can make some marketing strategies to make your app launch a massive hit.

Step 6: Maintenance and Support Services

Keeping your neobanking app running smoothly and users happy requires ongoing maintenance and support.

This includes updating the app regularly with new features, bug fixes, and security patches. By prioritizing continuous improvement and exceptional user support, you can foster trust and loyalty within your user base.

This is how you can develop an app like Monzo, now it’s time to know how much all this will cost you.

Cost to Develop an App Like Monzo

So, “How much does it cost to create an app like Monzo?”

On average the cost to develop an app like Monzo typically ranges from $30,000-$150,000 as discussed earlier. But remember, this cost can vary as per your demands.

Several factors play an important role in affecting your overall development cost of a mobile banking app which we will discuss later.

But first here is a small, quick breakdown of the cost.

| Basis | Development Time | Estimated Cost |

| Basic App | 2-4 month | $30,000-$60,000 |

| Medium Complexity App | 4-6 month | $60,000-$100,000 |

| High Complexity App | 6 month+ | $100,000-$150,000 |

Note: This is just an estimate. If you want to know the right cost to launch an app like Monzo, discuss your requirements with an experienced mobile app development company.

Factors Affecting the Cost to Develop an App Like Monzo

As we have already shared with you, several elements affect the overall cost.

To provide a more comprehensive understanding, let’s explore the key elements influencing the cost of developing a financial app like Monzo.

♦ Complexity & Feature

Although there are various elements that affect app development costs, one of the most common ones is complexity.

It’s not rocket science but an easy theory, the more complex your app idea is, the more it will cost. This is why it is necessary to keep the features simple, effective, and user-friendly.

♦ Development’s Team & Location

The development team and their location are also one of the major factors that affect the cost to make an app like Monzo.

Due to varying standards of living, the cost to hire developers can be different. For example, if you hire developers from regions like the USA and UK, the cost will be higher than in regions like Asia.

♦ UI/UX Design

It is more than necessary to develop a user-friendly interface to keep users engaged with the app.

But remember, a well-designed app with a clear and intuitive interface is easier for developers to implement, leading to fewer bugs and smoother development.

Whereas, a complex design might need extra development techniques or frameworks, potentially requiring more specialized developers and increasing cost. You can strike a balance between cost and design to manage the cost to develop an app like Monzo.

♦ Choosing the Right Tech Stack

Different technologies have varying learning curves and speeds. Opting for a tech stack that has huge community support can accelerate development and also help you in the future.

Conversely, choosing a cutting-edge tech stack with a limited developer base might necessitate hiring developers that charge higher rates. Also, choosing the right tech stack requires careful consideration.

♦ Type of App

What kind of app do you want to develop? It also affects your overall cost.

Suppose you want a basic app with the necessary features then the cost will be less as compared to an advanced app. Simply because advanced features will require more developer’s expertise and skills to develop, ultimately leading to increased costs to develop an app like Monzo.

Taking this into consideration, it is not wrong to say that launching a basic app gets your product in front of users quicker & under budget, allowing you to gather valuable feedback early on.

This might help you to work on that feedback and launch a feature that they like and engage with.

These are some of the elements that can affect your overall cost to develop an app like Monzo, let’s get to know how you will earn back the money.

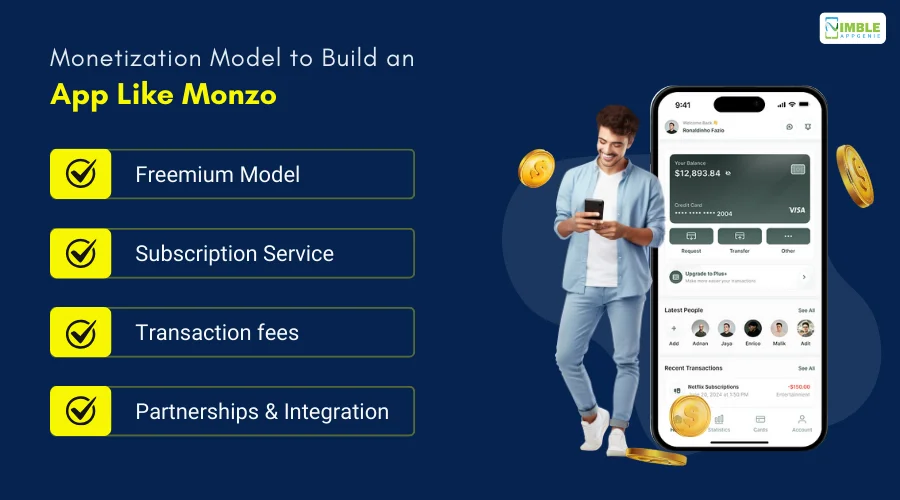

Monetization Models for a Monzo-Like App

Investors are all about seeing a return, and so are you!

To turn your app idea into a money maker, here are some app monetization strategies that you must know about:

➤ Freemium Model

The Freemium model consists of Free and Premium.

Similar to Monzo, you can offer basic features for free, whereas you can charge them a fee to enjoy premium features such as fee-free ATM withdrawals abroad, and interest on saving.

This attracts a large user base and makes it accessible.

➤ Subscription Service

You can take notes and integrate advanced features such as travel insurance just like subscription-based apps like Monzo. Also, charge a fee monthly, quarterly, and yearly.

If you have a feature-rich app, then surely it can cater to users who want some extra benefits. Plus, make them worth paying for, ultimately opening a great revenue stream for you.

➤ Transaction fees

Monzo earns a small fee from merchants whenever they use their cards for purchases. This is a common way for financial institutions to generate revenue.

Over the years, it has become a standard money-making strategy. But also make sure to explore other models along with this for long-term success.

➤ Partnerships & Integration

Another amazing way to make money out of a neo-banking app is to collaborate with different financial service providers for features like saving accounts and others.

This way, every time someone opens an account from your app, you can get a percentage as commission.

These are some of the ways to develop an app like Monzo and make revenue out of it.

Now, with that, if you have made up your mind, then it’s time to connect with a reliable partner. Our next section will help you with just that.

Nimble AppGenie, Your Partner in Developing an App Like Monzo

Statistically speaking, the potential of the neo-banking market is huge.

So investing in Monzo-like app development will be a smart idea. If you want to do so, you need to partner with a reliable mobile banking app development company i.e. Nimble AppGenie.

We have years of experience in launching robust and scalable banking apps. Besides, leveraging our deep industry knowledge can help you tailor the app to per the unique needs of your target audience.

Ready to take your neobanking vision to the next level? Let’s connect.

Conclusion

The neo-banking market is booming and with good reason. Apps like Monzo offer a user-friendly and convenient way to manage finances. If you’re considering developing your own neobanking app, there’s a lot to consider.

This guide has equipped you with knowledge of key features, development steps, cost factors, and monetization strategies. Remember, a successful app requires a balance between functionality, user experience, and cost-effectiveness. Partner with an experienced app development company to make a successful app.

FAQs

The estimated cost to build an app like Monzo ranges from $30,000 to $150,000, depending on the complexity of features and the chosen development team.

Essential features include easy user registration, real-time transaction notifications, budgeting and money management tools, secure login and authentication, account management, and seamless QR code and transaction capabilities.

Consider features like saving goals and round-ups, debit card management tools, and in-app customer support for a more comprehensive user experience.

The process typically involves market research, core feature definition, app design, development, testing and launch, and ongoing maintenance and support.

Common monetization strategies include freemium models with premium features, subscription services, transaction fees, and partnerships with financial service providers.

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.