From a basic smartphone to advanced supercomputers, every piece of technology today uses artificial intelligence in one way or another.

The same goes for various industries that have undergone digital transformation in fintech. Some even believe that AI in fintech has revolutionized how people interact with financial services digitally.

But the question that arises here is HOW?

How has AI revolutionized the fintech sector? What benefits does it offer? What are the use cases for AI in fintech? More importantly, how can implementing AI in fintech be beneficial for your business?

If you, too, want to understand the role of artificial intelligence in fintech, make sure you read this article to the end.

In this one, we will be focusing on how AI has enhanced the implementation of fintech, the benefits of using AI in fintech development, and the challenges that you might face.

Understanding the Role of AI in Fintech

Artificial intelligence, as a technology, is one of the most advanced and helpful technologies that can be implemented in every walk of life. In simple terms, AI is intelligence that is exhibited by machines and software, allowing these systems to interact with the user more convincingly.

The digitization of financial services has brought advancements in the way people handle their finances. While it was a headache for many to visit a branch regularly for one thing or another, today, most financial services can be accessed through a smartphone.

However, the convenience is not limited to users, as the implementation of technology also brings a lot of benefits to the service providers, in this case, financial institutions.

Integration of AI in Fintech can help financial institutions analyze patterns, predict trends, and make data-driven decisions that are more accurate and beneficial for their organization. It can easily streamline the entire process of data analysis and processing.

AI also enables several features that support fraud detection, custom recommendations, and chatbots. Hence, companies planning to penetrate the fintech market must use artificial intelligence to better manage and analyze the data to gain better insights.

AI in fintech is about leveraging advanced algorithms and machine learning to improve financial services. It’s essential for businesses looking to adopt these technologies to partner with AI consulting experts. These experts can assess organizational needs, develop tailored strategies, and ensure effective integration into fintech solutions.

These insights can further help in addressing the current market challenges for AI consulting services, uplifting the experience for both users and financial institutions.

Benefits of Implementing AI in Fintech

AI brings several benefits that can be implemented in technology to benefit your fintech platform.

Some of these benefits include –

-

Risk Management

Identifying and managing risks becomes super easy with the implementation of artificial intelligence. Risks in fintech mainly refer to the chances of a person defaulting on their payments and the poor assessment of an individual’s creditworthiness.

These defaults cost a lot of money for fintech companies. However, with AI algorithms combined with machine learning, you can create a solid risk management mechanism that helps you improve risk management on your FinTech platform.

-

Better Data Analysis

The implementation of AI also helps in better data analysis. Usually, this data is generated by the user and is used to identify user requirements.

However, with AI, this data can be used to analyze the entire trajectory of a user since they joined.

These patterns help in identifying the overall value of a customer for your company. Data analysis with AI often implements predictive analytics, allowing you to identify user patterns and make informed decisions.

-

Advanced Automation

Artificial intelligence can be used to automate several operations that usually require a dedicated resource. This yields a lot of cost savings for a company and improves the efficiency of the processes by a significant margin.

This also means that with the help of advanced automation techniques deployed through AI & ML, you can easily automate some of the basic steps that a user or your company has to perform manually.

-

Accurate Recommendations

Recommendations are one of the key players when it comes to pushing and converting your customers for additional services.

But in fintech, it is a service that helps users more than the business. Artificial Intelligence allows you to understand the patterns of a user so that you can identify what type of services they are interested in and recommend similar services.

This helps in converting more users into regular customers and cross-selling your services at the same time.

-

Improved Customer Support

Another sector where the implementation of AI in financial services is beneficial is customer support. With AI-based chatbots and text support, you can easily enhance your turnaround time on any ticket raised by the customer.

It also helps in satisfying a user’s urgent requests, as finances are a delicate matter, and delaying in reverting to a grievance may result in the loss of a customer.

-

Enhanced Operational Efficiency

With AI and machine learning, you can easily enhance operational efficiency. The implementation of AI can help streamline all the processes, making it operationally efficient and secure.

With the help of automation, operations become easier and easier to trace, which means fewer resources are invested in it, making it more operational than ever!

Other than this, AI in fintech can leverage all the user-generated content for better decision-making.

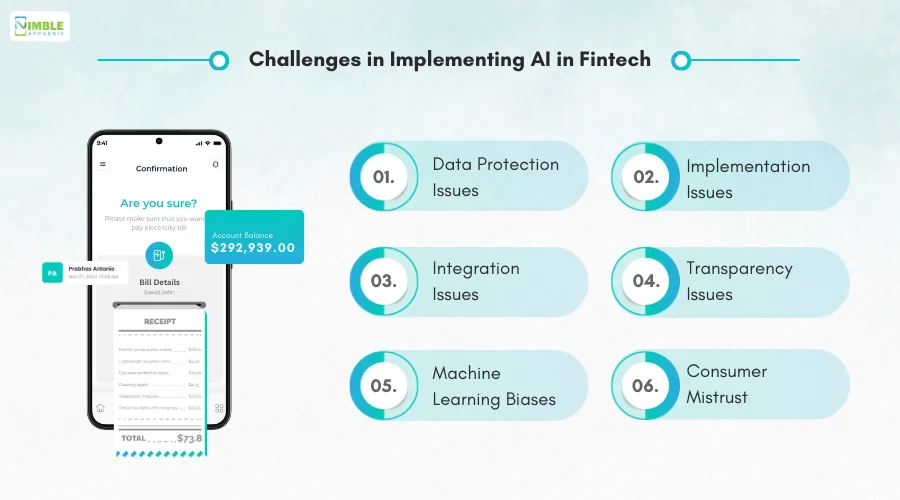

Challenges in Implementing AI in Fintech

When we talk about AI in fintech, the benefits do make a good case for implementation. However, keep in mind that there are significant challenges that you might face.

These challenges include –

► Data Protection Issues

To make the most of artificial intelligence mechanisms that you deploy on your fintech platform, you need to store loads of data.

The real issue begins when you have to securely store this data. This data also holds especially sensitive information about a user and is always vulnerable to leaks and breaches.

► Implementation issues

The cost of implementation is one of the biggest challenges. Some fintech businesses are unable to identify the exact use case for which they want to implement AI, making it more complicated for them to rely on AI.

► Integration Issues

Not all technologies may be compatible with the legacy systems that are currently being used to power your platform. It is difficult to integrate AI in fintech, as you will also have to upgrade your legacy systems, as they may pose an issue in compatibility.

► Transparency Issues

While AI can help in generating decisions faster, sometimes it may lack transparency in the entire decision-making process.

While AI implementations can enhance operations, people often have concerns about the authenticity of those decisions, as they do not know how these were derived.

► Machine Learning Biases

This algorithmic bias can often prove to be a problem as AI is usually implemented to simplify the workflow, not to complicate it.

However, you have to run regular audits on implemented algorithms to find if they are getting affected by the ML bias, or if they are working fine or not.

► Consumer Mistrust

For common consumers, AI is yet to make a mark as it has some serious glitches in the model. Not to mention, when anything is related to finances, consumers prefer interacting with humans more than artificial intelligence. Mistrust is one of the key challenges in the implementation of AI in financial services.

Read Also – Generative AI, Conversational AI, and Chatbots – A Complete Breakdown

The challenges may vary as per your domain in fintech, as insurtech has different issues than banking. Hence, you need to understand what issues can hamper your platform’s experience and work on them.

If you are unable to manage the implementation, you should ask the development team to guide you through it, as fintech development experts surely know how to implement things better.

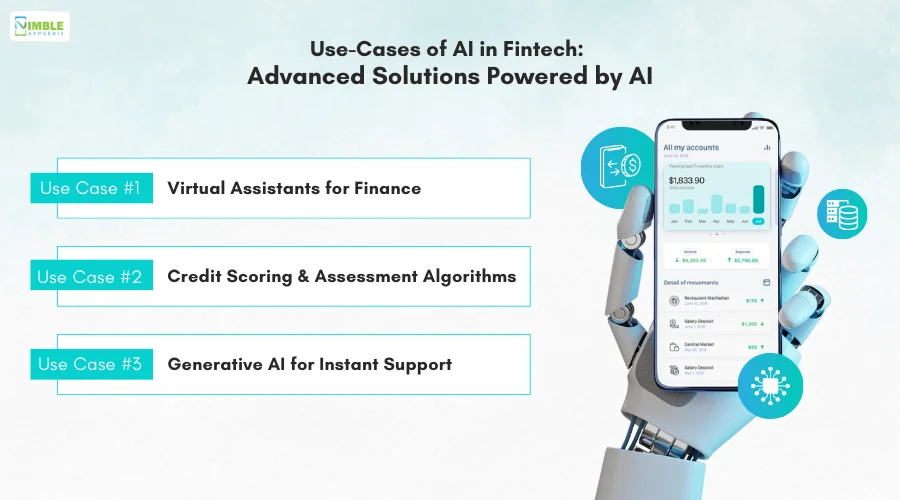

Use-Cases of AI in Fintech: Advanced Solutions Powered by AI

Knowing about the benefits and challenges of implementing AI in fintech, you might have gotten confused about whether to use AI in fintech or not. Well, challenges are often seen with almost every other technology.

But that does not mean that you should avoid it, especially when something offers benefits that streamline operations to a whole new level. AI has proven to be highly effective in every industry where it has been implemented and fintech is no exception.

Some of the key use cases of AI in fintech can give you a better understanding of how AI is reshaping the future of financial services!

Use Case #1 – Virtual Assistants for Finance

One of the best use cases for implementing AI is in smart virtual assistants for financial services.

Any fintech service provider can create a virtual assistant that can be deployed on the platform to resolve basic user queries, such as helping them find a service, simplifying their experience, answering frequently asked questions, and sharing the status of their requests.

Think of these AI assistants as “Siri” for your fintech platform.

Use Case #2 – Credit Scoring & Assessment Algorithms

Another crucial AI use case is credit scoring and assessment. When dealing in fintech, you should be able to assess the consumer’s creditworthiness properly.

By combining the smartness of AI and the complexities of a machine learning algorithm, you can easily automate these tasks, making them more efficient, effective, and quick.

Resolving credit scoring and assessing creditworthiness correctly can help you tone down your default rate, which directly reflects in the overall financial performance.

Use Case #3 – Generative AI for Instant Support

Generative AI has become one of the most commonly used AI solutions, thanks to its ease of administration. Generative AI often helps in generating texts, images, etc., for a prompt given by the user.

Now, by training your own generative AI model, you can directly deploy it as a quick support system. As soon as a user enters their query, this generative AI takes it as a prompt and generates an answer accordingly.

You can even leave suggestions for the users as to what they can ask or how they should structure their queries for the best results.

These are just 3 of hundreds of ways fintech companies are using AI to empower their businesses. Challenges do not stop them from making the most of available resources.

However, in order to implement these use cases, you have to be more and more diligent while implementing AI in fintech.

Not to forget, implementing these AI use cases will affect the cost of developing a fintech app by a significant amount.

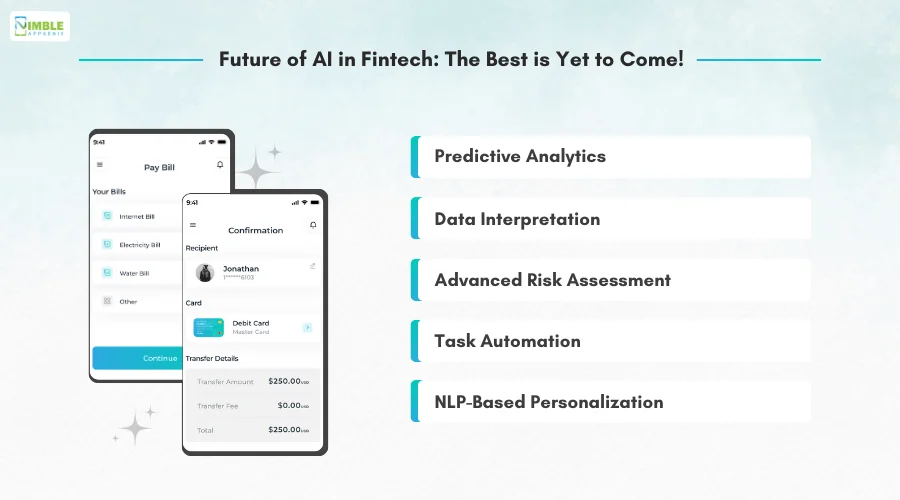

Future of AI in Fintech: The Best is Yet to Come!

While these use cases seem futuristic, we firmly believe that these are not the best solutions yet, as AI has a lot more potential.

With a team of out-of-the-box thinkers and development wizards, you can design unique use cases where AI in fintech can enable you to streamline the entire functionality in no time.

With every passing week, AI is advancing towards a better model of implementation, making it more and more intelligent.

♦ Predictive Analytics

Predictive analytics is the advanced version of data analysis and offers insights into future trends.

With the help of an AI-powered machine-learning algorithm, you will be able to deliver deeper insights on user behavior and their usage patterns, allowing you to predict future trends.

With improvements in predictive analytics, it will be a lot easier to make decisions that can help maximize their profits while maintaining a quality experience.

♦ Data Interpretation

In the coming years, AI will find its way into data interpretation, helping financial institutions strengthen their strategic planning.

For any business to run successfully, it is crucial to keep updating yourself time-to-time. But how do you know if it is the correct time to make a move? Well, you rely on data, and with the help of AI-based data interpretation, you will be able to interpret large amounts of data for your business quite easily.

♦ Advanced Risk Assessment

Financial risks are always a key challenge for both consumers and businesses in the field of finance.

The risk assessment will become more intelligent and accurate when it comes to making the right decisions, lend to the right people, and make things more efficient.

AI-powered credit scoring can help identify potential risks beforehand, reducing the chances of unintended consequences such as loan defaults.

♦ Task Automation

The future of financial services is moving towards task automation, which helps a fintech company to reduce human resource costs, improve efficiency, and make processes faster.

Task automation can be easily implemented with the help of artificial intelligence.

The key is to develop an internal AI engine that allows the optimization of long tasks into steps that can be easily converted into tasks that can be automated easily through machine learning algorithms.

♦ NLP-Based Personalization

Personalization is another area of fintech that AI will revolutionize shortly. This is because implementing artificial intelligence can enable Natural Language Processing to interpret the queries of the users in their purest form, with the intent.

This helps in creating personalized recommendations based on a user’s usage patterns and requirements.

Implementing AI with fintech can be highly beneficial, especially for a small business, as it can help in automating processes like customer support, data processing, and more. Saving a lot of time, effort, and money in the long run.

Conclusion

Artificial intelligence offers some cutting-edge solutions and helps streamline several integral processes. There are several challenges that you might face while implementing AI in fintech.

However, the ease of access and benefits that AI offers overshadow these challenges completely and hence make it more desirable to integrate them.

To integrate AI in fintech, you will need two things, conviction and a team. The above information should be enough to bring conviction on how crucial using AI is for your business.

AI in fintech can prove to be highly beneficial, and hence, you must connect with a trusted fintech app development company. Hope all these insights help you understand the impact of AI.

FAQs

One of the key factors in any customer service is its turnaround time. While a human may be occupied with some other task and may delay in replying, an AI chatbot is always available and can manage multiple queries without any stress. When we talk about fintech, people are looking for solutions, and with an ever-ready AI Chatbot, they can instantly navigate to the solution by interacting with it.

AI systems can monitor transactions in real-time, identify complex patterns that indicate fraud, and predict potential fraudulent activities. This enhances security and reduces the number of false alerts, making financial transactions safer.

AI analyzes user data, such as spending habits and financial goals, to offer customized financial advice and recommendations. This helps users manage their finances more effectively with tailored budgeting, investment, and savings plans.

AI provides more accurate and inclusive credit assessments by analyzing a broad range of data sources. This improves the accuracy of credit risk evaluations, speeds up the lending process, and offers credit access to individuals with limited credit histories.

Challenges include data privacy and security, regulatory compliance, algorithmic bias, lack of transparency, high implementation costs, data quality, integration with legacy systems, skill shortages, and ethical concerns.

Fintech companies can optimize costs by leveraging open-source AI tools, partnering with AI service providers, and carefully budgeting for development, data management, infrastructure, and talent acquisition.

Key trends include hyper-personalization, frictionless user experiences, enhanced risk management, democratization of finance, and increased regulatory scrutiny and ethical considerations.

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.