The evolution of Fintech has changed the way people interact with banking and money. The change is clear in all sorts of transactions, including international fund transfers. Gone are the days when you had to rely on services like Western Union to send remittances to your hometown.

Today, apps like Al Ansari Exchange are making it possible from the comfort of your home.

The emergence of online banking has opened a lot of opportunities for people who plan to penetrate the growing market. With the help of an app solution providing company, you can build an app like Al Ansari Exchange, catering to a newer audience.

You see, while the apps are already available, the market is exponentially growing, allowing more similar apps to emerge and make the most out of the user’s requirements.

In this post, let us take a closer look at one of the best international exchange apps, Al Ansari Exchange, and understand what it takes to build an app like it. But before we begin, let’s quickly take a market overview of the AI Ansari Exchange app.

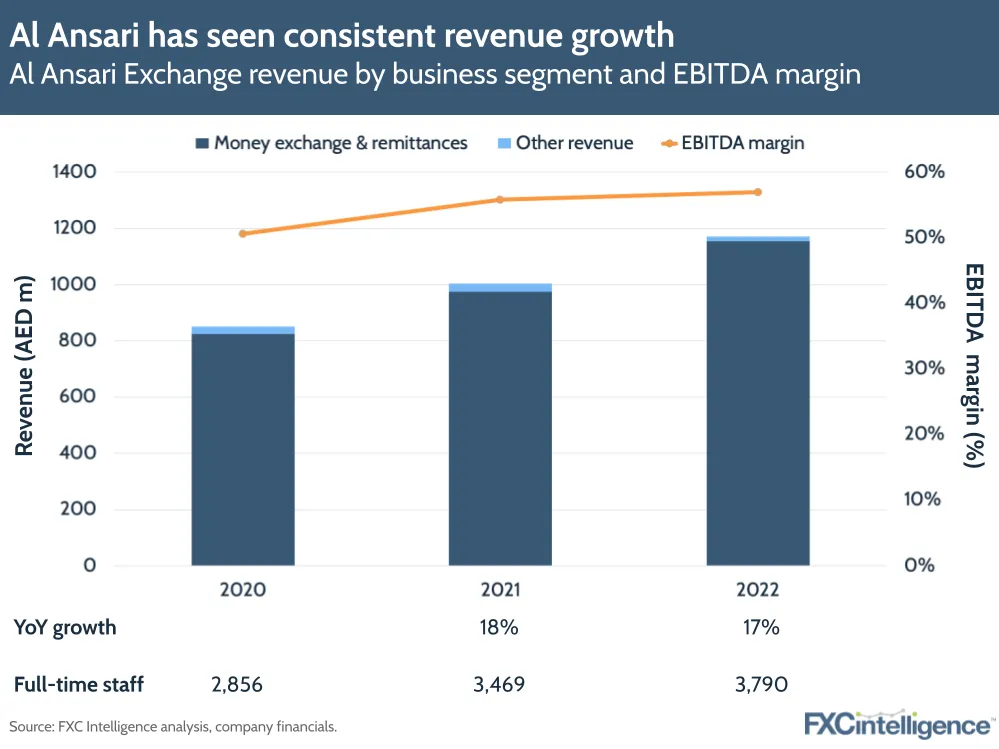

Market Overview of Al Ansari Exchange App

Al Ansari Exchange is one of the most popular financial institutions allowing users to process international fund transfers with attractive exchange rates. What makes the Al Ansari Exchange app successful is the Digital remittance feature as it is the most basic use case for which the application is used.

If we look at the stats, we can see that the global digital remittance market is achieving new heights every day. For instance, the entire market for digital remittances was valued at $21.8 billion in (2023). What makes this stat interesting is that the overall rate of growth CAGR for the period of 2024-2030 is estimated to be somewhere around 15.6%, taking the entire revenue to $60 billion!

As far as Al Ansari Exchange’s growth is concerned, the app is performing well. The company did $600 million in revenue for 2024, supporting over 130,000 transactions daily.

These numbers have garnered of attention as everyone wants to be a part of this exponential growth. Several players have emerged in the industry and several banking giants are planning to build an app like Al Ansari Exchange for their implementation. But, it is not that easy of a task considering there are several steps involved in the Al Ansari Exchange app.

Let’s take a look at those steps in the next section.

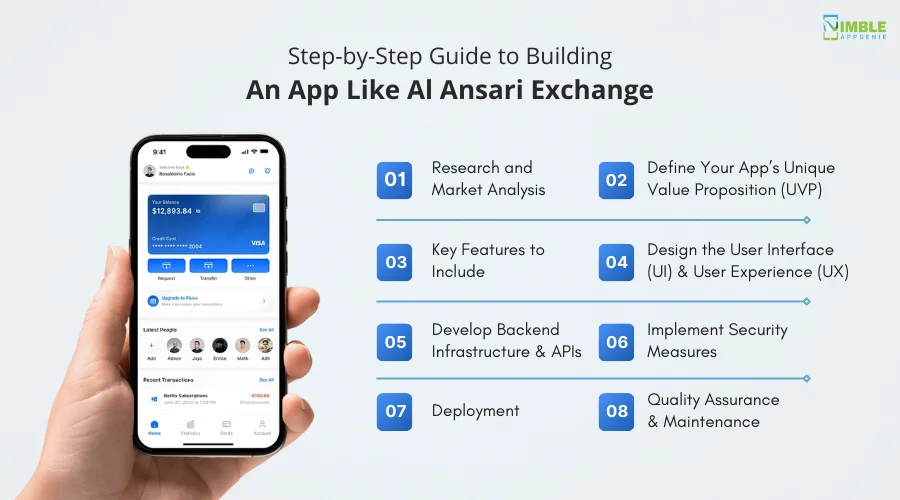

Step-by-Step Guide to Building an App Like Al Ansari Exchange

How to create an app like Al Ansari Exchange is a question that of people ask. It is not that difficult to create an e-wallet app as long as you have access to the best developers.

That is because while you can think of different ways to enhance the existing apps and make a better product, the developer should be equipped with the correct tools and knowledge to implement all of them.

To give you a perspective, there are 7 steps involved in building an app like Al Ansari Exchange.

These steps are-:

Step 1: Research and Market Analysis

The first step is to understand the needs of the market and its users. Researching app development processes can help you get deeper insights into how things work in the field.

More importantly, your understanding of the mobile app market is crucial as if you are aware of all the trends, you can plan to develop a better product that is future-proof.

Keep in mind that you will require assistance from subject matter experts, in this case, both banking & exchange professionals as well as developers.

Step 2: Define Your App’s Unique Value Proposition (UVP)

Once you are done with identifying the current market situation, you now need to define your application’s UVP. It stands for a unique value proposition. You see, creating a replica of the application may not work as expected considering someone has already implemented it.

Hence, you have to find a feasible solution to the current gaps in the market and position your application in such a way that it resonates with the problems of a user and solves them accordingly.

Step 3: Key Features to Include

After deciding on the value proposition of your application, you get clarity on what type of features you want in your ewallet application. Prepare a list of all the features that you want to include. Of course, the development team can help you with all the basic features required to build an application like Al Ansari Exchange.

However, you need to sit with them and identify key features that you want to include in the final application. These features define the gravity of your application hence it is a crucial step.

Step 4: Design the User Interface (UI) and User Experience (UX)

While functionalities and features seem to make an application successful, you should never underestimate the importance of user experience and interface. Banking applications already seem pretty complicated to use for the average user, so if you can design your currency exchange application in such a way that all types of users.

From basic to advanced, you can make the most of it, then the application is going to stick with the customers. The more hassle-free experience you give a user, the more they are inclined towards your application.

Step 5: Develop Backend Infrastructure and APIs

This is the step where developers work on your application’s backend infrastructure. The backend handles all the data handling and functionalities of your application. You can use various existing APIs to implement the features that you want.

The entire application takes shape in the process. You can have multiple iterations of the application before reaching the final build. This helps you test the application at a personal level to ensure that the features are implemented as you want.

Step 6: Implement Security Measures

Once the application is reaching its final stage, you need to implement security measures. You see, to build an app like Al Ansari Exchange, you have to meet several security prerequisites and compliances.

Make sure all the measures are implemented and there are no loopholes left in complying with the regulations. Banking applications are always under scrutiny by the government as they directly impact the economy. Hence you need to be double-sure about the practices and security protocols.

Step 7: Deployment

Lastly, when you feel that the application is ready, you can simply deploy it on various platforms like Google Play Store & Apple App Store, etc., depending on the compatibility of your application. During the deployment, you have to be active and promote the application so that new users are attracted to try the application.

The deployment may take some time considering the platforms you list the applications on, do their due diligence, and check everything about the application. If anything that does not meet the guidelines of the store is found, it may not be published and you’ll have to get the changes done.

Step 8: Quality Assurance & Maintenance

Once all these steps are completed, you are required to keep an eye on how the app is functioning and whether it requires any ewallet app maintenance or not. Your final application may encounter issues in the beginning as heavy traffic hits the platform.

However, it is the responsibility of the development team and quality assurance experts to ensure that your Al Ansari Exchange clone app works smoothly.

The job does not end after all these steps too! You have to be always on your toes and keep thinking about how to make things better for your users. Use the collected analytics to drive better results. The entire process is time-consuming and you will require proper banking app development services to guide you through.

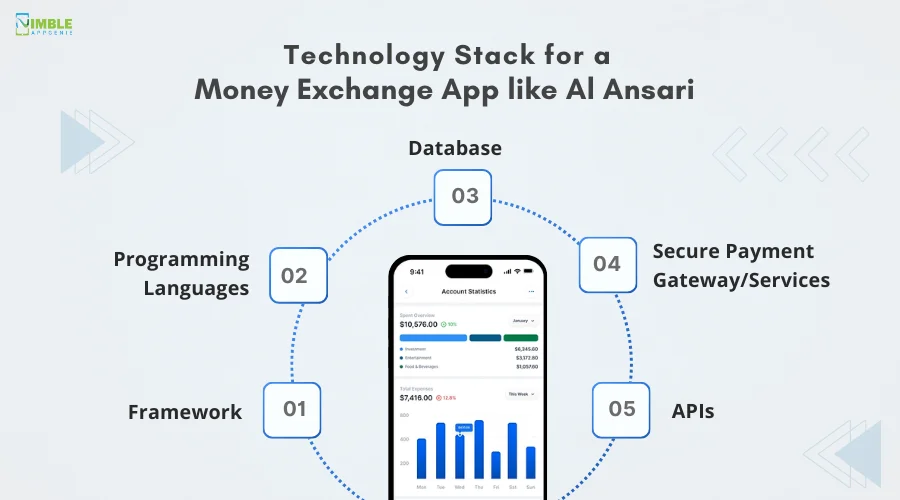

Technology Stack for a Money Exchange App like Al Ansari

While you might have an idea that it is not that easy of a job to develop an app like Al Ansari Exchange, there’s something that is even more confusing. And that is choosing the right tech stack for ewallet app.

The technology stack is a collection of all the possible technologies that you will use in the development of your money exchange application. You need to identify ideal technologies that are not too costly, future-proof in terms of further development, easily customizable, and low-maintenance.

There are different technologies of development for which you need to decide on a technology. These are –

♦ Framework

You have to choose a framework for your application based on the platform that you want to release it on. You have the choice of going for a Native framework or Hybrid depending on your plans. A native framework is dedicated to an operating system, while a hybrid development allows you to publish for multiple operating systems.

For Native app development, you can use Swift & Objective C for iOS and Kotlin for Android. As far as a hybrid framework is concerned, Flutter and React Native are good options.

♦ Programming Languages

To carry out functionalities in the backend, you require a programming language. Generally, it is chosen based on the availability of experts for the same. There are several options that you can choose from – Node JS, .NET, Python, Java, PHP, and TypeScript.

♦ Database

For any application to function and handle data, it requires a functional database management system. You can go for MongoDB, MS SQL, Oracle, etc.

♦ Secure Payment Gateway/Services

To enable secure real-time transactions, you need to integrate a payment service with your application. For instance, in the UAE, Aani offers real-time payments and supports all types of bank accounts, e-wallets, cards, etc.

♦ APIs:

You also have to choose what APIs to invest in. eWallet APIs allow your application to integrate features and implement them quite easily. Payment transfers, processing network integration, etc. are all done through APIs hence it is a crucial part of your techstack.

As you can see there are multiple options available for you to choose from. Do not get confused and in case you get confused, you always have the option to ask for suggestions. It is advised that you sit with your development team and identify the features of the Al Ansari Exchange app first.

This way, the technology that can be used to implement those features can be easy to choose and will make it an overall optimized experience.

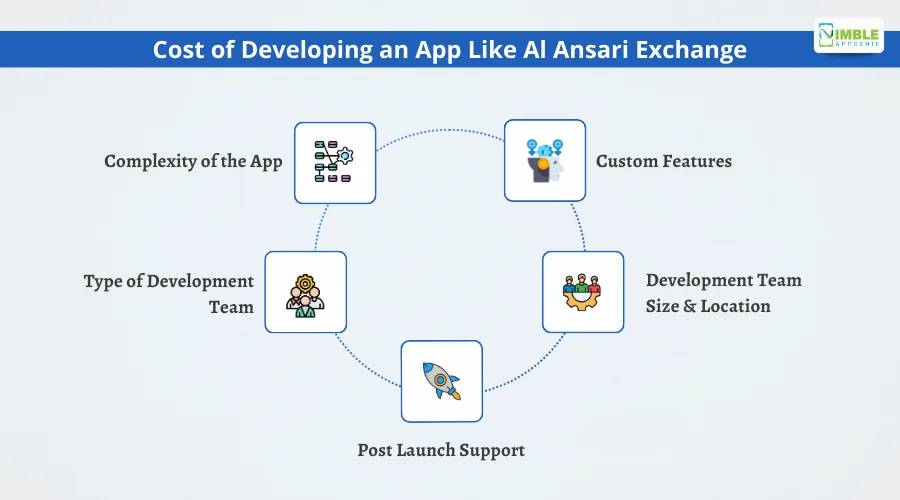

Cost of Developing an App Like Al Ansari Exchange

Cost to develop a secure money transfer app like Al Ansari Exchange can cost you anywhere in the range of $30,000 to $200,000. This is because the application has several intricacies that require time.

Several factors define the final cost of making an ewallet app. These factors include –

1. Complexity of the App

The complexity of development plays a crucial factor in deciding the cost of your application. If you are going for an app that uses only basic functionalities with a basic tech stack, it will be on the lower side, however as the complexity increases, the cost will rise too.

2. Custom Features

if you have selected a few features that are not necessarily aligned with the basic development or you have requested a fully customized list of features the cost will vary for your application. Customization is always a bit on the expensive side considering the resources required are costly.

3. Types of Development Teams

The cost varies depending on what type of team you are using. If you are using an in-house development team, it may cost you a bit more due to overhead costs such as salaries, benefits, insurance, etc.

On the other hand, outsourcing your fintech development can help you reduce the cost as you are only liable for a monthly fee and do not have to worry about salaries, insurance, and other benefits.

4. Development Team Size & Location

Other factors that may affect the cost of development for your money exchange app like Al Ansari Exchange is the team size and location. If you have outsourced your work to a smaller team, it may take some extra hours to finish, charging you more for the job.

Not to mention, the location of where the team works is also important. If you have chosen developers from a country where your currency is stronger, it can be beneficial, however, choosing a team from a country with a strong current rate can be costly.

5. Post Launch Support

The job of a development team is not over after the application is deployed. There has to be a dedicated support team that takes care of all the hiccups that your application might come across due to sudden user traffic. The cost of post-launch support varies depending on the strength of the team that you choose to deploy.

Based on all these factors, your cost of development will vary. If there’s one thing that you can do to get a quick estimate of what it would cost to develop an app like Al Ansari exchange, it is reaching out to FinTech development experts and consulting the idea with them.

Since professional developers have an idea of the industry practices, they can surely give you an estimate.

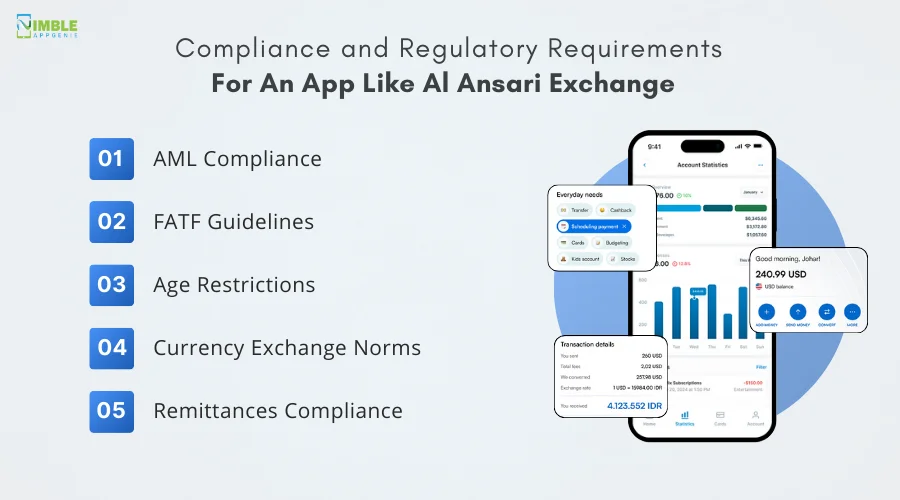

Compliance and Regulatory Requirements for an App Like Al Ansari Exchange

Since the entire concept of Al Ansari Exchange is based on handling money transfers across the globe, there are some serious complications that it has to follow.

Regulatory requirements are always strict when it comes to money management. Along with that, every application has to comply with the regulatory requirements of the respective countries that they deal with.

For an app like Al Ansari Exchange, the following are some crucial compliance and regulatory requirements –

-

AML Compliance

AML compliance is a set of rules and regulations that works to prevent criminals from using their illegal funds to transfer via such apps and turn them into legitimate money. Anti-Money Laundering guidelines are crucial to comply with. The core reason why apps related to money have to go through a lot of scrutiny is money laundering practices.

-

FATF Guidelines

The Finance Attack Task Force is the guardian organization for maintaining the order of any sort of fraudulent activity. The force can ask for compliance anytime and the guidelines must be followed properly to keep the app running.

-

Age Restrictions

Every country has its age restrictions when it comes to allowing money matters. For instance, Al Ansari Exchange has an age restriction of 21, making it only accessible to adults who are above the age of 21.

-

Currency Exchange Norms

While dealing in currency exchange, your app must adhere to currency exchange norms worldwide. This means that compliance related to different countries’ currencies also has to be followed. You must adhere to the policies of

-

Remittances Compliance

Various regulations and limits related to remittances in different countries should also be considered and complied with properly. If there are set limits for the amount of transactions, they should not be overpowered.

Other than these, there are regulations by stores that host your application. These include security feature regulations, data protection, mandatory features, etc.

Things can get extremely complicated if you do not have enough insights into what type of compliance is required to manage the application. Hence, make sure you connect with a app development company that has prior experience in developing a currency exchange and remittance-related application.

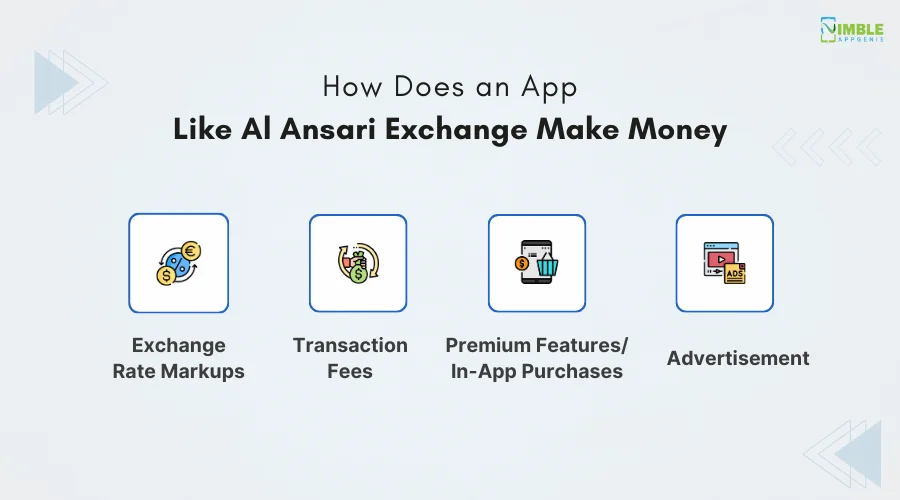

How Does an App Like Al Ansari Exchange Make Money

For any app to be able to solve problems and sustain, it has to make money. For many entrepreneurs trying to penetrate the fintech market, monetization is one of the key motivators.

However, many people are often confused about exactly how an e-wallet app makes money?

There are several ways an app like Al Ansari Exchange makes money, some of them include

1] Exchange Rate Markups

For any money exchange application, exchange rate markups are the ultimate stream of income. With a dedicated app, you can boost your revenue from these exchange rates. Since your regular investment will be less in an app than in providing these services offline, you can even play around with your margins and reduce them to attract more users.

2] Transaction Fees

If you give a user with a medium to carry out a fund transfer, you can charge them a transaction fee. Apps like Al Ansari Exchange use these charges to fuel the application, even if the percentage of this charge is negligible for a user, it helps the app in terms of monetization.

3] Premium Features/In-App Purchases

Another interesting way to earn money from an app like Al Ansari Exchange is by introducing premium features. Features like direct access to support, exchange rate calculators, credit score checkers, etc. can be great premium features to offer.

Since a user is already involved in money exchange and fund transfers, they will be more inclined towards using these features and will happily pay for them.

4] Advertisement

Another interesting way to monetize your money exchange application is by using ads. This also opens the door to a subscription model that you can implement to provide your users with an ad-free experience.

Ads of your products such as travel cards, credit cards, etc. can be used to attract a user to use more of your services, increasing the overall value of the client in the long term.

Other than that, you always have the option to monetize with user analytics, affiliate marketing, and cross-marketing between brands. You can even start trading tips and market insights to entice customers and get them to pay. The application has of potential to be monetized properly.

Why Choose Nimble AppGenie for Developing Your Exchange App Like Al Ansari?

When we talk about implementing all the steps and monetization for an application, the first thing we think of is who can do it for us? If you are looking for a team to help you develop your money exchange solution, then Nimble AppGenie is the ultimate solution.

The experience of developers at Nimble AppGenie in digital wallet and fintech application development makes it a reliable choice. With multiple clients from a similar field of work, they are completely aware of all the necessary compliances.

This means you can assign them the development project and stay stress-free as they can cope with all hurdles easily.

If you are planning to develop an online currency exchange platform that is unique and has never been done before, Nimble AppGenie can help you find your own USP. Moreover, they are experts in executing fresh concepts.

Conclusion

The market is growing for modern-day banking, money exchange, and e-wallet apps. But, with the growing market, the competition arises. Al Ansari Exchange is a top player in currency exchange and remittances. To capitalize on the opportunity of an growing market, you must develop an app like Al Ansari Exchange.

There are multiple steps in the development process and each of them is crucial for the final product to be as good as the existing top players. Keep in mind that while it might cost you a bit to get quality e-wallet app development services, the future holds of profitable opportunities.

Hence this is the right time to make the decision and start building an app like Al Ansari Exchange.

Hope this post gives you all the insights and clarity about how to build an app like Al Ansari Exchange. Thanks for reading, good luck!

FAQs

An app like Al Ansari allows you to instantly transfer funds using currency exchange. If you plan to develop an app similar to it, here is a list of features that it should have:

- Realtime Currency Exchange/Converter

- Fund Transfer Option

- Bill Payments

- Transaction Status Tracking

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.