Gone are the days when the majority of your customers indulged in cash transactions only. Since the pandemic, cash usage has seen some serious decline as credit cards, debit cards, and digital payment methods are on the rise.

However, this means that small businesses have to update their payment systems.

But that is not going to be as easy as it seems, considering there are multiple payment systems that can prove to be confusing to choose from.

Closed-loop and open-loop payments are the two classifications of now functioning payment systems. The majority of businesses find it challenging to choose which payment system they should adopt.

If you too are facing an issue in making a decision, then this is the blog for you! In this post, we are going to compare both closed and open-loop payment systems, giving you a clear perspective on how they differ and which one is the best for your use-case scenario.

With that said, let’s get started!

Closed Loop Payments System: An Overview

A closed-loop payment system is an internal financial arrangement that limits all transactions to a specific network or ecosystem.

In simple words, it is a type of payment arrangement in which the payment method and the funds can only be used at a certain location or within a specific business.

These types of payment systems are really helpful for businesses and brands that tend to cater to a loyal customer base that keeps returning to them.

Closed-loop payment systems are best if you plan to create a loyalty program that is specific to regular customers or carry out an internal ecosystem that allows the customers to experience seamless payments and added advantages.

The best examples of closed-loop payment systems are the Starbucks Rewards app and ClassPass.

Both of these apps can be used to pay for the services, but, only for the dedicated business ecosystem. You cannot use Starbucks rewards funds to pay for your gym class and vice versa.

Open Loop Payments System: What’s the Buzz About?

On the other hand, open-loop payment systems offer a universal payment option that can be used with all sorts of businesses and services. Neither of the parties involved in the transaction needs to be part of the same financial institution, network, or ecosystem.

This allows a business to accept payments from all types of customers, irrespective of their bank. It works smoothly as it offers all types of payment modes like cashless, cards, etc.

Open-loop payment systems work on shared networks that are used by banks and payment processors, enabling instant approvals of transactions.

This payment system is not limited to a specific merchant, making it easier for a customer to carry out transactions on different networks and locations.

Shared payment networks like Visa, MasterCard, American Express, etc. allow these transactions to go directly to the merchant’s account irrespective of what financial institution they are associated with.

Closed Loop Vs Open Loop: Key Differentiating Factors

Both payment systems tend to create a seamless transaction experience for businesses in their own way.

However, it is crucial to understand the differences between them so that you do not make the mistake of implementing a system that may not be the most suitable for your line of business.

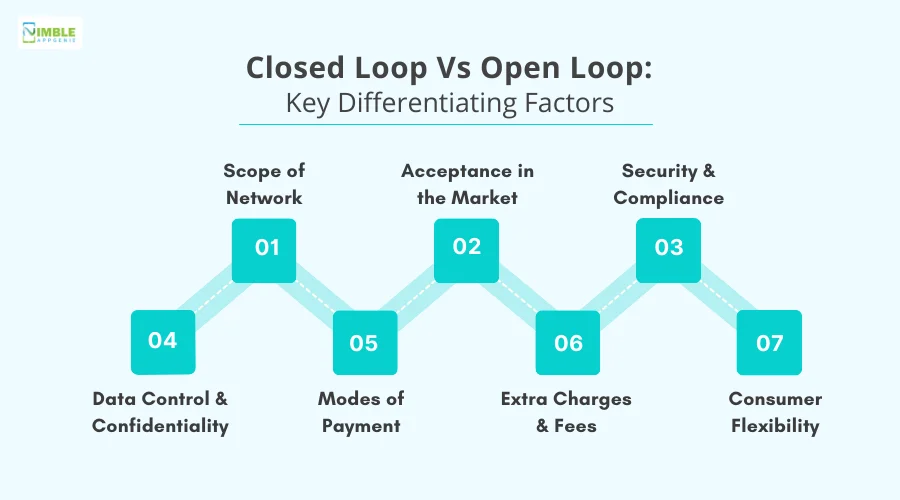

But before we begin with the differences, there are some factors that we are going to base the comparison on and you should be aware of them.

These factors are-:

♦ Scope of Network

This refers to the usage scope of the payment network involved in the transaction system.

♦ Acceptance in the Market

This factor refers to what extent the payment system is accepted in the market.

♦ Security & Compliance

For any payment system to be implemented there are several compliances to be met to ensure proper security of the parties involved and their information.

♦ Data Control & Confidentiality

With an implemented payment system, defining the limit of accessing data and measures of confidentiality is crucial, hence this factor is a must consider.

♦ Modes of Payment

This refers to the type of payment method a payment system uses for instance a card, an app, a coupon, etc.

♦ Extra Charges & Fees

There are several types of transaction charges associated with different payment systems. Knowing if the system you plan to implement

♦ Consumer Flexibility

Another crucial factor to consider before implementing a payment system is to understand the ease of access and flexibility that it provides to the parties involved in the transaction

Now that you are aware of all the factors that define the basis of this comparison.

Take a look at the following table to find the key differences between closed-loop and open-loop payment systems-:

| Closed-Loop Payment System | Open-Loop Payment System | |

| Scope of Network | Restricted to a specific network or ecosystem. | Accepted across a wide range of networks. |

| Acceptance in the Market | Limited acceptance as it is dedicated to a single merchant. | Accepted among different merchants who use the same shared network. |

| Security & Compliance | Necessary features available for security. It adheres to security standards set by the merchant. | Secure and follow broader regulations and compliances as implied by payment networks and banks. |

| Data Control & Confidentiality | It offers complete control to the merchant who has set up the payment system, allowing a better definition of loyalty programs. | Provides less control than closed-loop payment systems. But maintain enough transparency. |

| Modes of Payment | A dedicated proprietary card or app is issued that can only be used with the closed-loop payment system. | Uses standard bank-issued cards for transactions. A single card can be used for multiple merchants. |

| Extra Charges & Fees | Transaction fees are comparatively less. | Translation fees are higher as multiple entities are involved. |

| Consumer Flexibility | A customer might have to carry different payment modes, leaving them no room for flexibility. | A single card can be used for all the merchants, offering ease of access and flexibility. |

How to Choose a Payment System for Your Business?

After going through all the factors and differences between closed-loop and open-loop payment systems, you might have clarity on which of these is more suitable for you.

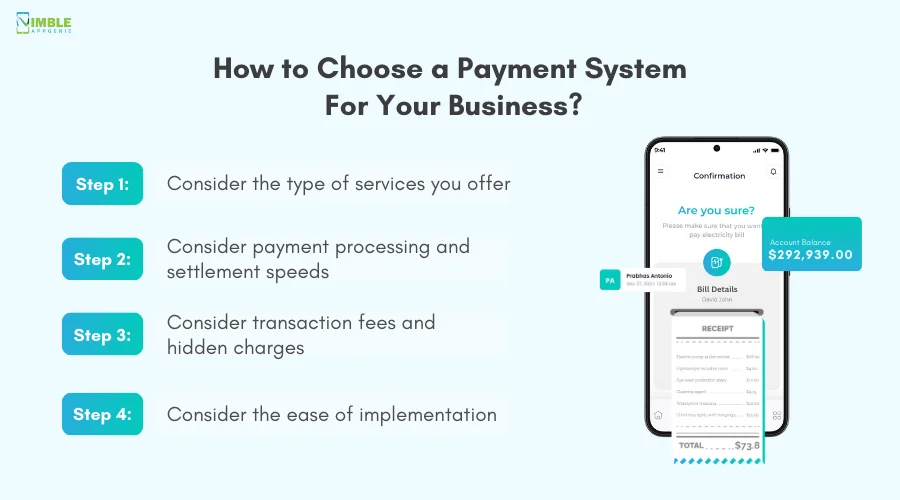

If you are still confused, here are a few pointers to consider before reaching the decision-:

Step 1: Consider the type of services you offer

If it is something that a niche of people will be attracted to, you can implement closed-loop payment system; but, if you have more new customers than repeat ones, you should consider an open-loop payment system.

Step 2: Consider payment processing and settlement speeds

To maintain a steady cash flow, you need to have a payment system that settles the payments fastest and makes the funds available instantly.

Open-loop payments are directly settled in your account, irrespective of which financial institution was involved in the transaction.

Whereas in a closed-loop system, you might have to wait for someone outside your payment network to make a transaction.

Step 3: Consider transaction fees and hidden charges

If your consumer base is steady enough, you can opt for a closed-loop payment system as it is a merchant-exclusive arrangement and hence the transaction charges are minimal. Usually, transaction charges in open-loop payments are higher as there are several external parties involved.

Step 4: Consider the ease of implementation

If you are trying to set up a payment system in your existing business, you should check how easy implementing a certain system is.

For instance, you have to create a complete custom closed-loop payment system and then train your employees to use the entire system.

On the other hand, an open-loop payment system only requires a payment terminal, and the rest of the services are provided by the backing financial institute.

Other than these factors, the user experience, flexibility, and security are also crucial factors to consider when choosing a payment system for your business.

How Nimble AppGenie Can Help You Create a Seamless Payment Experience?

If you have decided on what type of payment system you want to implement, but do not know whom to connect for digital wallet development, then we have got you covered.

With our robust payment mechanisms and e-wallet development services, you can carry out both closed and open-loop payment systems as per your requirements.

At Nimble AppGenie, we take a thorough look at the requirements of your business and suggest the ultimate solution.

Our expert developers can provide tailor-made payment solutions, helping you stay ahead of the competition with cutting-edge technologies.

Conclusion

The core difference between closed-loop and open-loop payment systems lies in the type of environment it is implemented. Both of these systems have their benefits and drawbacks. Now it depends on which one you opt for.

However, doing your due diligence and research is a must before deciding on any of these payment systems. Hope these differences make it easier for you to make the choice. That will be all for this blog. Thanks for reading, good luck!

FAQs

The key differences between open-loop and closed-loop payment systems include:

- Closed-loop payment systems limit transactions to a specific network or ecosystem, while open-loop payment systems can work on multiple shared networks.

- Closed-loop payments require a dedicated payment card issued by the merchant and can only be used with that merchant. Open-loop payments accept cards issued by the bank.

- Closed-loop payments give better data control than open-loop payments, which means a merchant can get deeper insights to create loyalty programs.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.