If want know the cost develop a Buy Now, Pay Later (BNPL) app involves various factors that influence.

On average, the development cost for a BNPL app ranges between $120,000 and $250,000.

The cost includes expenses related to project complexity, feature set, development team location, technology stack, and security measures.

Essential features of a BNPL app typically include user authentication, transaction management, payment processing, credit scoring, and fraud detection.

By understanding and strategically managing these factors, businesses can optimize their budgets and achieve high-quality results.

Factors That Affect the Cost to Develop a BNPL App

It’s time to look at the factors that affect cost to build a BNPL app.

Here, we will breakdown the cost of developing BNPL. So, with this being said, let’s get right into it:

Factor 1: Project Complexity

The complexity of the BNPL app is a significant factor influencing the development cost.

More complex projects require extensive planning, a larger development team, and longer development times.

Complexity can arise from the number of features, integrations, and the architecture of the app.

| Project Complexity | Estimated Cost |

| Simple | $25,000 – $50,000 |

| Moderately Complex | $50,000 – $150,000 |

| Highly Complex | $150,000 – $300,000+ |

Key Considerations:

- Feature Set: Advanced features like AI-driven credit scoring, fraud detection, and real-time analytics increase complexity.

- Integration: Integration with various payment gateways, banking systems, and third-party services adds to the complexity.

- Architecture: A scalable, high-availability architecture requires more sophisticated design and implementation.

Factor 2: Feature Set

The features included in the BNPL app play a crucial role in determining the development cost.

Basic features like user registration, transaction history, and payment processing are standard. However, adding advanced features increases the cost significantly.

| Feature Set | Estimated Cost |

| Basic Features | $20,000 – $50,000 |

| Advanced Features | $50,000 – $200,000+ |

Factor 3: Development Team Location

The geographic location of the development team affects the cost to develop a BNPL app.

Labor rates vary greatly around the world, with developers in North America typically commanding higher rates than those in Eastern Europe, Asia, or Latin America.

Therefore, location can greatly affect cost to hire developers.

Key Considerations:

- North America: Higher labor costs but potentially higher quality and easier communication due to proximity and language.

- Eastern Europe & Asia: Lower labor costs with a growing number of skilled developers, though there might be time zone and communication challenges.

- Latin America: A balance between cost and quality, with moderate labor costs and closer time zones for North American businesses.

| Region | Hourly Rate |

| North America | $100 – $200 |

| Eastern Europe | $30 – $75 |

| Asia | $20 – $50 |

| Latin America | $40 – $80 |

Factor 4: Technology Stack

The fintech app’s technology stack impacts the cost to create a BNPL app.

Different technologies have varying costs associated with licensing, development, and maintenance. The technology stack should align with the project requirements and future scalability needs.

Key Considerations:

- Backend Technologies: Choices like Node.js, Python, Ruby on Rails, and Java.

- Frontend Technologies: React, Angular, Vue.js.

- Database: SQL (MySQL, PostgreSQL) vs. NoSQL (MongoDB, Cassandra).

- Cloud Services: AWS, Azure, Google Cloud.

| Technology Stack | Estimated Cost |

| Open-Source Technologies | Lower initial cost |

| Proprietary Technologies | Higher initial cost |

Factor 5: Development Methodology

The development method adopted can impact both the cost and the timeline of the BNPL app development project.

Agile methodologies, which involve iterative development and continuous feedback, can lead to higher initial costs but often result in a better-quality product.

| Development Methodology | Cost Structure |

| Waterfall | Fixed cost |

| Agile | Variable cost |

Factor 6: Security and Compliance

Ensuring the BNPL app is secure and compliant with relevant regulations is crucial.

Security features and compliance with financial regulations can add to the cost to make BNPL app, but they are essential for protecting user data and avoiding legal issues.

| Security and Compliance | Estimated Cost |

| Basic Security Measures | $10,000 – $30,000 |

| Advanced Security Measures | $50,000 – $150,000+ |

Factor 7: User Interface and User Experience (UI/UX) Design

A well-designed user interface and user experience are critical for the success of a BNPL app.

Investing in high-quality UI/UX design can enhance user satisfaction and increase adoption rates, but it also adds to the cost to build BNPL app.

Also Read: Fintech App Design Guide

- Custom Design: Unique, tailored design for the app.

- Responsive Design: Ensuring the app works seamlessly across various devices and screen sizes.

- User Testing: Conducting user testing to refine the design based on feedback.

| UI/UX Design | Estimated Cost |

| Basic Design | $10,000 – $30,000 |

| Advanced Custom Design | $30,000 – $100,000+ |

Factor 8: Third-Party Integrations

Integrating fintech APIs into the BNPL app can add significant value but also increases the development cost.

These integrations might include payment gateways, CRM systems, analytics tools, and more.

- Payment Gateways: Integration with services like Stripe, PayPal, and other financial institutions.

- CRM Systems: Integration with customer relationship management systems for better user management.

- Analytics Tools: Integration with analytics and reporting tools for data-driven insights.

| Third-Party Integrations | Estimated Cost |

| Basic Integrations | $5,000 – $20,000 |

| Complex Integrations | $20,000 – $50,000+ |

Factor 9: Maintenance and Support

Another big factor is cost of app maintenance and support.

Ongoing maintenance and support are essential for ensuring the app remains functional, secure, and up-to-date.

This includes bug fixes, updates, and general support, which adds to the overall cost.

| Maintenance and Support | Estimated Cost |

| Annual Maintenance | $10,000 – $50,000/year |

| Comprehensive Support | $50,000 – $100,000+/year |

By understanding and planning for these factors, businesses can better estimate the cost to make a BNPL app and ensure a successful, cost-effective development process.

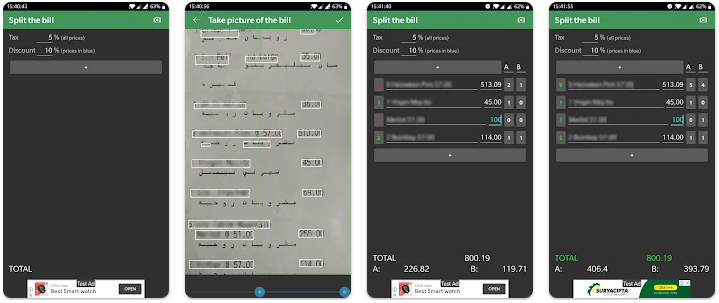

Popular BNPL Apps & Cost to Clone Them

It’s time to look at the best BNPL apps and how much it will cost to develop a clone app like them.

So let’s get right into it, starting with:

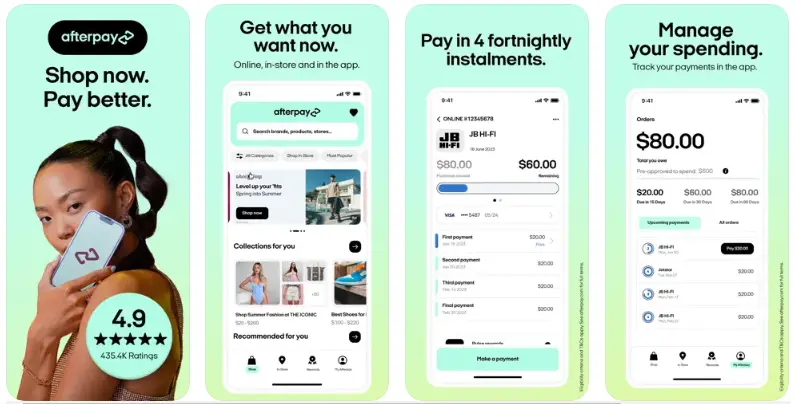

► Afterpay

Afterpay is a leading BNPL service that revolutionized the way consumers make purchases.

Established in Australia, Afterpay allows users to split their payments into four equal, interest-free installments over six weeks.

The app is particularly popular among millennials and Gen Z users who prefer budget-friendly payment options without the burden of interest.

It seamlessly integrates with numerous online and offline retailers, providing a convenient checkout experience.

With its user-friendly mobile app, Afterpay makes managing purchases and payments straightforward.

Key Features:

- Split payments into four installments

- No interest or fees if paid on time

- Integration with various online and offline retailers

- User-friendly mobile app

Also Read: How To Create An App Like AfterPay?

Cost Breakdown:

- Design and UI/UX: $15,000 – $30,000

- Backend Development – : $50,000 – $80,000

- API Integration: $10,000 – $20,000

- Payment Gateway Integration: $15,000 – $25,000

- Security Features: $10,000 – $20,000

- Testing and Quality Assurance : $10,000 – $15,000

- Maintenance and Support: $10,000 – $20,000/year

Total Estimated Cost: $120,000 – $210,000

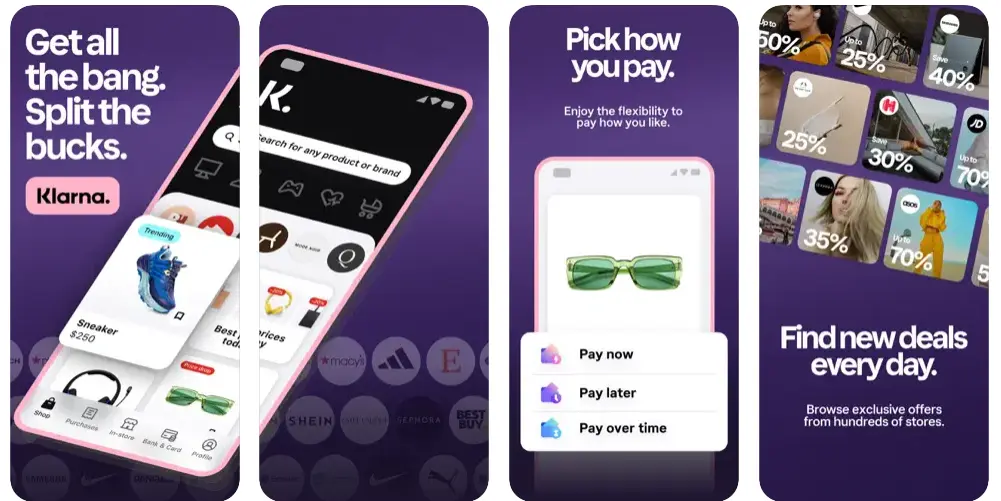

► Klarna

Klarna is a Swedish fintech company that offers a range of payment solutions, including the BNPL service.

Klarna provides users with multiple payment options: pay immediately, pay later, or finance their purchases over time.

Known for its smooth user experience and extensive integrations with over 200,000 merchants worldwide, Klarna enhances online shopping by offering flexible, interest-free installment plans.

The app also includes features like personalized shopping experiences and advanced fraud detection to ensure secure transactions.

Key Features:

- Flexible payment options

- Integration with various e-commerce platforms

- Advanced fraud detection

- Personalized shopping experience

Cost Breakdown:

- Design and UI/UX: $20,000 – $35,000

- Backend Development – : $60,000 – $90,000

- API Integration: $15,000 – $25,000

- Payment Gateway Integration: $20,000 – $30,000

- Security Features: $15,000 – $25,000

- Testing and Quality Assurance : $15,000 – $20,000

- Maintenance and Support: $15,000 – $25,000/year

Total Estimated Cost: $160,000 – $250,000

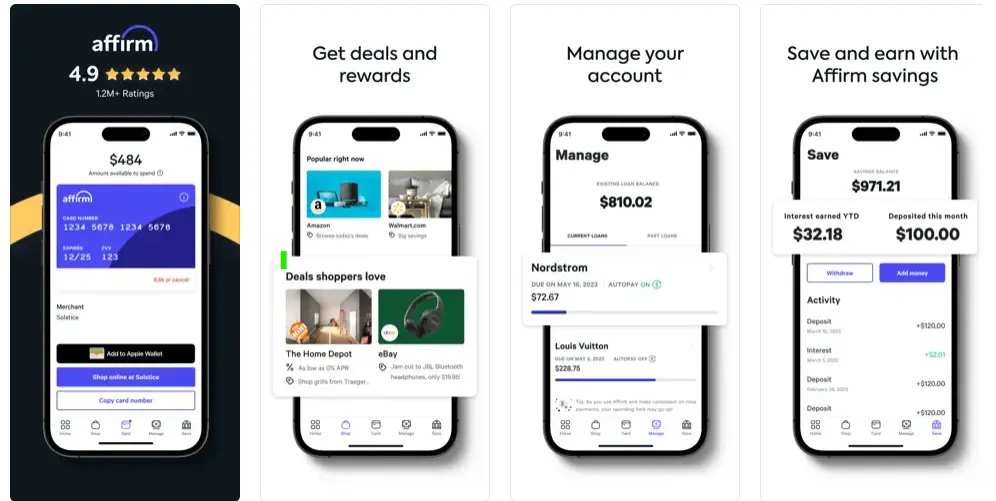

► Affirm

Affirm is a San Francisco-based BNPL company that offers flexible installment plans to help consumers finance their purchases over time.

Affirm stands out due to its transparent terms, with no hidden fees or late charges.

The app provides instant credit decisions and works with a wide range of merchants, including major online retailers.

Affirm’s focus on user trust and straightforward financial products has made it a popular choice among consumers looking for reliable payment options.

Key Features:

- Customizable installment plans

- No hidden fees

- Instant credit decision

- Integration with major e-commerce platforms

Cost Breakdown:

- Design and UI/UX: $15,000 – $30,000

- Backend Development – : $50,000 – $80,000

- API Integration: $10,000 – $20,000

- Payment Gateway Integration: $15,000 – $25,000

- Security Features: $10,000 – $20,000

- Testing and Quality Assurance : $10,000 – $15,000

- Maintenance and Support: $10,000 – $20,000/year

Total Estimated Cost: $120,000 – $210,000

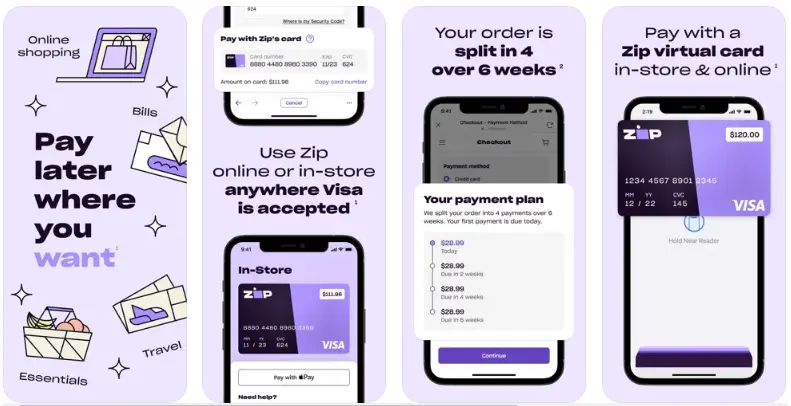

► Zip (Quadpay)

Zip, formerly known as Quadpay in the US, is a BNPL service that allows users to split their purchases into four interest-free installments over six weeks.

Zip is known for its ease of use and wide acceptance across numerous online and offline retailers. The app offers a real-time credit check process, ensuring quick and easy approval for users.

Zip’s straightforward and transparent payment model has gained a loyal customer base, especially among younger consumers.

Key Features:

- Four installment payments

- No interest or hidden fees

- Integration with online and offline retailers

- Real-time credit check

Cost Breakdown:

- Design and UI/UX: $15,000 – $25,000

- Backend Development – : $50,000 – $75,000

- API Integration: $10,000 – $20,000

- Payment Gateway Integration: $15,000 – $25,000

- Security Features: $10,000 – $20,000

- Testing and Quality Assurance : $10,000 – $15,000

- Maintenance and Support: $10,000 – $20,000/year

Total Estimated Cost: $110,000 – $200,000

► Sezzle

Sezzle is a BNPL platform that offers interest-free installment plans, enabling users to split their purchases into four payments over six weeks.

Sezzle focuses on empowering young consumers to budget responsibly without incurring debt. The app features a quick approval process and a user-friendly interface.

Sezzle’s mission to promote financial freedom and its seamless integration with numerous merchants have made it a popular BNPL choice.

Key Features:

- Four interest-free installments

- Integration with numerous merchants

- Quick approval process

- User-friendly app interface

Cost Breakdown:

- Design and UI/UX: $15,000 – $30,000

- Backend Development – : $50,000 – $80,000

- API Integration: $10,000 – $20,000

- Payment Gateway Integration: $15,000 – $25,000

- Security Features: $10,000 – $20,000

- Testing and Quality Assurance : $10,000 – $15,000

- Maintenance and Support: $10,000 – $20,000/year

Total Estimated Cost: $120,000 – $210,000

► Splitit

Splitly offers a unique approach to BNPL by allowing users to split payments using their existing credit cards.

The fintech business model eliminates interest charges and fees, leveraging the credit limits that users already have.

Splitting is particularly appealing to consumers who prefer to manage their finances using credit without taking on additional debt.

The app integrates with a wide range of merchants, providing a flexible and convenient payment solution.

Key Features:

- Uses existing credit cards

- No interest or fees

- Real-time credit approval

- Wide merchant integration

Cost Breakdown:

- Design and UI/UX: $15,000 – $25,000

- Backend Development – : $50,000 – $75,000

- API Integration: $10,000 – $20,000

- Payment Gateway Integration: $15,000 – $25,000

- Security Features: $10,000 – $20,000

- Testing and Quality Assurance : $10,000 – $15,000

- Maintenance and Support: $10,000 – $20,000/year

Total Estimated Cost: $110,000 – $200,000

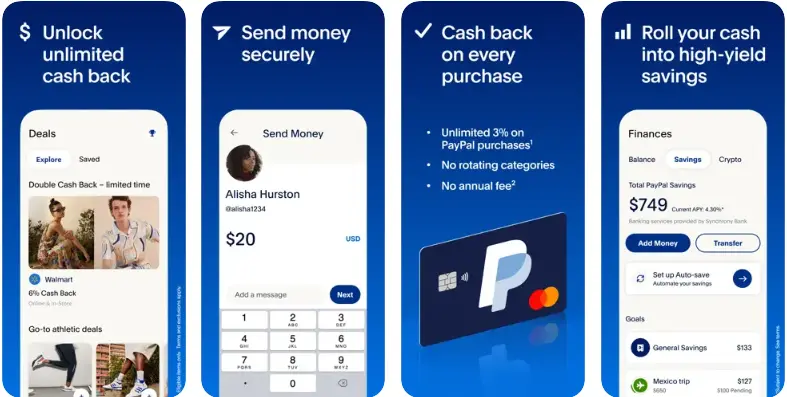

► PayPal Credit

PayPal Credit offers a reusable credit line for online shopping, providing the flexibility to pay for purchases over time.

The service is integrated with PayPal’s extensive merchant network, making it widely accessible. PayPal Credit is known for its user-friendly terms and advanced fraud protection features.

Users can manage their payments through the PayPal app, benefiting from the security and convenience of PayPal’s platform.

Key Features:

- Reusable credit line

- Flexible payment options

- Wide acceptance across online stores

- Advanced Fraud Protection

Cost Breakdown:

- Design and UI/UX: $20,000 – $35,000

- Backend Development – : $60,000 – $90,000

- API Integration: $15,000 – $25,000

- Payment Gateway Integration: $20,000 – $30,000

- Security Features: $15,000 – $25,000

- Testing and Quality Assurance : $15,000 – $20,000

- Maintenance and Support: $15,000 – $25,000/year

Total Estimated Cost: $: $160,000 – $250,000

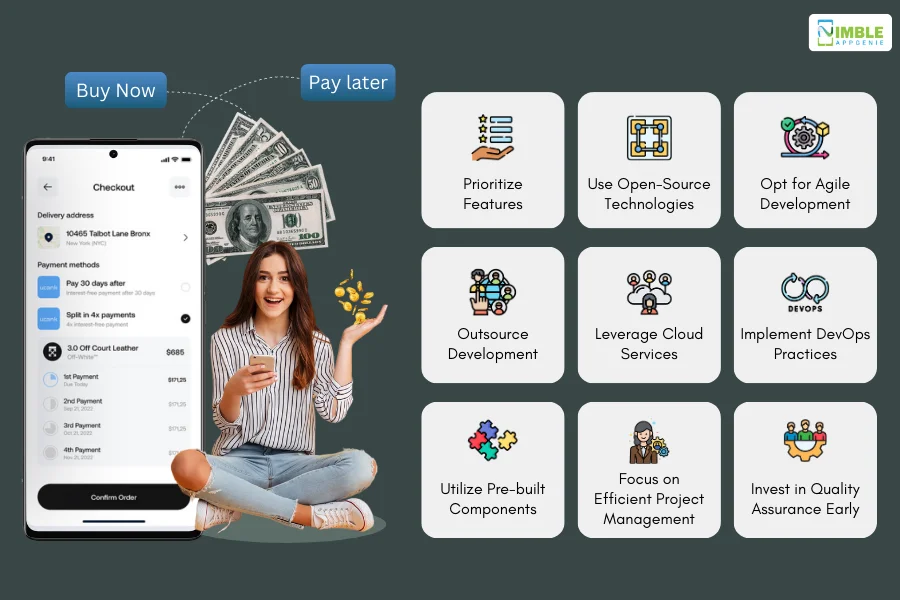

How to Decrease the Cost to Develop a BNPL App?

Developing a BNPL app can be expensive, but there are several strategies you can employ to minimize costs without compromising on quality or functionality.

Here are some effective approaches:

1. Prioritize Features

Start with a minimum viable product development that includes only the essential features. This allows you to launch the app quickly and start generating user feedback and revenue, which can then be reinvested to add more advanced features.

Steps:

- Identify core functionalities necessary for the app’s initial launch.

- Defer advanced or non-essential features to future updates.

- Use user feedback to prioritize feature development post-launch.

Benefits:

- Reduced initial development costs

- Faster time-to-market

- Focused development efforts on high-priority features

2. Use Open-Source Technologies

Leveraging open-source technologies can significantly cut down on licensing fees and other costs associated with proprietary software.

Steps:

- Choose reliable open-source frameworks and libraries for development.

- Ensure the chosen technology has robust community support and regular updates.

- Consider open-source solutions for databases, server environments, and development tools.

Benefits:

- Lower software licensing costs

- Access to a wide range of tools and libraries

- Community support and frequent updates

3. Opt for Agile Development

Agile development methodologies can help manage and reduce costs by breaking the project into smaller, manageable parts and allowing for iterative development and continuous feedback.

Steps:

- Implement Scrum or Kanban methodologies to manage tasks and sprints.

- Conduct regular sprint reviews and retrospectives to optimize processes.

- Adjust priorities based on feedback from each sprint cycle.

Benefits:

- Enhanced flexibility and adaptability

- Early detection and correction of issues

- Better project control and cost management

4. Outsource Development

Outsourcing development to regions with lower labor costs can result in significant savings. However, ensure that quality is not compromised by selecting reputable outsourcing partners.

Steps:

- Identify regions with lower development costs but high-quality talent, such as Eastern Europe or Asia.

- Vet potential outsourcing partners based on their portfolio, client reviews, and technical expertise.

- Establish clear communication channels and project management tools to oversee progress.

Benefits:

- Lower development costs

- Access to a broad talent pool

- Flexibility in scaling the development team as needed

5. Leverage Cloud Services

Using cloud services for hosting, storage, and other infrastructure needs can reduce the cost associated with maintaining physical servers and IT infrastructure.

Steps:

- Select cloud service providers like AWS, Azure, or Google Cloud that offer competitive pricing and scalable solutions.

- Use cloud-based development environments to streamline collaboration.

- Implement cost management tools provided by the cloud service provider to monitor and optimize usage.

Benefits:

- Reduced infrastructure costs

- Scalability and flexibility

- Enhanced collaboration and productivity

6. Implement DevOps Practices

Integrating DevOps practices can streamline development and operations, reducing the time and cost associated with deployment and maintenance.

Steps:

- Automate testing, deployment, and monitoring processes.

- Use CI/CD pipelines to ensure continuous integration and delivery.

- Foster a culture of collaboration between development and operations teams.

Benefits:

- Faster and more reliable deployments

- Reduced downtime and operational costs

- Improved the quality and performance of the app

7. Utilize Pre-built Components

Instead of building every feature from scratch, use pre-built components, SDKs, and APIs to add functionality quickly and cost-effectively.

Steps:

- Identify third-party services that offer pre-built components suitable for your app.

- Integrate SDKs and APIs for features like payment processing, authentication, and analytics.

- Ensure that the components chosen are secure and reliable.

Benefits:

- Reduced development time and costs

- Access to advanced features and functionalities

- Enhanced security and reliability

8. Focus on Efficient Project Management

Effective project management can prevent cost overruns and ensure that the project stays on track and within budget.

Steps:

- Use project management tools like Jira, Trello, or Asana to track progress.

- Set clear milestones and deadlines.

- Conduct regular project reviews to assess progress and make necessary adjustments.

Benefits:

- Better resource allocation and utilization

- Reduced risk of project delays

- Improved budget management

9. Invest in Quality Assurance Early

Early and continuous testing can prevent costly fixes later in the development process, ensuring that issues are identified and resolved promptly.

Steps:

- Implement automated testing for continuous feedback.

- Conduct regular manual testing to catch edge cases and usability issues.

- Establish a comprehensive QA strategy that includes performance, security, and usability testing.

Benefits:

- Reduced post-launch maintenance costs

- Improved app quality and user experience

- Early detection and resolution of issues

By applying these strategies, you can effectively minimize the development cost while still delivering a high-quality product that meets user needs and market demands.

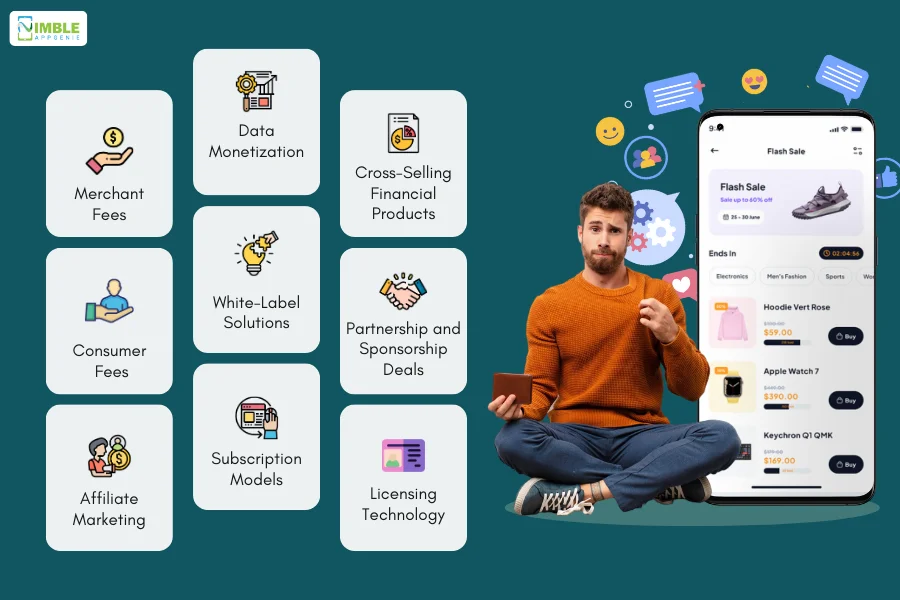

BNPL App Monetization Strategies

Buy Now, Pay Later (BNPL) apps have become a popular payment solution, providing a convenient way for consumers to purchase items and pay for them over time.

However, for these apps to be profitable, developers and investors need effective monetization strategies.

Here are some key monetization strategies along with their:

1] Merchant Fees

BNPL apps charge merchants a fee for offering their payment services.This fee is typically a percentage of each transaction facilitated through the app.

Merchants are often willing to pay these fees because BNPL options can increase sales, reduce cart abandonment, and attract new customers.

- Average Fee: 3% to 6% of each transaction

- High Potential: With high transaction volumes, merchant fees can generate substantial revenue. For example, a BNPL app facilitating $1 million in transactions per month at a 5% fee would earn $50,000 monthly.

2] Consumer Fees

Some BNPL apps charge consumers fees for using their service.

These fees can include late payment fees, monthly account fees, or interest on longer-term payment plans.

While many BNPL services market themselves as “interest-free,” they may still charge fees for specific features or conditions.

- Late Fees: $10 to $30 per late payment

- Interest Fees: 10% to 30% APR on extended payment plans

- High Potential: Consumer fees can be a significant revenue source, especially if the app has a large user base and a high rate of late payments or extended financing options.

3] Affiliate Marketing

BNPL apps can partner with retailers and brands to promote specific products or services.

In return, the BNPL app earns a commission on sales generated through these promotions. This strategy leverages the app’s user base to drive sales for partners.

- Commission Rate: 1% to 10% per sale

- Moderate to High Potential: Depending on the volume of promoted sales, affiliate marketing can provide a steady revenue stream.

4] Data Monetization

BNPL apps collect a vast amount of data on consumer spending habits, preferences, and creditworthiness.

This data can be anonymized and sold to third parties, such as marketers, financial institutions, and researchers, or used internally to enhance targeted marketing efforts.

- Data Sales: Variable, depending on the market and demand

- High Potential: With the increasing value of data, monetizing user data can be highly lucrative. However, it is crucial to adhere to privacy regulations and obtain user consent.

5] White-Label Solutions

BNPL companies can offer their technology as a white-label solution to other businesses.

This means other companies can integrate the BNPL service into their platforms under their own brand, while the BNPL provider earns a fee for providing the technology and support.

- Setup Fees: $10,000 to $50,000 per client

- Monthly Fees: $1,000 to $10,000 per client

- High Potential: This strategy can create a stable, recurring revenue stream, especially if the BNPL provider partners with multiple businesses.

6] Subscription Models

Some BNPL apps offer premium features or services through subscription models.

Consumers or merchants pay a monthly or annual fee to access these additional features, such as enhanced analytics, premium support, or exclusive deals.

- Subscription Fees: $10 to $100 per month

- Moderate to High Potential: Depending on the value and demand for premium features, subscriptions can provide a consistent revenue stream.

7] Cross-Selling Financial Products

BNPL apps can cross-sell other financial products, such as personal loans, credit cards, or insurance, to their user base.

Leveraging existing customer relationships and data, these offers can be highly targeted and relevant.

- Commission per Product Sold: Variable, often $100 to $1,000

- High Potential: Cross-selling can significantly boost revenue, particularly if the app successfully markets high-value financial products.

8] Partnership and Sponsorship Deals

BNPL apps can enter into partnerships and sponsorship deals with brands and retailers.

These agreements can include co-branded marketing campaigns, exclusive promotions, and special offers for BNPL app users.

- Partnership Deals: $10,000 to $100,000 per deal

- High Potential: Well-negotiated partnerships and sponsorships can generate substantial revenue and enhance the app’s brand recognition.

9] Licensing Technology

BNPL providers can license their technology to other financial institutions or fintech companies looking to incorporate BNPL solutions into their offerings.

- Licensing Fees: $50,000 to $500,000 per license

- High Potential: Licensing technology can lead to significant upfront revenue and long-term royalties, depending on the agreement.

Nimble AppGenie: Your Partner in BNPL App Solutions

As a leading BNPL app development company, Nimble AppGenie is dedicated to helping businesses create innovative and cost-effective BNPL solutions.

Our expertise in fintech apps ensures that your project not only meets industry standards but optimizes costs throughout the development process.

We leverage advanced technologies, proven methodologies, and strategic planning to deliver high-quality BNPL apps that cater to your specific business needs.

Whether you are looking to develop a new BNPL app or enhance an existing one, Nimble AppGenie is your trusted partner in achieving cost efficiency and exceptional results.

Conclusion

Developing a BNPL app involves various cost factors, from project complexity to the choice of technology stack.

By understanding and strategically managing these factors, businesses can optimize their development budgets and achieve high-quality results.

Effective monetization strategies, such as merchant fees and affiliate marketing, can further enhance the app’s profitability.

FAQs

The cost to develop a BNPL app can range from $120,000 to $250,000, depending on factors such as project complexity, feature set, and development team location.

The development timeline for a BNPL app can vary from 6 months to over a year, depending on the scope and complexity of the project.

Key features include user authentication, transaction management, payment processing, credit scoring, fraud detection, and integration with various merchants and payment gateways.

You can minimize costs by prioritizing essential features, using open-source technologies, opting for agile development, outsourcing to cost-effective regions, and leveraging pre-built components.

Monetization strategies include merchant fees, consumer fees, affiliate marketing, data monetization, white-label solutions, subscription models, cross-selling financial products, partnership deals, and licensing technology.

Factors include project complexity, feature set, development team location, technology stack, development methodology, security and compliance requirements, UI/UX design, third-party integrations, and maintenance.

Yes, integrating with existing payment gateways like Stripe, PayPal, and others is possible and often recommended for a seamless user experience.

Security considerations include implementing strong encryption, complying with financial regulations, integrating fraud detection mechanisms, and ensuring secure API management.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.