Fintech is the future!

With every passing year, we are witnessing the rise of Fintech apps that keep popping up and doing wonders, and 2024 was no different.

The ability to access your accounts from anywhere across the world, and tracking regular transactions is just the tip of the iceberg of utility features that a fintech app offers.

All these accessibility features will make your business skyrocket in no time. Hence, it can be safe to say that investing in developing an app like CAIXA is the need of the hour.

But is it easy to get your hands on a similar app? More importantly, how much does it cost to develop an app like CAIXA? Well, all your questions are valid and will be answered by the end of this post!

Keep on reading as in this one; we are going to discuss how you can win over the market by integrating a simple yet effective fintech app like CAIXA and what it would cost you.

But before we jump to the structure and framework of a CAIXA-like banking app, let us quickly take a look at the current market status.

Market Overview of CAIXA App

The CAIXA app has been one of the most successful Brazilian banking and transaction apps in the past year. With over 43% market share in digital banking, CAIXIA has dominated digital banking.

For those unaware, CAIXA is a digital platform that helps its users with both basic and advanced banking and financial services. From enquiring about your account balance to advanced investigation options and payment solutions, the application does it all.

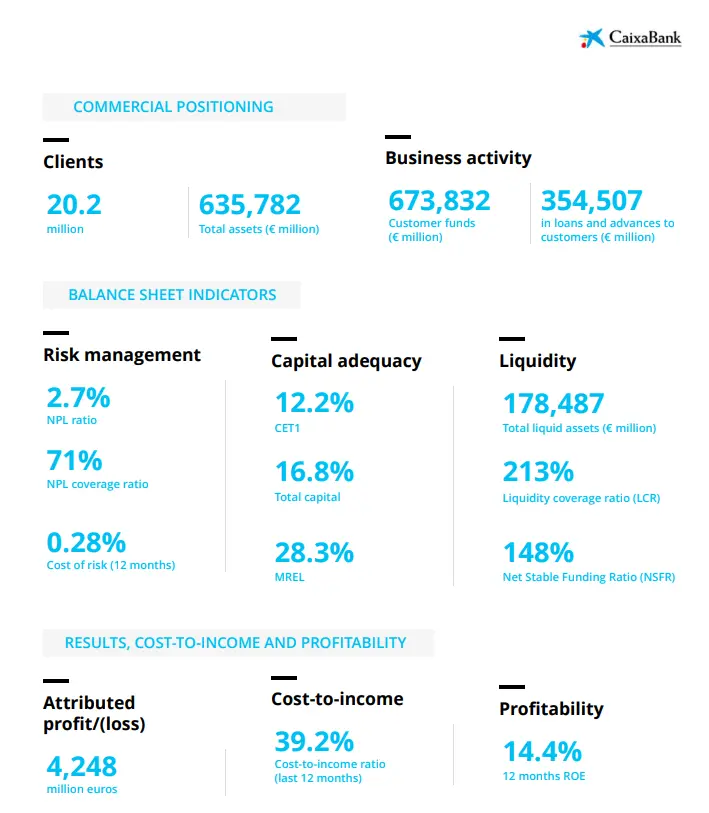

Needless to say, the market has welcomed it with open arms considering their financial report for Jan – Sept 2024 indicates a massive growth in both their customer base as well as revenue.

As mentioned in their Activity and Results report, the data indicates how an app like CAIXA can help you achieve success by providing the best financial management tools.

Not to mention, creating a digital platform for your business is always a decision that can help you boost your reach, traction, and revenue.

But to be fair, just the thought of creating an app is not enough. You need a proper development team that can assist you with the best features, practices, and a solid strategy.

Also, you require an understanding of features that can help you create a digital platform as robust as CAIXA.

In the next section, let us take a look at some of the features that CAIXA offers that make it the hottest fintech platform for over 2 million regular users.

CAIXA’s Core Features

For any digital banking platform to be successful, there are several must-have features. CAIXA ticks all the boxes for an ideal fintech application as it offers the following set of functionalities –

♦ Transaction Details

A user can easily keep track of all the transactions, be it a withdrawal, deposit, online, or offline. Having a direct interface to keep track of all the transactions comes in super handy for any user.

♦ Cards Management

The ability to use digital debit and credit cards always attracts users. CAIXA offers hassle-free card management, allowing you to easily track the activity on all your credit, debit, and prepaid cards. You can also request a replacement and block the card.

♦ Loans & Mortgages

Loans and mortgages are a crucial part of a bank’s revenue model. And hence, making it accessible to your users via application is a brilliant move. With CAIXA’s digital platform, a user can easily check their current loans, manage EMIs, and show interest in getting a new loan.

♦ Wearable Support

The app is user-friendly and offers wearable support. A CAIXA user can easily track their transactions with a glance using their smartwatch. This adds to the convenience that it offers, making it more effective and easy to interact.

♦ Savings & Goal Setting

The application offers a section in which you can easily set your saving goals and contribute. With ease of projections, the app allows you to adjust your savings accordingly

♦ Instant Cash Transfers

With an integrated feature known as Bizum, the CAIXA app allows you to send instant money using your smartphone. All you need is a phone number and you can send money for free!

♦ Help and Grievances

When using an online banking platform, issues related to the service not working or transactions not going through are a common occurrence. Hence CAIXA also offers a help and grievances section that allows you to get in touch with a support agent to help you out.

♦ Bill Payments

If you have recurring bills such as electricity, your phone bill, etc. You can use the CAIXA app to take care of this as well. This feature helps in keeping the user engaged and enhances the daily active users for the app.

The list of features can go on and on, however, with these core functionalities, CAIXA is the best example of a balanced digital banking application.

It is important to have insights on what type of features the best applications offer as it gives you an understanding of what you are getting into and where you will be spending your money.

These features, along with the resources required, combine to form the overall estimated cost for developing a CAIXA-like banking app.

Why Develop an App Like CAIXA?

For the majority of finance and banking purposes, companies still depend on conventional methods. Meaning, the trust on digital platforms when it comes to money matters is still a point of concern.

However, after analyzing the overall structure and functioning of CAIXA and how it boosts the business, it is clear that going digital can help a lot.

If you are still wondering why develop an app like CAIXA, the following factors can help you decide!

1. Expanding User Base

When things are digital and convenient it becomes easier to expand your user base. With a fintech application similar to CAIXA, you can easily allow users from across the globe to use your services without them having to be present.

2. Ease of Access for Users

From basic passbook entries to advanced loan tracking and processing, everything becomes segregated and simplified to give your users the ease of access that they require.

3. Online-Offline Integration

By integrating services, you can reduce the hassle of offline operations and utilize your resources well. This enhances the overall productivity of your workforce, helping you yield better results.

4. Generating User Data

With the digitization of the entire banking process, you allow users to interact more with the services, leading them to generate ample useful data for your reference. Data is a priceless commodity in today’s day and age and can help you do wonders!

5. Analyzing Data for Decision Making

With data related to app usage and feature usage patterns, you can easily identify the pain points of the users and improve your services. This can help you uplift the overall quality of service, leading to better results!

Last but not least, with the digitization of everything, it is practically impossible to survive in the current competitive market without a proper application or digital platform for your services.

Average Cost to Develop an App Like CAIXA

If you plan to develop an app like CAIXA, the average cost comes somewhere in the range of $50,000 to $300,000.

Here’s a quick breakdown –:

|

Development Stage |

Cost Estimate (USD) |

| Planning & Research | $5,000 – $10,000 |

| UI/UX Design | $10,000 – $25,000 |

| Frontend & Backend Development | $25,000 – $100,000 |

| API Integrations | $5,000 – $20,000 |

| Testing & QA | $5,000 – $15,000 |

| Deployment & Launch | $3,000 – $10,000 |

| Post-Launch Support & Maintenance | $2,000 – $10,000/month |

However, that depends a lot on what type of service provider you work with. Sure, if you dig deep enough in the market, there are chances that you can get things done for a lower price, however, if that means compromising on a few features, we recommend you do not go for it!

To ensure that you are paying the correct price for the product, you first need to identify the best app development company that suits your preferences and budget.

The research does not stop there as you need to identify the key factors that are directly responsible for the overall cost of developing a fintech app.

Check out the next section where we have shared a list of all the factors that you should consider while accounting for a budget to develop an app like CAIXA.

Factors That Affect the Cost to Develop an App Like CAIXA

Understanding these factors can help businesses plan their budgets effectively.

Key considerations include:

♦ App Features & Functionality

For any application, the development cost mostly depends on its features and functionality. If you are looking for an application that performs basic tasks such as transaction checking, online statement generation, etc.

It might cost less than an app that performs advanced tasks such as instant money transfers, loan application tracking, mortgage management, etc.

This is because to add these functionalities, the app development team requires skilled developers and added costly resources.

♦ Platform Choice (iOS, Android, or Both)

Another factor that defines the cost of developing a fintech app is the choice of a native platform. While applications may work similarly on different operating systems, the process of building and resources required to enhance compatibility on each of the platforms is different. For instance, an Android app is created in a completely different environment than that of an iOS application.

Needless to say, a single platform development will cost you less, however, it also limits the reach of your application to the users of a particular platform. To make the most of your CAIXA-like banking application, it is advised that you should be available on both Android and iOS.

♦ UI/UX Design

User Interface and User Experience define the way your application looks and functions. To ensure proper ease of access, you need an app that is not complex to use.

Adding user-friendly animations and creating a navigation method that is smart, easy, and unique will cost you a bit more but it defines your user base and brand.

Keep in mind that UI also plays a crucial role in how your application is presented to the user. Hence spending a little on it might benefit you in the longer run.

♦ Backend Infrastructure

While dealing with financial matters, it is recommended you spend the most on your backend infrastructure. This is because there are several guidelines that you need to meet to ensure proper data processing and safety of a user’s financial data.

For instance, if we look at the current data for CAIXA, there are over 20.2 million customers that they cater to. Hence, having a solid backend is a must for them.

With the help of a robust backend infrastructure, you can easily develop a banking app that is scalable in the future, allowing you to manage your user’s data more efficiently. Hence, spending on backend infrastructure only helps you to better develop an app like CAIXA.

♦ API Integrations

APIs are a faster way to add features to your existing platforms. From basic login APIs to advanced custom-created APIs for secure payments and application tracking, all are used while developing a CAIXA clone application.

As mentioned earlier, the features that you decide to develop or integrate describe the nature of your application. Hence, APIs that are integrated ensure that the features that are available via other services are also available.

While APIs are readily available, integrating them can be a tough task. Hence, the more complex an API is, the higher the cost. However, you should keep in mind that these APIs contribute a lot to the overall list of features of a CAIXA-like app.

♦ Security Features

For any finance-related application, security is the top priority. The cost to develop an app like CAIXA varies according to the type of encryption and security tactics used.

If you are only looking for basic pin-based security and basic payment gateway security, you can get them for a lesser price. However, if you plan to integrate biometrics and additional 2-factor authentication, the cost may be higher.

Being the leaders in app development ourselves, we do not recommend cutting corners while choosing security features as it is the basis of trust for your customers.

♦ Compliance with Regulations

While getting an app developed is at the discretion of the business, it is not that easy to create a FinTech app. You see, there are several financial regulations that your app should be compliant with to be rolled out.

In some states, it can be difficult to accommodate both functionality and compliance, which makes it more complex for a development company. This is also the reason why it may sometimes result in extended costs.

♦ Development Team Size & Location

Another factor that you must keep in mind is the team size and location of the development company that you choose. The more resources deployed on your projects, the higher the overall development cost.

However, choosing to go with a smaller team might delay your project. Hence balancing the set of resources and development team size can help you minimize the cost.

Not to forget, the location of the development team is also a factor that defines your cost. If you have outsourced your fintech development work to a country where developers are available at a much more affordable price, the cost will automatically go down. Hence, scouting the best CAIXA clone development company is a must.

♦ Testing & Quality Assurance (QA)

No app development is complete without thorough testing and quality assurance. If you are investing in a fintech application to reach more users and simplify their banking experience, you don’t want to deal with unnecessary bugs.

To ensure that your CAIXA-like application is free of errors, you need to ensure that you spend properly on your FinTech app testing and QA.

Basic manual testing is available for a lesser price but it is comparatively slow to advanced automated testing. You can choose accordingly, and the price will vary as per your choice.

♦ Post-Launch Support & Maintenance

The job of development is never over, even when your product is already in the market. While an application is being developed, it requires proper post-launch support and maintenance.

You can choose from the offered packages for your app support and maintenance of your freshly developed banking application. The cost to develop an app like CAIXA can vary depending on what type of post-launch support you have on board.

After taking all these factors into account, you can analyze the final cost to develop a similar app to CAIXA. Keep in mind that the choices are always in your hand. You can always minimize the cost by choosing the correct app solution partner that guides you with the best choices.

How Long Does it Take to Develop an App like CAIXA?

Now that we have defined the cost and features that you need to develop an app like CAIXA, let us take a look at how long it would take to get the app in the market.

While it depends on the type of application and its size, you should be able to get a CAIXA-like banking application developed in 6-12 months.

The entire process depends on the choices you make while planning for the application. For instance, if the complexity of the features that you have chosen is higher and customized, it will take more time.

Similarly, if you plan to get a basic application to start, you can hit the market as soon as 6 months.

Here’s a quick breakdown of the stages and duration that define the overall time it would take to develop a financial app–:

|

Stage of Development |

Duration Required (Range) |

| Research & Analysis | 2 – 4 weeks |

| UI/UX Design | 4 – 8 weeks |

| Development (Frontend & Backend) | 12 – 20 weeks |

| API Integration | 4 – 6 weeks |

| App Setup (Security & Compliance) | 3 – 5 weeks |

| Testing & Quality Assurance | 4 – 6 weeks |

| Deployment & Launch | 2 – 3 weeks |

| Post-Launch Support | Undefined |

However, since we are talking about an application in the finance sector, it is advised that you spend good time in the development and testing phase so that you do not have to struggle after the app is released.

How to Drive Revenue in Your CAIXA Clone?

It is crucial to identify the streams of revenue before you invest in any field. Some businesses often ignore going for a digital platform because they are unaware of how exactly it can help drive revenue.

The confusion is even more significant for fintech apps as they are usually considered as an additional expense for banks.

Well if you also feel the same, then think again as there are several ways you can use this app to generate revenue. Some of the most commonly used strategies include –

► Placing Ads in the Application UI

Several services align with financial aid and banking. You can create a dedicated ad space in your UI and lend it to other businesses similar to yours (not competitors) and charge them for the same.

► Blocking Ads at a Minimal Charge

While you are adding ads, you can create a fee plan for your users who do not want to watch those ads and charge them for blocking the ads. This can help you generate revenue directly from an existing user.

► Convenience/Transaction Fees

If you provide a service, you can easily charge a transaction/convenience fee for the same. Usually, the fee ranges from 0.5 to 1% of the transaction value, which may not seem much in the beginning but can help you generate a stable income once you have an ample number of users.

► Subscription Fees

By adding a few advanced features such as regular credit scores, asset management tips, and regular push notifications, you can create a subscription model. These features can be easily integrated while developing an app like CAIXA.

► Data Monetization

Another effective method to create a revenue stream is by monetizing the data generated through your application.

There may be several regulations that you may need to keep in mind while designing your data privacy policy, however, you can always monetize the data by sharing it with similar businesses and government bodies.

Nimble AppGenie – Simplifying Fintech Development!

Now that you have understood all about the cost of developing an app like CAIXA, let us tell you about the best fintech app development company you can trust! Nimble AppGenie is a reliable name when it comes to developing robust and reliable digital payment platforms.

What makes us unique is the combination of experienced developers and cutting-edge technology that helps us stay on top of development.

We are very well-versed with all the complexities that may appear while developing a CAIXA-like application. Our experience allows us to not only simplify the process but also create a product that is scalable and allows you to penetrate the market easily.

Reach out today and start your journey to build an app like CAIXA with Nimble AppGenie!

Conclusion

To develop an app like CAIXA, you need to be well versed with all the required factors such as the features required, how much time it takes to finish the development, and most importantly, how much it costs to develop an app like CAIXA.

After acquiring a decent understanding of all the factors, you can easily identify the perfect development company that can help you with an app like CAIXA in no time!

FAQs

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.