When you desire to enter the banking app industry, it’s significant to evaluate the implementation of the latest technologies for sustaining in the competitive industry and even for transforming the future of financial services.

From the enhanced customer service and improved fraud detection, the banks provide advanced risk management, as well as personalized banking services which might drive significant changes in the industry.

In this comprehensive guide, we will explore it all from the benefits of using AI in banking apps to steps to implement it and its future in the industry.

Shall we proceed?

Market Overview of AI in Banking Over the Years

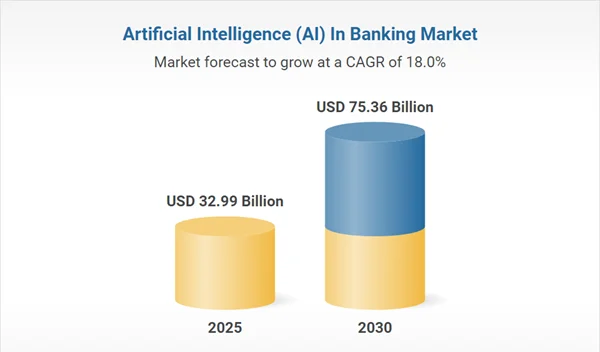

- Artificial intelligence (AI) in the banking market is estimated to grow at a CAGR of 17.96%, attaining US$75.357 billion by 2030, from US$32.988 billion in 2025.

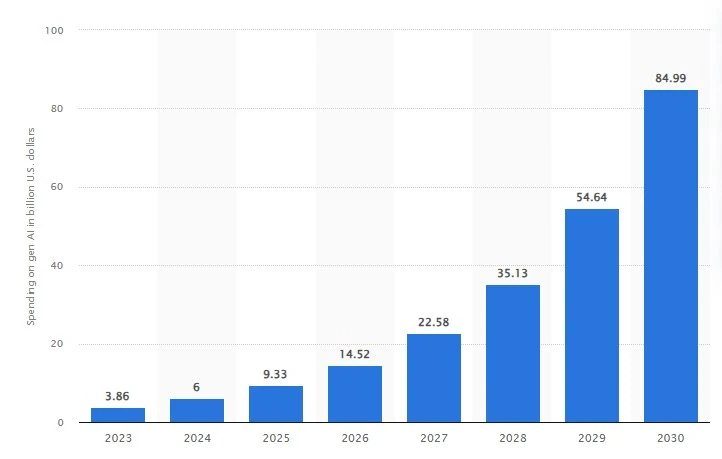

- The banking sector’s spending on generative artificial intelligence (AI) is projected to reach 84.99 billion U.S. dollars by 2030, with a remarkable 55.55% CAGR.

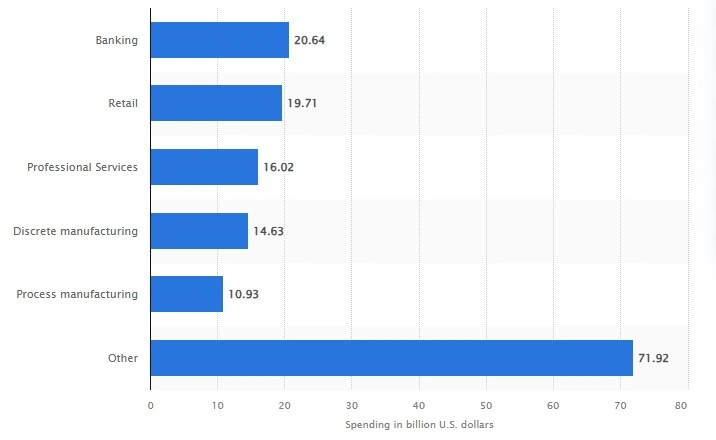

- Worldwide spending on AI-centric systems was estimated at 154 billion U.S. dollars in 2023 across all industries. The banking sector’s investments amounted to 20.6 billion U.S. dollars, the highest across the observed industries.

Why Use AI in Mobile Banking Apps?

There are many reasons to consider when it comes to implementing AI in banking apps.

The implementation of AI in the banking sector provides several benefits that might increase the efficiency, security as well as customer experience of the banking platforms.

Let’s consider some of them as below.

♦ Improves User’s Experience

One of the ultimate goals of your business can be enhancing user experience, right?

Well, adding AI to banking apps can serve this purpose well. The AI algorithms are developed for analyzing customer data and for offering personalized financial services, tailored banking solutions, and product recommendations.

You can provide the user’s instance access to customer support through AI-powered chatbots, as well as virtual assistance. This factor enhances the overall user experience. With the implementation of AI, you can help banks with data analysis, automotive repetitive tasks, and enhancing customer services.

♦ Enhances Customer Service Operations

AI can be useful in enhancing customer services through using chatbots, where financial firms can allocate routine requests to AI for redirecting the users to the human agents as and when required.

The implementation of AI can ensure instant as well as efficient support for customers. With this assistance, the users can have effective guidance that will resolve their queries and offer support without involving any third party.

Additionally, with the adoption of AI chatbots, and voice notes, you can have cross-sell opportunities based on the interactions and for forming audio transcriptions for accessing and obtaining the precise information.

♦ Helps in Credit Decision-Making

With the implementation of AI in mobile banking, banks can evaluate and even process vast amounts of data, which will even comprise non-traditional data sources, for accessing credit risks accurately.

It will further help the users to make credit decisions faster provide benefits to personalized lending rates and enhance access to credit for the customers with the limited credit history.

Through analyzing the vast amount of user data, the banking industry can be able to analyze the wide amounts of data beyond any traditional credit scores. It will provide comprehensive evaluation results within a more accurate and fair credit assessment that can offer personalized lending solutions accordingly.

♦ Fraud Detection and Cybersecurity

An AI in the banking industry will be useful in availing fraud detection. How?

Well, the AI algorithm is well aware of the user’s behavior patterns and can detect unusual activity including password changes, sign-up processes, and even contact details. With the help of features such as multi-factor authentication, the app helps prevent any identity theft.

With the assistance of AI systems, users can analyze the transactions as they take place, through providing real-time fraud detection. AI systems can shift through massive datasets to identify irregular patterns and anomalies that might detect fraudulent behavior patterns.

♦ Assists in Reducing the Costs

Through automating the processes with the assistance of AI, the users can reduce the need for manual labor, by reducing operational costs, as well as enhancing the profitability of the businesses.

AI can help scale the growth of banking platforms and help handle increased workloads without adding to the costs.

With the use of AI, you can streamline operations by automating repetitive tasks, speeding up the complete processes, and reducing errors. Further, you can optimize resource allocation and might ensure minimal wastage which ultimately lowers costs.

♦ Useful in Regulatory Compliances

Automating the processes with AI can further be useful in reducing the need for manual labor, reducing operational costs as well as enhancing profitability.

AI is capable of handling large datasets and instantly processes the new regulatory texts, by updating the compliances in real-time.

This assists the companies to remain competent in real-time, and efficiently run tests for establishing the fintech compliance policies and procedures that are not just in place but even actively followed.

After considering why you should implement AI within the app, let’s consider how AI will be helpful for banking apps in the next section.

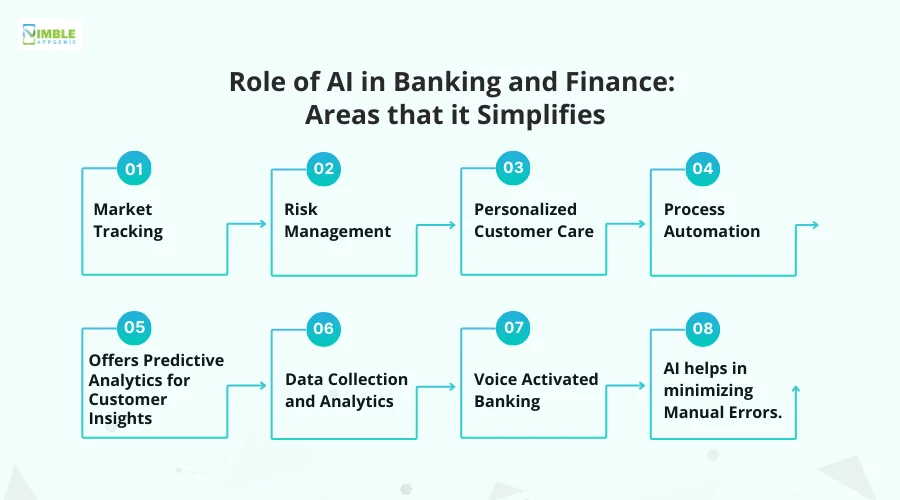

Role of AI in Banking and Finance: Areas that it Simplifies

AI plays an important role within financial service organizations in controlling manual errors in data processing analytics, document processing and onboarding, customer interactions, and other tasks via automation.

Want to know more about the role of AI in banking apps, let’s evaluate them all below.

1. Market Tracking

You can implement AI in banking apps, to assist banks in processing large volume data, and for predicting the latest trends in banking apps. With the help of advanced mobile apps that are powered by ML can even provide the users with prominent investment options for evaluating the market sentiments.

The implementation of AI in digital payments apps will be useful for predicting market shifts, identifying the latest technologies, and helping businesses to proactively create strategies.

2. Risk Management

The AI algorithms are useful for analyzing data and providing more accurate and timely risk assessments. It will further assist the banks in identifying the potential hazards and even evaluate their impact on making informed decisions.

It further helps the banks access large sets of data points to quickly realize the insights that might assist them in providing protection against several losses as well as boost the ROI for the customers.

3. Personalized Customer Care

Chatbots along with virtual assistance are among the common AI tools that are developed for handling a wide range of customer queries and providing instant responses. The technology has the ability to operate 24/7 services by ensuring customer support at any time.

AI personalization within marketing can even assist users in identifying their preferences and needs and then providing them the recommendations accordingly. Banking companies can use the insights from AI to forecast future customer behavior.

4. Process Automation

The AI algorithms are designed in a way to enhance operational efficiency and accuracy for reducing costs through automating time-consuming, and repetitive tasks. In the current era, banking institutions make use of robotic processes to boost transaction speed as well as to enhance complete efficiency.

AI assists in significantly reducing processing times and operational costs. Additionally, AI can be useful in warning of equipment failures even before they occur. This will be useful in enhancing the complete operations of the app.

5. Offers Predictive Analytics for Customer Insights

The integration of AI within the banking apps can leverage predictive analytics and can even offer personalized financial insights. AI can even assist users in predicting future spending patterns and can even include correlations in the data.

This highlights the role of AI in the banking app industry. AI too plays an important role in predicting potential issues as well as in taking proactive actions that further comprise managing the networks, equipment issues, and security threats.

6. Data Collection and Analytics

One of the crucial roles of AI in banking apps is to collect a wide amount of user’s data and then provide them with analytics accordingly. It’s also about structuring and recording a wide amount of data without any kind of errors.

The implementation of AI enhances the complete user experience by detecting fraud and making credit-related decisions. It provides the users with a complete understanding of the user’s data and businesses.

7. Voice Activated Banking

AI in banking apps Comprises voice recognition technology helping the users to perform potential transactions with the help of voice commands. Further, this feature improves accessibility and convenience which makes the banking service more user-friendly.

Additionally, it enhances the convenience level among the customers that cannot be found within traditional banks. This feature facilitates the especially abled people to perform banking operations smoothly.

8. AI Helps in Minimizing Manual Errors

With the assistance of AI, the banks minimize manual errors in data processing, analytics, onboarding, customer interactions, and several other tasks. One of the significant roles of AI is to monitor transactions in real time as well as flag up potential fraud and risks.

Another efficient role of AI is assisting the banks in automating several tasks including identifying fraudulent activities and tracking the loopholes in their system to enhance overall online security.

These were all important roles of AI in the banking industry. Now, as we move ahead, you might be interested in real-world examples, right?

The following section can be helpful.

Top Banking Apps That Are Implementing AI

Before you integrate and implement AI in your banking apps, it’s vital to evaluate how competitors are already using it.

Do you know that 85% of banking firms are already using or even planning to use AI?

If you are interested in integrating AI within top banking apps, this section can be useful.

► JPMorgan Chase

The company conducts research and develops algorithms for generating realistic synthetic datasets which are applicable to financial services. Researchers at the organization even state that it takes approx. 101 days for a trojan virus to compromise the overall company networks.

Additionally, the company implements and uses Contract Intelligence (CoiN) for legal document analysis. This system even exemplifies how with the assistance of AI, the bank is automating complex as well as time-intensive tasks.

Key Applications:

- Fraud Detection

- Customer Service

- Contract Analysis

- Processes Large Data Sets

► Capital One

Capital One uses AI and ML to look out for the customer’s well-being, and even assist them to become more financially empowered as well as to better manage their spending. One of the missions of the bank is to bring ingenuity, simplicity, and humanity in banking.

Additionally, the bank is applying the data and AI to understand the user’s needs, pain points, and goals for delivering the users an effective service. AI is enabling the users to minimize friction as well as to provide a top-notch experience for the customers.

Key Applications:

- Improves navigation process

- Ensures Data and privacy

- Resolves user’s issues

- Solves the Overall challenging industry problems

► European Bank

With the assistance and implementation of generative AI, the banks have a nested function in which the customer may manage the tasks and even ask the chatbot to provide banking-related recommendations.

AI has acted as a clear, easy-to-understand approach that is based on four different levels of risk management, specific transparency risk, for customizing the services as well as products for the individual needs, for streamlining the operations.

Key Applications:

- Sets the interest rates

- AI helps to add benefits and risks to the financial system

- Eliminates repetitive tasks

- Fast and accurate services

► Bank of America

Bank of America is leveraging natural language processing and machine learning to answer the queries that arise during the trading day. It enhances the accuracy of responses based on the user’s data collection.

Additionally, they are utilizing AI algorithms for evaluating the client data and providing personalized advice based on user issues. It has a virtual assistant “Erica” that resolves many issues of the users related to banking and related services.

Key Applications:

- Evaluates customer insights

- On-time assistance

- Assist in sustaining the competitive market

- Helps in Fraud detection

► HSBC

HSBC bank is working on AI to enhance financial services and provides cutting-edge machine learning approaches to the users assisting them to resolve their queries over banking and related services.

The bank uses an AI-powered system “Amy” to help customers with basic banking transactions and queries. However, their AI-based compliance tools may ensure adherence to the regulatory requirements.

Key Applications:

- Assist in customer services

- Fraud detection

- Providing assistance in regulatory compliance

- Transaction monitoring

- Risk Management

► Wells Fargo

AI is designed for banks like Wells Fargo to make banking much easier. It has made the branch-based bankers’ and tellers’ jobs much easier. It too assists the bank in data processing, analytics, document processing, onboarding, and customer interactions.

With the assistance of AI, banks often offer ultra-personalized experiences that help to anticipate customer needs and even do so responsibly. Further, AI helps the bank in automating manual tasks providing errors-free operations.

Key Applications:

- Predictive Analysis

- Risk management

- Customer Service

- Providing useful recommendations

These are all the important examples, that you can consider while deciding to implement AI in your banking app.

After evaluating, how competitive banks are performing it, let’s look for any challenges that you can face while adopting AI in the banking app.

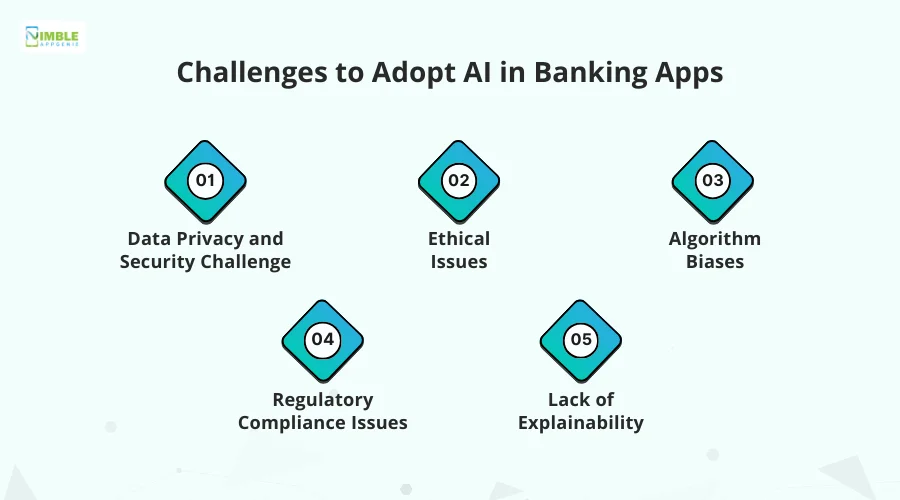

Challenges to Adopt AI in Banking Apps

What are the issues that you can face while adopting AI in banking apps?

Well, when you enter the banking app industry, it’s significant to implement the latest technologies for sustaining the market and providing an exceptional experience to the targeted users.

You should learn the challenges while developing banking apps to practice effective strategies.

However, there can be a certain amount of challenges that your banking app might face. Let’s check them all here.

-

Data Privacy and Security Challenge

When you add any new technology such as AI in the banking app, losing sensitive data and information is one of the biggest challenges that you might face while ensuring the security of the banking app.

In a time, when the data’s importance cannot be ignored, protecting sensitive information becomes a challenge. This challenge might result in losing the user’s trust in the app.

-

Ethical Issues

The implementation of AI for customer and employee screening can impact the existing biases that are present within the algorithms. This further can hinder a bank’s ability to achieve gender and diversity targets that even limit the outreach to customers.

With the help of adopting and implementing AI, several ethical issues were identified such as wrong credit scoring, sharing of wrong information, unauthorized trading, and even mis-selling.

-

Algorithm Biases

If the AI algorithms are designed to inherit biases, it might lead to unfair and discriminatory results. The implementation of AI algorithms can result in biased outputs if the data is not representative, or diverse.

The biases can be found in AI algorithms in different ways such as adding discriminatory data and manipulating the algorithms in order to earn high commission within the user’s amount.

-

Regulatory Compliance Issues

The inherent complexity and opacity of certain AI models will make it complicated to provide the needed transparency which can result in trust issues as well as potential non-compliance with the regulations that demand explainability.

With unbiased algorithms, regulatory compliance issues can arise as it can result in manipulating the algorithms and might lead to an impact on the complete user’s performance and even the bank’s goodwill.

Related: Guide to GDPR Compliance for Web and App Development

-

Lack of Explainability

The implementation of AI-based systems is applicable in the decision-making processes as they eliminate errors and even save time. Additionally, the AI can state results based on biases learned from previous cases of poor human judgment.

To avoid such a challenge, the banks should offer an appropriate level of explainability for all the decisions, and recommendations presented by the AI models.

Well, to avoid such challenges, it’s important to deliver apt solutions that will address such kinds of issues.

Now, are you ready to adopt AI in the banking app?

Well, then let’s proceed with the following section that defines the steps to undertake for implementing AI in the banking mobile Application.

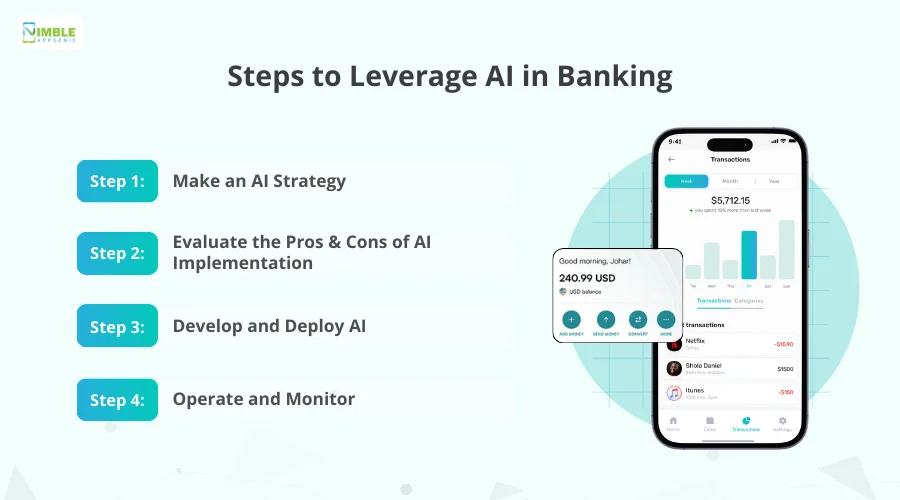

Steps to Leverage AI in Banking

Confused about building a banking app that leverages AI?

Implementing AI in the banking apps will assist you in enhancing the overall performance of your business.

When thinking about implementing AI in the banking app, it’s important to know the important steps to adopt the same.

Let’s evaluate them all here.

Step 1: Make an AI Strategy

You should build an AI strategy, where the process will start by developing an enterprise-level AI strategy by keeping in mind the goals and values within the organization.

It’s significant to perform internal market research that will be helpful in evaluating the current use and implementation of technology based on competitive parameters.

Step 2: Evaluate the Pros and Cons of AI Implementation

Now, you should identify the benefits and disadvantages of using AI in mobile banking apps. This is a step that will display a clear picture of what will happen if you adopt AI in your project.

Under this step, you can even visualize your banking app as how it will appear on implementing AI. It will even assist you in knowing how your app will look after adding AI to it.

Step 3: Develop and Deploy AI

Well, it’s time to develop and deploy AI in mobile banking apps. Connecting with an experienced team of app developers, you can deploy AI in your dream project.

Here they will create algorithms to add AI to banking apps. Additionally, they will conduct various testing processes for successfully implementing AI technology.

Step 4: Operate and Monitor

Now, it’s time to operate and monitor your app’s performance after implementing AI. Additionally, the implementation of AI banking solutions will result in continuous monitoring of the app and maintaining it.

It will result in managing the cybersecurity threats and identifying the errors that might impact the operations and overall performance of a banking app.

What’s the Future of AI in Banking?

Adopting any technology within the banking app will lead to evaluating how it can impact the future of the industry, and does it will be beneficial enough when it comes to the future.

Well, let’s evaluate the following points that describe the future of AI in mobile banking apps.

➤ Account Inquiries

With the assistance of AI in banking apps, banks can employ chatbots for monitoring and driving information related to their accounts, and transaction history, or even for finding any transactions.

➤ Money Transfers

In the future, AI can even be useful in performing money transfers and even paying bills just via chatbot or enabling Voice AI. It will reduce the errors that might occur while manually adding accounts or filling out the merchant details.

➤ Credit Score Monitoring

AI implementation in banking apps can also lead to credit score monitoring. Here the adoption of AI will help in checking out the credit ratings and even to provide advice on how to enhance them.

➤ Account Management

With the implementation of AI, users can manage accounts by arranging automatic payments, changing personal information, and even more. The adoption of AI can analyze vast datasets for identifying patterns and even predicting future trends.

Well, after evaluating the benefits of using AI in banking apps, you can connect with a team of qualified developers.

How Can Nimble AppGenie Leverage AI in Banking Platforms?

Connecting with the team of Nimble AppGenie, you can include advanced AI in the banking platforms after discussing its pros and cons successfully.

We are the leading banking app development company delivering your dreams with quality and integrity. Our developers can help you with all the required assistance.

The experts can help identify the current market, adopt AI, and even develop the complete app.

Conclusion

In the banking app industry, it’s essential to use AI to enhance the overall user experience and increase the complete app’s performance. It plays an essential role in market tracking, is helpful in credit decision-making, assists in reducing costs, and even in improving the customer’s experience.

Additionally, the application of AI in banking apps can help stay ahead in the competitive financial landscape. Here you can add AI to improve current operations that even can meet future challenges through innovation.

FAQs

AI in banking apps can be implemented by following these steps:

- Step 1: Develop a Strategy: Evaluate the need for AI in streamlining processes such as loan processing, customer service, and fraud detection.

- Step 2: Develop Pros and Cons: Assess the pros and cons of AI, consider all alternatives, and choose the best fit for the project.

- Step 3: Develop and Deploy AI: Build and integrate AI solutions into the banking app to enhance functionality and security.

- Step 4: Operate and Monitor: Continuously monitor AI performance, identify issues, and make improvements as needed.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.