Digital onboarding is changing the way people use financial services. From opening a bank account to starting your investment journey, fintech has made everything digital.

While these digital solutions present a great opportunity for users to experience convenience.

The rising competition in the fintech app market has made it tough for apps to attract and retain users. One key factor in this equation is the onboarding process of fintech apps.

While key players in the field have already identified the potential of having a proper onboarding strategy, new fintech apps often make the mistake of neglecting a streamlined digital customer onboarding process.

If you are planning to start your fintech application, or already have one but are not happy with its performance, then focusing on digital onboarding can be just the change your app wants.

In this post, let’s take a look at some key steps you can take to improve your digital onboarding journey and convert more new visitors into regular users.

We will also try to identify what are some best practices that can help you achieve your dream digital onboarding solution for a bank and what mistakes you should avoid.

So without further ado, let’s get started!

What is the Digital Onboarding Process in Fintech?

Digital onboarding in banking is a term used to describe the process of welcoming new customers and making them familiar with the services you offer.

It is also considered the first impression that your application leaves on the user. The simpler the onboarding, the easier it is for a user to start using the app.

Think of it this way: suppose you enter a restaurant for lunch and ask for a table.

Now, there are two ways this could pan out,

- Scenario 1 – The attendant behaves a bit uninterested and rude and asks you to download their restaurant’s app, reserve a table there, enter your details, wait for a few minutes, and then show you your table.

- Scenario 2 – You tell them your requirement, and they skip all the steps; they just get your registration details and directly show you your table for lunch.

Now, which scenario would you prefer? The majority of you would love to skip scenario 1 as it complicates your experience and ruins the first impression of that particular restaurant. The same goes for a fintech application.

If a user doesn’t like the first impression of the app or finds it difficult to get the job done, they have enough options to switch to.

Hence, it all boils down to how easy it is to onboard, register, or use your application.

Why is Digital Onboarding Important? Benefits & More

Digital onboarding in financial services makes your application more and more user-friendly, which means people are more open to directly starting to use it.

Digital onboarding bridges the gap between a consumer and a service provider.

Being offline, a service provider has multiple ways to guide their users and onboard them for the long run.

However, when things are completely dependent on the user themselves, the best a service provider can do is provide them with the ease of onboarding.

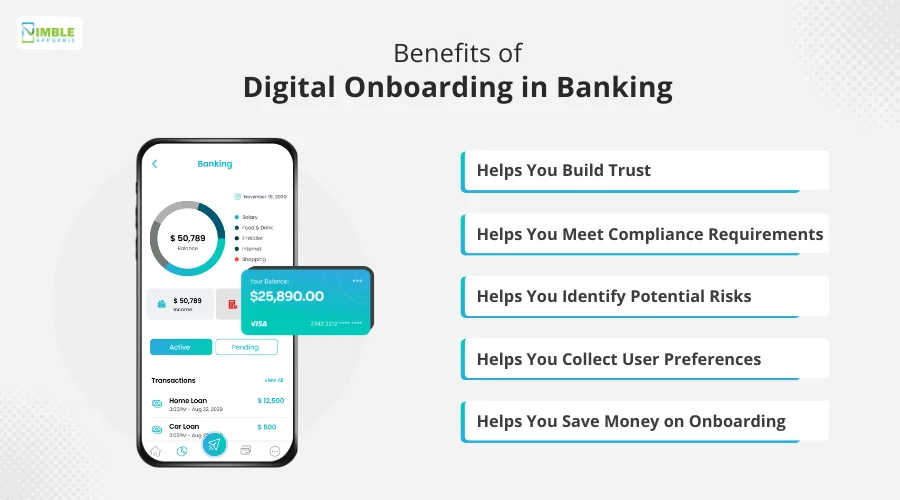

Benefits of Digital Onboarding in Banking

Having a smooth digital onboarding experience contributes to an improved user base.

Other than the user base, digital onboarding also helps in making things work from the point of view of your application.

It will help your app to become more user-friendly and provide the following benefits –

-

Helps You Build Trust

When you are transparent about collecting information and give your users an authentic experience through verification, you build a sense of trust among them.

-

Helps You Meet Compliance Requirements

Digital onboarding in banking is highly helpful as it can incorporate all the necessary compliances. With KYC being mandatory in financial services, digital onboarding simplifies the process as all of it can be done through a smartphone, instantly.

-

Helps You Identify Potential Risks

With fintech APIs working seamlessly, every detail your user shares can be instantly verified, helping you identify potential risks and assess your user’s creditworthiness.

-

Helps You Collect User Preferences

As well as digital customer onboarding for banks, you can collect all the necessary user information and build a personalized experience for the user from the very beginning.

-

Helps You Save Money on Onboarding

The cost of digital banking onboarding solutions for a new user can be greatly reduced with the help of digital onboarding, as the time-to-revenue is significantly lower on a fintech application.

Digital Onboarding in Banking – How it Works?

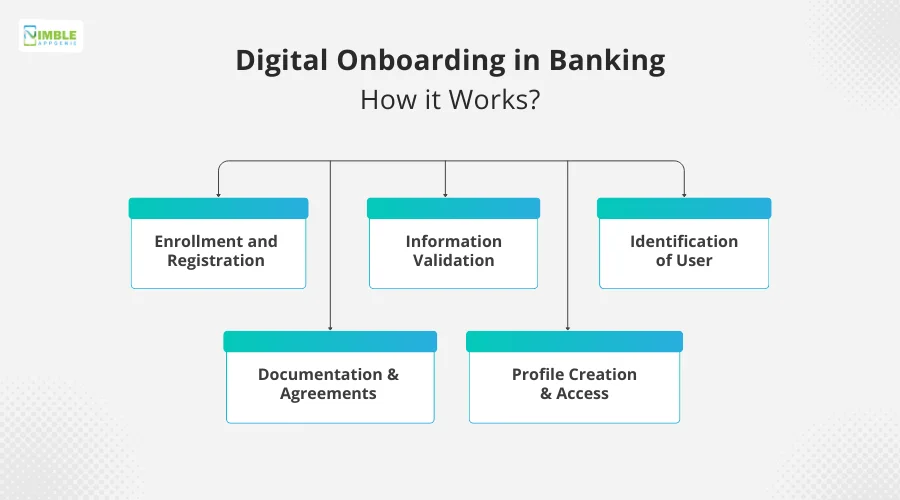

With all these benefits, adopting digital onboarding for financial services is surely a vital decision.

However, it is not as easy as it seems. You see, there is a complete process that is followed to make the onboarding process completely digital and smooth.

The ideal digital onboarding in banking apps follows the given steps –

-

Enrollment and Registration

Users can easily enroll for a profile/account on your platform. This is the stage where your application can ask for all types of basic information about the user, allowing them to express who they are.

-

Information Validation

The next step involves validating the information entered by the user. This can be automated so that the entered data meets the required format and is properly filled.

-

Identification of User

Once all the information is filled, you need to ID the user. You can either use a digital ID, biometric identification, or liveness verification to ensure that the user is legit.

-

Documentation & Agreements

After the user is identified successfully, you can share all the necessary agreements and documents for a user to review your compliance and usage policy. For fintech apps, it is mandatory that a user gives consent before using the apps.

-

Profile Creation & Access

After all the above steps are completed, a profile is created for the user to manage. A unique username for this profile is created, which allows access.

Other than these steps you can also include tutorials and guidelines. All these steps align closely with the user’s first impression of your application.

Keep in mind that if these steps are too time-consuming or complicated, a user might not go through all the steps and increase the chances of customer churn, which is not ideal for any app.

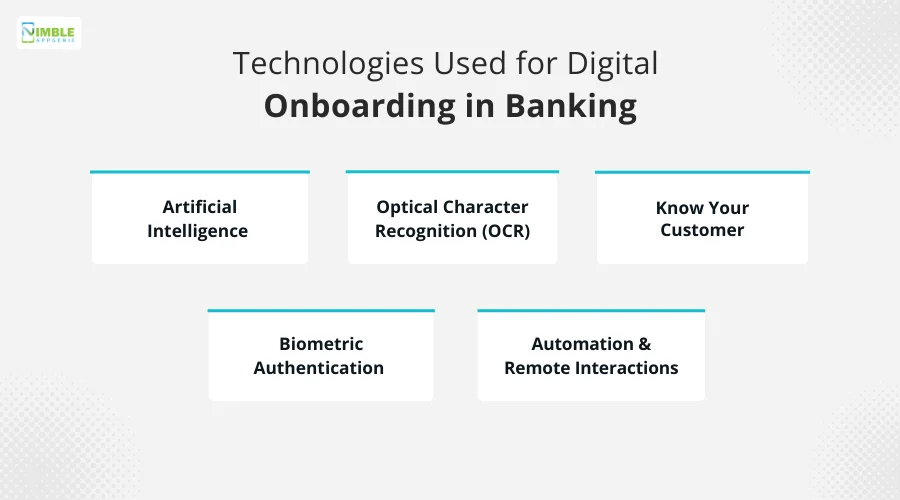

Technologies Used for Digital Onboarding in Banking

To make all of these steps simpler for the users, several technologies need to be integrated into your banking application.

Technology helps in creating a frictionless experience for the user, leading them straight to the services you offer.

Some such technologies and techniques that are integrated with a fintech application include –

- Artificial Intelligence

- Optical Character Recognition (OCR)

- Know Your Customer

- Biometric Authentication

- Automation & Remote Interactions

In order to make the most of digital onboarding in banking applications, these technologies are a must to include in your banking app tech stack.

If you are worried about integrating them in your app, you need developers who can get it done for you.

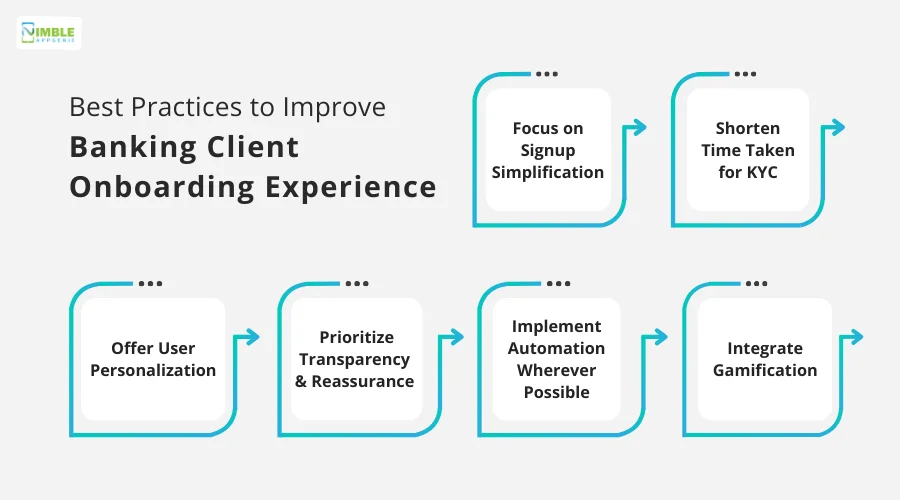

Best Practices to Improve Banking Client Onboarding Experience

Knowing what makes everything possible, you may have an idea of how you can get a digital onboarding experience for your fintech application.

However, a lot of apps have a series of digital steps to onboard new users, but are not getting the results they expect.

This happens because optimization is really crucial for these onboarding methods.

Here are some best practices you can incorporate into your application for improved digital onboarding –

1. Focus on Signup Simplification

Signing up is the first step in any user’s journey on your application. You would be shocked to know, but this is also the step where the customer churn rate is the highest for any app.

This happens because of the complicated signup process. Some apps often ask for too much information just to allow access to the users.

To ensure that this doesn’t happen to your fintech app, you must focus on simplifying this step.

Reduce the required fields to the minimum and only ask for relevant information for the signup. Also, make sure your signup page is autofill compatible so it’s a smooth experience for the user.

2. Shorten Time Taken for KYC

KYC in fintech apps is a mandatory compliance for financial institutions as it allows them to identify everything about a user and establishes that the user is genuine.

The digital onboarding of financial services is significant to government policies and hence cannot be skipped.

However, what you can do is make the entire process quicker and clearer.

With digital onboarding in banking, you can do that easily by reducing the required

fields, identifying missing documents instantly, and using biometrics for instant verification.

3. Offer User Personalization

Engage your users from the get-go by personalizing your customer journey. Learn about your user with the help of a few ice-breaking questions.

This way, your digital onboarding experience is more direct and helps you understand the aim of the user joining your application.

This way, if your banking app offers multiple services, you can understand what the user is looking for and personalize their experience.

This helps in creating a flow in the digital onboarding process as the user also takes proper interest in choosing the right series of services as per their requirements.

4. Prioritize Transparency & Reassurance

To boost your application’s digital onboarding experience, you must keep everything transparent between you and your users.

Every detail that you ask for should be justified, along with a clear user policy, and it can be difficult if a proper digital onboarding mechanism is not in motion.

Hence, both of these factors, i.e., transparency about how the user data is being used and reassurance about how you ensure that your app does not compromise on managing data privacy.

5. Implement Automation Wherever Possible

While designing digital onboarding for banking apps, you must ensure that the application uses automation as much as possible.

You see, unlike a normal app user who visits your app and gets the job done, a first-time user doesn’t have to pay attention to the services. They are reeled in due to the user experience.

Hence, when your digital onboarding experience uses automation to let users sign in, it gives your application an edge and makes it more user-friendly.

6. Integrate Gamification

To make your fintech app’s digital onboarding experience more engaging for the user, you should add elements of gamification.

This means adding all types of interactive graphics, such as a progress bar, a CTA button, and a real-time payments feature, to make it more appealing.

There can be difficulties in integrating gamification into your banking apps as people often find it annoying if not done correctly.

Other than these, offering notifications to remind a user to complete the onboarding is another interesting practice you can follow.

However, keep in mind that all these practices should be done after completely analysing your user data and targeted user base.

Not to mention, you must have an experienced team of experts to help you implement digital onboarding in the banking sector.

How Nimble AppGenie Can Assist With Digital Onboarding in Banking

Implementing all the practices, integrating the technologies, and identifying the key factors and benefits that encourage digital onboarding can be difficult for you if you do not have enough experience with fintech apps.

If you are wondering how to implement a solid digital onboarding plan in your fintech application, then worry no more, as Nimble AppGenie is just the right option.

Reach out to our fintech app development experts and ask for a dedicated digital onboarding strategy for fintech applications.

Not only do the experts offer the finest banking app development services, but they also make significant efforts to ensure that your application has all the necessary features, including digital onboarding.

Conclusion

Digital onboarding is a key factor that improves your app’s usability and reliability among users.

While different industries have already cracked down on OTP-based smooth registration, fintech apps require a lot more details.

Hence, paying attention to an optimized digital onboarding in a fintech app is a must.

Different benefits to implementing these techniques, and hence, you must invest in the technology required to build a digital onboarding experience.

Other than these technologies, several implementation practices can be used to enhance the overall results. With that said, we have reached the end of this post.

Hopefully, now you have all the necessary information to implement the onboarding process.

Thanks for reading, good luck!

FAQs

Using Digital Onboarding can provide several benefits, including:

- Improved efficiency: By automating the onboarding process, organizations can save time and reduce the risk of errors.

- Enhanced customer experience: Digital onboarding provides a seamless and convenient user experience, making it easier for customers to sign up and start using a product or service.

- Increased security: Digital onboarding APIs can help organizations to verify user identities more accurately, reducing the risk of fraud and ensuring compliance with regulatory requirements.

To get the most out of a Digital Onboarding API, consider the following best practices:

- Simplify the user experience

- Verify user data thoroughly

- Ensure compliance with regulations

- Monitor for fraud

- Continuously improve the process

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.