Are you planning to build a mobile banking application?

As fintech fever grows among users worldwide, it has forced some of the world’s largest industries to reconsider their standing.

Some of the top banking and financial institutions are considering building their app.

The average cost to develop a mobile banking app ranges between $25,000 and $150,000+. It depends on various factors like complexity, compliance, features, platform, development team, and much more.

That is to say, goes on behind estimating the cost to develop an app than what meets the eye.

Speaking of which, if you want to learn more about how much you might have to pay or are curious about the cost of your next project, we have got you covered.

From the average cost to a complete breakdown of factors, we will be discussing it all.

Let’s get right into it:

Why Develop a Mobile Banking App?

There are a lot of businesses, banks, & startups who want to develop a banking app.

But why?

One of the biggest questions, even more prominent than how much it costs. Well, there are various reasons to build a mobile banking app in 2024, especially, in-demand banking apps. Let’s look at some of these below:

♦ Personalization and User Engagement

Banking and finance app users expect a personalized experience that caters to their individual needs.

Offering tailored features and services not only enhances user satisfaction but encourages regular app usage.

Plus, adopting omnichannel strategies, where your banking app is integrated with various other platforms, can boost client retention rates.

♦ Mobile Banking Popularity

The rise of neobanks, which are banks operating only through mobile apps without traditional physical branches, showcases the potential and demand for mobile banking.

For instance, mobile banking statistics neobanks generated $6.8 billion in revenue in 2021, with NuBank alone attracting over 40 million users.

This demonstrates the massive user base and revenue potential for mobile banking apps.

Average Cost to Develop a Mobile Banking App

So, how much does it cost to create a mobile banking app?

Well, on average, the cost to build a mobile banking app ranges from $25,000 to $150,000+. It is affected by factors like complexity, features, app type, compliance, and on.

Now, why is it hard to estimate the development cost of a mobile banking app?

Much like any cost of building a mobile banking app, when calculating the budget for a banking app, the factors play a big role.

In layman’s terms, each project has a unique development cost.

So, if you want an exact estimate, it’s recommended that you consult an app development company.

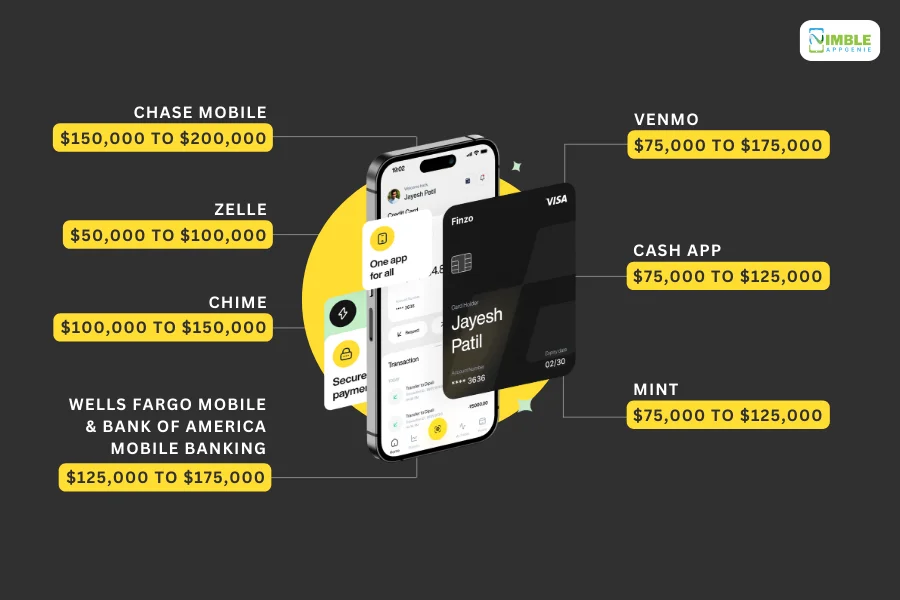

Popular Banking Apps and Their Development Costs

The market is filled with super popular mobile banking apps.

More often than not, these are the inspiration behind businesses wanting to develop their own app, being the subject of clone app development.

To help you estimate the cost of developing a banking app, let’s look at popular apps and their cost.

These are, as mentioned below:

1. Chase Mobile

Let’s start with Chase.

It is a comprehensive banking app from a major financial institution.

Here, users can manage accounts, transfer money, deposit checks, and access other banking services conveniently.

Its success inspired others to create similar secure and feature-rich banking apps.

So, how much does it cost to develop an online banking app like Chase? You can expect the cost to develop a mobile banking app like this one to be anywhere between $150,000 and $200,000+.

2. Venmo

Venmo is one of the most popular person-to-person (P2P) payment apps known for its social features.

Users can send and receive money with friends, often with split-bill functionality.

The ease and social aspect of P2P payments make it attractive to replicate. Now, coming to the cost of development part:

The cost to build a banking app like Venmo is $75,000 – $175,000.

3. Zelle

Zelle is yet another P2P payment app known for its bank-to-bank transfers.

It offers a fast and secure way to send money between linked bank accounts. The speed and security of bank-backed P2P transfers make Zelle’s business model for similar apps.

The cost to develop an app like Zelle would cost anywhere between $50,000 and $100,000.

4. Cash App

Want to build an app like Cash?

Well, for those who don’t know, it is a mobile payment and investing app with a millennial and Gen Z focus.

It allows users to send and receive money, make purchases, and invest in stocks.

Its appeal to a younger demographic with its multi-functionality makes it a target for similar app development.

The cost to build a banking app like Cash ranges from $75,000 to $125,000.

5. Chime

Chime is a challenger bank offering online banking services with no monthly fees and features like early access to direct deposits.

Its focus on low fees and innovative features makes it an inspiration for similar fintech apps.

So, the cost to create a banking app like Chime is between $100,000 and $150,000.

6. Mint

Mint is one of the most popular banking apps, a personal finance management app that allows users to track budgets, manage bills, and monitor investments.

Its budgeting and financial organization tools are valuable to users, making it a model for similar money management apps.

So, how much does it cost? The cost to develop an app like Mint is between $75,000 and $125,000.

7. Wells Fargo Mobile & Bank of America Mobile Banking

Finally, we have the Wells Fargo mobile banking app.

Like Chase Mobile, these are secure and feature-rich banking apps from major institutions.

They offer account management, money transfer, bill pay, and other functionalities, making them strong examples of similar apps, those focused on established banking brands.

The cost to build such a mobile banking app ranges from $125,000 to $175,000.

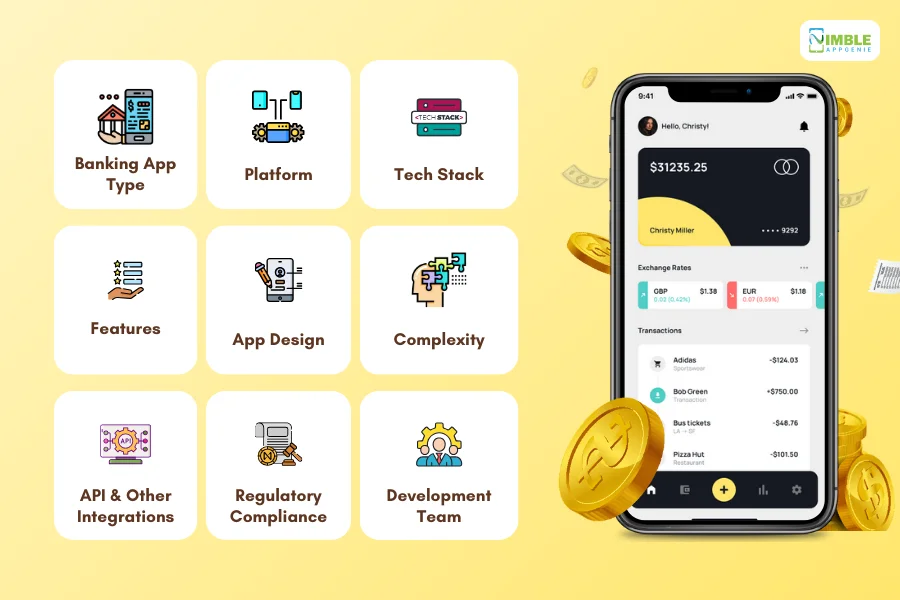

Factors That Affect the Cost of Developing a Mobile Banking App

If we have learned anything about app development cost, it is, there are a lot of factors.

So, if you want to estimate how much you might have to pay to create a banking app, you need to understand this factor. And that’s what we will be doing in this section of the blog.

Now, it’s time to look at the factors that affect the development cost of a mobile banking app:

1] Banking App Type

The very first factor is the type of app.

While the mobile banking app itself is a form of fintech application, it can be further divided into two types. Let’s see what these are:

-

Dedicated Banking App

Let’s start with a dedicated banking app. As the name suggests, this is when a bank or any other financial institution wants to develop an app for their brand.

For instance, the Bank of America App. They are dedicated to their brand, hence the name.

Now, the cost to develop a dedicated digital banking app will be 100,000+.

-

Banking App Aggregator

On the other hand, we have an aggregator banking app.

A good example of this model would be Zelle.

These apps connect with n number of banks and let users enjoy their services, without being limited to any one of them.

The cost to develop a mobile banking app in an aggregator model ranges between $25,000 and $150,000.

This establishes that the type of app you are developing or the app idea behind your banking app project can affect the total development cost of a digital banking app.

Now, with that out of the way, let’s look at the second factor…

2] Platform

Once you have an idea for a mobile banking app, the next thing you need to focus on is a platform.

Typically, people choose between Android and iOS app development, but the platforms go beyond that.

3] Tech Stack

Once done with the idea and platform, it’s time to choose a tech stack.

The tech stack plays an important role in dictating the performance of mobile banking applications and also highly affects the cost to develop a mobile banking app.

Choosing the right tech stack is super important at so many levels. In any case, let’s move on to the next.

4] Features

The next step in the app development process is choosing features for the mobile banking app.

When we speak of features, we are using umbrella terms as they can be divided into subsections like user features, admin features, core features, advanced features, and so on.

5] App Design

It’s time to design the app.

UI/UX design, as statistics show, plays an important role in user attraction, retention, and satisfaction. So, investing in your mobile banking app’s design is a good idea.

To the point, it can affect online banking apps.

Additional Cost Considerations:

- Number of Screens: For each additional screen with a unique layout, expect a design cost increase of $500 – $1,000.

- Design Iteration: Multiple design revisions throughout the development process can add $1,000 – $3,000 per iteration to the design cost.

- Design Team Experience: Senior designers with expertise in mobile app design will command higher fees compared to junior designers. The cost difference can range from $10,000 – $20,000 for the entire project.

6] Complexity

As a general rule of thumb, the more complex the project is, the higher it will cost.

That’s what makes complexity the biggest factor to consider when estimating app development costs. Here’s a breakdown:

| App Complexity | Estimated Cost Range |

| Basic | $25,000 – $50,000 |

| Moderate | $50,000 – $100,000 |

| Advanced | $100,000 – $150,000 |

| Complex | $150,000+ |

Now, let’s see how third-party integration can affect development costs.

7] API & Other Integrations

When developing a banking application or any kind of fintech app for that matter, a lot of third-party integrations are required.

While many of these are free to use, the majority of banking APIs are paid for.

Choosing which APIs to include and which not is an important decision and can affect cost.

Also Read: Open Banking APIs

8] Development Team

The development cost of any app is also proportional to the cost to hire app developers.

How Long Does It Take To Develop A Mobile Banking App?

Well, depending on almost the same factors as cost, it can range from 3 months to up to 18 or more.

Here’s a breakdown of app development time:

| App Complexity | Development Time (Months) |

| Basic Banking App (Account Management, Balance Viewing, Transfers) | 3-6 |

| Moderate Banking App (Bill Pay, Mobile Deposits, Basic Security Features) | 6-12 |

| Advanced Banking App (Investment Tracking, Budgeting Tools, P2P Transfers) | 12-18 |

| Complex Banking App (All of the above, plus complex features like Loyalty Program Integration and Credit Score Monitoring) | 18+ |

Nimble AppGenie – Your Partner in Developing Next-Gen Mobile Banking Apps

Do you want to make your mobile banking app? We’ve got you covered.

As a market-leading mobile banking app development company, Nimble AppGenie has what it takes to develop feature-rich banking apps.

We have worked on over 350+ projects, delivering 95% client satisfaction.

Plus, we have extensive knowledge of developing the next best mobile banking solution, we have delivered master class projects before:

- Pay By Check– Pay by Check is a popular e-wallet mobile app in the United States of America. It allows users to transfer, pay, or even exchange currency.

- SatPay– An eWallet platform is a Versatile eWallet Solution that allows users to request, receive, and send payments without hassle.

- CUT– an E-wallet Mobile App, CUT is available in China and Myanmar. It works well with both RMB and MMK currencies.

- SatBorsa– a Currency Exchange Fintech app. SatBorsa is one of the platforms that is available on both platforms, iOS and Android.

We can do it again!

Hire Mobile app developers and start your journey today.

Conclusion

The cost of developing a mobile banking app doesn’t have to be a mystery. By understanding the factors we’ve explored – from app complexity to development team structure – you can create a realistic budget for your financial brainchild.

Remember, a well-designed mobile banking app isn’t just a cost, it’s an investment in user engagement, operational efficiency, and a competitive edge in the ever-evolving financial landscape. Now you’re armed with knowledge, take the next step!

FAQs

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.