Fintech is one of the leading industries in the competitive world. Here the users are engaged with the types of services provided by these networks.

Over the past 10 years, the industry has evolved from a niche to an elusive industry trend within a transformative world.

Thus, it’s a pretty good opportunity to enter into the competitive fintech industry. You can build an app like PalmPay which may bring revolution.

Let’s examine the steps, strategies, features, reasons, working procedures, and monetization strategies in this blog.

About PalmPay

Here are some details about the app, for those who are unaware of it.

Palmpay is a fintech app trusted by millions of Nigerian users for seamless money payments and transfers. Here one can sign up with their phone numbers to get mind-blowing rewards.

The app is a fintech innovator that aims to make digital payments more accessible as well as flexible for merchants and customers. PalmPay enhances users’ digital payment experience by offering instant financial creation, money transfers, and bill payments.

Since launching the app in 2019, the app has made itself one of the continent’s fastest and leading growing payment providers.

Growing at a CAGR of 10%, Africa’s financial services market is set to reach its peak revenue of about $230 billion in 2025, which clearly makes it one of the fastest-growing industries, attracting a lot of new startups in Africa.

What makes this growth sustainable for them is the rise of smartphone users, reduced internet costs, and decent availability of network coverage.

These trends have allowed new and agile fintech companies to takeover the market and create their presence in this fast-paced financial services market of Africa.

The app can enhance the user’s digital payment experience by providing instant financial account creation, bill payments, and money transfers. The platforms empower individuals as well as businesses with payment solutions, easy-to-use tools for financial management, and high-yield investment opportunities.

Well, let’s check out the reasons to develop an app like PalmPay in the following section.

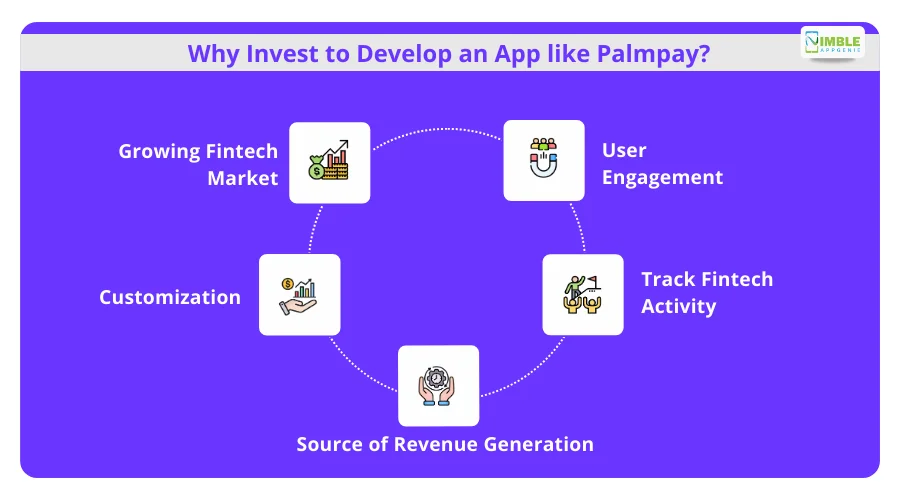

Why Invest in Developing an App like PalmPay?

To continue with the PalmPay app development, you are required to identify the reasons for proceeding with the same.

Here’s a list to consider for the same.

♦ Growing Fintech Market

In January 2024, America was the region with the largest number of fintechs globally. Additionally, there were 13,100 fintechs within Americas with almost 1,500 more than the previous year.

In 2017, the global fintech industry revenue was about $90.5 billion, such a figure has increased by over 100% since then. Well, considering these growing figures, you can go ahead to build an app like PalmPay fintech.

♦ User Engagement

By building a fintech app like PalmPay, you can connect with diversified users directly with the app even without including any third party. If you build an app, it can attract users more than a website?

There are about 5 and 7 billion mobile phone users in the world through diversified estimates. Along with this, developing mobile apps can be effective in fostering deeper connections with the users. Thus, creating an app can be useful in engaging customers in the long run.

♦ Customization

Customization is a critical aspect of creating an app like PalmPay. It’s important to identify the types of functionality to be included within the app to enhance the users’ satisfaction.

Through app personalization, users can enhance customer experiences, boost customer loyalty, and enhance user retention rates. With customization, you can make a solid impression on the users which may boost engagement within fintech apps.

♦ Tracking Fintech Activity

With the assistance of a fintech app, you can have simple access and can keep track of all the transactions and financial activities of the users. This is the way through which you can bring innovation to the industry.

You can help the users by providing them the features where they can find assistance to address their financial transaction barriers with ease.

♦ Source of Revenue Generation

Building an app like PalmPay can provide you with a better source for revenue generation. Here you can implement diversified sources of income generation such as in-app purchases, in-app advertising, data monetization, subscription plans, and transaction fees.

Well, these profits can be useful in expanding your business and paying off the expenses. Along with this, don’t you like an app that can help you with a great income source?

These were all the reasons to consider for building an app like PalmPay.

Now, are you ready to develop an app like PalmPay?

Let’s determine the working process of an app like PalmPay.

How Do Apps Like PalmPay Work?

What is the important working process of PalmPay?

Before proceeding with the working procedure of PalmPay, you need to know the steps.

- After installing the app, the user needs to link their bank account with the app and is required to mention essential details.

- Another important step is to give permission to the app so that it can access bank accounts and contacts to whom the payments need to be made.

- Now, the users can go ahead with the activities that they want to continue with whether it is sending and receiving money, paying bills, shopping online and offline, saving and investing, value-added services, access loans, and others.

- With encrypted security, users can go ahead with seamless transactions. You can create strong passwords and may enable two-factor authentication to provide security to the end users.

- Later, the users can provide reviews based on their experiences.

After learning about the working procedure to build an app like PalmPay, let’s examine the features to include within it in the next section.

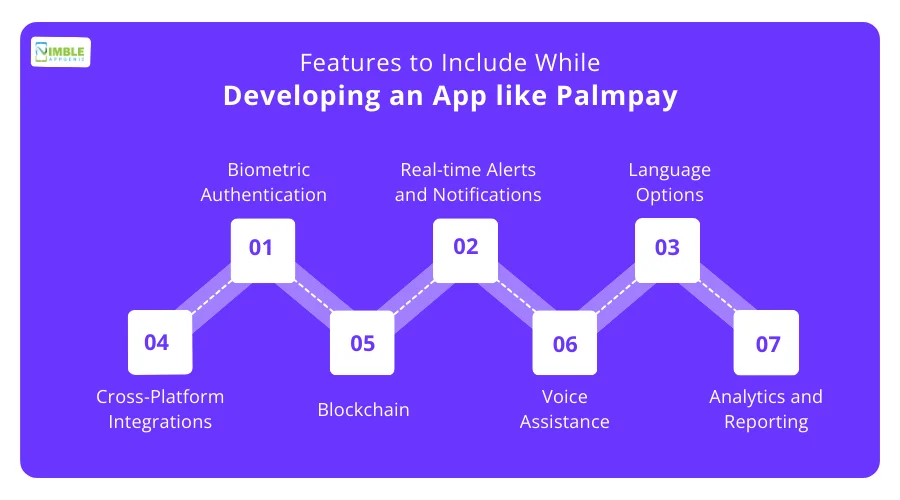

Features to Include While Developing an App like PalmPay

What are the top fintech app features to include in an app like PalmPay?

Here’s a list to go ahead with-:

-

Biometric Authentication

Security is a critical aspect for FinTech apps and for biometric authentication that adds an extra layer of protection among FinTech apps.

It is a security pattern that includes fingerprint scanning, voice recognition, and facial recognition and provides enhanced security as well as convenience.

-

Real-time Alerts and Notifications

You can have real-time alerts for all the transactions, where you can keep the users informed as well as monitor their finances closely.

Here, users will be able to get immediate updates on the balances of all their linked accounts and ensure that they have the latest information.

-

Language Options

By supporting multiple languages, you can ensure inclusivity and enhance content accessibility for users worldwide.

You can provide the users with all the language options, you can help them feel included by assisting them to select one language as per their opinion.

-

Cross-Platform Integrations

Cross-platform integration features can be effective in combining data from diversified platforms and sources. It empowers people to work smarter and more successfully.

It does include both hardware and software systems that are aligned to work similarly across different platforms.

-

Blockchain

Through blockchain, you can give complete protection to the users. Additionally, you can enable secure, real-time cross-border transactions without any need for intermediaries.

This feature can help record transactions and track assets across diversified business networks.

-

Voice Assistance

Here you can help the users by assisting them with search with voice assistance. Here they need not type anything, they are only required to tap and hold the microphone button to process the activities.

It is an efficient feature helpful to make the user’s experience pleasant with the app. This can be useful in making transactions seamless even without touching the device.

-

Analytics and Reporting

The feature will track the spending habits of the users by analyzing their transactions as well as learning about their spending habits to make well-informed decisions.

With this feature, you can offer comprehensive analytics and reporting that comprises categorization breakdowns, trend analysis, net worth reviews, and cash flow reports.

By implementing such features, you can build an app like PalmPay successfully.

Now, let’s evaluate the steps to build an app like PalmPay in the following section.

How to Create an App like PalmPay?

To develop a fintech app, it’s vital to proceed with essential steps.

Here is the series of steps to make an app like PalmPay.

Step 1: Market Analysis

You should know the market well before launching your app there. Hence, it’s important to conduct a detailed assessment of your target business market along with the competitive landscape in a specific industry.

Mobile app market research can help you to understand the details of fintech apps along with the current competition that exists in the environment.

Here you can identify the potential users for your fintech app and can conduct a survey or respective research to know the current gap that exists in the market.

This will enable you to create an app like PalmPay that can bridge the gap and fulfill users’ demands successfully.

Step 2: Develop an MVP

It’s essential to build an MVP where you will launch the app with minimum features enough to grab the attention of the early adopters.

This is a step that will save you the complete cost of creating an app like PalmPay by defining you what measures are required to attract users to the app and if the version is effective in drawing revenue or it needs to be modified.

Here, you can add only essential features and later add more features looking forward to the user’s needs.

Additionally, with MVP, you can bring your fintech app idea into the market even before your competitors do.

Step 3: Build an App Design

Fintech app design under this step where technologies such as web design, CSS, JavaScript, and HTML will be implemented to create a lasting impression on the users.

Additionally, you need to create a app wireframe and prototype for your app that will help select a worthy design.

You can create a buyer’s persona and journey mapping to identify the users’ area of interest and how they will proceed with the app. This will help you with selecting the crucial design for your app like PalmPay.

It’s important to follow UI/UX app design principles for successfully creating an app that needs to be authorized by the users and capable to influence them.

Step 4: Create a Tech Stack

It’s essential finetch tech stack enough to support all the respective features and selected designs. It should be sufficient enough to launch and even effective so that the users can successfully operate the functions.

Are you aware of what tech stack is? Well, it’s a set of technologies that are utilized by the companies for building and running the website smoothly.

When it comes to fintech, it should be smooth and capable so that no bugs can be found while using the app effectively.

The mobile app tech stack can include programming languages such as Python, Java, React, and C#. Backend frameworks like Node.js, Django, and .NET Core.

Step 5: Develop the App

Now, it’s time to build the complete app by combining all the suitable steps. Here you need to create the front end of the app along with the back end.

This is the final stage of app development, here you need to check for the platforms for which you are developing an app like PalmPay, and then continue for the same.

Here the platforms can be Android, iOS, or Hybrid depending on the type of audience that you want to reach.

Thus, after verifying all the measures and combining all the steps, you can finalize the app.

Step 6: Testing

Wait! Are you going to launch the app into the market? Well, it’s not the right time. Here’s what comes in, fintech mobile app testing.

Under this step, you should test the app with different tools and types. You can conduct security testing, performance testing, compatibility testing, localization testing, exploratory testing, and many others.

When it comes to fintech apps like PalmPay, you should be more aware of their security. Well, a bug in the app can destroy the complete formulation and functionality.

Hence, you should ask the developers to have a rigorous testing procedure for finding any bugs and errors, and then correcting them before the launch.

Step 7: Deploy, Launch and Maintain

Well, here you are with your app like PalmPay. Now you should deploy it over the selected platform, and then launch it in the competitive market.

It’s important to launch the app on the determined date for engaging the audience. Your task isn’t over yet.

Now, it’s time to connect with app maintenance services to go ahead with the maintenance part. Bugs detection, enhancing security, and scalability can aid to protect your app against any vulnerabilities in the future.

App maintenance is a proactive approach that can protect you from future app failures and helps to avoid the risk that might throw you out of the competition.

Till now, we have discussed the app, market stats, development process, reasons to create it, and potential features.

Now, let’s determine the mobile app development cost in the following section.

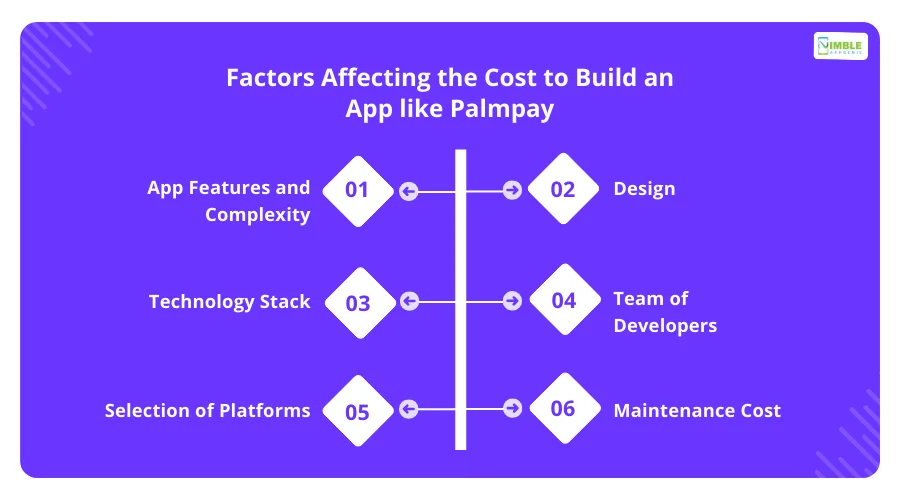

Cost to Make an App like PalmPay

What’s the cost to create a fintech app?

The average cost to build an app like PalmPay can vary from $15,000 to $200,000 depending on the type of features needed including the complexity of the app, design, technology stack, platforms, team of developers, and maintenance as well as security.

Let’s discover a brief about the factors in the next section.

Factors Affecting the Cost to Build an App like PalmPay

To build an app like PalmPay, you should proceed with the cost it includes.

Let’s discover certain important factors impacting this cost.

1. App Features and Complexity

You need to determine the types of features along with the complexity level of the app. A highly complex feature will lead to more cost while a less complex feature can result in minimum cost.

You need to evaluate that if the features are complex such as geolocation, machine learning algorithms, and augmented reality, that will enhance the development costs due to technical errors.

Here the cost can vary from $3000 to $20,000. Here, for the basic level, you can include user registration, and push notifications, while on the advanced level, it may comprise AI, AR, and VR.

2. Design

When you design an app like PalmPay, you should consider simplification. A fintech app should be as simple to understand that the end user doesn’t need a guide to proceed further.

A complex design will require complex tools and highly experienced designers. However, for a low-level design, you can include basic tools.

Additionally, you should note that an experienced designer will be able to convert complicated designs into simple forms and require high cost. Here, the cost to design an app can vary from $5000 to $30,000 depending on the type of features.

3. Technology Stack

Along with the design cost, you should determine the type of technologies you are integrating for creating an app like PalmPay.

While integrating the tech stack, there are multiple factors such as hiring additional staff including the backend and their expertise in implementing technologies.

The technology stack cost can vary from $10,000 to $40,000. This cost will further be impacted by different determinants such as complicated techs, or updated technologies.

4. Team of Developers

Some diversified developers can lead you to success. All you require is to select the right team.

Here, selecting the developers will depend on two factors, including their location and expertise. Here the level of expertise of the developers along with their location will impact the overall cost.

The cost can vary depending on the location, if you hire developers from Asia, it can be from $15,000 to $200,000 at an expert level. However, the cost to hire developers from the US can vary from $20,000 to $300,000.

5. Selection of Platforms

It’s important to select the types of platforms, here. It can be Android, iOS, or Hybrid. This will impact the complete cost of building an app like PalmPay.

The selection of platforms will impact the cost you will pay for license fees and for registrations.

Thus, the selection of platforms can vary from $15,000 to $40,000. The cost will depend on the target audience and the current value of the platform to launch the app.

6. Maintenance Cost

After you launch the app in the market, it’s important to maintain it. Thus, this will include the costs.

The cost to maintain an app can vary from $10,000 to $80,000 depending on the type of app. A highly complicated app will require effective maintenance.

When it comes to fintech app maintenance, you need to evaluate the types of tools to update and maintain it successfully.

These are some of the attributes to consider that might impact the total cost to create an app like PalmPay.

After evaluating the cost and significant factors, let’s learn some of the important monetization frameworks too, in the following section.

How to Monetize an App like PalmPay?

What are the strategies to include for monetizing an app like PalmPay?

Here is a list of effective app monetization strategies.

♦ In-App Purchases

In-app purchases are a strategy where you can add multiple features and users can pay for them according to their demand.

For instance, if they want to have an AI feature to make a report of all your transactions and expenses, via paying an additional amount, users can grasp this function. This can add a revenue source to your app.

♦ In-App Advertisement

Here, in-app advertising is all about providing a space for other brands to promote their services and products via your app.

Here, you can charge a commission from the brands to display their ads on the platform. Thus, it can be a suitable monetization strategy, when your app or business is well recognized.

♦ Transaction Fee

Your app will provide a platform for users to make payments or transfer money and enjoy a seamless facility.

Hence you can charge revenue from the users for every transaction they make via your app. This can get you a permanent revenue source.

♦ Subscription Model

The subscription model can be determined as a recurring fee that you can gather when users subscribe to the app.

Here you can add valuable subscription plans depending on the users’ demands and preferences. Here you need to check the market rates and then decide on the different prices.

♦ Freemium Model

The freemium model is a popular strategy, where you can offer certain services for free and may charge for premium services.

For instance, here you can charge the users for reminders or any added feature that can help them to make their payment process financial transactions journey smooth.

These were all the important monetization frameworks to consider successfully while building an app like PalmPay.

Now, it’s time to score for any type of challenges you might face as you proceed to create an app like PalmPay.

Are you ready to get through the next section?

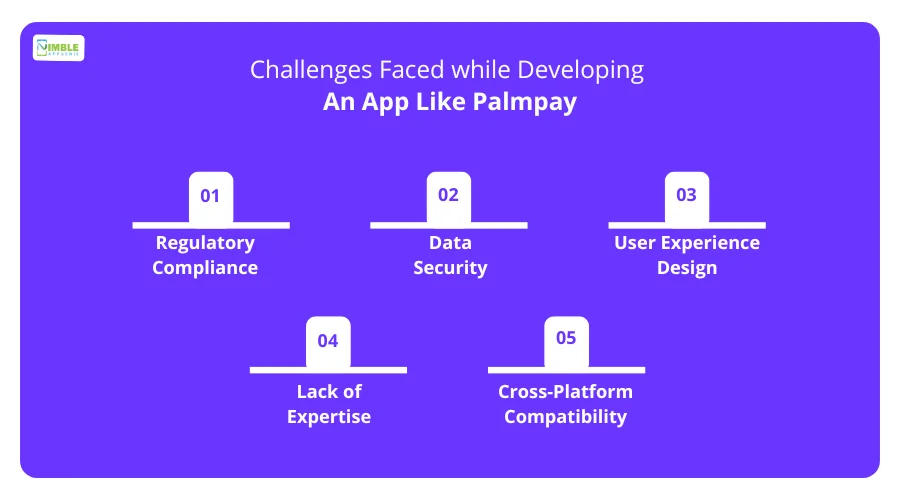

Challenges Faced while Developing an app like PalmPay

While considering to develop a clone app like PalmPay, you need to know the different types of challenges or barriers that can be in your path.

Here is a list of mistakes to avoid while building a fintech app.

1] Regulatory Compliance

When you enter the financial industry, it’s important to know and learn about the compliances that regulate it. Well, avoiding them can result in a large issue while developing an app like PalmPay.

2] Data Security

Maintaining the security of the data is the biggest concern when you proceed to develop an app like PalmPay. A lack of data security can allow outsiders or cyber attackers to get an opportunity to access the data.

3] User Experience Design

A poor design of an app can impact the entire application. Additionally, with a bad design, you can fail to meet the user’s needs successfully. This will further impact the complete app development process.

4] Lack of Expertise

If your app has been developed by a poor expertized team, then it can result in an ineffective app. This will harm the overall development and functioning of the app or even it can’t reach its respective goals.

5] Cross-Platform Compatibility

Avoiding the cross-platform compatibility concept can impact your app development. Here, all you need is to check if your app is available on different devices or not. This issue can impact the overall functionality of the app.

These are all the challenges that you might consider while creating an app like PalmPay. Now, if you are still confused about the same, connect with an experienced company.

Connect with Nimble AppGenie and Develop your app

Searching for a company to connect with?

Nimble AppGenie is here to help. Our leading fintech app development company that can provide you with a strategy that can bring your app idea into reality.

Our team will assist you in creating a plan, building budgets, and then even maintaining the apps. We have already done it before. We have already done it before.

SatBorsa is a cutting-edge currency exchange platform that is designed to provide seamless and secure services.

Additionally, the app ensures accessibility with ease of use of the interface across multiple devices. It is a multi-language, user-friendly interface that helps users with currency exchange services.

Well, you can connect with us to know more.

Conclusion

When you proceed with creating an app like PalmPay, it’s important to include diversified steps such as market analysis, creating MVP, selecting features, building design, tech stack selection, testing, and launch.

Along with this, there are multiple features you can include within the app such as biometric authentication, language options, cross-platform authentication, blockchain, authentication, and support.

If you are unaware of the reasons to build an app like PalmPay, then it’s important for user engagement, the growing fintech market, biometric authentication, analytics, and reporting. If you are still confused about how to proceed, then connecting with an effective app development company might help.

FAQs

You can follow the steps below to create an app like Palmpay:

- Market Analysis: Research the current market and analyze competitors to identify opportunities.

- Select Features: Define the features that will engage users, such as security, payment options, and more.

- Build Design: Develop the app’s design, including color schemes, themes, and wireframes.

- Choice of Tech Stack: Choose suitable databases, programming languages, and infrastructure for backend development.

- Testing: Test the app rigorously using multiple testing procedures.

- Launch and Maintenance: Launch the app in the market and ensure regular updates and maintenance.

The features to include in an app like Palmpay are:

- Biometric Authentication

- Language Options

- Real-Time Alerts

- Analytics and Reporting

You can monetize an app like Palmpay through:

- In-App Purchases

- Advertising

- Transaction Fees

- Freemium Model

- Subscription Model

Challenges to avoid while developing an app like Palmpay include:

- Regulatory Compliance

- Data Security

- Lack of Expertise

- Cross-Platform Compatibility

The cost of build an app like Palmpay depends on several factors, including:

- The complexity of the app

- Design

- Tech Stack

- Development Team

- Maintenance and Security Costs

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.